Another TBB post featuring the most eclectic links around the web such as finding retirement purpose, the polarizing Cybertruck, memecoin pumping is rampant, JetBlue future, inheritance confessions, US state tax rates and brackets, repeating bubbles, mankind museums and free sounds, best travel tips, airlines and airport lounge developments, the best photography links and of course always all of the most important developments in the crazy world of miles and points at the lower half of the post. Enjoy the weekend and file your tax returns early.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No sponsored posts. Also, no AI!

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This is a one man labor of love operation, enjoy it while it lasts.

BLOG HOUSEKEEPING

I started a new Bluesky account. Please follow me there, my handle is @feeonlyplanner again. It will be mostly personal finance stuff. There will not be a Bluesky account for my blog.

This blog continues someway somehow, not sure for how long.

Support independent sources to strengthen civil society and democracy. This blog has no advertising and sponsors. And no paywall either, everyone can read it regardless of income. The very few (actually about nine of you) who choose to use this blog’s links for credit cards or buy me a few coffees provide the financial support (which I don’t really need but keep this venture as a business concern to justify the long hours that go into bringing it to you) to keep my baby going. Nice supportive comments and emails also go a long way to keep this blogging crusade going. Anyway, we are all in this together.

PERSONAL FINANCE

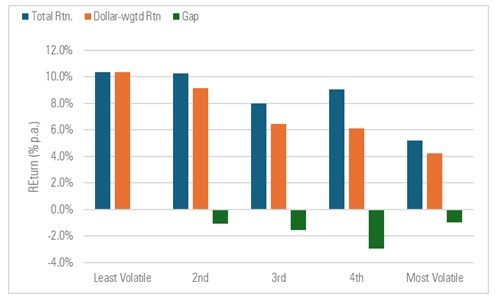

Not shocking: The Less Fund Investors Did, the Better They Did. The average dollar invested in stock funds with the most stable cash flows earned more than 10% per year while the average dollar invested in funds with the most volatile cash flows made less than half of that. What’s more, investors in funds with more-stable cash flows captured most of the funds’ aggregate total return while investors in funds with less-stable cash flows captured substantially less of those funds’ time-weighted returns.

Did this happen to you? It is very common actually: Confessions of a Financial Planner: I Felt Guilty About an Inheritance.

Questions often start circling in people’s minds:

- Why me and not another person?

- What did I do to deserve it?

- How can I make the most of it?

- How can I steward this money well?

- How much should I give away?

There is so much crappy advice on YouTube. I don’t use TikTok by the way, I hear it is way worse over there. Anyway, remember when some time ago I brought to your attention a “financial influencer” (red flag right there) dude named Kevin who had the audacity to start his own ETF? Well, not shocking: YouTuber Is Closing His ETF After Performance Woes, Soaring Costs.

Kevin Paffrath, a financial influencer who goes by the online moniker “Meet Kevin,” said in a video on his channel that his fund, the Meet Kevin Pricing Power ETF, would be closing at the end of this month some two years after its inception and with just $32 million in assets. Paffrath, who has more than 2 million followers on YouTube alone, sells courses on his website promising to teach people how to grow their wealth and “master stocks.” But Paffrath struggled to pick stocks that would make his fund grow. [Should have stuck with selling courses instead of mastering stocks smh]

Great video on Retirement Purpose, Health and Aging. My wealth management practice has now veered into focusing in this phase of life.

Great resource to bookmark: 2025 State Individual Income Tax Rates and Brackets. I added this to the Personal Finance Resources page.

SCAMS/CRYPTO/AI/TECH

Article attempts to answer this question: Déjà bubble: Can bubbles repeat? Sadly, the answer is yes it appears from the arguments the authors make. Then again, we keep bringing up the Dutch tulips from centuries ago. How is that relevant in today’s world with wifi everywhere? At some point I would like to refer back to human nature not extending one hundred years. Ok, last sentence was supposed to be a joke, I need to work on better ones lol.

Bubbles might be especially likely to repeat today thanks to social media, which creates a hothouse environment for ideas to spread across the investor population. If we think of bitcoin investing as a virus, this virus can evolve, mutating and spreading to susceptible minds. Just as the rise of modern air transportation allowed highly contagious diseases to spread across the globe in days, the rise of social media allows highly contagious ideas to infect financial markets. Modern medicine has produced a vaccine for COVID. Sadly, a vaccine for investor overoptimism remains out of reach.

