Another TBB post featuring the most eclectic links around the web such as beating up on alternative investments, stupid tariffs, the best waterslides, our roadtrip to Mammoth Cave, what to do in crazy volatile markets, income tax brackets, we need more immigrants, a tragic story about OCD and the latest research on ADHD, the new music industry reality, we travel to Patagonia, we checkout the 100 top wonders of the world, the latest updates on Thailand, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No sponsors. No AI. No tariffs.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This is a one man labor of love operation, enjoy it while it lasts.

BLOG HOUSEKEEPING

Blogging is not easy. This blog is free and it employs no algorithms, no AI, no clickbait, no sponsors, no ads. And now no tariffs too.

Support what you value. Without such support it is not possible to continue to exist.

The Tariffs section will need to be retired or possibly renamed. Any ideas for a new name? One day when support clicks dry up completely I may move the first two financially related sections to its own Substack newsletter. But until then enjoy my blog baby #sameold.

NEW: Huge 100,000 point offer on the card all four of us in my household have and keep from my favorite bank – literally the offer of the year in my opinion, even better than the 75k Capital One Venture X!

TAKE ME TO THIS OFFER

PERSONAL FINANCE

I have been around for a long time and it still shocks me how fast the sentiment and direction of the markets can change. Anyway, good article to just ponder where we are right now and seven lessons we can learn from the turmoil: School Is In.

There are no guarantees

Economics is not a science

Bad news isn’t the worst thing

The stock market is-ultimately-rational

Even policymakers don’t know where policy is headed

The Fed’s control is more limited than it may seem

Stock picking is difficult but may be even more difficult at times like this

I am glad Jason Zweig over at the Wall Street Journal addressed “alternative funds”. Because they are back in vogue with all the crazy volatility recently. “Don’t Buy Into This Easy Fix for Stock-Market Craziness”. Be wary of alternative funds that cost too much, disclose too little and are higher risk than they sound. Yep, I can tell by how many emails I get from vendors pumping these lately. First, what counts as “alternatives”?

…can include hedge funds, venture capital, private-equity funds, nontraded real estate, private credit, infrastructure and other assets.

I was going to excerpt more from Jason’s article and then it hit me! I wrote about this about 10 or so years ago for the Wall Street Journal and found the link, here it is: “Do Alternative Investments Belong in Most Individuals’ Portfolios?”. I remember being approached to write about this and was told I was going up against another professional making the opposite viewpoint. And I would not know who I am going up against until the actual publication. So, I remember vividly how concerned I was that I was going to get beat up. Well, I think I clearly won. Plus, I looked good and I think I need to retire that picture since I am not as young looking anymore lol. In case the link does not work, I will paste what I wrote in the comments below.

