Another TBB post featuring the most eclectic links around the web such as the 2025 key tax numbers, Amway ruining lives, caviar pizzas, the Trump golf track website, tariff basics, Vanguard cuts fees again, more elaborate pig butchering crypto scams, amazing table tennis video, Santorini may blow up, top under-the-radar destinations, weird acoustic destinations, the best photography links again and of course always all of the most important developments in the crazy world of miles and points at the lower half of the post. Enjoy the weekend and file your tax returns early.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No sponsored posts. Also, no AI!

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This is a one man labor of love operation, enjoy it while it lasts.

BLOG HOUSEKEEPING

Making some changes online. I killed my second Twitter account, my handle was “FlyerTalkerinA2”. And I have deleted this app off my phone for ever, good riddance!

I started a new Bluesky account. I will not start a second Bluesky account for my blog. Please follow me there, my handle is @feeonlyplanner again. It will be mostly personal finance stuff. Or whatever I come up with, this feels like the old Twitter app that goes well with my spontaneous personality I guess.

I am keeping the TBB Instagram account posting strictly travel related photos. And keeping my TBB YouTube account and will post only occasionally there as I have realized I don’t have the talent and time for it, maybe it’s my face.

I am keeping the TBB Instagram account posting strictly travel related photos. And keeping my TBB YouTube account and will post only occasionally there as I have realized I don’t have the talent and time for it, maybe it’s my face.

I am done scrolling and posting on Facebook. Not that I did much of that in recent years. I will keep Facebook open because of Facebook Messenger I still use.

This blog stays alive until either of two things happen. No credit card is sold in a full calendar month or my 2nd credit card vendor kicks me out due to low sales again. This blog earns 90%+ of its tiny revenue that mostly covers the blog costs from credit card sales. It takes many hours to bring it to you. It also brings many psychic rewards making a difference in reader’s lives as many of you let me know, always a pleasure to hear from you. It also gives me a purpose to do my part to educate, entertain and sometimes even inspire. For 12+ years, which is insane! No spam, no sponsors, no ads, no AI. Ever. It is up to you to support causes you want to keep around. Thank you.

When this blog ends, I will most likely start a newsletter sharing my eclectic links. It is really odd mixing my two passions in this blog. I am odd so I guess this is why I am still here? Ok, no comment. That’s all for now, enjoy another post. And we’ll see what happens tomorrow, always enjoy the journey in what you do. And be kind, even among all the cruelty in the world lately.

PERSONAL FINANCE

I have been super busy with tax work these days so it is a miracle this blog post is here today.

So, here we go: Key Tax Numbers That Have—and Haven’t—Changed for 2025.

This is very welcome news: Announcing the largest fee cut in Vanguard history. Effective February 1, 2025, the firm reduced fees on 168 share classes across 87 funds. The fee reductions are expected to save investors more than $350 million this year alone.

Some really good explanations given in this piece: Let’s Talk About Tariffs. You know they will be back. At least, let’s keep it simple:

When the USA imposes a tariff the importing corporation pays a fee at the border. The foreign country isn’t the one paying the fee. The corporation pays the import fee. And this fee operates like a corporate tax. And corporate taxes aren’t paid by corporations because corporations pass on their costs to actual people. This means increased consumption costs, lower wages or lower share prices (or some combination of all the above).

This is on the softer side of money, you know, purpose and how money gets factored in, it is complicated: Why You Should Pursue the “Unnecessary” Things in Life. The five connections of the relationship between money and purpose:

Money can’t buy purpose

Purpose makes us happier than money

Purpose can fuel wealth

Money can help us nurture what gives us purpose

The purpose of money may be to give it away

And the article ends like this:

If your money isn’t changing you for the better, it’s not serving much of a purpose.

