Another TBB post featuring the most eclectic links around the web such as stock market iron laws, AI eating everything, rethinking adult ADHD, best jungle hotels, airport lounges guide, explaining US labor reports, missing short sellers, crypto bros being crypto bros, explaining the American economy, urbanization and British christian fundamentalist cults, most terrifying destination in each US state, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend and stay cool.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

Due to new severe credit card affiliate restrictions, there will not be any credit card links in the body of the blog posts other than Capital One Bank and personal referral links going forward. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the big beautiful “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE to avoid clicking to find the one credit card you want to apply for. Or you can always email me, thanks for your support.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

Every time I hit publish I look back and I feel content that I did my best and this blog sticks to its mission.

PERSONAL FINANCE

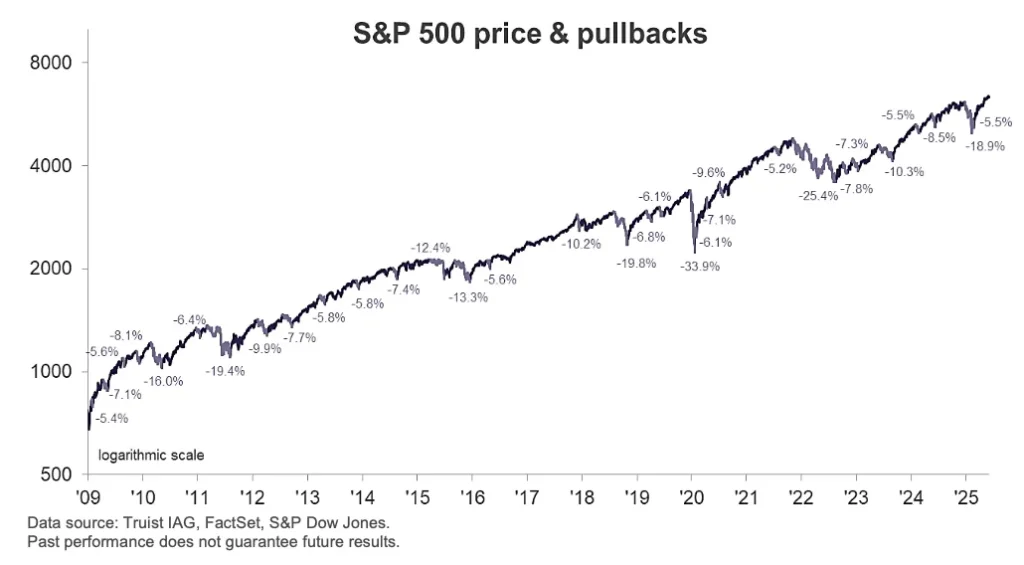

I really have no arguments about these Iron Laws of the Stock Market.

Volatility is mean-reverting

Buy when the stock market crashes

Diversification is your best hedge against extreme events

Your biggest edge is not data-driven but behavioral

The stock market has to crash sometimes

The market is hard to beat

Risk never completely goes away

Mean reversion and momentum are here to stay

Extending your time horizon increases your odds of success

Markets eventually punish certainty

Let’s now go deeper and learn all about the labor market. And how the data about it is derived: All About That Labor Report.

It’s no coincidence that the softest hiring of the last few years occurred right when the tariff scare started.

There’s a real chance that we’re undergoing a seismic shift in how we all work and that AI is either going to replace a lot of work or reduce the need to hire people to do a lot of that work.

There’s a lot going on with BLS employment reports and there’s a lot that can go wrong, but they’re not manipulated and we know they’re not manipulated because the process doesn’t allow for it…The BLS is incredibly transparent about all of this so it’s not like they’re out here hiding things from everyone. They will tell you themselves that their own process is inefficient and needs upgrades (and a bigger budget). But make no mistake – the data isn’t manipulated. It cannot be manipulated. It would take a coordinated effort by all 50 states to manipulate the QCEW (Quarterly Census of Employment and Wages) and that’s implausible. The monthly data might be noisy and unreliable, but revisions do not reflect manipulation or inaccuracy. The revisions actually bring us closer and closer to the QCEW data, which we know is right. So Friday’s employment report and its big revisions are telling us the truth about what’s going on in the labor market.

