BEST OF

Loyalty Lobby has all the details you need about the Marriott First Quarter 2013 Megabonus. First one out of the gate and the more complete information about it.

Travel by Points has another very useful table summarizing award booking fees. I believe this is your second great table? If you keep this up you will become the TTG, the Tables Guy. So we can have TPG, FTG, TBB, TTG, MMS. 2 letter and more than 3 letter acronyms don’t count, lol.

FTU now has its own website. Very nice video from the FTU event in LA. If only TBB had the technical talent and manpower behind the sharp FTU folks!

Frequent Miler had a pretty good article on “Drawing the Line“. Some interesting points and comments! Commenter Elizabeth had the best comment, imho as always: “This points game is an addiction. We keep pushing the boundaries until the lines start to blur between what is right and what is fundamentally wrong. I believe that most of us in this hobby are inherently good people, but I think we all need to take a step back and really evaluate the lengths we are going to and the lines we are crossing all in the name of free travel.” – Right on Elizabeth!

Travel Summary wrote “Twitter Matters in the Points Game“. Oh, so we agree! TBB loves Twitter! Check out TBB’s comment there! And you can follow us on Twitter too!

Gadling has a nice list of hotels offering free wifi. One day all wifi shall be free! Let me hear an Amen!

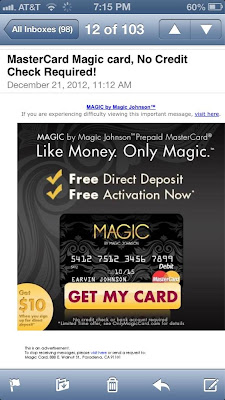

Miles Quest says he quit the Starwood AMEX and says we may be overspending, come again? Actually, it never ceases to amaze all the cheerfulness other bloggers show for relentlessly pushing credit cards. I guarantee you at this VERY minute there are tons of people who are charging something they probaby do not need. And they are justifiying the purchase in so many ways (need to meet minimum spend, need the EQMs, it is 5x/6x/doubleX/tripleX, comes with free lollipop, it is on sale, you name it). But, you may say, they need to be responsible. Of course! But some people have a spending problem and encouraging them to get credit cards is like giving them rope and…letting them go hang themselves. Which always comes back to us responsible people to pay for the greed and stupidity (bailouts)…ok, here I go again. Breathe, breathe, serenity now, serenity now. Ok, I am fine now, let’s move on!

Just Another Points Traveler has a very ymmv Club Carlson 3k pts opportunity. Does THIS cross the line? Giving out corporate codes like they are “secrets” crosses the line? This whole hobby is full of such dillema. As I do maintain property in Europe and hold a 2nd passport I felt I am eligible. Please no dog signups;-)

Randy Petersen weighed in the discussion in FlyerTalk’s “What is the most useful frequent flyer blog?” and answered some questions regarding Boarding Area blogs. It is post # 1113.

NOT SO BEST OF

I finally get Frequent Miler in here, I ‘ve been trying for ever! He admitted in the post above that he opened a Club Carlson account for his dog. Bad Frequent Miler, bad Frequent Miler. Listen to your wife before you do things like that, will ya? 🙂

I was going to let him slide but I just can’t after this post! Travis, Travis, you at it again! He gives away the farm in a post approaching MMS like status that…even a Caveman can do it now. Only thing missing is some nice pics (your SO?) and arrows! Hmm, if you get arrows perhaps you can find some arrows with peanuts in them? And why is everything on your site I have seen elsewhere? If I only had your techie skills…I think CVSstores will issue an Office Depot like action letter to all managers any day now! And then the whole blame game will start all over again! It was not the bloggers…it was fraud, it was Obama, etc.

US AIR “NEW” CREDIT CARD OFFER INVESTIGATION:

Please see our investigative piece here. We added two more entries following View from the Wing:

Unroad Warrior [50k in title, with disclosure of “small fee”, was the bold font on the 50k necessary?, no word on the balance transfer cost or to stay away from it? Do bloggers just get these and post them right away without doing ANY research at all?]

