Another TBB post featuring the most eclectic links around the web such as the US debt reckoning, the industries leveraging AI, scuba diving and roller coasters destinations, the new 80k CITI Strata Elite card, the $4 Million girlfriend experience with stolen money, private assets are coming to raid your 401k plans, crypto kidnapping is thriving, musicians are suffering, shoe laces and ADHD and solar power, tourism deep dive and Bangkok wiki, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend and stay cool.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

Due to new severe credit card affiliate restrictions, there will not be any credit card links in the body of the blog posts other than Capital One Bank and personal referral links going forward. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the big beautiful “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE to avoid clicking to find the one credit card you want to apply for. Or you can always email me, thanks for your support.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts. I know this may sound a little repetitive by now but it is still true after all these years.

PERSONAL FINANCE

Well, it is August 1st and here we go with more tariff nonsense smh…

With the recent passage of the new tax law it is time to start planning how you donate to charity: Get Ready for New Rules on Tax Breaks for Charitable Giving. Donors have several months to plan their contributions before changes from the One Big Beautiful Bill kick in.

At least we have Jason Zweig at the Wall Street Journal looking out for regular people. Please be careful of what is coming: Wall Street’s Big Bad Idea for Your 401k. Recent moves by some alternative funds highlight the flaws of offering private assets to public investors.

Because private assets don’t trade, it’s the fund managers—not the market—that determine what they’re worth. That enables the managers to report much fewer and lower fluctuations than public funds do. Then they get to declare that private funds are low risk. That’s ridiculous. In the real world, risk is the chance of losing money, which has nothing to do with how often prices are reported.

In short, an alternative fund can claim to be low risk and to be at least partly liquid—but, sooner or later, it won’t be able to sustain both claims at once. That’s true here, and for all the other funds hoping to rope in a much wider base of everyday investors. Remember that as politicians ease the way for alternative funds to land in your retirement plan.

At some point the debt will matter. Debt Reckoning. Don’t read this if you want to stay happy enjoying your summer, ok?

For now, some hope remains in the fact that the U.S. economy is still growing, in the idea that perhaps we can somehow grow fast enough to outrun our debt—that old American exceptionalism.