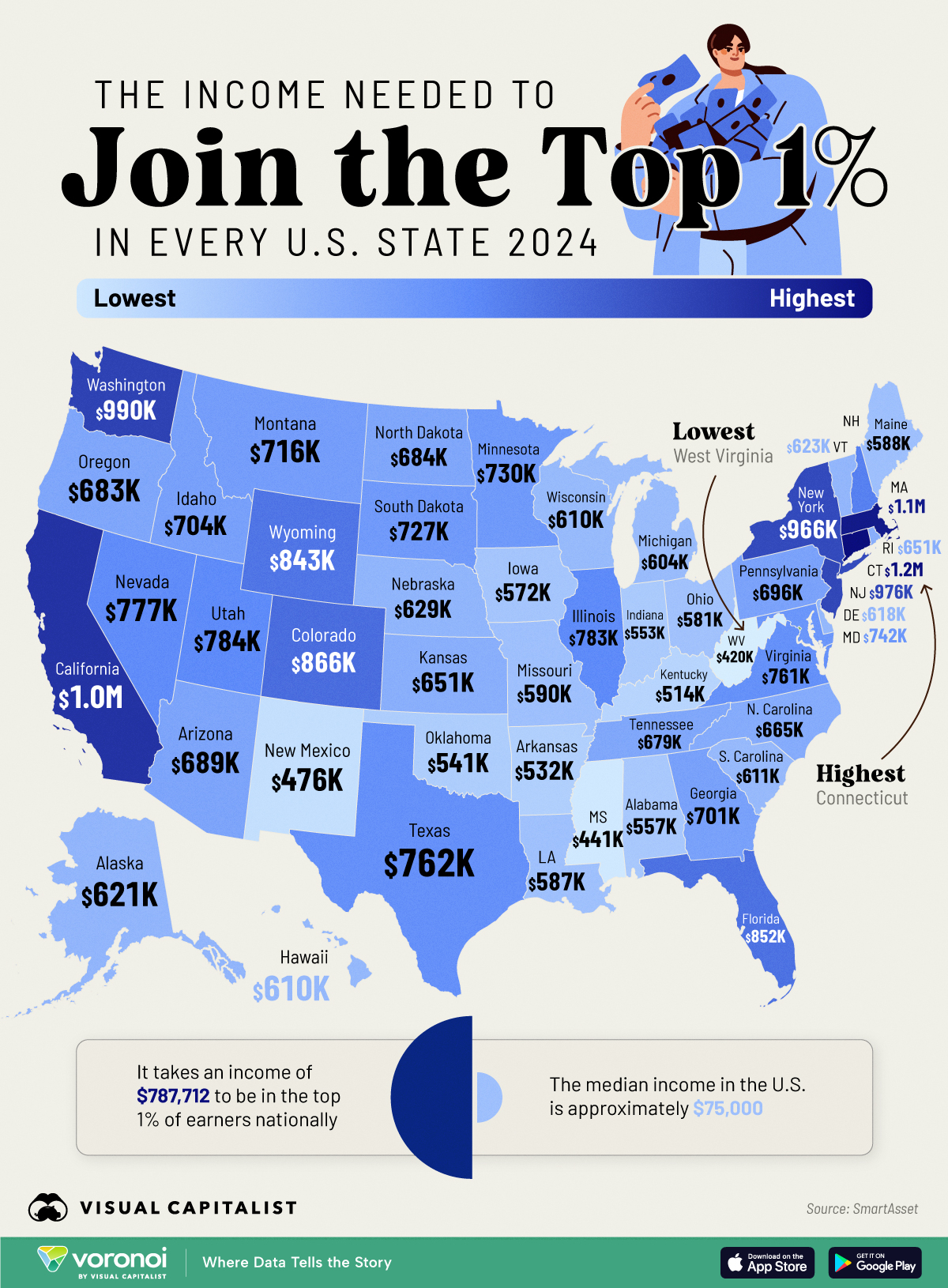

The Income Needed to Join the Top 1% in Each US State. Are you in the top 1%? Maybe buy me a dozen coffees, thanks! 🙂

SCAMS/CRYPTO/AI/TECH

Wow, this article shows how good the scammers are. And how they can play the long game, be careful out there. How I Almost Got Slaughtered in a Pig Butchering Crypto Scam. I think she messaged me too. I deleted it because I stay in my lane league lol.

