Another TBB post featuring the most eclectic links around the web such as Life After Layoffs, National Debt, Long COVID, US Credit Card Debt Soars, the 2023 tax fact and sheet calendar, what to watch out for when you consider 401(k) Plan rollovers, we talk about this weird economy, fighting the last bull and bear markets, we make fun of Elon Musk while more crypto scammers are having arrest warrants and go deep in hiding, the inane destruction brought upon maniac Putin shows no stopping as do mass shootings in the US, we thank US banks for the millions of miles and points they have given us over the years and a lot more, enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or visiting our LINKS or Donate

You like my blog? Send a link to someone please!

This blog publishes every Friday and Tuesdays.

Welcome to all new blog readers from George, your diligent curator of the BEST web content I find and share with you. No ads, no clickbait.

PERSONAL FINANCE

Bookmark this: Your 2023 Tax Fact Sheet and Calendar.

There are financial advisors out there who are always on the hunt targeting people about to retire with fat 401(k) balances and then they sell them ridiculous crap. A good financial advisor will lay out the benefits whether to rollover your retirement plan to an IRA. And then of course how it will be invested inside the IRA if you do proceed, be careful out there! Rollovers from a 401(k) plan to an IRA: Weigh these 7 factors first.

This may happen to you or a loved one, this is a good article on the layoffs subject: Life After Layoffs: A Financial Guide.

Something gets hot, money pours into it. When something gets cold, money goes the opposite way. This happens over and over in investing. I can’t believe financial media still comes out with crap like “The 10 hottest stocks/funds/ETFs to buy now!”. These are most likely THE things to avoid like the plague. This is the essence of this post: Fighting the Last Bull & Bear Market.

The problem is it’s not a great idea to chase the high-octane strategy only after it goes to the moon. It’s also not a great idea to switch over to the volatility dampener only after the bear market has already mauled your portfolio. If your investment strategy relies on constantly putting your money into strategies you wish you would have invested in prior to a big move in the market you’re always going to be playing from behind. There’s a reason it’s buy low, sell high and not the other way around.

Sticking with a long-term investment strategy isn’t very sexy but it gives you a much higher probability of success rather than trying to pick the thing that’s going to work in the next market environment. [In other words, boring is beautiful. Save your excitement for your hobbies or other aspects of your life!]

BUSINESS/ECONOMY

I have been saying how weird everything has been for a while. I think this article may have the answer… One plausible explanation for this too-good-to-be-true economy.

The most plausible explanation of all is that the pandemic and subsequent recovery were so unusual that the normal rules of economics don’t apply.

This return to normal is helped by numerous tailwinds: Gas prices are back down, China has reopened and appears to be rebounding, and immigration is picking back up, providing more workers to fill job openings. Wage growth is also slowing down as workers aren’t quitting and jumping to new roles as often. This could keep inflation on a downward trend.Put all of this together and the story is that employment remains strong, consumption issolid and businesses are growing cautiously more optimistic. Avoiding a recession, which seemed unthinkable only a few weeks ago, could be possible. [Time will tell…You should stick to your financial plan and don’t worry about these things…unless your investment horizon is short term. If it is, you are a speculator, not an investor and good luck!]

I enjoyed this podcast about the economy and the coming recession (well, maybe) and the housing market that gets hot again every time mortgage interest rates settle around 6% it appears: Why Everybody is Wrong About a Recession and Housing’s Great Comeback.

You will be hearing this question way too many times as we get near the inane debt ceiling date of “doom”, brace yourselves: Will Interest on the National Debt Cause Hyperinflation?

Fantastic substack to follow: TKer by Sam Ro. I added it to the Personal Finance sites I recommend.

CRYPTO/FTX/ELONMUSK/TWITTER

No surprise at all with this guy! Yes, Elon Musk created a special system for showing you all his tweets first.

“He bought the company, made a point of showcasing what he believed was broken and manipulated under previous management, then turns around and manipulates the platform to force engagement on all users to hear only his voice,” said a current employee. “I think we’re past the point of believing that he actually wants what’s best for everyone here.”

The guy is just addicted to Twitter so much he bought it for a ridiculous amount (thanks Elon for paying me $54.20 per share lol) and he has been screwing with it ever since smh…Brings to mind that meme “This is fine” while everything around you is burning smh…More than half of Twitter’s top 1,000 advertisers stopped spending on platform, data show.

Looks like the SEC headed by Gensler is going about regulating crypto the right way…Very encouraging that this happened: SEC charges Do Kwon, Terraform with fraud in connection with Terra collapse. This dude was even more arrogant that Elon Musk…and you thought this was not possible huh?

