We bring you the best of 2017: the top 25 news photos, the best science photos, the top National Geographic Instagram shots of the year and hopeful images!

TBB Blog Mission: To Entertain. Educate. Inspire. In That Order!

You can support TBB by applying for CREDIT CARDS, shopping with our AMAZON AFFILIATE LINK & clicking our REFERRAL LINKS. Thank you!

Lets get to some of the 2017 Best lists to end the year…

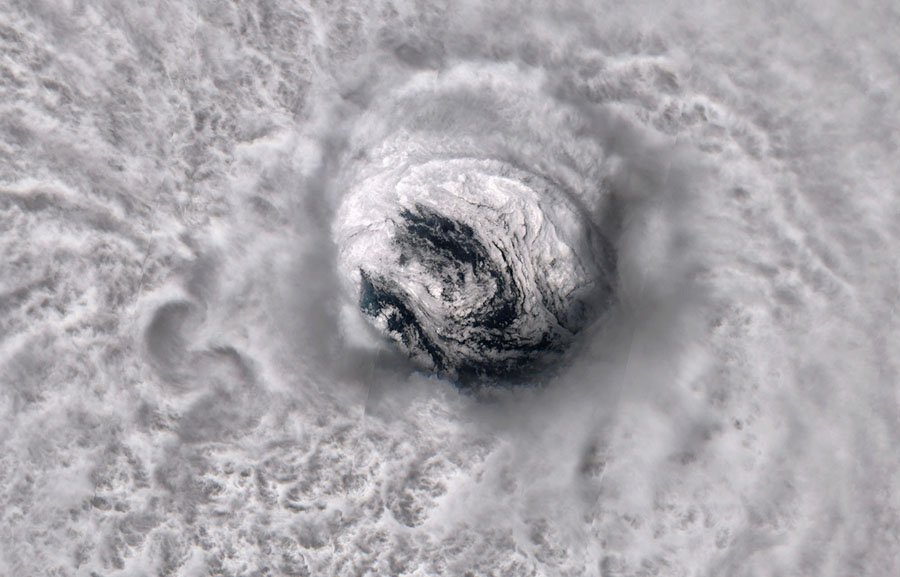

Top 25 News Photos of 2017

This is from the Atlantic…

You can see more awesome photos from the months of 2017:

The Most Stunning Science Photos of 2017

This is from Business Insider. Not my favorite source but I must admit these are stunning indeed!

10 Most Popular National Geographic Instagram Shots Of 2017

Yep, another amazing link for your eyes only.

Hopeful Images from 2017

Hope never dies as long as TBB can keep this blog going 🙂

21 incredible photos of people practicing religion all around the world in 2017

Cool…

And I leave you with this…

Check out my updated blog lists: Blogs I Love, Blogs I Like, Blogs To Ignore

Check out my updated blog lists: Blogs I Love, Blogs I Like, Blogs To Ignore

TBB

travelbloggerbuzz@gmail.com

Follow TBB on Twitter @FlyerTalkerinA2

You can subscribe to TBB below, winners only!

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Wow my first gold!

How about that!

Great collection of photos today.

Bronze!!

Definitely some incredible and moving photos. Really have to feel for people in situations like in Iraq.

The Little Rocket Man pic is so bizarre – the desk, the map with paperweights carefully arranged at the corners, the binoculars – just goofy as hell. You wonder what really goes through his mind.

VFTW had a post title today asking if the CSP annual fee is worth it. The answer will SHOCK you!!! (I’m guessing – won’t click on it)

VFTW had a post title today asking if the CSP annual fee is worth it. The answer will SHOCK you!!! (I’m guessing – won’t click on it)

Every time this happens, two things I wonder about: Will DoC link to it and Tagging for Miles interact with Gary on Twitter about it 🙂

Nick has gone Gleff today over at FM about Hyatt.

Buzz-

Are clients (pre)paying advisor fees to get the deduction that’s going away? Any 10 year rates?

Most are limited by that pesky 2%…add that to the fact it is added back for AMT and you really don’t want to see what happens next…

Some will be hurt a little of course but it should be made up in other ways.

The way some of us charge (by AUM fees) this is not really that doable…which is leading many of us to change/consider changing over to flat fees/retainers.

This was indeed an unfriendly move for my industry…

Last night back home, tomorrow at my favorite Greek hotel, the Thessaloniki Hyatt…

I am really starting to be afraid by Transavia, 10 hour (earlier!) schedule change, wtf!

The alternative minimum tax is a dreaded reality for many Americans–including ones who wouldn’t expect to get caught up in it: middle-class families.

The AMT—an alternative set of rules for calculating income tax—was enacted in 1969 with the objective of targeting 155 filers with incomes of $200,000 (an exorbitant amount at the time) who avoided paying any federal income tax. While their actions were 100% legal—they were using deductions and legislated tax breaks appropriately—their $0 tax liability was an embarrassment, calling for action by lawmakers.

Functionally, the AMT takes away certain tax breaks including: (1) your personal exemption (2) dependent exemptions (3) deductions for state and local taxes paid (4) deductions for interest on home equity loans not used to improve your home and (5) miscellaneous itemized deductions. And it gets more complicated by adding several adjustments involving depreciation deductions and certain “preference” items, among other things. (For a good guide on the AMT, see Fairmark’s Guide to AMT.)

And while wages have increased since 1969, the AMT was not automatically adjusted for inflation each year, which means the AMT has hit a growing number of taxpayers year after year. Rather than targeting the highest income earners, the AMT is disproportionately hitting many middle-class families. In practice, AMT is more likely to hit taxpayers with families, those who are married and those who live in high-tax states.

According to researchers at the Tax Policy Center, a joint venture of the Urban Institute and Brookings Institution, only 19.7% of households filing 2015 tax returns with incomes greater than $1 million are affected by AMT. However, 27% of households with income between $200,000 and $500,000 and 59.1% of those with incomes between $500,000 and $1 million are affected by AMT. It’s not unusual for single taxpayers in a low-tax state with over $500,000 of ordinary income to escape the brunt of the AMT while a couple with children making a combined salary of $200,000 gets hit.

“….made up in other ways.”

A tax partner I worked for once told me that anyone can add up the numbers, but only a few of us can make them dance.

Artie, George could not said it better himself

Slow news day – the Hyatt award nights counting news is about all there is up on BA. I’m sure Mommy Points is most excited!

What do you mean about slow news day??

Bloomberg has:

“Bread Is the Dish of the Year” on their main page. Apparently this is from 2017 AD and not 2017 BC.

https://www.bloomberg.com/news/articles/2017-12-26/the-best-bread-at-restaurants-shops-and-to-cook-at-home

i love bread

LOL!