The latest monthly roundup at The Ponzi Scheme Blog for January 2025. They just keep coming. You know the expression death and taxes. It should be death, taxes and Ponzi schemes. I always believed that there must be a fraud gene or something as some people just can not stop. Like this guy:

Seth Adam Despiano aka Marcus Lazaro and Steven Baron Sr., 43, who is already in prison for running $24 million Ponzi scheme and is serving a nearly 13-year prison sentence, has been indicted for allegedly running more fraudulent schemes from prison. Despiano is accused of posing as a broker from his prison cell and using fake identities to market and sell property that did not exist.

Probably one of the saddest stories in a while in my blog. Oh, selling the dream while ruining the lives of so many. When someone offers you this, run away please. The ‘Exciting Business Opportunity’ That Ruined Our Lives. Amway sold my family a life built on delusion.

For some Americans, joining the business might have been harmless. For us, it was not. Soon my mother and stepfather had no other job. Their bad decisions ricocheted in the echo chamber of Amway culture, where they were encouraged to dedicate themselves more deeply. Surely, any day now, we would make it. Within three years, we were living in a filthy house without electricity, eating food out of a cooler that we kept filled with ice. Then we were evicted, and my mother and stepfather declared bankruptcy. Ordinary people might have thought twice about sticking with Amway. But by that point, we had left the small dreams of ordinary people behind.

And it got worse after that, yikes.

This blog is not going to blog itself. I rely on my readers helping it grow as I don’t have time to do any promotion/marketing. Which leaves the content clean of intrusive sponsoring posts and stupid ads and stuff like that.

You like my blog? Send a link to someone please!

ODDZ & ENDZ

This article blew my mind. All you wanted to ever learn about caviar: Caviar Pizzas, New Money, and the Death of an Ancient Fish. Full disclosure: I tried caviar once flying First Class a long time ago and I did not like it. At all. Fancy fish eggs have become the latest luxury good to go viral on social media, raising questions about the future of sturgeon. Oh, all you wanted to learn about sturgeon as well, I had no idea!

Absolutely amazing: The Best Table Tennis Points of 2024.

Ok, this is funny. And sad at the same time. Trump Golf Track. I am so glad eggs got cheaper smh! Ok, I stop here. If you decide to unsubscribe from my blog or read it for the last time, good bye. Wait, maybe you will be interested to read this: This Is So Much Worse Than Last Time. Ok, I go back to normal programming and will try to refrain from politics here. Brace yourselves!

Always the absolute best photography links in my blog, enjoy: 2024 Winners of The Big Picture Competition.

TRAVEL

Oh oh, something is brewing in the Greek Isles: Thousands evacuate Santorini as more earthquakes strike island. The seismic activity has been absolutely crazy lately.

This is a pretty good list: The Top Under-The-Radar Destinations. What do you think?

This fits my quirky blog: 14 places you need to hear: the world’s most weird and wonderful acoustic destinations.