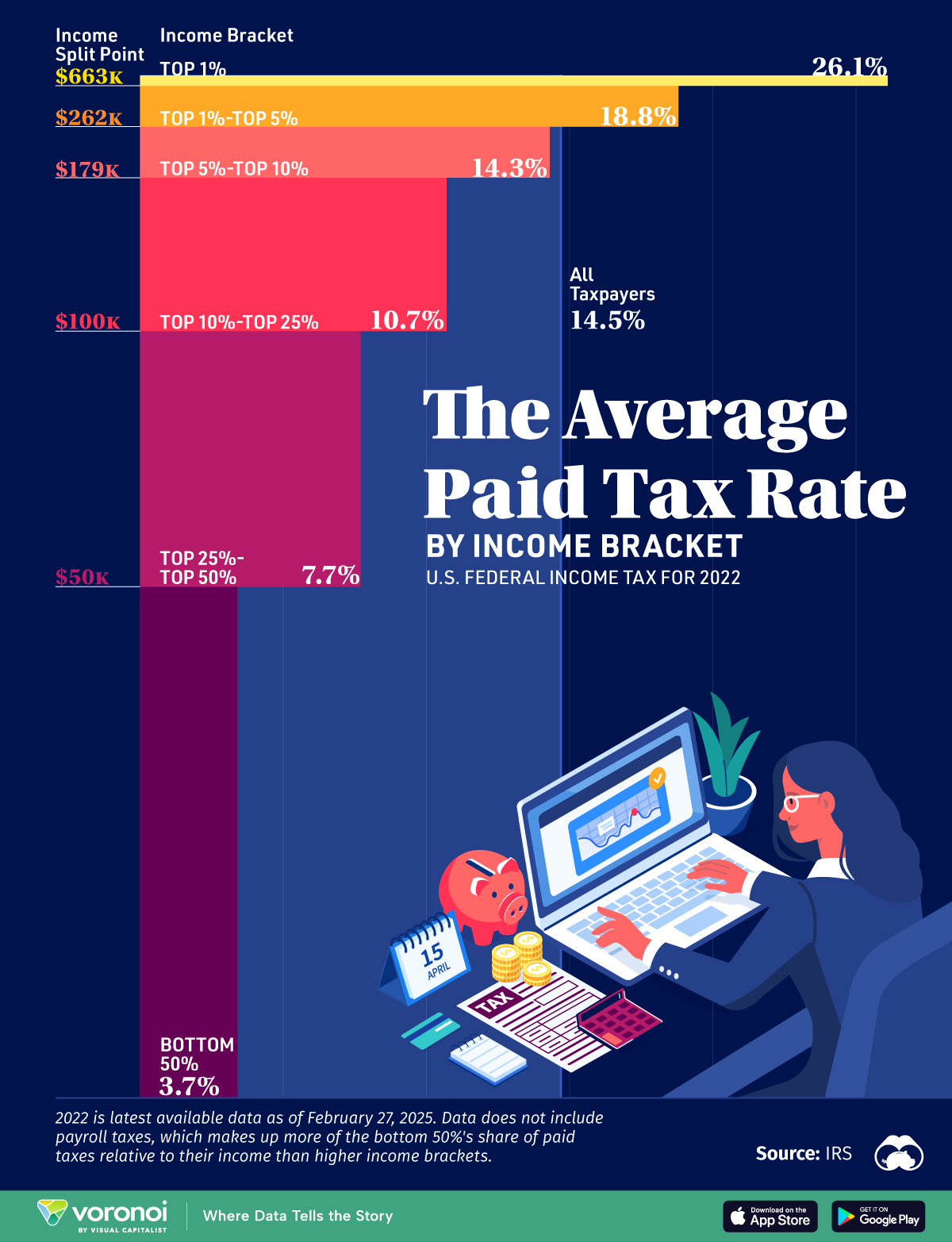

Interesting: How Much Income Tax Americans Pay by Wealth Bracket.

TARIFFS

Good to see Cullen Roche post more regularly again. And I hope this is not obsolete by the time I publish this blog post. This is where we are in regards to the Fed and its independence, what is happening in the bond market and some possible scenarios with what Trump does with the stupid tariffs. Cherish the independence of the Fed, it has greatly contributed to the dominating performance of the US economy for decades. I hope Jerome Powell can hold out but then when he is gone come May 2026 we are going to be faced with someone who will follow orders most likely. We can guess which of the three possible scenarios may come true but the truth is we don’t know. The unpredictability of this executive branch is so high that is off the charts. So, diversify and brace yourselves and stick to your plan. Assuming you have one.

Update: The previous paragraph was written very early Monday morning when the markets dropped over 1,000 points. And then it happened, Cullen comes back with an update on Tuesday from the Trump front incorporating what happened since his first post:

- He’s not going to fire Powell.

- He says the tariffs on China will be “come down substantially, but it won’t be zero”.

Update just before publishing this post very early Thursday morning: Seeing so many headlines with “mixed tariff signals” and “murky tariff details” it is nuts. How can anyone plan in this environment, come on!

As a former foreign student it is so hurtful to see what is happening these days. I think many of us who studied in the US and ended up staying and becoming naturalized US citizens have contributed proudly to this country. Take a look at the CEOs of the largest US companies, especially in the tech industry and you will understand. We must stop targeting them but it may already be too late. Would I recommend any foreign student come to the US now to study? No way. Anyway, really good article that proves my point. You don’t like my point? Fair enough. You can start your own blog to post propaganda (yes, someone emailed me to accuse me of this lol). The self-inflicted death of American science has already begun. Trump’s crackdown on foreign students and scientists will do irreparable harm to the country.