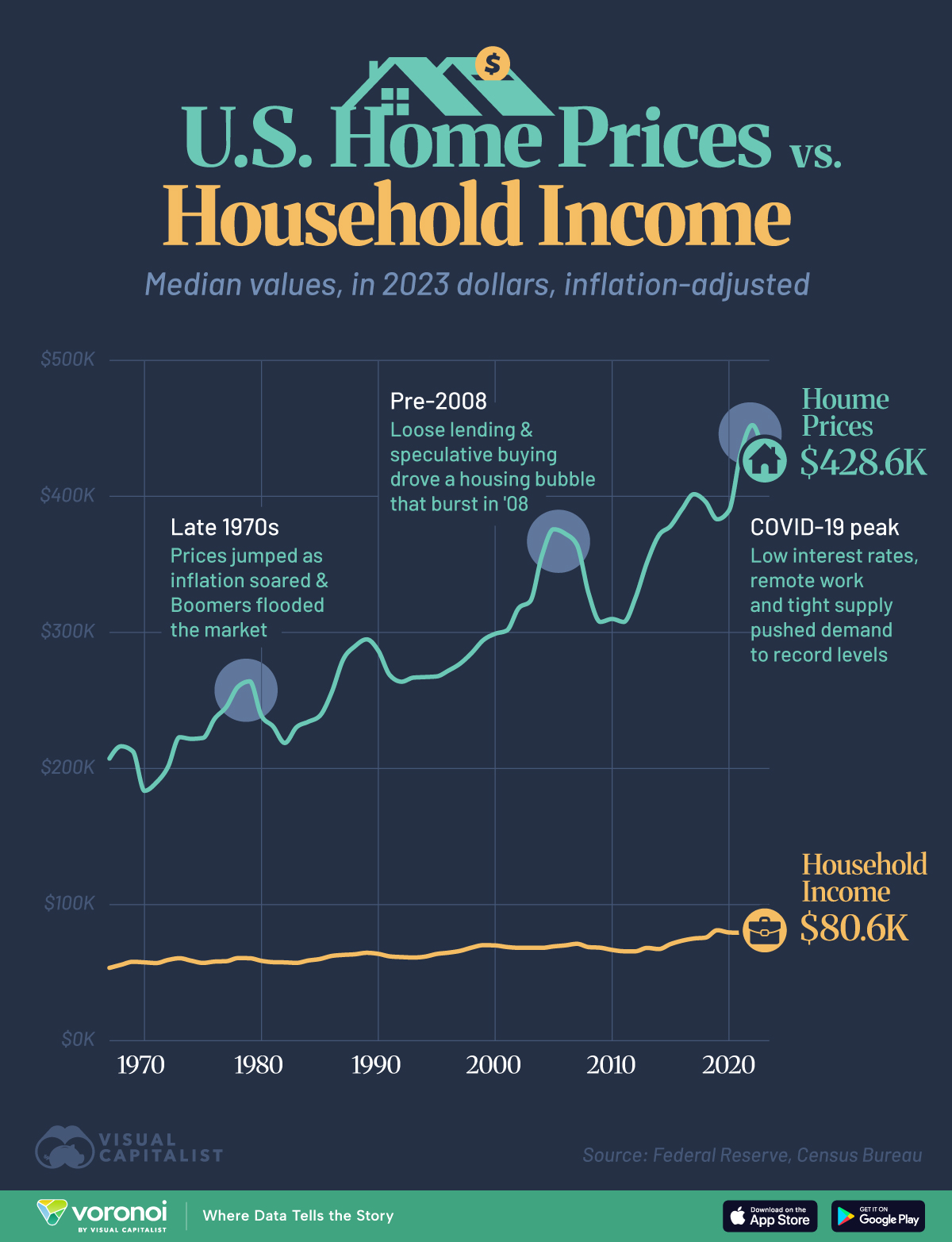

One big structural deficiency in the US economic system (if not the world) is this: The Decline of U.S. Housing Affordability (1967–2023).

SCAMS/CRYPTO/AI/TECH

Sometimes Toronto Life has these awesome in depth articles about, well, certain slippery situations. And this one stood out: The $4-Million Girlfriend Experience. Stephanie Sahler was a cam girl. Ralph Puglisi was a man willing to pay anything for her doting attention. It was the perfect arrangement—until she realized that every penny he sent her was stolen. I have seen a lot and I must admit this one shocked me. So much to excerpt here but I’ll let you enjoy this read all on your own. Picture an accountant working at a university without any decent accounting internal controls leaving him in charge. Add previous divorces, two adult daughters and one getting married, aging mother with health issues, a disabled brother, a new love and…you won’t believe what happened next. Currently resting comfortably in a federal prison after being sentenced to 10 years. Sometimes I wonder if he ever seriously thought he could get away with it…

And here goes another fraudster. But this guy went on to scam a billionaire instead making the accountant above look like peanuts: How to Extract $400 Million From a Billionaire: Use a Gilded Age Family Name. He called himself Gregory Mitchell and worked for what looked like an Astor family fund. But who was he really? Reading this I was wondering if some people were born to scam and how in the world a billionaire can fall for this wtf! On top of it all, the fraudster was answering emails from Wall Street Journal reporters, oh the brazeness.

BREAKING: After more than 15 years ever since some dude named Satoshi (we still don’t know who he is by the way) came out of nowhere with his bitcoin paper, we finally have a consumer app to go with it, just kidding. Drum roll: “Wrench attacks”. Say what?

The kidnappings are part of a wider category of incidents known as “wrench attacks” — when perpetrators attack their victims in the real world as a means of acquiring their cryptocurrencies. The term “wrench attack” comes from a comic where two figures talk about stealing someone’s cryptocurrency by hitting them with a “$5 wrench.”