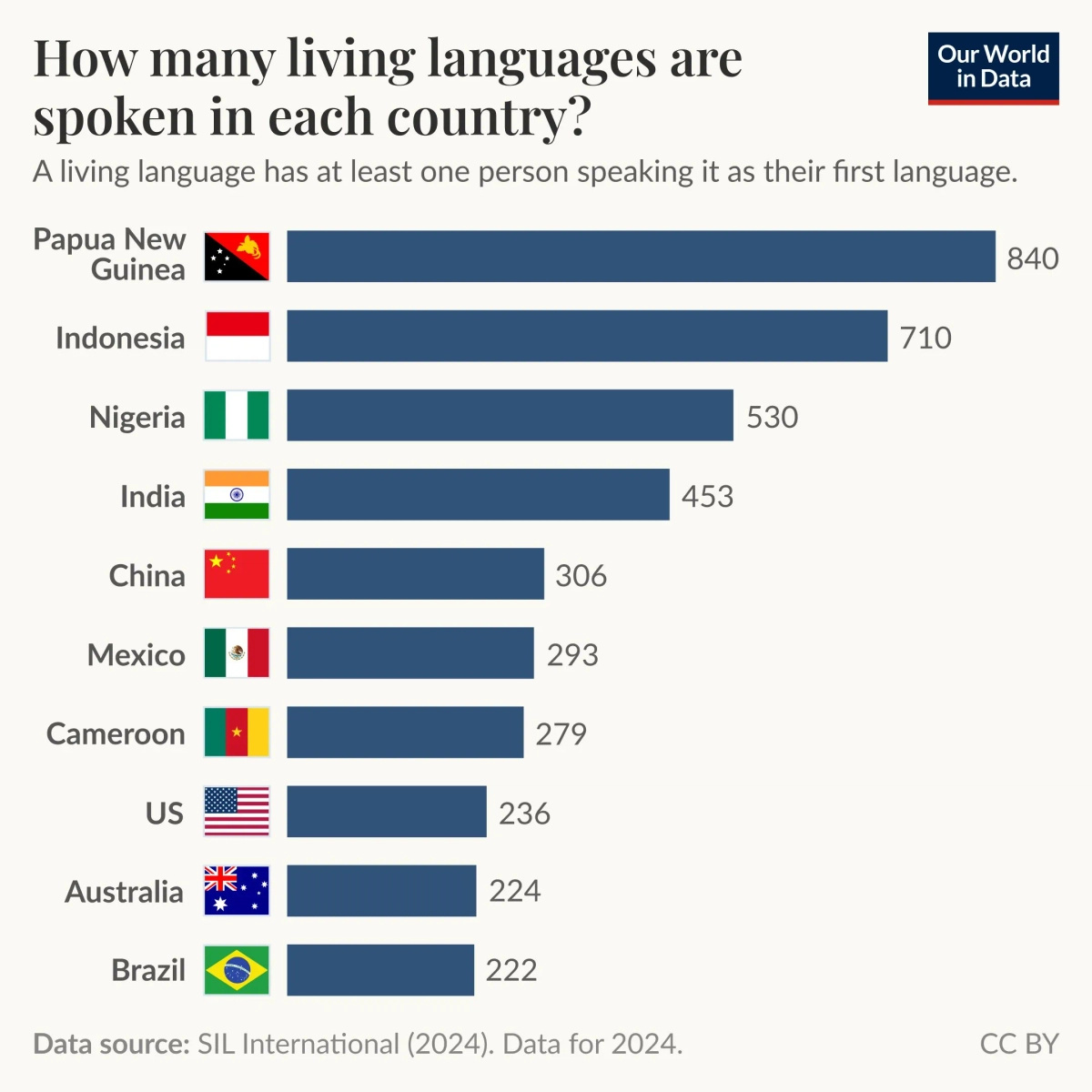

Shocking: The Countries that Speak the Most Languages. 840? WTF!

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS

Here we go, buckle up:

Pretty good website to bookmark if you have an Amex Platinum card and want to use those hotel credits: Max FHR.

Some nice properties listed: The New Hotels We’re Most Excited for in 2025.

The next logical step in this: ITA Airways Has Exited SkyTeam & Joins Star Alliance In 2026. Star Alliance keeps getting bigger…

Thrifty Traveler is getting bigger, I recently saw the company advertising for a Marketing Director. I can assure you that this would not happen if banks stopped paying sales commissions selling travel rewards credit cards. Anyway, this was a good article aimed at newbies who have plenty of slots open for Chase cards #hint: The Basics of Booking First & Business Class With Miles.

I have several in my hands already. 1099 Megathread for the 2024 Tax Year. I still don’t get why I am not seeing them online in my Chase accounts. I dread the day IRS sends me a nasty letter telling me I never declared income from a 1099 I never received via snail mail.

This one at Fodors, I guess the company is still around: Is Earning Airline Status Actually Worth the Hassle? Or Is It Completely Stupid? Ask yourself these seven questions to determine if airline status is worth it for you. Lol, “completely stupid“.