SCAMS

Can you imagine being scammed by Enron, Bernie Madoff and now FTX? Wow! Hellish hat-trick: This ultrarich New York family lost billions on Enron, Bernie Madoff, and now FTX — here are 3 simple tricks to avoid getting scammed yourself. Be careful out there you guys! And good advice to not be like this greedy guy surrounded by advisors full of BS, what the hell were they doing?

Like a man struck by lightning three times, billionaire oil baron Robert Belfer has the dubious distinction of falling prey to Enron’s corruption, Bernie Madoff’s Ponzi scheme and the implosion of cryptocurrency exchange FTX. To say this 87-year-old is a financial fraud survivor is putting it mildly. Madoff took him for tens of millions. Kenneth Lay’s energy company drained him of billions. Now, as first reported in the Financial Times, Belfer stands to lose a total stake of $34.5 million in Sam Bankman-Fried’s crypto company.

Ok, this is not a scam, at least not yet. But I am starting to wonder about this ChatGPT thing and them AI aided search engines, like: Microsoft’s Bing is an emotionally manipulative liar, and people love it. Some of the answers thrown back at us from it are, hmm, a bit unhinged? Or are some of the programmers behind them phucking with us? Grab your popcorn…

UKRAINE RUSSIA WAR

Best of Web: I support Ukraine. You should too. Because the Russians are genocidal here…‘They Didn’t Understand Anything, but Just Spoiled People’s Lives’. How Russian invaders unleashed violence on small-town residents. No excerpts, read it all and if you are somehow convinced not to support Ukraine…I am speechless! Archived Link.

Sometimes I wonder what the hell are the Russian people doing and going along with this maniac? WTF was he thinking? Ok, let’s not go there smh. A year after Russia invaded Ukraine, Putin is beginning new offensives – and he desperately needs a victory.

Why is Russia beginning these offensive activities in Ukraine now? There are three reasons.

The first and most important is political. Putin needs a victory. His forces over the past 12 months have suffered battlefield defeats in the north, south and east of Ukraine.

A second reason Russia has commenced the preliminary operations for its offensives is to disrupt future Ukrainian offensives.

Finally, the Russian high command will want to ensure Russian forces are in a better position, in the east and south of Ukraine, to hold more defensible ground before the full effect of recent Western donations of tanks, armoured vehicles and munitions can be brought to bear by the Ukrainians.

ODDZ & ENDZ

Best of Web: Must read for everyone interested in the subject: The Future of Long-COVID. This emergency is not about to end.

Never heard of this blog, Infidel753. Hmm, okay. This post about the “exhausted majority” was pretty good. I long for the days we all can unanimously praise or make fun of a Superbowl halftime show! Yeah, right…

The real radical crazies are irredeemable, but they’re a minority, even if they’re making most of the noise. Ultimately the sane people on both “sides” have to find a way to take the country back from them, instead of allowing ourselves to be herded into the existing opposing camps that view each other with hatred and incomprehension. [Amen!]

This is a long personal story of searching. For something/someone/meaning/whatever. I like getting up early in the morning and do the reading that ends up in this blog so you can enjoy the same stories I read. This one spoke to me. Or maybe it is how we all deal with grief differently. And regrets not saving your friend…Definitely do not read this if you are looking for a story to pick you up okay? What We Search For.