Anyway, the gory details of some truly remarkable arrogant assholes getting pummeled after showing off are here: Crypto kidnapping: How armed gangs are hunting the internet’s high rollers. You know, seeing that dude drive that luxury car in his dirt poor village in Uganda or the Pakistani crypto influencer crying, you know, I don’t feel bad at all that this happened to them. I know, I know, I am sorry. Moral of the story: Keep your mouth shut if you got lucky with crypto. But then again keeping quiet while holding crypto just do not go together.

Nothing really stands out in the latest monthly July 2025 Ponzi Scheme Roundup. Just the usual crypto and real estate schemes, promising crazy returns and stuff like that. Oh, expensive wines ponzi was new. Anyway, NEVER invest in anything that does not come with having your money in an independent custodian (think Schwab or Fidelity) where you have access 24/7 to check in if your money is still intact. Which of course it means NEVER sending money to the salesperson asking you to invest, ONLY to an independent third party you have heard of and can check up on.

You may say this excludes you from joining all the big shots who (supposedly) make so much money in direct real estate investments, start ups, hedge funds, etc. Yes I do say exactly that. And it is perfectly okay and WAY safer to do so. Don’t fall for the sex appeal of these things you can brag about at the next party you are invited to. Stay under the radar, invest in boring low cost index ETFs and focus on what is important, you’ll be glad you did while your friends end up tangled in one of the future Ponzi Scheme roundups lol.

Tough break on college students graduating these days. As it appears many of the job tasks they were hired for AI is taking care of them. Or so they say. Nevertheless, very interesting link: The Industries Leveraging AI The Most. Based on a “survey”, percent of workers using gen AI in one or more functions are:

Technology: 80%

Professional services: 80%

Advanced Industries: 79%

Media/Telecom: 79%

First.

Marking everyone tardy!

I think I agree that “No Country Ever Got Rich From Tourism.” Louisiana’s a state, not a country, but we’re a decent example of how this has been tested over decades since we went from oil & gas being the #1 industry in the 1970s to tourism being the #1 industry since the early 1980s.Young talent is forced out of the state because the opportunities just aren’t here.

Can I bring a note to excuse my lateness?

All sorts of interesting links today! You’re right about the wine ponzi! I’ve never

read about such a move.

Wow! There’s always a lot of good stuff here but this week’s post is exceptional! Gonna have to start waking up on East coast time instead of west coast, I guess. I don’t like being tardy but I don’t work and I sleep in so it is what it is!

Apparently there are links out there floating around for a 100K offer on the new Citi Strata Elite so one doesn’t have to call in to a bank. I don’t know where they ever got that goofy name for that line of cards though. I guess because Strata = levels?

That steak looks dang good!

While I largely agree with the basic premise of the “No Country Ever Got Rich From Tourism.” concept, I think we’re missing the forest by staring at a tree. Tourism is not necessarily evil and actually helps the standard of living in a lot of places. I visit Bali a lot and while there are unquestionably some serious drawbacks to the heavy tourism there the standard of living is notably higher than in the rest of Indonesia. Likewise, the Bahamas has pretty much no natural resources so if not for tourism it might be a lot closer to Haiti in their standard of living.

Regarding your trip to Greece I’d say that if you’re flying Monday-Thursday you may want to look at Lufthansa, particularly in first class. I just did that myself for the first time, leaving the week before last to Prague for a week, and it was really nice and not all that much over business class at 100K Aeroplan miles each way on a 747 transatlantic. I figure that first class is a dying breed – particularly on awards touching the USA – and the Queen Of The Skies is likewise vanishing so I wanted to try it out. I was quite happy. If you can position to where Lufthansa has availability a couple of days ahead it’s a fun thing to do.

@ peachfront: Could be relevant for Greece too I think. The country lost so many doctors in the past 15 years.

@ DML: TBB Board of Directors will consider your idea about the validity of the note you are referring to in the next Board meting, thank you 🙂 Yeah, wine ponzi took the cake on that monthly ponzi summary, nothing came close.

@ Carl: Well, I think exceptional fits, not to brag 🙂 Strata: If you took out tr and replaced it with a k, it means shit in Greek lol. I really enjoyed that steak, had been a while.