Sadly, this is true. No Country for Short Sellers. The capitulation of short sellers makes the market a riskier place to invest.

We used to debate the efficient market hypothesis. Now we debate whether to take out a home equity loan to YOLO into Tesla. And people are serious. There are actual posts—real ones—from investors lamenting that owning a home kept them from going all-in on Elon. The average investor now spends six minutes researching a stock. The market is a dopamine delivery systems of a society that stopped asking “what’s it worth?” and started screaming “NUMBER GO UP!”

There is no market left for short sellers. No market left for value investors. No market for the cautious or the skeptical or the diligent or the prudent. And no country for old men. [I burst out laughing after seeing this below…and when I could not laugh anymore, I switched to crying…we are all mixed up in this meme world we are living through…]

We have all been trying to explain the reasons behind this and yet we have all failed. I am at a point where I just keep going back to my disciplined investing process. Wait, this is what I have always done. Diversify baby, keep the costs low, rebalance at regular intervals and make smart tax moves. And let the “experts” try to figure this out while we all focus on more important things in life and keeping our heads above all this endless nonsense. But maybe, just maybe, this is what is going on?

a market dominated by active investors tends to be characterized by “mean reversion”—in which high valuations are followed by a correction—a market dominated by passive investors is instead characterized by “mean expansion,” in which high valuations are followed by even higher valuations…A market dominated by passive investors also naturally becomes more concentrated. Active investors tend to avoid larger stocks that they believe might be overvalued, but the opposite is true for passive investors. Because they allocate funds based on the existing size of companies, they end up buying a disproportionate share of the biggest stocks, causing the value of those stocks to rise even more, and so on.

The explosion of passive funds over the past 15 years could explain why the market has become less sensitive to real-world downturns, more likely to keep going up no matter what, and dominated by a handful of giant companies. Or that theory could end up being disproved by unforeseen events. It wouldn’t be the first.

Be grateful if you managed to stick with it…

SCAMS/CRYPTO/AI/TECH

Crypto bros are a special breed. A unique combination of arrogance, grift, bad taste, greed and just pure assholeness. And these guys omg: Tequila, Drugs and Torture: The Spending Binge of Two Crypto Bros That Ended Behind Bars.

The two men were on a mission that, whatever it was at the start, disintegrated into a weekslong binge of cocaine, booze and spending. It ended in May with arrests and allegations of kidnapping and torture within the posh confines of a $75,000-a-month rental in Manhattan

I started excerpting parts of the article and kept shaking my head. And I stopped. Because I wanted to keep my head intact. Read and be careful about your head. Because you may shake it violently and lose it, you have been warned.