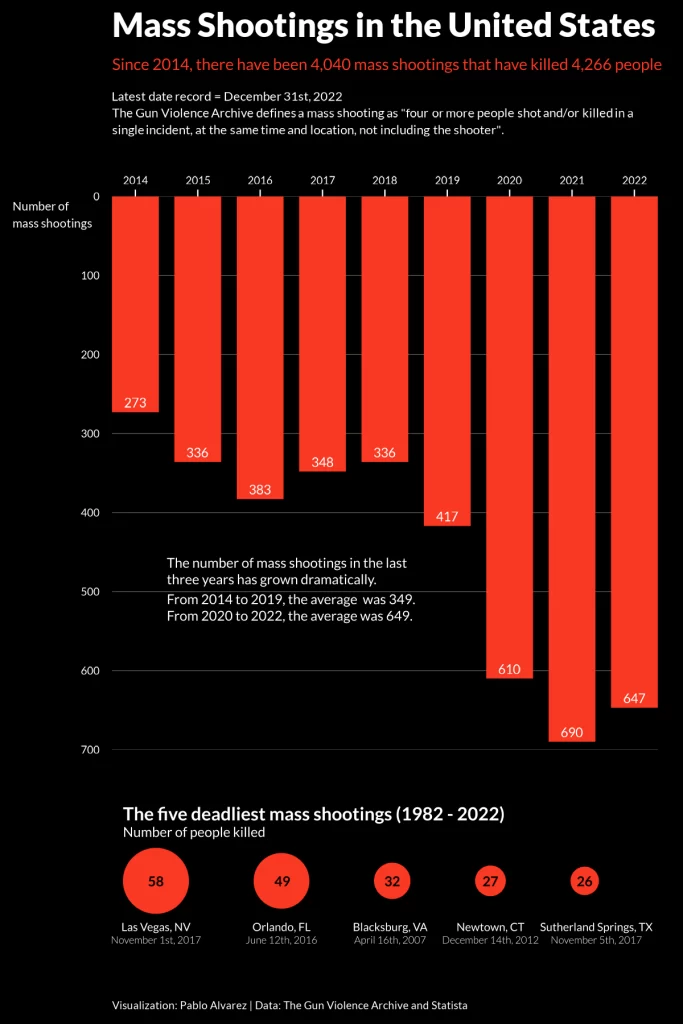

I pretty much gave up on meaningful gun reform when Sandy Hook happened and, well, nothing really happened afterwards. And the killing has not stopped…I don’t think this table reflects the latest shooting an hour away from me at Michigan State University. It is sheer madness we keep placing students in body bags smh…Charted: Rising Mass Shootings in America.

These are absolutely amazing! The 2023 Underwater Photographer of the Year Contest Dives into the Stunning, Heartbreaking Lives of Aquatic Creatures

These are absolutely amazing! The 2023 Underwater Photographer of the Year Contest Dives into the Stunning, Heartbreaking Lives of Aquatic Creatures

TRAVEL

Fodor says these are the 10 destinations to reconsider in 2023, Fodor’s No List.

If you are interested in a trip to the end of the world – Ushuaia, Argentina.

I guess sometimes things work out! She got the last seat on a flight next to a stranger. They’ve been married for 40 years.

Since we are on the subject of airplanes, how about The retired Boeing 737 that’s been transformed into a private villa. Lost interest when I saw the starting nightly rate of $7,000 lol.

BUZZING

A section where I go on and on about some stuff that happens in my life and anything else that just does not fit in another section above.

It looks like this time is a go, taking mother back to Greece this Tuesday. I have no return ticket yet, we’ll see how it goes. Not the best timing during tax season but it has become clearer that the US is just not for her and the sooner she gets back to her familiar environment the better off she will be…We are supposed to fly Lufthnasa through Frankfurt and the airline’s latest IT issues and strikes sure is not helping! #developing

Marathon training is going great but I need to tone it down. Because every time I said that…something bad happened. I signed up for the Rock CF half marathon race in a month to get me ready for the Toledo Glass City Marathon in late April.

This one hit pretty close to home, so heartbreaking. And we let it happen over and over again smh: Michigan State professor details terror of mass shooting in Room 114.

What am I listening to lately? I am in love with this song: “The Condemned” by Das Koolies.

Everything below deals with the hobby of collecting frequent flyer miles and points. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/MY ACTION

The main point of this hobby is the fact that US banks keep showering us with lucrative travel rewards credit card signup bonus offers. For responsible consumers like us who always pay our credit card balances EVERY month, who don’t mind the additional legwork to juggle different credit cards along with keeping up with all the different spending requirements and always changing promotions…this hobby is amazing that it can produce travel experiences that most people could not even dream off that they can afford. We stay quiet and just keep taking from the US banks. Well, it used to be this way until the US banks started paying bloggers to become their marketing representatives about twelve or so years ago. Anyway, the loyalty programs and the travel industry has been drastically changing for the worse ever since. But one fact remains: The generosity of US banks to keep offering six digit signup bonuses on sometimes no annual fee credit cards is paid for by the backs of consumers who are, well, spending challenged. The ones who keep piling up on credit card balances and paying hideous interest rates on them. It is awful because undoubtedly some of these people are driven to despair. I wish it was not this way but…we deal with what we are faced. It is better to be a taker than a giver. So, for the past thirty years this hobby has afforded some of us takers to earn millions of miles and points. And all because of this fact: US credit card debt soars: What to know about rising rates, balance transfers.

Credit card balances hit $986 billion by the end of last year. Before the COVID-19 pandemic-related shutdowns cut into spending and credit card debt, the high was $927 billion. Over a 12 month period, consumers added on $130 billion in credit card debt from December 2021 through December 2022, according to New York Fed research…We’ve seen a rapid rise in interest rates overall in the past year, driving the average credit card rate to 19.91% as of Feb. 15, according to Bankrate.com, up from 16.28% a year ago.