@ Christian: Valid points on tourism. Sometimes I wonder if Greece did not have tourism to save itself every year where would it be? Maybe the country would redirect resources to more sustainable industry development? Yeah, it is a complicated subject indeed. Good point on the Lufthansa FC last minute availability. I would have done that I think easily if the Detroit-Frankfurt had FC but LH has really downgraded that route for a long time. And I am just not up to taking positioning flights, something I tend to avoid.

@ All:

If you are looking for Citi/Strata cards, email me.

Just had another one who unsubscribed…Averaging losing one every week. That just BLOWS! Exceptional Carl said above. If true, why am I not adding and only losing…Ugggh.

Going for coffee and time to let blog go for the weekend to keep my sanity.

Wait, what, you’ve got to tell us the story of the multiple near death scuba diving incidents

Just two, nothing to do with scuba diving. Just regular swimming, one when I was around 6 or 7. And one in Cancun outside one of those Hyatt all inclusives, forgot the name, Zilara or something, the one for adults. Rip tide almost got me, barely made it out on shore, I think I saw Jesus swimming my heart out.

Wow that’s crazy. I would expect a high-end resort like that to have lifeguards.

That story about the USF guy stealing millions was shocking. I can’t believe it wasn’t caught sooner and seeing as how the cost of college has outpaced inflation for several decades it makes me wonder how much waste is buried in college budgets.

Speaking of scams that use a famous name, did you ever hear about “Clark Rockefeller”? I read a book about him a long time ago, he was quite the scammer. https://en.wikipedia.org/wiki/Christian_Gerhartsreiter

The name does sound familiar but can’t recall exactly. Maybe it is because he has been locked up for so long. Ok, just googled his picture, definitely did not know about him. Thanks.

Hello from Tallinn, Estonia. Been out of Greece for a few weeks. Ended up taking an overnight ferry to Rhodes and flying to Helsinki on Finnair. Since then been to Helsinki, Bergen, Trondheim, Riga, and now Tallinn. Been missing those Greek air conditioners. They are few and far between in Northern Europe. I think it was a few days in the 90s when I was in Norway. Had to take a cold shower before going to sleep for a few days!

Re:“No Country Ever Got Rich From Tourism” I would agree. If the country is expensive, ie. have a higher cost of living, they naturally have an economy that doesn’t need tourism and they charge accordingly. If a country isn’t as wealthy or they need tourists to visit, it’s going to be cheaper.

Best case scenario? Capital comes streaming in to the country to prop up the tourist industry. It trickles down to feed real estate companies, banks, hospitality businesses, transportation, etc. But then, your cost of living also goes up which means you’re less competitive than your neighbors. If it was suddenly 20% more expensive to visit than your last trip, you’re probably going some place else or stay for less amount of time to fit a budget.

Then as we know with capital cycles, you over-invest expecting the boom to last and suddenly another place becomes a hot spot or your country becomes fascist and the bust happens and you’re right back where you started. If you know economic cycles and when countries get ‘hot’ you can also figure out why the hotels you visit in Greece, Thailand, or Japan seem a bit dated. That’s because they most likely got built during the boom times and they’ve never got around to having the capital to upgrade them.

A great book to read if you never have is called ‘Capital Returns: Investing Through the Capital Cycle: A Money Manager’s Reports 2002-15’. A book that I always keep coming back to, I probably read it at least once a year.

I was in Rhodes in the summer of 1986, you won’t believe what happened back then lol.

Is this that hot up there in Scandinavia? Wow.

Good points about countries doing tourism. I remember when some time ago Turkey’s President pulled out another “trick” which caused the currency to implode and suddenly Greek tourism took a deep dive as tourists shifted to Turkey because, well, it was almost 50% off.

Sounds like an interesting book. Also, there may be parallels between over investing in tourism… and now AI?

For sure! The prequel to that book is Capital Account which covers the late 90s’ internet and TMT bubbles. Tons of parallels to today.

