Another TBB post featuring the most eclectic links around the web such as inflation hell, Mag 7 AI risks, best US places to camp, huge Capital One Venture X offers, best 529 college plans, the latest scams, encouraging gun violence stats, visiting each country in the world without flying, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Have a great weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This blog stays in business with clicks only from readers for credit cards and coffees. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE . Or just email me.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

Hello from Bangkok, Thailand. I am posting frequent trip updates in Instagram. And YouTube when I get around to it.

QUOTE OF THE WEEK

“Retiring is hard” – Anonymous?

MUST READ GEMS

One article this week. I started reading this and I set it aside, it was slow reading. And then I came back to it and gave it a bit more time. And then I just could not stop until the end. Amazing what some people can do deceiving others, let alone their own families. And how come I hear about this guy for the first time? And I just hope he does not profit from this giving away movie rights. And how come this has not translated into a movie yet? You’ll understand. Support The Atlantic for beautiful writing like this:

PERSONAL FINANCE

For that eventuality ahead: The Astonishing Bull Market Will End One Day. Are You Ready?

But terrible stock market declines happen with shocking regularity. Diversification , or owning a variety of assets, has helped to ease the pain in the past. When the stock market is better than expected, it’s worth remembering how bad it could suddenly become…If you’re going to take the risk of investing in stocks — particularly during a stock market rally that seems to have been swept by excessive enthusiasm — it’s critically important to be ready for setbacks, even severe ones. [Good reminders]

Always a good reference: Morningstar 529 Ratings: The Best Plans of 2025.

At least we still have Jason Zweig at the Wall Street Journal who still warns us all about the dangers of all these “private” and “alternative” funds: This Small-Town Pension Fund Has a Warning for Millions of Retirement Savers. If you think cashing out of a private fund is easy, just ask a guy who used to manage $750 billion.

The advocates of private funds say they can provide superior returns to public markets. That’s absolutely true, but there’s a big difference between “can” and “usually do.”

In the fiscal year ended Sept. 30, the pension plan was able to redeem only a little under $64,000. That was less than 7.5% of its position in the fund at the start of the year. (Of course, the Intercontinental fund has distributed income over the years.) Last October, Intercontinental permitted Indian River Shores to withdraw $1,684, less than 0.2% of its holding. “Apparently they had a lot of people stacked up over the airport waiting to get their money,” says Auwaerter. Like other private fund managers, Intercontinental has the right to restrict redemptions as long as it’s fully disclosed to investors. [$1,684 lol]

The typical alternative fund is “a roach motel,” says Auwaerter. “You come in, and then you can only get out when they liquidate an asset. And you don’t know what that price is going to be down the road, but the range is probably so wide you could drive a Mack truck through it.” As a bond-fund manager, says Auwaerter, “When I bought illiquid stuff, I was getting a return premium for it! Here, it’s a trifecta of bad things: lower returns, higher fees and no liquidity. You’ve got to be paid for taking all those risks, and that’s absolutely not the case.”