Of course the more US banks get into this credit area, the better for us! Competition is wonderful and we always benefit. Wells Fargo may be coming back with some serious credit card alternatives, hopefully Citi wakes up from its lethargic recent past, Capital One hopefully sticks to its latest strong entry into this market and not suddenly abandon it, Amex will do what Amex does (lol) and of course Chase will hopefully continue to give every breathing US consumer one of its credit cards or two or dozen. Of course we will always have weird banks like Barclays and US Bank doing things without rhyme or reason here and there scratching our heads. One of the most positive developments was seeing Goldman Sachs get into the consumer credit business with its Apple and GM credit cards and of course its online savings Marcus accounts. GS even bid for these cards recently but lost all of them: Macy’s, JetBlue, Expedia Group and Hawaiian Airlines and T-Mobile most recently. Sadly, it looks like GS will not be competing for more of this business in the near future, boo.

I am still working on my daughter’s Chase Ink Cash minimum spend to earn another 90,000 Chase Ultimate Rewards points. For no annual fee cards, come on! It is amazing this has lasted so long wow. I mean, you can have 90,000 flexible Chase bank points or fall for marketing gimmick earning shitty Delta Skymiles. This is NOT a trick question! Delta did have some rare Flash Sales that could warrant collecting some Skymiles. And then, well, there goes Delta stinking up the joint again to a level only Delta can reach smh: Delta Flash Sale: Just 240,000 – 750,000 Miles Round Trip to Europe in Delta One.

Well, the shoe is expected to drop from American Airlines as yet another airline is about to go fully dynamic in its pricing. So, book some AA awards to use up your AA miles. I should do this too but this blog post is not going to post itself lol. Anyway, bloggers will of course never stop selling you credit cards so, if you do get one/two/sixty-nine cards, please consider my site before they take my cc links away from “overuse” lol. Anyway, good post: [Final Weeks For Award Chart And Earning 2022 Loyalty Points] American’s 2023 Mileage, Elite Status, And Award Chart Changes: The Good, The Bad, And The Unknown.

Only Capital One will 1099 you for Global Entry credits wow! Anyway, very weird how this bank goes about this. Deciphering Capital One 1099s (Global Entry Credits are Taxable). Never expected so many decimals smh:

Capital One values a Capital One Mile at $0.010029 each. I have no idea why it’s not an even penny, but that is why all of your 1099s end in pennies.

I haven’t had time to book any awards…just need to book my return from Greece soon…like next week…maybe. But I can’t because I don’t know how long I will need to stay #firstworldproblems

MILES & POINTS

HOT CREDIT CARD OFFERS: 90k CHASE Ink Cash, 90k CHASE Ink Unlimited, 75k Capital One Venture X, 100k CHASE Ink Business Preferred, 60k CHASE Sapphire Preferred, 60k CHASE World of Hyatt Visa, 20k CHASE Freedom Flex, 175k IHG Rewards Premier and many more, including many AmericanExpress cards, including Delta, Marriott and Hilton cards! Please check out my Affiliate links. Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. If you do not see a credit card with my affiliate links, perhaps I could refer you?

This section is about my hobby addiction of collecting frequent flyer miles and hotel points since the early 1990’s! SKIP if you are not into it!

As of today, I have burned 32,000 miles/points year to date in 2023 and have 4,565,342 miles/points in the bank. Some do drugs, I do miles lol!

Thanks to US banks, very lucrative travel rewards credit card offers come and go all the time. This section will act as a reference point on the best CURRENT offers. I will designate new material preceded by NEW.

BEGINNERS

The Beginner’s Guide to Getting Started with Credit Cards, Points & Miles

BASICS: This travel hacking hobby is mostly about getting the fat Signup Bonus of travel rewards credit cards while of course NEVER EVER carrying a balance. Banks have a marketing budget and are willing to give us many THOUSANDS of miles/points to travel mostly for free hoping to hook us to charge 20%+ interest rates on our balances. The poor souls who fall for their marketing paying these ludicrous interest rates end up subsidizing us responsible consumers who enjoy taking advantage of, cough, such bank marketing budgets! Some of us have been doing this for thirty years creating amazing travel memories…Feel free to ask me questions or post them in the comments.

BASICS: Prefer credit cards from the proprietary points programs of banks, such as Chase Ultimate Rewards, American Express Membership Rewards, Citi ThankYou Network, Capital One Rewards Miles because they are a lot more flexible and are not devalued as frequently. Over pure airline and hotel travel rewards credit cards. Pure cash back credit cards may work for you best and they are getting more valuable as airline and hotel loyalty programs keep getting devalued. Sometimes, a pure no annual fee 2% cash back card works best for simplicity!

