Another TBB post featuring the most eclectic links around the web such as how to succeed in investing, hideous crypto maniacs, the best fall scenic drives, the new Alaska Airlines Atmos Rewards program, playing along with a scammer, most popular slangs by year, the best nude beaches, top international bridges, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend and stay cool.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

Due to new severe credit card affiliate restrictions, there will not be any credit card links in the body of the blog posts other than Capital One Bank and personal referral links going forward. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the big beautiful “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE to avoid clicking to find the one credit card you want to apply for. Or you can always email me, thanks for your support.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

Next several posts will be published while traveling in Greece. Do not expect the posts to be as long and so up to date with the latest developments as this post today.

Finish the summer strong everyone!

PERSONAL FINANCE

Your investing should be boring. Whenever I met with a prospect I told them if you are looking for excitement in your investment portfolio I am definitely not the financial advisor for you. Choosing to do nothing is a choice, just like so many in my industry choose to follow much more active trading strategies consulting their proprietary crystal balls. Oh, the link that caused me to go off a little starting today’s post: Why Hands-Off Investing Pays Off.

In fact, Morningstar found that, on average, the actual returns of fund investors were significantly less than the posted market returns, a discrepancy explained by poor trading decisions — buying when the market was high and selling when prices were low. Over extended periods — say, 30 years — this drag on returns produces chilling results: a reduction in the money in an average investor’s portfolio of more than 18 percent, according to Morningstar calculations performed at my request.

Reaching for better returns may hurt you in the end. Keep your investing clean and simple, avoid risks you can’t afford to take and try to stash enough money in safe places to pay the bills. If you’ve done all that, remind yourself: Leave your investments alone.

So along the way you will always encounter people in my industry who will try to sell you amazing solutions shit to get rich. You know, they have a secret sauce or something. Some get lucky with their timing and then go on for years trying to get lucky again. When shit happens, these people come out in droves and sell the latest hot thing. You should hold your nose and ignore them. Easier said than done. The average tenure of my clients is 15 years and I bet you (I don’t bet but I will when I am 100% assured of winning lol) they have done way better than any of these hot shots who pump the latest “can’t lose” products. Sorry for the long intro of this second link: When ‘invest like the 1%’ fails: How Yieldstreet’s real estate bets left customers with massive losses.

Company Tagline: “Invest like the 1%” [Maybe ‘Lose like the 1″ is more appropriate. Oh yeah, that eternal appeal to exclusivity and plain greed smh]

“There isn’t a day that goes by without me saying, ‘I can’t believe what happened,’” Klish told CNBC. “I lost $400,000 in Yieldstreet. I consider myself moderately financially savvy, and I got duped by this company. I just worry that it’s going to keep happening to others.” [Moderately savvy and overly greedy]

Of the 30 deals that CNBC reviewed information on, four have been declared total losses by Yieldstreet. Of the rest, 23 are deemed to be on “watchlist” by the startup as it seeks to recoup value for investors, sometimes by raising more funds from members. Three deals are listed as “active,” though they have stopped making scheduled payouts, according to the documents.

Yieldstreet CEO: “Our mission at Yieldstreet is, how do we help create financial independence for millions of people? You do that by helping people generate consistent, passive income.” [M*#@!^ and way too many other expletives just escaped my mouth, exsqueeze me, I need to control myself better, I am working on it…]

Yieldstreet CEO: “We understand that when winter comes, there will be challenges, but we take comfort in knowing that there’s underlying collateral. Anybody could put money out. It’s about bringing it back home. [And this is when I started looking for something to punch lol]

At least that CEO is no longer around. I always try to find something positive to counter my intense distaste for this shit that gives my industry such a bad reputation. Which it deserves sadly. Thanks to blog reader NickPFD for bringing this article to my attention.

Getting rich with investing is easy. If you are able to stick with it. Easier said than done of course: The Big Secret to Long-Term Investment Success.