Long time readers know where I stand. If you are new here, I recommend you read this: ‘I Did Not Think for One Second He Was Going to Go This Crazy’. Inside Wall Street’s big split with Trump. I am going to stop here and move on…

Ok, one more. Serenity now, serenity now…

SCAMS/CRYPTO/AI/TECH

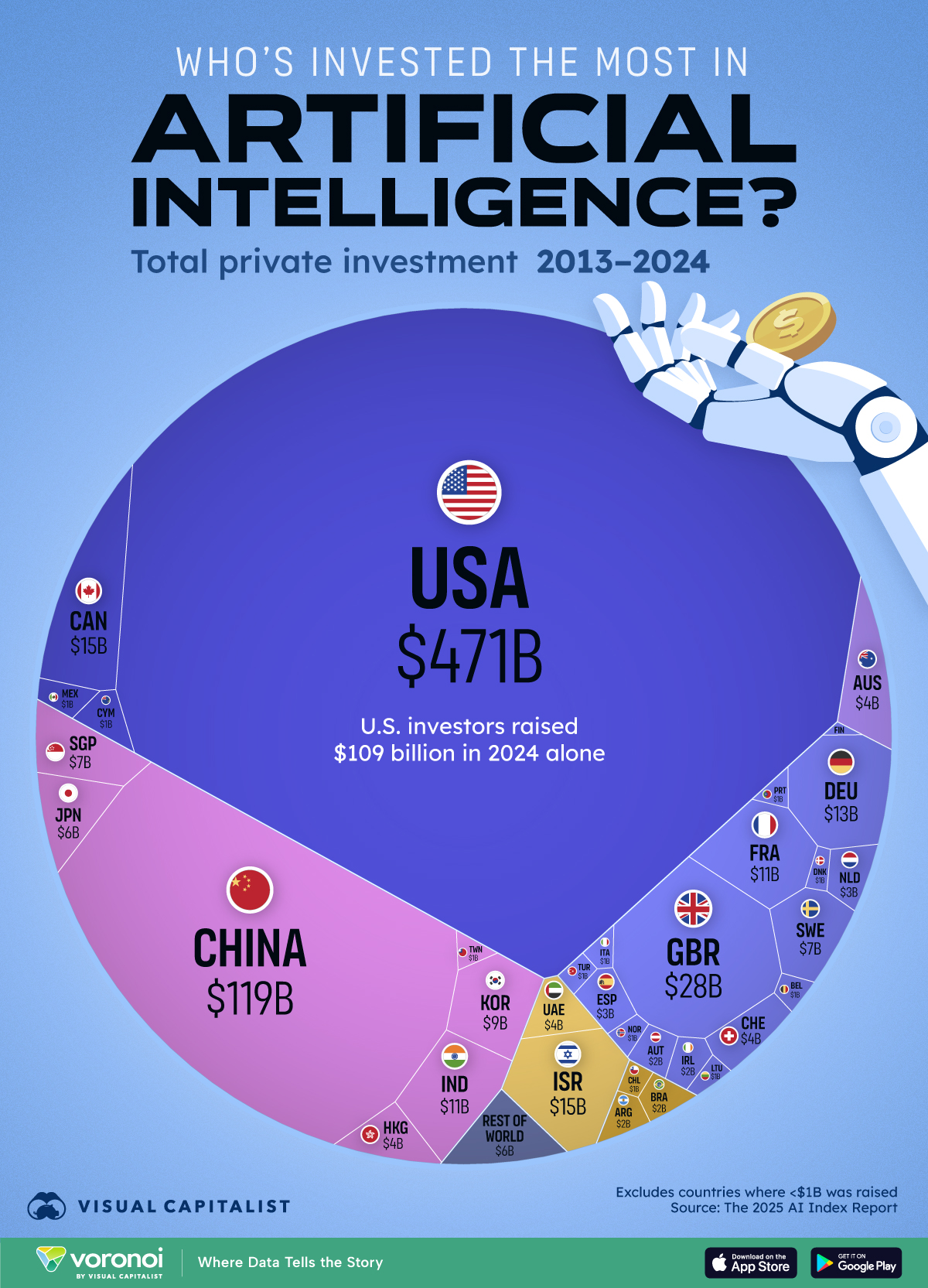

Wait, like I said in the previous section, to prove my point about how we must stop targeting immigrants: Most of America’s Top AI Companies Were Founded by Immigrants.

High-skilled immigration has long been a key driver of US technological leadership. This is especially true today — with immigrant entrepreneurs powering American AI dominance. Our new research shows that 60% of the top US-based AI companies have at least one immigrant founder.