From one of my favorite online publications Texas Monthly: The Most Polarizing Thing on Wheels. A year after its debut, the Cybertruck has come to embody Tesla’s infamous CEO, with critics suggesting it’s as defective and unreliable as Elon Musk himself. Of course:

“So much of this car is worst in class,” says Matt Farah, the host of The Smoking Tire, the country’s leading automotive podcast. “The panel gaps are atrocious. The wiper sticks out over the A-pillar. I wouldn’t let these flaws pass on a Sub-Zero refrigerator, let alone a six-figure truck. There are so many corners they have backed themselves into with this design.”

and yet, straight from the author…

I neglected to mention one other thing: The Cybertruck is completely, and unambiguously, thrilling to drive.

Years later we will look back in this crazy time and wonder what the hell was happening. We have sitting heads of state promoting their own meme coins for crying out loud. Not to sit back: Argentina president faces impeachment calls over crypto crash.

You like my blog? Send a link to someone please!

ODDZ & ENDZ

Find any sound you like: freesound.org.

Flip through this: The Secret Museum of Mankind. I feel psychic rewards bringing to my blog readers stuff like this, you are welcome. I guarantee you have never seen these photographs from our ancestors all over Planet Earth.

This blog exists primarily to educate. Did you know that we can live without our colon, spleen, appendix, gallbladder and adenoids? Now you know: 5 Organs Your Body Can Live Without.

Let’s look at the best images from the 2024 Pet Photographer of the Year Awards.

TRAVEL

Hard to believe everyone survived intact. And talk about compensation: Delta offering $30K to passengers aboard flight that crashed, flipped in Toronto. I bet ambulance chasing attorneys are speed dialing every passenger for the class action lawsuit as we speak.

First, they came for the boarding process. Then, came for the first ever layoffs: Southwest Airlines to Lay Off 15% Of Corporate Workforce in Cost-Cutting Push.

Travel to a city around the world while listening to music: CityHop. Love this. My favorite is Koh Kut island in Thailand while listening to house music, we are all different.

It has been super cold here in Ann Arbor, Michigan. We are talking polar vortex temperatures. So I find myself dreaming of Thailand. And these are The Eleven Best Hotels in Thailand. According to this publication. All lists are subjective of course. Hyatt’s brand, The Standard, strikes again, I need to visit one of them.

Very interesting article by Kevin Kelly: 50 Years of Travel Tips. There are some great tips we know. And a few really bad ones. So, I found these the most uniquely helpful, ymmv, we are all different:

When asking someone for a restaurant recommendation, don’t ask them where is a good place you should eat; ask them where they eat. Where did they eat the last time they ate out?

You can get an inexpensive and authentic meal near a famous tourist spot simply by walking at least five blocks away from the epicenter.

People in other places are not saints. You might get cheated, swindled, or taken advantage of. Paradoxically, the best way to avoid that is to give strangers your trust and treat them well. Being good to them brings out their good. If you are on your best behavior, they will be on their best behavior. And vice versa. To stay safe, smile. Be humble and minimize your ego. I don’t know why that works everywhere in the world—even places with “bad” reputations—but it does.

It is always colder at night than you think it should be, especially in the tropics. Pack a layer no matter what.

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS

Here we go again:

Do this now: How to Avoid Uber Foreign Currency Conversion Fee.

Really good comprehensive post on all The American Airlines Partners You Can Book With AAdvantage Miles.

So, please do not ever stop efforts to stick it to the big banks. Because they are going to do this to you more now: CFPB No Longer Forwarding Complaints To Financial Institutions.

The trend for more hotel brands continues. Here we go with IHG Acquires Ruby Hotel Brand. No big deal, just 32 properties in cold Europe. This makes it brand #20 for IHG, slackers lol. Interesting how IHG is positioning Ruby properties to be full of “heaps of character, a dash of wit, and the coziest rooms in your must-visit cities“.

Airport lounges keep coming. Capital One opened one in Las Vegas yesterday and Chase opened one in Philadelphia two days ago.