All investments center around beliefs about what will transpire in the future. No one really knows what will happen tomorrow, next month, or next year. The most catastrophic disruptions are those that we never saw coming. All those events tend to wash out over multiple decades. The secret to long-term investment success comes down to tapping into that long-term economic growth in the most cost-effective way possible. It also requires staying put when the inevitable downturns unfold. [The author singles out the Vanguard Total Stock Market ETF at an expense ratio of only 0.03%. Latest client portfolio reviews have them at an average expense ratio of 0.04%, I need to do better lol. Also, never forget that in the long run we are all going to die ok?]

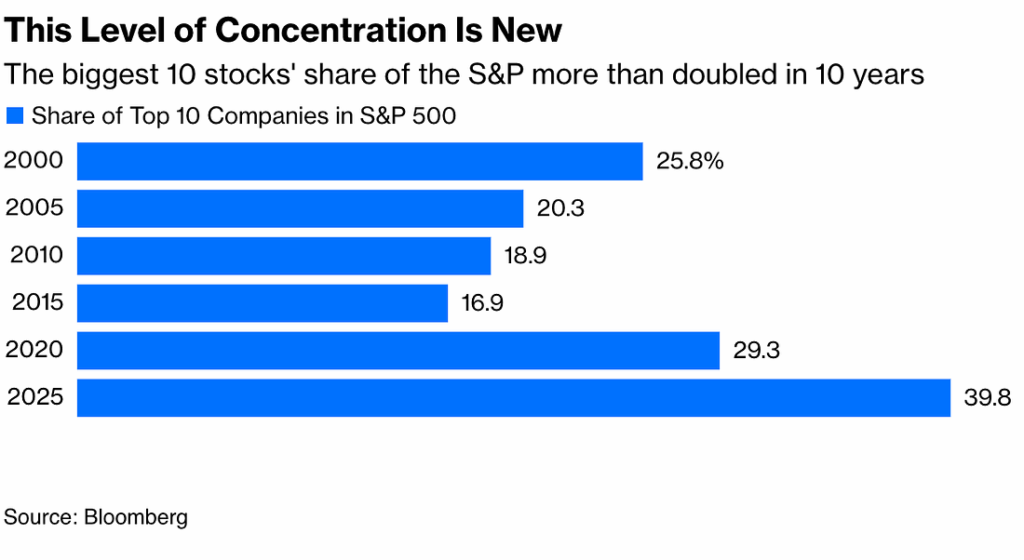

This caught my attention, something to ponder. Remember, nobody knows what will happen in the short term and there will always be something to worry about…

SCAMS/CRYPTO/AI/TECH

Remember those two crypto bros who tortured another Italian crypto bro in New York City to get him to spill the passwords to steal his crypto stash? Well, if you thought the previous article about this incident was stomach turning, you haven’t seen anything yet. This one will make you barf and wonder why all these horrible people are attracted to this shit, come on! The Crypto Maniacs and the Torture Townhouse. How two men charged with an outrageous kidnapping scheme introduced a new kind of crime to the city. Read at your own risk. I always had very low expectations about these guys but this far surpasses them wow.

Fascinating account of a writer who plays along with a scammer after responding to a text. Of the kind we all receive these days trying to strike up a conversation or offering us a job, etc. My Scammer. I responded to one of those spam texts from a “recruiter”—then took the job. It got weirder than I could have imagined. Amazing how these scammers work you wow. Anyway, the author wonders near the end:

Now we have seen trillions of dollars put toward radically overhauling the nature of interpersonal communication, of commerce, the great global reach of the internet and its incredible world-shrinking power. More than 5.5 billion people are online. The capabilities of microchips have increased 100,000-fold in the past 30 years; computing power doubles every 18 months. We have crossed the threshold of A.I., this newest digital chapter that is supposed to make the previous three decades look basically analog by comparison. This whole march of human cultural production—incalculable progress—and the one constant that has survived and adapted and thrived? The scam.