TOP TRAVEL REWARDS SIGNUP BONUS CARDS

Master Guide to Credit Card Applications: All the Rules You Need to Know, Bank by Bank

How to Sign up for Chase Ink Cards

The Chase 5/24 Rule: Everything You Need to Know

By far, the best BANG you can get these days! These two NO ANNUAL FEE Chase Business cards are now offering an amazing 90,000 Chase Ultimate Rewards Points, the Chase Ink Business Cash and the Chase Business Ink Unlimited! Bottom line, I think these are the BEST business travel rewards cards out there right now! The 90k Signup Bonus can be earned after $6k of spend on the cards in the first three months. I am not going to make a fool of myself with recurring “69 reasons I love these two cards”, this is not a sales maximization blog ok? You can click to find out more about them and you can apply HERE to support this blog, thank you.

Chase Ink Cash vs Ink Unlimited: Which Offers the Best Return For Your Business?

The Capital One Venture X card offers a 75,000 point Signup Bonus after a minimum spend of $4k in the first three months. If you like simplicity and looking for one (premium) card, I highly recommend this card (and yes, I have it myself!). It has an annual fee of $395 but it comes with a VERY easy $300 statement credit for travel booked on its excellent travel portal, essentially turning it into a $95 annual fee card. But wait…there is more! On each card anniversary you earn 10,000 points essentially making it FREE! Every dollar of spend earns 2 points and flights booked on the travel portal earn 5 points per dollar. You get access to Capital One and Plaza Premium airport lounges and a Priority Pass Select lounge membership and, this is important, you can add FOUR authorized users FOR FREE who can also have their own Priority Pass Select airline lounge membership. You can transfer your Capital One points to up to 18 Transfer Partners. No foreign transaction fees. Free Hertz President’s Circle rental car top elite status. Cell phone protection and PRIMARY rental car coverage. Awesome seats at baseball stadiums for just 5k points each. And lots more. Available with my Credit Card Links, thank you for your support!

7 Sweet Spots to Use 75K Capital One Venture Miles

7 Underrated Benefits of the Capital One Venture X Card

Chase IHG Rewards Premier Card 175,000 Points Signup Bonus. After only $3,000 in spend in the first three months. Not free, you gotta pay the annual fee of $99. Free night up to 40,000 points per night starting with the second year of holding the card. Automatic Platinum status (which is not a big deal) while you hold the card. Card earns 26x per dollar spent on IHG properties, 5x on travel/dining/gas and 3x everywhere else. Fourth reward night free on stays of 4 or more nights. Under Category/Hotels HERE, thank you.

Six new higher offers for the consumer and business Delta Gold, Platinum and Reserve cards. I do not recommend Delta Skymiles, especially with so many better and more flexible points choices out there. Unless you know what you are doing and you can swing more of them because they work for you. Or you can jump on the Delta Flash Sales right away…Available HERE.

Some of the links are behind a paywall. You can try to read them using Archive.is.

TBB

travelbloggerbuzz@gmail.com

You can subscribe to receive every post below:

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The recent experience with AI chatbots suggests that Stanley Kubrick was right!

You’re right. The banks keep throwing these amazing offers our way.

Thanks again for the links.

Silver! FTPNW! Geez, hope all goes well with taking your Mom back to Greece! Best wishes to both of you on this, I know it is hard.

On a short road trip so will read at the great stuff here over the weekend. Thanks as always!!

Thanks for the great post Buzz.

Sincerely wish you and your mom the best on your upcoming return to Greece.

On the bright side, I’ve almost completed the construction of my transcontinental jetpack. it’s powered by the methane collected form the chambers of congress. If I complete it in time, I’ll see you in Greece!

Good luck with your mom, I know it’s not easy.

Maybe it’s just the routes I’m checking but it feels like AA has mostly been dynamic pricing for a while now. Speaking of which, for our summer vacation the most recent plan is fly into Milwaukee, hang out in Green Bay for a couple of days, spend a day crossing the UP, hang out in Traverse City for a few days, then fly out of Grand Rapids. If it were just me I’d maybe spend a night or two on the UP but with the whole family plus my mother-in-law checking into and out of hotels is time- and energy-consuming.

Running my third-ever 5k tomorrow… Can I avoid serious injury? Stay tuned!

Mother fell…

Going to be okay but going back is looking like an ultra marathon…

Also, no dinero here since Feb 6 at all, zilch.

Enjoyed the day off from running…but mentally I am beyond exhausted.

Thanks for the comments, will respond later this weekend if I find time.

Tuesday post is 98% done, need a funny pic. Friday? Lol