The move to all dynamic pricing is like one of those things that are unstoppable. You know, kind of like how mutual funds are being abandoned and investors moving to ETFs, there is likely no going back. In our hobby here, we thrived on them loopholes for so many years. And they are all being sealed, surely and steadily. The bang is getting smaller/harder. Is there still value in this hobby? Yes. Is it as lucrative as it was years ago? Hell no. We are nearing the point to decide if it is time to wrap it up and just pay to travel, likely from dough from cash back cards preferably lol. More hits:

Iberia Plus Program Changes Announced On February 12, 2025

Air Canada Aeroplan Award Chart Changes On March 25, 2025

Just a few notes on the above devaluations. Kiss them 35k business class awards on Iberia to Spain goodbye. Maybe book asap, you have…5 days. Another sweetspot bloggers killed, they will not relent until they kill them all and sold you plastic along the way, wake up! And really glad I did not transfer any Chase points to Air Canada Aeroplan recently.

TRAVEL REWARDS CREDIT CARDS

I can assure you Bilt already has decided what to do next to see how they can keep the company going after Wells Fargo finally ends the ridiculous contract with them. The hints are all over the place and bloggers just keep giving the company a lot more PR than it deserves smh: Bilt Card 2.0 – Changes to Fee-Free Rent Payments, New Premium Cards and More? I mean, they even spell it out in another BS press release:

Ensuring this benefit goes to members who genuinely engage with our broader program—rather than those taking advantage of loopholes—will allow us to continue delivering long-term value for our entire cardholder community. [bold font added for emphasis]

BONUS OFFERS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click on the link above

2. Create an account

3. Subscribe

MY ACTION AND BLOG BUZZING

I am already up to 125,000 miles/points burned year to date. How it goes around here:

Son: Hey dad, I am going to Bali for a volleyball tournament that starts on Month/Date. I could be a little flexible arriving a bit earlier up to a week. I checked on Google Flights, crazy high prices, can you help?

Me: 10 minutes later. I see this route at only 37.5k American Airlines miles, you ok with it?

Son: Yes.

Me: Done. We’ll work on your return later, enjoy your flight 🙂

I actually did check Alaska Airlines just in case to see how many miles it would cost and it came out at 120k miles LOL. So, I guess I am sticking with using my Alaska Airlines miles to fly short distances on partner American Airlines only hehe. I need to focus on using up my American Airlines miles stash this year, preferably asap.

Also, I booked son plus one one night at the Cancun Four Points by Sheraton for 22,500 Marriott Bonvoy points on their way to yet another wedding. And this is how it rolls in the TBB household. One day I am looking forward to retire as the family travel agent lol.

I hit 10 Hyatt elite night credits after my one night in Boston and 4 coming from spend on the personal Chase Hyatt Visa. Throttling the next $5k of spend with it to hit $15k for the Free Night Cert and 2 more elite night credits. I am not seeing hitting 60 again to requalify as Globalist elite as I have a very bad feeling that the changes coming in this program will be very harmful to our hobby, I hope I am wrong. Also, about requalifying for Globalist, I was saying the same thing early last year too. And then we know what happened, I ended the year with 70.

I am no YouTuber material. But I did post two more videos of hotel room reviews. Both ended up as Reels and not Videos, I need to make them a bit longer. But they were not Suites so it was hard to manage to keep them even this long.

Blogging is rough these days. And my blog has been completely independent. I could go to Boarding Area and solve the “cover the blog costs” issue once and for all. But that will make my independence suffer and I am not having that. So, be aware of what is happening and the reasons so many small blogs die and how this space has been hijacked by bigger companies that probably do not have a fiduciary mindset. Meaning, you do not come first if it does not make business sense. You always come first here, thank God the day job pays well. Ok, long intro, here is the article from a small blogger residing in Boarding Area: Video Killed the Radio Star (but we’re not dead yet!).

I am still shocked about this NBA trade: Luka Doncic to Lakers, Anthony Davis to Mavs in 3-team trade. The only explanation I can find is that Luca’s injury is way worse or the Mavs executive was bribed by the Lakers organization. Or something like that.

So, a follow up to my feet issues. I have stopped physical therapy because I was just overpaying. I have been doing daily exercises that I found on YouTube and now up to 3 miles walking daily. Actually, in the last week or so, 0.5 miles of the 3 miles was light jogging. In the last two days, that has gone up to 1 mile jogging of the 3 miles. Progress! #keepthefaith. I did sign up for the University of Michigan Big House 5k run by the way so I guess I am training for it. Oh boy, training for a 5k, oh how the mighty have fallen.