I predicted not too long ago here that JetBlue will not stand on its own in a few years. Well, I lost count how many rumors are out there these days: Despite Merger Chatter, JetBlue Exec Fondly Recalls American Partnership. With United in the forefront even if they keep denying it. Come to think of it, JetBlue’s timing to introduce the worst premium credit card ever (issued by Barclay’s bank) is just bizarre. Stay tuned. I wonder with Spirit Airlines emerging out of bankruptcy, will they try again? This administration will be a lot more accommodating to this now…I think. I still say United is best suited to get in bed with JetBlue but it may just be too much right now amid a lot of uncertainty hanging in the air with economy’s direction and fluid employment landscape.

TRAVEL REWARDS CREDIT CARDS

Do NOT do this: Capital One Readds Jetblue As Transfer Partner (5:3 Rate). If you ever do this I will kindly ask you to leave and go read The Points Guy Inc.

When new credit card offers come out, all the credit card selling bloggers come out in force, there are so many out there. Especially on YouTube. Some of these guys are so new it amazes me. And they are all targeting the newbie trying to impress them how they can fly for “free”…if only they clicked on their credit card affiliate links. I swear 99% of all these outfits will quit when the banks stop paying them to push plastic. I would probably still be around here trying to sell more than 2 credit cards per month to my audience that is definitely not classified as newbie. Not sure if this is good marketing but this blog is a mental escape mostly for me and not my main job. If it was, well, I guarantee you that it would not be here for 12+ years. Ok, now let me fake my excitement about this new bonus, WOW, HURRY, LIMITED TIME OFFER, IT WON’T LAST, BEST BONUS EVER (not really) smh…

75k CAPITAL ONE Venture Rewards PLUS $250 Travel Credit

The annual fee is $95 and the minimum spend required is $4,000 in three months. Capital One cards usually earn a simple flat 2 points on every dollar. This card earns 5x on hotels and car rentals booked on its own travel portal. No foreign transaction fees. Get $120 credit towards Global Entry or TSA Precheck. Complimentary Hertz Five Star elite status. Most importantly, you can transfer the 75,000 points out to airline and hotel partners. Or just erase travel charged on the card for $750. And then of course you get the $250 travel credit. Basically, $1,000 of travel for $95. Very tempting indeed. For diversifying purposes as well if you have enough miles and points elsewhere as it is always nice to use this card to pay for a trip and then use Capital One miles to erase the charges. Capital One can be, well, finicky in approvals. If you are denied, you can not call to ask them to reconsider, it is all done by algorithms so, good luck! Finally, YES, you can have both the Venture X and the Venture Rewards cards.

Frankly, if you only go for one Capital One card it should be the Venture X, see below, no brainer. Oh, by the way, only the Venture X card gets you into Capital One lounges for free.

More elevated offers finally from Chase:

100k CHASE United Business

And just like that, the welcome offer for this card went up to 100k from 75k. The annual fee is $99 and and the minimum spend is $5k in the first three months. The card earns 2x on United, gas stations, restaurants, office supplies, local transit and commuting. And 1x on everything else. If you buy 7 United tickets with it, you will get a $100 United flight credit at card anniversary. You get two United club passes every year. If you have a personal United card as well, you get a 5,000 mile “better together” bonus. 25% discount on United in flight purchases. Expanded award availability. Ability to earn Premier Qualifying Points (PQP). Free checked bag for credit card holder and one companion on the same reservation. Priority boarding. No foreign transaction fees. Can be a good fit for travelers flying on United a lot. Available from my favorite bank HERE.

NEW: United Business Card Review: Sky-High Bonus Plus Multiple Unique Perks Help Justify the Annual Fee [“Sky-High” lol, anything to help credit card sales I guess]

Please help the small independent blogs like mine continue to exist by supporting them with your CREDIT CARD clicks, thank you!

The 75K CAPITAL ONE Venture X card has a minimum spend of $4k in the first three months. If you like simplicity and looking for one (premium) card, I highly recommend this card (and yes, I have it myself!). It has an annual fee of $395 but it comes with an easy $300 statement credit for travel booked on its own travel portal, essentially turning it into a $95 annual fee card. But wait, there is more! On each card anniversary you earn 10,000 points essentially making it FREE! Every dollar of spend earns 2 points and flights booked on the travel portal earn 5 points per dollar. You get access to Capital One and Plaza Premium airport lounges and a Priority Pass Select lounge membership and, this is important, you can add FOUR authorized users FOR FREE who can also have their own Priority Pass Select airline lounge membership and, this is BIG, they can bring in unlimited guests with their FREE Priority Pass card! You can transfer your Capital One points to up to 18 Transfer Partners. No foreign transaction fees. Free Hertz President’s Circle rental car top elite status. Cell phone protection and PRIMARY rental car coverage. Awesome seats at baseball stadiums for just 5k points each. And lots more. If you prefer, this is my personal referral link.