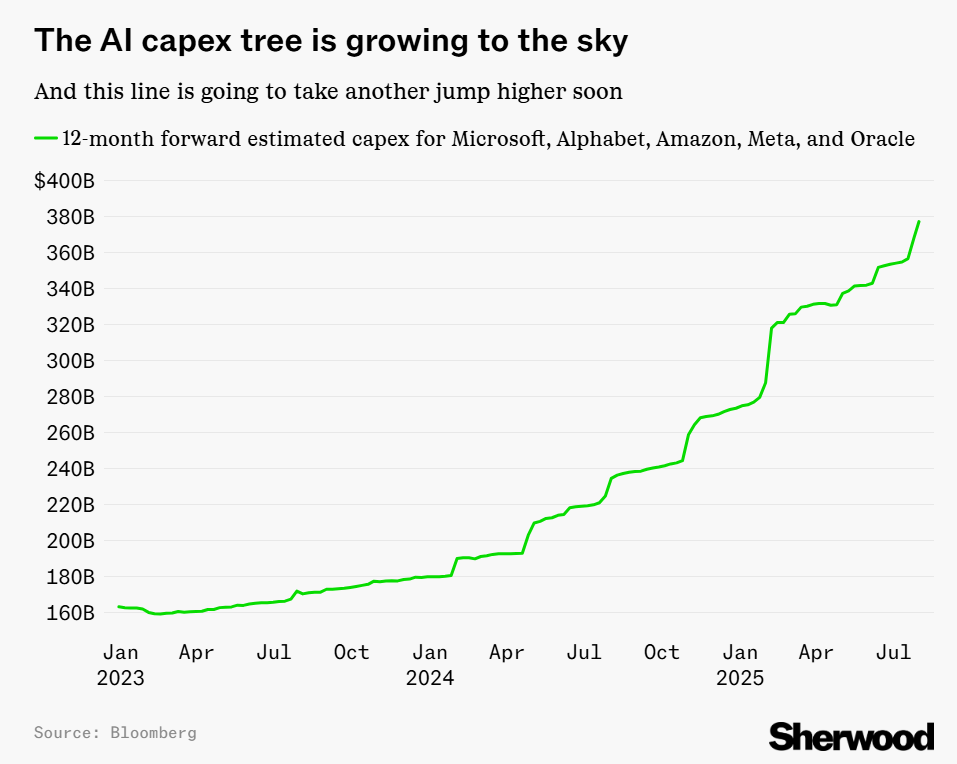

Another post from A Wealth of Common Sense: AI is Eating the Economy. Yeah, we are living through an era that we are not sure how it all shakes out. And if someone tells you they know they are lying. All we know is the gazillions that are spent on all things AI are unreal and this probably saved the stock market after ChatGPT entered our lives in November 2022.

Remember the guy who threw his hard drive that contained 8,000 bitcoin in a landfill and has been trying to dig it up for years. Well, he gave up. But wait, as with all grift that goes along with this shit, he does exactly what you expected smh: UK man who lost 8,000 bitcoin in landfill says he hasn’t given up, pivots to tokenizing legal claim.

Howells said now he is planning to tokenize his legal ownership of the lost 8,000 BTC into a new Bitcoin Layer 2 smart token named Ceiniog Coin (INI), utilizing the upcoming network update that removes the 80-byte cap on the OP_RETURN opcode in bitcoin transactions to free up space for more functionality. The token is slated for launch after October, and an ICO is planned for later in the year, Howells added. “The intention is to bootstrap the Ceiniog ecosystem and launch a successful high-speed, high-scale, fast-confirmation, payment-focused web3 environment secured by the Bitcoin blockchain and backed by 8,000 BTC,” Howells told The Block. [I felt this urgent need to punch something…serenity now, serenity now.]

And I left for last in this section one of the must read articles: How AI, Healthcare, and Labubu Became the American Economy. The author is trying to bring it all together and explain this really strange phase of life we are living through, enjoy reading it as much as I did.

There are currently 3 Americas:

- America 1 (The Speculative Class): The first America is the speculative class, and its engine is artificial intelligence. The Magnificent 7 are spending over $100 billion a quarter on data centers, which are these monumental projects of hope. They consume vast amounts of capital and electricity, a place where money and power are absorbed in a high-stakes gamble.

- America 2 (The Real Economy): The second America is the real economy. With 75% of new jobs in healthcare and social assistance, our workforce is being absorbed by the essential but underfunded ‘maintenance economy’ of an aging population. While it props up the labor market, it fails to generate the type of wealth that fuels the stock market or long-term growth, as resources are poured into maintenance rather than creation.

- America 3 (The Memes): The third America is the bridge between the other two, acting somewhat as a psychological gold sink for those who are priced out of a house and a future. The money spent here is largely speculative and doesn’t build a sustainable future (is memecoin investing productive, I don’t know) but it gives people a sense of agency and hope within a system that otherwise offers them little.

It’s a very strange world.

Indeed it is, it gets better after that going deeper in each America…

Hi Buzz,

Great post with lots to think about.

A question: Is that $7 Dunkin’ Donuts credit if you buy there or if you stay away? How do you spend $7 at Dunkin’ Donuts?

You can load the $7 credit to your account monthly then go in and use it whenever you like.

Dunkin’ donuts…None near me. I very rarely use Uber. Every lounge I have seen lately is stupidly crowded or I don’t have much time to use it. The value out of some of these expensive cards is not what they say it is, I have found. To me, anyhow. Venture X seems to be the easiest to get at least most of the value out of the AF. Therefore I wonder when this will get nerfed.

All good reading as usual so thanks for that! I always look forward to Friday’s and getting the latest from you!