Been a while since I had a music song recommendation. I recently heard again the song “Folitician” from UB40 and it still sounds so sweet after all these years.

My cousin in my hometown back in Greece was interviewed by a local TV station as she is the President of the gas station owners association (she took over from my dad and my uncle). During the interview she said after the interviewer teased her about when she will retire and she said “I can not relax, I have a problem”. I think this runs in our family genes lol.

As of today, I have burned 125,000 miles/points year to date (2,027,816 in 2024) and have 4,414,831 miles/points in the bank.

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

Well done breaking the seal and getting the redemptions going for 2025. It’s been slow going in our household as the enthusiasm is low at the moment, tired from 2024 travels. That said I am off to Singapore this week in Singapore biz and returning Emirates biz both for points and a few bucks. But as people keep telling me, these points things, they just don’t work, can never get a redemption.

Go easy on the increase in jogging! Slow will win. Glad to see such a wonderful post with a lot of good reading!! I always appreciate it. Just got the OK for a second short school, this one in Bologna. Looks like I have about 2 months travel planned out and mostly locked down so far, and still no return ticket purchased! Departure time is closing in. 2/26 I am on my way. DC area for a few days then straight to Italy.

You’re mighty generous to be the family travel agent. I guess I am lucky that neither of the kids like to travel much , and one won’t fly at all!

Appreciate the reminder about the coffees. I haven’t spotted you any for a bit. I’ll try and rectify that shortly once at my desk.

Thanks, George, for all the time and work you put into this blog. It’s a gift, really.

Good morning Buzz,

It will be interesting to see the opportunities created for quick wealth once the current administration annihilates most things we hold sacred.

I’m with Vicky, just putting the finishing touches on a 2 month trip starting in May, all on points.

Thanks again for another great post. Good luck with your exercise routine and please don’t overdo it like the last time.

Have a great weekend!

Thanks for the wonderful links! I really like the Ponzi guy who started

another one while in prison! THAT is the big time …

Glad you are thinking about a 5k …

I hope you continue with the blog. It is aways so helpful and interesting. But if you move to just a newsletter, you should charge a fee. I will subscribe for sure.

I will respond to the comments most likely by Saturday at noon.

I just deleted my Buffer account, end of an era with both Twitter/X accounts now gone. Cost cutting at TBB HQs lol.

If u r concerned about 1099s can wait to file til April (or later). Should be able to pull your transcript then 🙂

Wow that pig butchering story was brutal. Thankfully he didn’t lose any money. An NPR reporter’s sister(?) was scammed and she didn’t realize until she excitedly told relatives at Xmas dinner. What a way to find out!

Fascinating tale about the pig butchering. What scares me is that if someone that savvy could almost get taken then what does that mean for the rest of us poor schmucks?

I’ve said it before but I’ll repeat: Thanks for doing this. I use your links where possible (very unfortunate about Chase tightening up so hard on business cards) but I don’t think I have any kids so that restricts my options a bit. When you do shut down I’ll say that even if you made a difference to a dozen people as I’m certain you have then you’re doing better than a lot of people I know, arguably including myself. In the meantime, keep up the good work.

@ Vicky: Nice job, Singapore and Emirates. The kitchen project is officially killed so I have some space now to think about booking travel. But just got recommended an amazing kitchen pro so maybe we stop by there and see what he can do down the road #developing. Thanks for the coffees and the kind words, much appreciated. These are the psychic rewards I am referring to often.

@ Carl: Thanks for the kind words again. No worries about the coffees. Looks like the Italy trip is coming together nicely. I need to retire from travel agent duties. I know I need to take it slow in the running. But we talked with friends to do the Copenhang marathon in 2026. Of course I made sure there is a half marathon lol. I am so far from that point.

Ooops, clicked “Post Comment” too quickly. I am not really driving up the page views intentionally for ads revenue you guys, really!

@ David: Two months trip all on points, we are not worthy 🙂 Thanks again for the support and kind words. All nine of you long time supporters would be taken care of when I sell my blog. Sadly, there has only been one offer for $100 and I am not sure that was even serious lol.