Click on my TOP CREDIT CARD OFFERS to see a DETAILED explanation of the features of these cards.

Here are my three TOP CREDIT CARD OFFERS as of today:

The #1 Top Offer is the 75k Capital One Venture X card. It is amazing what you get for FREE with this card!

The #2 Top Offer right now is the 75k Chase Ink Business Unlimited card.

The #3 Top Offer right now is 75k CHASE Ink Business Cash card.

Learn more about these offers HERE.

BONUS OFFERS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog (and you don’t have to hunt down the link in my Credit Cards page!)

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click on the link above

2. Create an account

3. Subscribe

MY ACTION AND BLOG BUZZING

This section will include some advanced hobby miles/points collecting stuff as before. And oh boy, there was a massacre last Monday President’s Day. No, I am not referring to any federal government firings. I am referring to American Express: Lessons from the Big Axe: American Express 2025 Edition. I keep it safe around here with just strategic card signups for the welcome offers. So I can keep playing. I do travel less but I am determined to keep my streak alive for not getting banned from any banks. ETrade banning me for repeatedly opening investments accounts to score the signup bonus many years ago does not count ok? I know of a friend who lost 5 million Amex Membership Rewards in this massacre. So, be kind always ok?

Last Friday my wife reminded me that we were going to attend a friend’s surprise birthday party in Rochester, Michigan which is about an hour away. We had talked about perhaps staying at a nearby Hyatt Place to make it a bit easier on us as we were going to have to drive back home late at night. I had totally forgotten about it and then we were also hit with a winter weather alert to take place just about when the party was starting. So I went on the Hyatt website and burned 5,000 World of Hyatt points to book us one night the next day at the Detroit/Utica Hyatt Place which is less than 10 miles from friend’s house. And this is how I roll lol. This makes it 11 Hyatt elite night credits. Three nights booked at Toronto later this year and 2 more coming from the personal Hyatt Visa card spend (and a free night cert) soon. Requalifying for Globalist elite at 60 night credits again looks like a really high hurdle this year. Update: I haven’t found the time to post my review with pics of the hotel and a video on my YouTube channel yet. I guess I am not cut out to be an influencer lol.

Alaska Airlines had done a fairly good job bringing in to the fold Hawaiian Airlines. But not for us. We are giving up claiming Alaska Airlines credit for son’s October 29, 2024 HA flight from Tokyo to Honolulu. He had entered his Alaska Airlines number on all four legs of that trip flying Korean Airlines, Japan Airlines and Hawaiian. And guess what? Both Korean and Japan flights were properly and timely credited to Alaska Airlines. Thankfully those were enough for him to requalify as Alaska Airlines MVP Gold elite again. But that HA leg was just left hanging. We were given the typical BS 6 to 8 weeks. Then we followed the exact process here to get this finally resolved by emailing Mileage Plan the flight info AND the boarding pass in mid December. When contacted, we were told the 6 to 8 weeks BS excuse. So, we are now in mid February and now we were told that the only way to do this is to contact Hawaiian Airlines and then merge the HA account to the Alaska Airlines account. And that is just inexcusable and all the agent would come up with “we apologize”. This shit makes me furious, phuck them. Son has not flown Alaska Airlines yet this year, coincidence? It is just mind boggling the Asian Airlines made this happen like clockwork and American Airline Alaska Airlines is buying could not smh. Also, I had to contact JetBlue again to claim mileage credit for my November 2024 Qatar Airways flight from Doha to Bangkok. They promised action within 72 hours. Sure as we are past it already. If only everything worked as it should be, is that too much to ask?

I need to watch the Saturday Night Live 50 Year Anniversary show one day soon. Oh wait, you can watch it all here in all 28 videos, enjoy.