I hope this works out in the end: Visualizing Global AI Investment by Country.

You like my blog? Send a link to someone please!

ODDZ & ENDZ

One of the most disturbing articles I read recently. We all know someone like this. And somewhere along the way we realize that there is not much we can do, only go along while hoping things don’t blow up. I mean, what do you do with them? The Firefighter With O.C.D. and the Vaccine He Believed Would Kill Him. I found myself thinking about this for many days after I read it. You have been warned.

Let’s stick with a similar condition. Another article which made me think about ADHD a lot after I read it: Have We Been Thinking About A.D.H.D. All Wrong? With diagnoses at a record high, some experts have begun to question our assumptions about the condition — and how to treat it. I always thought that prescribing drugs to treat this condition ends up doing more harm than good and pretty much everyone has this to a degree. And we are all living with it and, you know, coping with life. Or something like that. Definitely very thought provoking. I like to share content like this. If you are here for the latest clickbait shocking revelation…I can assure you that this blog is not for you.

That ever-expanding mountain of pills rests on certain assumptions: that A.D.H.D. is a medical disorder that demands a medical solution; that it is caused by inherent deficits in children’s brains; and that the medications we give them repair those deficits. Scientists who study A.D.H.D. are now challenging each one of those assumptions — and uncovering new evidence for the role of a child’s environment in the progression of his symptoms. They don’t question the very real problems that lead families to seek treatment for A.D.H.D., but many believe that our current approach isn’t doing enough to help — and that we can do better. But first, they say, we need to rethink many of our old ideas about the disorder and begin looking at A.D.H.D. anew.

Great piece on how the music industry has changed: Old School/New School. A few that stood out, click the article for more.

OLD SCHOOL

Get a record deal.

NEW SCHOOL

Get a fan base.

OLD SCHOOL

Learn how to play your instrument.

NEW SCHOOL

Learn how to use your computer.

OLD SCHOOL

Perfect the music and only release what’s up to snuff.

NEW SCHOOL

Put absolutely everything up on YouTube so fans can find it if they’re looking for it. Live shows, acoustic in the studio, everything. Forget quality, otherwise why would people be watching audience-based videos? They want a taste of what it was like at the show. Fans want to get closer, don’t put up a brick wall, but a conduit.

Amazing photography from the 2025 Sony World Photography Awards.

Sometimes there is beauty in the ugliness. As in so called brutalist structures: More Than 180 Photographs Chronicle Brutalist Suburbs and Public Buildings in ‘Eastern Blocks II’.

TRAVEL

Suggestion by blog reader bluecat, great resource: Top 100 Hillman Wonders of the World.

Fun article, appearing in the WSJ of all places: Inside the Country’s Saddest Airport Lounge. I laughed reading lines like these:

The sad food choices are just one of many shortcomings that routinely land the tiny, windowless lounge in Terminal 5 atop unofficial rankings of the country’s worst airport lounges. The only notable attribute for many visitors: There are no bartenders so you mix your own drinks at the self-service bar.

In Reddit forums, posters regularly lambaste the lounge and suggest skipping it. My favorite description: “It’s like hanging out in the early 90s at your friend’s basement at the house his divorced dad rented. Dank. Dark. Weird stains. But you get to pour your own liquor because there are no adults in charge.”

The Swissport lounge is little more than a glorified airline gate area. It’s cramped and loud. Seats and power outlets are hard to find. Free drinks and snacks take a little of the edge off and save money.

The Swissport lounge was a downer from the second they stepped in. “We didn’t even stay there the whole time we could because it was so depressing,” he says. “The only way to make this an enjoyable place is if you were drunk.”

We all realize the subjectivity in almost all “best of” lists. And yet, here we go again: The Best Waterslides Around the World. Because, waterslides are fun you guys. Some of these look amazing. And I wish I was younger because if I get a bump these days it takes so much longer to heal. Anyone been to any of these?

Interesting post from Patagonia: Floating Lines. Looks nice but looking at the tents I can not help my mind wander to sights like a sweet suite in a Hyatt and the smells of the rich breakfast buffet lol.

My Thailand related links: Learning about all the different visas to stay in the country is confusing. Here is a video that really helped me out to make sense of it all: The 8 Best Ways to Retire in Thailand (Your Options Explained). And this was expected finally: FAA Officially Upgraded Thailand’s Aviation Safety Rating To Category 1. Looking for the eventual direct flights from the US to finally land, probably not anytime soon.