Can I interest you in another sordid crypto tale? https://www.wsj.com/us-news/crypto-duplessie-woeltz-kidnap-torture-aae24e88?st=jTY2Rs

Nick,

Seriously, I would feel very comfortable selling my blog to you, I am sure we can work something out lol. Why? Because we think alike. THIS article was already in the draft for next TBB post. Leading the Scams/Crypto/AI/Tech/ section. Because, how could it not? I think you will like my incendiary commentary about it. Boarding Area will never let me express my true feelings so I blog here independently 🙂

BREAKING: I have the first cc sale for August. Well, it is not an actual sale. But a referral. From Amex! Which I think it may be the first referral ever after so many years? Thank you to the reader who used my Amex referral link, much appreciated.

As the annual fee on my Amex Business Platinum is coming up…and the thought of moving on from them Centurion lounges and joining the common people in restaurants nearby with better food and no lines (and paying for it)…I think this referral credit will enter my brain process to justify keeping it for another year smh.

Hey Buzz, good afternoon. Yes, you could say I’m a tad tardy for the last two weeks. Been busy trying to figure out if we’re actually staying in business or not after 39 years. This administration is doing a helluva job…barfff.

Naturally we just experienced our best 4 years ever only to see it come to a screeching halt.

I actually had a delusional customer tell me how happy he was that gas for his Toyota truck was now costing him 50% of what is used to cost under Biden. The price dropped 10 cents a gallon for a few weeks. I’m guessing it would be a bad idea to hire my customer as my financial adviser. To top it off, diesel just increased about 75 cents a gallon. Yes, my customer is still drinking the Kool Aid.

And lest we forget, he’s still a rapist, this time I’m not referencing my customer. Oops I said that out loud didn’t I…

I am thinking that it’s definitely time to retire and travel a bit, go see your team play in Larissa and try the winter in SE Asia.

Fascinating post from last Friday. The USF article is absolutely nutty. I had a gander at Toronto Life and read the article about the snowboarder turned cartel general…WTF. Don’t know if you saw it, bust just as incredible.

bob, thanks for the tip regarding the book Capital Returns.

I spent a lot of time in 3rd world countries in the 80’s & 90’s. I’d have to say that tourism helped somewhat until the backpackers found other countries to spend time in. Of course Central America has been hit very hard ever since due to the rise of the cartels and our insatiable appetite for their drugs…smh.

I can hardly wait till the dollar is backed by crypto…oh boy!

Thanks again Buzz for another great post. Have a great week. Coffee coming soon.

Hi Dimitri, Vladimir here 🙂

I am finding it increasingly pointless to change their minds, they are drunk with Kool-Aid. Hopefully enough have some brains left to vote better next time. But at this point I am not that hopeful. Man, we have 41.5 months to go with this shit…

On that retiring thing, I hear you. And I am still going to catch at least two season games in Larissa soon. And 3+ weeks in Thailand. I am not complaining but yeah, thinking more about it. Time to start clearing some credit cards off my plate slowly…

Yeah, that USF article, how can they call that Accounting Dept with basic internal audit controls is unreal.

Waking up and now seeing that the dotard is not done inflicting pain…may be requiring something like $15k bond for tourists coming to the US. To the voters relying on foreign tourists, vote better next time. Can’t be blaming Biden or Pelosi again, it’s all on you.

Visited client’s new home yesterday. Their dream home. After I encouraged them to go for it for several years. Felt good to see them so happy.

Thanks to one new email subscriber, the slide has been halted, hooray!

Capital One credit card sales post once a month for sales done two months prior. So good to have 2 more sales credited in June getting cc sales for that month up to 7. And June cc sales are now up to 6 (with Capital One sales to be credited in September). And in August we are already up to 3 cc sales. Thank you so much to the readers, I am sensing you guys don’t want me to quit. Will roll on…for a while. I have a post almost ready for the time I would be in Greece, maybe I can have another one to make it two. So I can cut down on the time spent to produce the content here and devote it, you know, to family matters instead for a while in Greece!

Anyway, this Friday’s post is going to be awesome. Then again I am biased.