Miles Momma [50k in title, no disclosure, offers link of the generic offer but shoots it down way too quick. For the record, the generic link still works just fine, no one has been denied yet for not being a US Air employee all right? Says balance transfer is a bad deal. She gives the card a thumbs up, I give it a thumbs down. I got no conflicts of interest, who are you gonna believe? 🙂 ]

ODDZ & ENDZ

New York’s Red Light District in Photos. A Wall Street trader quits his job to roam the toughest streets of the Bronx. Wow!

THE END

If you like what you read here, please pass on the link to my blog to family, friends and pets too!

You can follow me on Twitter @FlyerTalkerinA2 along with 1,137 others!

You can find me as gpapadop in FlyerTalk and Milepoint.

It is the second table featured on TBB. There are a few more other tables ;). Thanks for the kind mention and “TTG” – happy holidays to you all!

Happy Holidays to you and yours TTG;-)

From above… Miles Quest says he quit the Starwood AMEX and says we may be overspending, come again? Actually, it never ceases to amaze all the cheerfulness other bloggers show for relentlessly pushing credit cards. I guarantee you at this VERY minute there are tons of people who are charging something they probaby do not need. And they are justifiying the purchase in so many ways (need to meet minimum spend, need the EQMs, it is 5x/6x/doubleX/tripleX, comes with free lollipop, it is on sale, you name it). But, you may say, they need to be responsible. Of course! But some people have a spending problem and encouraging them to get credit cards is like giving them rope and…letting them go hang themselves.

While guys like you and me know how to manage our credit, many don’t. There’s more downside to people that are over-spending just to get miles. I predict bankruptcies in the future. One of these days, there’s going to be a long thread in Flyertalk or milepoint on this very issue.

dhammer53

Bankruptcies in the US have continued at a high pace in the last several years. I believe there has been a small decline actually ever since there was a change in the lawsy to make it a bit harder to go through it. I wonder how many out there got hooked in this hobby which then took them down a path to…added stress, neglect of real life responsibilities, loss of jobs/spouses and bankruptcy…I am sure they are out there but they won’t be volunteering for any interviews I am sure. I can see it now in a FT thread and then real life support group…

“Hi, my name is Michael and I am an addict whose life got screwed up by the credit card churing I did for free travel. It all started with a Chase Sapphire Preffered card from Million Mile Secrets. Before I realized what hit me, I was churning tens of cards along with several prepaid cards & of course a few Bluebirds. As my spending got out of control, I neglected my job and spouse. As my job performance deteriorated, my income suffered. Nevertheless, my cc churning increased and somehow, it is a big mystery to me, my spending did not adjust to the new income realities. Before you knew it, I started carrying balances and started paying late fees. I could not tell how much in annual fees I was paying, I am sure it was well above four digits! The stress got to me so I started drinking (of course I used my Amex HH for 6x at my local grocery store!). Then my wife left me and then I lost my job. And here I was, thousands in debt, alone, but all is not lost. I still had millions in miles/pts!

Or something like that…

We laugh but I am sure this has happened and is happening!!!

Are we really to involve ourselves this deeply in someone elses life? Why stop at CreditCards? – Are they paying too much for cable, cell phone, too big a Mortgage? At some point doesnt someone have to be responsible for their own actions?

Yes at some point of course. People should also save more for retirement but they don’t. BUT a tweak of the 401k laws and regulations made it possible for companies to automatically enroll workers in 401k Plans. If they did not want to participate, the workers HAD to opt out. That little change has made a substantial difference! I am not sure what you can do when it comes to credit cards. Perhaps enforce a maximum number of plastic that anyone can carry? A ceiling on credit lines based on income reported on tax returns? Of course that would be hurtful for our hobby BUT it may contribute to the good of society. I am FINE with that! Instead we get bloggers selling stuff that can be weapons of mass destruction…at least for a portion of the population who gets hooked on them and they are clearly NOT ready for them…I am rambling now…

Of course you pay too much for cable;-)