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS

Here we go…

Well, I hope this is only a glitch: United Seems to be Hiding Awards Space from the US travelers-Here’s How to Reveal It.

I don’t like this and I guess we will find out how it actually happens in real life: Hilton Standardizes Confirmed Late Check Out Fees Across All Brands In 2026. Just screams out that nickel and dime vibe.

I guess this is a positive: JetBlue Adds Points Redemption to Japan Airlines Partnership. As long as Japan Airlines still charges fuel surcharges you should probably not care.

I do not promote anything here that I do not agree with. And I am super picky, you may have noticed that. Anyway, I was aware of this hotel search outfit named Gondola. And after I learned that the tool requires FULL access to our email address I clicked away and moved on. Disappointed Frequent Miler wrote about it: Gondola: Compelling new hotel award search tool. If the owners of this tool can make it work without the full email access please let me know so I can take it for a spin myself. In this age of crazy hacking all around us, doing this is unacceptable and you should stay away imho.

And suddenly…

TRAVEL REWARDS CREDIT CARDS

NEW: Huge 100,000 point offer on the card all four of us in my household have and keep from my favorite bank – literally the offer of the year in my opinion, even better than the 75k Capital One Venture X!

TAKE ME TO THIS OFFER

Well, if you have that much spend in you: Elite status via credit card spend: AA vs Delta vs United vs Alaska vs JetBlue vs Frontier. Oh, how did Frontier get in there, hehe.

A few offers have now announced expiration dates, they are:

Expiration date of 4/30/2025 on the juicy 200k Chase IHG Business Premier card offer, for more details on this card click HERE.

Expiration date of 4/29/2025 of the AMEX Hilton cards, see below.

More elevated offers finally from my favorite bank:

What stands out from the massive changes in all United credit cards is the 80k United Explorer card and the 125k United Business card, learn and apply with the links in the link below, thank you! Or, for the BA offers, go you know where.

United Revamps Credit Card Lineup in a Big Way – Here’s What’s New

We have two NEW great Amex Hilton cards elevated welcome offers below (learn more about them HERE):

70k AND Free Night Hilton Honors American Express Card (Expires 4/29/2025)

130k AND Free Night Hilton Honors Surpass American Express Card (Expires 4/29/2025)

Another elevated offer from Capital One:

75k CAPITAL ONE Venture Rewards PLUS $250 Travel Credit

and the best offer still remains:

75k CAPITAL ONE Venture X

Please help the small independent blogs like mine continue to exist by supporting them with your CREDIT CARD clicks, thank you!

TOP TRAVEL REWARDS CREDIT CARD OFFERS RIGHT NOW:

NEW: Huge 100,000 point offer on the card all four of us in my household have and keep from my favorite bank – literally the offer of the year in my opinion, even better than the 75k Capital One Venture X!

TAKE ME TO THIS OFFER

The 75K CAPITAL ONE Venture X card has a minimum spend of $4k in the first three months. If you like simplicity and looking for one (premium) card, I highly recommend this card (and yes, I have it myself!). It has an annual fee of $395 but it comes with an easy $300 statement credit for travel booked on its own travel portal, essentially turning it into a $95 annual fee card. But wait, there is more! On each card anniversary you earn 10,000 points essentially making it FREE! Every dollar of spend earns 2 points and flights booked on the travel portal earn 5 points per dollar. You get access to Capital One and Plaza Premium airport lounges and a Priority Pass Select lounge membership and, this is important, you can add FOUR authorized users FOR FREE who can also have their own Priority Pass Select airline lounge membership and, this is BIG, they can bring in unlimited guests with their FREE Priority Pass card! You can transfer your Capital One points to up to 18 Transfer Partners. No foreign transaction fees. Free Hertz President’s Circle rental car top elite status. Cell phone protection and PRIMARY rental car coverage. Awesome seats at baseball stadiums for just 5k points each. And lots more. If you prefer, this is my personal referral link.

Click on my TOP CREDIT CARD OFFERS to see a DETAILED explanation of the features of these cards.

Here are my three TOP CREDIT CARD OFFERS as of today:

The 75k Capital One Venture X card. It is amazing what you get for FREE with this card!

The 75k Chase Ink Business Unlimited card.