Do not give any financial advisor money. You should only be transferring money to a well known company (Schwab or Fidelity for example) where you can see 24/7 that your money is still there. Because the risk of losing it all is just too much, it happens daily everywhere. Like with this guy near me: Detroit investment fund owner sentenced for wire fraud.

Middlebrooks is the former majority owner, CEO, chief investment officer and portfolio manager for a private hedge fund called EIA All Weather Alpha Fund 1 Partners [“private hedge fund” and “Alpha” are dead giveaways]

Investigators said the hedge fund owner told clients he was able to exploit “inefficiencies” in global equity markets and yield large returns for his investors. However, the fund failed to produce predicted returns and resulted in large losses. [to the tune of $30 Million smh]

First!

From Hell

Can’t beat Jeff Epstein! He’s probably not sleeping in much …

Thanks for all the links …

I hope your docs figure out what sort of interactions

there were from the injection. That sounds grim.

Wow, between the big annual extreme croquet tournament (Qualifier games) this weekend and all this good stuff to read here, well, there’s not much time left over! Thanks as always!

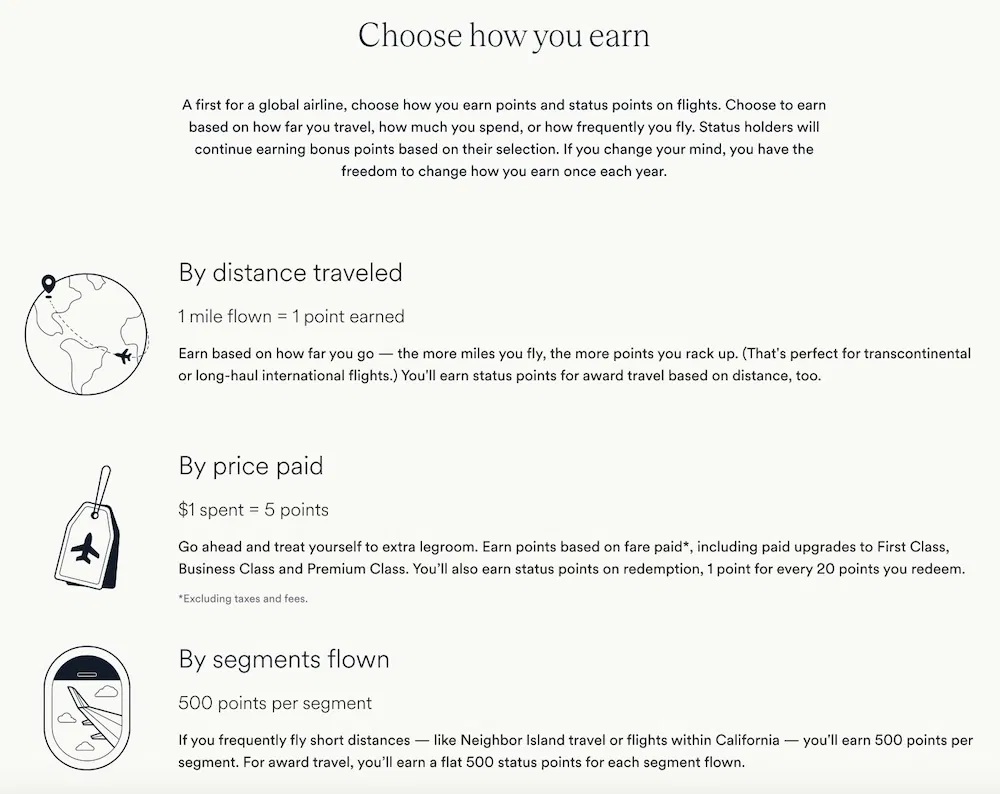

Signed up to be notified on the Alaska card last year so I think I got 500 points for that and am seriously thinking to go for it what with living so near to Seattle. I see it as a one year card though. I do like that 3x on foreign spending and like you, I don’t think that will last.

Weather is great this week and so gonna go enjoy it!