@ DML: Some people just can’t help themselves, they live to grift. Some scientists one day will discover a fraud gene I tell you. The 5k is in April, I think I have enough time to train lol. Not thinking anything beyond that at this point. Thanks, you are one of the nine by the way 🙂

@ Nellcat: Wow, thank you so much for the kind words. My son has been telling me to start a Patreon and give those readers the full post and only give a sample of each post to free readers. And I am like, you know, yet another platform to maintain and that will restrict more people of being educated/entertained/inspired. I did not start this blog to make money, I just want to make a little bit to justify to my own brain cells that it is worth the time/pain to bring this baby to the world 🙂 And it’s been okay…while trying to see the first cc conversion this month smh. But no worries, someone in my household will use my links before the end of the month, it’s like an internal bailout lol. Internal bailout, just came up with that. What I dread is one day I receive that email from my 2nc cc vendor telling me “sorry, due to low sales, we decided to end our relationship”. Frankly, I am shocked it has not happened yet. When that happens, I will look to go to the newsletter route…Thank you.

@Sexykitten_7: Yeah, these scams are increasing in sophistication. Just learned a relative back in Malaysia lost a lot of money in one of them. This is happening every day and these people are really really good at this. Always be alert and block/delete without any hesitation. Hope it does not get to that for 1099s, has to be a better way. I am sure DOGE is on it lol.

@Christian:

>>>>>>>What scares me is that if someone that savvy could almost get taken then what does that mean for the rest of us poor schmucks?

Exactly!

Thank you always, you have been there supporting this little baby of mine for a long time. If most readers did use my cc links I would not be bitching about making less than minimum wage around here for so long. Which I really don’t like doing anyway but it kind of justifies in my own head to keep this crusade to change the world going. Until the ax falls I think I am hooked at this. I am enjoying the ride, thanks for coming along.

And now time to head to the gym, only 23 F degrees outside, it’s a heatwave!

Was this performance by the Eagles defense the best ever in the Superbowl or what? Wow.

Weekly email with blog traffic showed some improvement. Maybe there is hope this blog will be discovered…one day.

Hit lowest weight since my college days on Sunday morning. Celebrated with ribs and chicken wings while enjoying the KC Chiefs taking a hell of a beating.

I was going to start drafting the Friday post today. Took a quick peak at the credit card sales table and there has been zero action there since January 7. So I passed and will start it…eventually.

My life will have less stress without this blog. I can’t believe the days has not come yet to say “Phuck it, I am done”.

You all have a great week.

Maybe I do a daily comment. To increase page views and ads revenue, lol.

They watched how the Bucs beat the chiefs in the 2021 Super Bowl. Turned out to be a very boring game. The Eagles were just too dominant. I need subtitles to understand the halftime show.

Yeah, I agree. I kind of felt how the Lions felt losing to Washington. You know, sometimes nothing goes right. At all. I went to sleep at 40-7 or something. I don’t like this type of rap, never really understood all the crap between this guy and Drake and I don’t give a shit actually…but the visuals of the show was pretty impressive imho. Also, so much DEI 🙂

Normally I don’t care for a super bowl blowout but that game was enjoyable. The Chiefs’ luck finally ran out.

In other news: scurvy?!?!

https://www.news-medical.net/news/20240719/Scurvy-on-the-rise-in-the-United-States-Pediatric-cases-triple-in-five-years.aspx

Never heard of scurvy, wow!

I started drafting the Friday blog post. And already have added/replaced two mind blowing links I discovered just today. Starting on Wednesday it is most likely I won’t be doing any additions to the links already prioritized and in the queue…they would have to be mind blowing squared or something like that.

I feel so much safer with no more paper straws LOL.

This Friday post will be amazing.

Last credit card sale here was on January 7. I don’t think I am going to bail my blog out again by getting one. The end is near and I am ok with it. This started as a three month joke back in 2012 and it has lasted way longer than everyone in this universe predicted it would. When almost 2 months go without a single cc sale from readers it just proves that readers do not support it. End of story.

Enjoy the Friday post.

Another phucking snowstorm today. And just when you thought this Musk/Trump shitshow could not get worse, hold our beers.