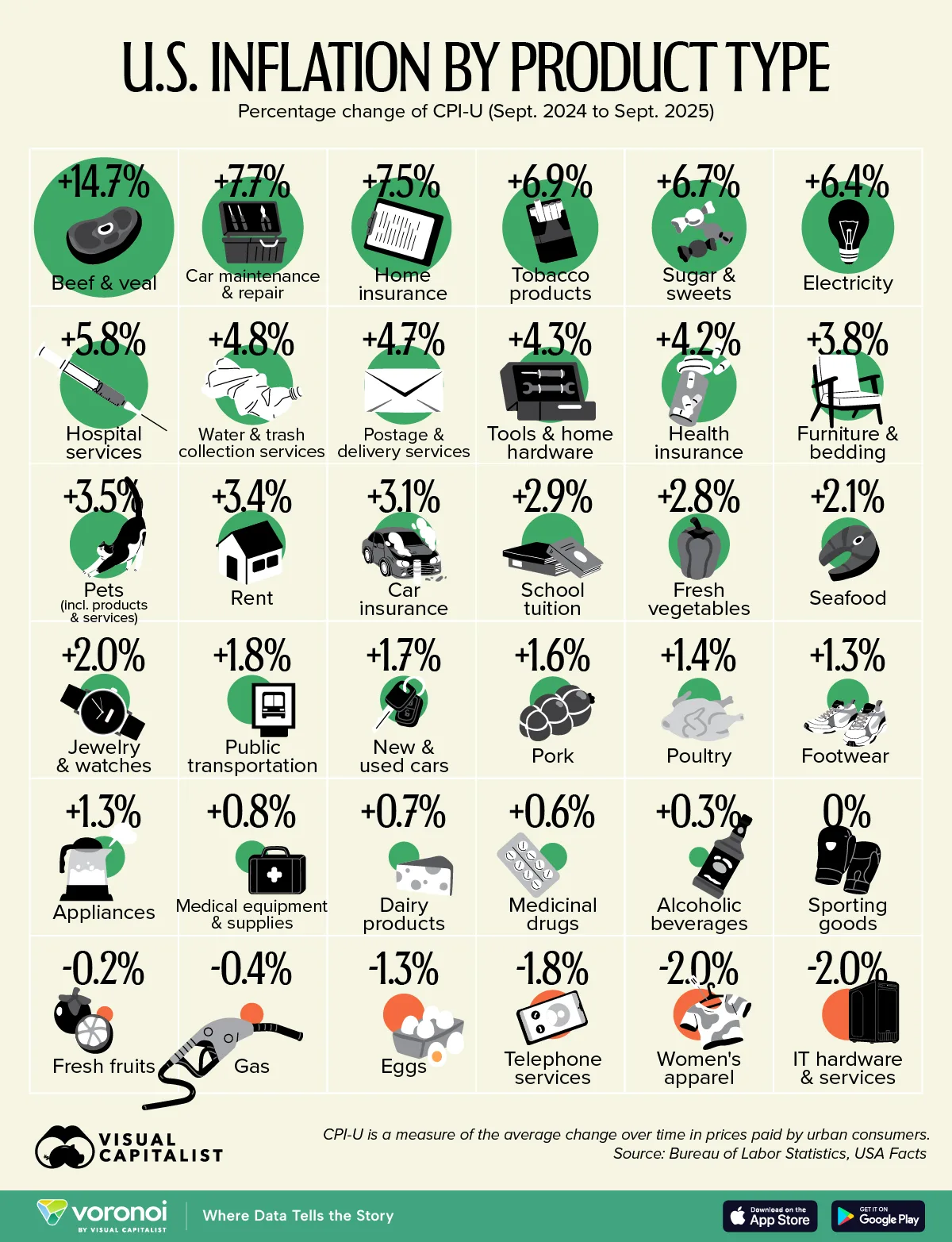

Inflation affects us all. Some not as much. And I must admit I was in that camp and never really understood how pissed off so many people here in the US were about it. And voted likewise. I am glad this is working out so well: There’s something worse than recession and we’re all already in it.

It affects all one hundred out of one hundred people in our sample. Everybody hurts. Even the owner struggles to keep employees and maintain his or her cost of doing business. Inflation affects us all and, as such, is potentially more destabilizing than a periodic bout of job loss. It infects us. Turns us against each other. Produces the sort of firebrand politicians and harebrained political solutions that tear at the divides we already face, making them worse and more glaringly apparent. Inflation creates the conditions for outsized and unexpected reactions among the electorate. It turns dissatisfaction into dystopian rhetoric. It turns disagreement into distrust. It eats away at everyone and everything until bad things happen.

US Inflation by Category in 2025:

SCAMS/CRYPTO/AI/TECH

When lawyers steal money from trust funds to finance their lavish lifestyle smh. This made me ill, lock them up now! Pathological Lawyer What happens when a real estate lawyer uses her firm’s trust account to finance her family’s lavish lifestyle? Inside the multimillion-dollar embezzlement case against Singa Bui. Can you imagine wiring $2.175 million for the closing of the house you thought you bought and it went poof?

By all appearances, she and Cartel were the couple who had it all: the right house in the right neighbourhood, fancy clothes, flashy cars, children in private school and summers in Europe. But it was all just an illusion. In King’s experience, cases like this often involve a costly vice, a drug or a gambling habit that has spiralled out of control. With Bui, he sees a similar pattern: “I think what we’re looking at is an addiction to the high life.” [Yikes!]

One of these days I am going to separate AI to its own Section. Until then it will stay here. Like this article: AI Rally Market Risks.

The so-called Magnificent Seven stocks—Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta and Tesla—now account for more than a third of the S&P 500’s total market value, up from less than 10% a decade ago. So if they stumble, the overall market will stumble. That’s the risk, and that’s why it’s fair that investors want to better understand these companies’ finances.

How will things turn out? The reality is that no one knows for sure. Partisans on both sides of this debate make valid points. But as always, risk management should be paramount. Nvidia and its peers have helped drive the stock market up over the past two years. But because of the resulting top-heavy nature of the market, now is a good time for investors to review their portfolios. Look to see how diversified you are beyond these big tech stocks.

Another super sad story of scammers taking advantage of gullible lonely seniors: Fake FBI agents, intricate paperwork and how his dad lost $400K to a scam. Check up on your parents folks, this is a scam pandemic.

The world’s largest floating photovoltaic plant in Germany just looks kind of wild:

Thanks for all the links! I’ll have a weekend to work though them.

The Marriott – Sonder collapse ought to be — but probably won’t be — a wake-up

warning about “advice” from those with no incentive to look into financial

structures. Marriott – Sonder was not Ponzi but it had a similar property. All

sorts of people were able to find below market accommodations in such

the same way early investors in a Ponzi were able to find above market returns.

I’ll check out your YouTube postings.

Woot! A *LOT* of reading ahead. Great posting this week and have fun in Thailand. I just got diagnosed with Trigeminal Neuropathy this week. It affects the left side of my face to the top of my head. Hurts, too. I am on meds and hoping it passes. The doc say it does, *sometimes*. UGH! That’s on top of the neuropathy in the feet that I have suffered with for several years now. I feel for ya, brother.

Have a great time there and enjoy! You’ve definitely earned it!

Hi Buzz-

I found One Mile at a Time’s discussion of how AI may impact his blog thought provoking. He seems to fear that once AI gloms onto a bit of advice-the best seat, hotel room, redemption access-few will pay Ben to give that advice. AI will also list the best bonus for each credit card. It’s not a big jump from there to ask when banks will just pay or produce their own tips and cut the bloggers down or out.

Hear that tick-tick-ticking. It’s the clock counting down until the first lawsuit is filed on the Marriott-Sonder debacle. Grab some popcorn and pull up a seat.

I don’t if you were trying to make me feel better about never having run a marathon but you sure did. Seriously though, I’m glad you figured out the issue and I wish you the best of luck in treating it.

That missing kayaker story is wild. As always, the human mind is a mysterious thing.