Sitting around for the past 10 days doing nothing. Would you like a cc link via email? Help me keep my job, boss is about to DOGE me out of it!

I feel like Drew just leaving…This post just bombed judging from the silence that fell on it.

And I thought it was one of my very best.

Maybe I just need a break…

Off to Ludington next

Managed to find award space for daughter out of Athens on the same flight as her mom for 80k United miles. Flying them both on Austrian Airlines business class to Vienna and then Washington IAD. Then they split to Detroit and Seattle on United, hooray!

Second, for the record, all these miles/points bloggers I have been linking to for years have never linked back to me. Never.

And these are the same guys who go out of their way to link back to the self proclaimed travel thought leader who posts the most vile clickbait shit ever smh. Just today (from Milesfeed, I don’t click on clickbait shit):

Flight Attendant from BA Safety Video Found Naked, High On Meth in Toilet…

Non Stop to Disgusting: Passenger Drapes Bare Foot Across The Aisle Onto Woman’s Armrest-While His Other Foot Gets a Massage..(no doubt this one came with shocking foot pics wtf)

I need to take a break from blogging me thinks…

Your Atmos explanation reminded me of the scene from My Big Fat Greek Wedding- Give me any word and I show you the greek root. LOL

https://www.youtube.com/watch?v=jXt0VCPKfQ4

I’m actually experiencing FOMO of the Atmos cards. Finally one which I wish we could apply for. Oh well, have to remind myself keep life simple. BTW did you notice that Andaz Bangkok has something going on with the Hyatt website? It only comes up for me if I search for it specifically by name, not by city. I dare say there will be no December opening and wonder if it has been pushed way back by earthquake damage.

As expected, Lufthansa availability has shot up a few days before departing. Now seeing availability on UA for LH Business class starting at 110k and in LH First at 165k. Passed on it, keeping my UA Polaris seats that comes with many hours eating/drinking in Neward Polaris lounge. Oh, over at Air Canada Aeroplan I saw LH First via Chicago ORD at just 100k….Soooooo tempting. But I don’t have high confidence that UA will get me to ORD from Detroit with just about an hour layover. In the meantime, I already chose my meal on UA Newark to Brussels, went with the reliable chicken selection 🙂

@ucipass: You picked up on that, I was thinking of the same movie when I made that comment.

@Vicky: Yeah, if I was not departing I would go for the Summit card most likely, oh well. Yeah, something is up with the Bangkok Andaz for sure.

Haha…Epstein

Yes, tardy again…lousy brown 11th place ribbon

Thanks Buzz for all the links, halfway through that fascinating article about Jill.

Have a great week

On my way…just like last time I will likely give up posting Greece trip updates on Instagram. Until then, enjoy. Thumbs up for the United Polaris Lounge at Newark EWR.

And thanks David, yeah that article blew my mind…maybe I get the book when I retire 🙂

https://www.instagram.com/p/DNynHpRXiEH/?igsh=MXJlbTR3Y3o2YmExNg==

I’m trying to figure how to time doing the Hawaiian personal card, the Atmos premium card, and the Atmos business card. Good old fashioned AOR?

I guess it’s just my age (same as you) but I’m really finding your investing links to be increasingly valuable.

Oh those AOR days…If there was a cc combo screaming AOR…this may be it? Good luck. I have a link for the Atmos premium card if you didn’t get that email giving the extra 5k.

Thanks for the feedback on the investing links. The more I think about it the more weird it is to have this combo, investing and miles/points together. Then again, this is what may differentiate me? I don’t know….just noticed the travel thought leader all the other bloggers kiss up to posted today:

American Airlines passenger plants dirty socks on tray table while crew looks away

And I can’t even $#%&*!

Anyway, hello from Brussels The Loft lounge. United Polaris was great…on the ground. In the air? Not so much. Slept fine. FA service so slow and indifferent. And food so average. And I skipped breakfast to atone for my sins at the EWR Polaris lounge lol.

Off to Thessaloniki on Aegean next.