As far as the 50 most terrifying destinations in each state–I… didn’t find the Mt. Katahdin trail terrifying, much less Mount Rogers, Mount Magazine, Barataria Preserve or Clingman’s Dome… I guess some of the truly terrifying stuff, like those crazy rides, I just don’t visit.

As far as I know, we’ve never lost a tourist to an alligator in Barataria… I always have the idea that people-eating alligators are more of a Florida thing. 🙂

Sorry to be late! I’ll send a note from the archivist.

Lots of interesting ideas and links today. The consequences of the acceptance of

the efficient market hypothesis are really important. Does belief in the EMH change

the behavior of the market? Oh my.

Just booked a Hyatt Place stay at the other side of the state to accompany son in a beach volleyball tournament. He was going to drive there very early tomorrow so here comes his Globalist dad, let me fix that for you lol.

World of Hyatt projected elite night credits: 54

I will respond to the comments sometime over the weekend.

Finish the weekend strong.

I’m waiting for Nobody 2 to come out next weekend although like most sequels it’s highly unlikely to be as good as the original.

I’m anxiously awaiting the new primo Alaska card. Any idea if you’ll have any referrals, general or personal?

I also like the new Alaska livery. Feels like the old design was rooted in the past and felt saggy.

AI and ChaptGPT. I finally dragged myself out of the cave and have started using it. I do think people need to beware, I asked tax questions – one US based and one for Oz tax. I knew the answers to both and have to say ChatGPT made basic errors, but for someone who did not have prior knowledge they could end up severely misled. What surprised me was when I initially mentioned capital gains it did not ask me if I meant LT or ST. I have been using it for travel itinerary suggestions and for that it has been brilliant. I can see that aspect giving me hours of my life back.

Tuvalu relocating citizens to Oz, isn’t it amazing that we can take them and I’ve not heard disagreement from anyone in the community suggesting we start our own ICE force or start banging on about welfare. We already have a visa program for islanders to come each year and do crop picking. Works for everyone involved, they get to earn decent money and take it home to a place they enjoy with their families but where they struggle for work.

Oops that’s daggy not saggy, damn auto correct.

@ Sam: Say no to drugs and…Dunkin 🙂

@ Carl: The Capital One Venture X pays for itself. Actually pays cardholders $5 after offsetting the $395 fee with the $300 travel credit and 10,000 points each year. It was nerfed earlier this year…just the authorized user/lounge visits. But still, a winner. Will it get nerfed again a year later? Probably.

@ peachfront: You know, I almost did not post that link. Because I thought someone will call it out for not being dangerous enough lol.

@ DML: Archivist, really? Is this the 2025 version of “dog ate my homework” excuse? 🙂

@ Christian: Has there been a sequel that was better than the original? Hmmm, something to think about. At this point, no Bank of America referrals or affiliate links. But I will ask as I think the new premium Alaska Airlines card may be a winner. I think the airline will go all in on revenue based earning/burning. I think the AA loyalty points scheme may be winning?

@ Vicky: Interesting observations about ChatGPT, thanks. Son is paying $20/month for it. I have not found any must use applications to me personally yet. Let alone paying a monthly fee for it. Which makes me scratch my head when I see the gazillions spent towards it. Also intrigued by the potential application of AI in the Travel industry. Well, developing for sure…Don’t get me started on what is taking place here in the US. Every single day, several times a day, I shake my head and curse the people who voted for the worst POS twice. Just six months in and I am starting to wonder if the pace of destruction will surpass the point of saving ourselves.

To the guy who unsubscribed yesterday, thanks a lot for not meeting your expectations I guess. This hurts so many years later. If readers liked my content they would not unsubscribe. So PLEASE, if you like my content please forward a link to this post to people you care about. Prove that organic growth works. Because it sure ain’t working judging from the decrease in subscribers!

Thanks to Sam for getting credit card sale #4 this month.

Great day yesterday in Grand Haven, Michigan swimming and beach volleyball. Who needs Hawaii beaches when you can drive to Grand Haven 🙂

Hope you got credit for the Hyatt Card via your links. I had to go thru reconsideration and after that who knows. Trying hard to toss ya the bone 🙂