I am up to four miles a day, two walking and two jogging. Progress is stagnating? Never give up. Anyway, I may be having issues with carpal tunnel syndrome lately and avoiding going to the doctors. Because the prescription will likely be lay off the keyboard and the cell phone. And that will mean the end of this blog prematurely and before the 2nd credit card vendor cans it for lack of credit card sales. Stay tuned.

Tax time is always stressful. Plowing through client tax returns, almost at half point already #winning.

I need to find time to go see the film “Becoming Led Zeppelin“.

I haven’t done anything with my miles/points all week. I am thinking about going for the 100k United Business card…

Oh, I am trying really hard not to go all political here. Unless you want me to. I see that Kottke.org has completely gone political, wow. There are so many places for this online…

HOT CREDIT CARD OFFERS:

75k CHASE Ink Business Cash, 75k CAPITAL ONE Venture X, 75k CHASE Ink Business Unlimited, 100k CHASE United Business, 150k AMEX Business Platinum, 200k CAPITAL ONE Spark Cash Plus, 150k CAPITAL ONE Venture X Business, $1,000 Cash Back CHASE Ink Business Premier, 75k CAPITAL ONE Venture Rewards AND $250 Travel Credit, 90k CHASE Ink Business Preferred, 60k Chase Sapphire Preferred, 80k CHASE Southwest Performance Business, 15k AMEX Blue Business Plus and many more!

Learn How To Apply HERE to support the blog. Or email me if you have any questions about any cards, I’m happy to help, thank you!

As of today, I have burned 175,000 miles/points year to date (2,027,816 in 2024) and have 4,345,474 miles/points in the bank.

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

First!

First credit card sale this month goes to FullMoon, thank you. Sadly, it is the only cc sale this month. Sometimes I wish the cc vendor just takes me out, it will help on the carpal tunnel thingie a lot!

I had Carpal Tunnel in both wrists years ago. After years of suffering, had Carpal Tunnel surgery. INSTANT relief.

Lots to read and ponder upon here, it will take a couple days. Off on my next trip next week, looking like I’ll be gone for about 3 months. Gonna try not to gain weight but I dunno, not going to be easy!

Glad you are back to running (some). I am sure you are pleased as well!

That Delta plane flip was really something! And no one was killed. Without knowing more than anyone else I’d bet that a lot of credit goes to the flight crew for getting people off FAST!

And of course the plane held together long enough …

Wow. There are things that work.

I need to renew my drivers license and I can’t do it online so I have to take time off from work to wait in line for a few hours. I wish points and miles could help with that.

LOL that sucks. That was me for my car reg since i moved last year. I thought I lost my license – looked all over house/car for it, ordered replacement online. Found it. In my wallet! I’m getting old.

Interesting tax map but what really matters is the top (and avg) rate for YOU. They should make the same map but with a slider. Maine is known for “high” income taxes and I’d agree. My marginal rate is 7.15 (the highest) and my effective rate is 6.12 🙁 And yes I did deduct my ibond interest and gov-obl dividends.

And these mothaphuckers reduce my state deduction. lolzor. time to move to floridaaaaaa

The Standard at Hua Hin looks interesting. It’s only February still plenty of time to hit Hyatt Globalist though not sure it is worth going out your way for. Re the Alaska debacle, I had the same thing happen, a business class flight on Fiji Airways that never credited. In the end I did not have the energy to continue to pursue. Life is too short. It’s a bit of a sad year here for redemptions as well, only spent 111k for 1 flight 1 night. Have to say I can not get onboard with Emirates business class, it’s all very ordinary after having experienced the joy of their first.

The two Chiang Mai hotels on the list are interesting. The first one on the Ping River, I have no doubt got flooded badly late last year. Hope they got the mold out. The other one I pass by every week since I play at the sports court across the street. The staff is always really nice when my grab driver gives up on dropping me off across the street and just drops me off at the entrance to the hotel.

But I would be very hard pressed to pay out of pocket for any of these hotels in Thailand given the discrepancy between what a 5-star hotel costs and what a 3-star hotel costs. You’d probably get better comparable value in a country where the value gap isn’t as wide.

But you know what they say about a fool and their money…..

I love The Most Interesting Man In The World advertisements. They are fun, funny and just timeless. Good call.

https://www.the-reframe.com/the/