The 75k CHASE Ink Business Cash card.

Learn more about these offers HERE.

BONUS OFFERS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog (and you don’t have to hunt down the link in my Credit Cards page!)

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click on the link above

2. Create an account

3. Subscribe

MY ACTION AND BLOG BUZZING

I chatted with an Amex chat agent and got me a retention offer on my Amex Business Platinum card. Which is a kind of pathetic “earn 10k Membership Rewards miles for $5k spend in the next three months”. Well, at least I got one lol. I placed my strong “the Dell credit is going from $400 to $150” feelings up front so maybe this is what made the difference? Ok, that was a joke.

I was targeted for an easy 5x offer on my United Gateway card for $1k spend on groceries/gas stations/restaurants. I’ll take such targeted offers anyday, hit me!

Road trip! Will be spending this weekend exploring Mammoth Cave National Park in Kentucky. Staying one night inside the park at the Mammoth Cave Lodge, I managed to snag a terrace type room the first night. Came to $155.04 and I used my Capital One Venture X $300 credit for it #winning. Then, you know, World of Hyatt considerations adjusted my plans once again. I had a Category 1-4 Free Night Cert expiring in a few weeks so I looked to use it of course. Sadly, there was only a Category 1 Hyatt Place nearby and no award availability both nights, what? Anyway, area appears busy over the weekends, so beware. So, since I managed to stay in the Lodge the first night, I made the executive decision how to best use this Hyatt Free Night cert. And I decided to leave later in the day on the second day at the Caves and drive to Cincinnati to burn the cert at the Category 3 Cincinnati Hyatt Regency. Which looks very nice with good reviews, so looking forward to the free Globalist breakfast, missed it so much lol. I will try to post some pics in my Instagram account if you are interested.

I am checking out the National Park Trail Guide app and I like it.

I finally upgraded my Samsung Galaxy S21 Ultra to the new Samsung Galaxy S25Ultra. I like it a lot. Of course I had to spend substantial time logging in to many apps and stuff like that. The quality of the pics and videos will see a definite improvement ahead. And the battery life/management is much improved. I really like this video by the way: Galaxy S25 – First 50+ Things To Do (Tips & Tricks).

I can not believe it took 17 years for the Detroit Pistons to finally win an NBA Playoffs game!

I watched the movie Sinners. Well, the movie took a turn I was not expecting at all. Very well made, I liked it even though that genre the movie turned into I was never a fan of.

The kitchen remodeling project may be back on. Going to be a long process and sometimes I wonder if I have the patience for it.

We will have a new Pope. When that happens they adopt a new name. So, we can not have this guy become Pope. Why? Because his real name is Pierbattista Pizzaballa ———> LOL to infinity

HOT CREDIT CARD OFFERS:

100k CHASE Sapphire Preferred, 75k CHASE Ink Business Cash, 75k CAPITAL ONE Venture X, 200k CHASE IHG Business Premier (EXPIRES 4/30/2025), 75k CHASE Ink Business Unlimited, 125k CHASE United Business, 80k CHASE United Explorer, 150k AMEX Business Platinum, 200k CAPITAL ONE Spark Cash Plus, 350k CAPITAL ONE Venture X Business, $1,000 Cash Back CHASE Ink Business Premier, 75k CAPITAL ONE Venture Rewards AND $250 Travel Credit, 90k CHASE Ink Business Preferred, 80k CHASE Southwest Performance Business, 15k AMEX Blue Business Plus and many more!

Learn How To Apply HERE to support the blog. Or email me if you have any questions about any cards, I’m happy to help, thank you!

As of today, I have burned 191,500 miles/points year to date (2,027,816 in 2024) and have 4,537,582 miles/points in the bank.

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

From the WSJ Article back in 2014:

Alternative investments aren’t just for deep-pocketed institutions and the very wealthy anymore.

In recent years, investment firms have flooded the market with a wide variety of alternative offerings aimed at the less affluent, including private-equity funds with manageable initial investments and mutual funds and exchange-traded funds that employ hedge-fund-like strategies.

Individual investors seeking to juice their portfolios have responded with enthusiasm, pouring tens of billions of dollars into the new offerings. Assets under management in alternative mutual funds, for example, swelled to $317.9 billion in March, up from $180.4 billion at the end of 2012, according to fund tracker Lipper.

Supporters believe that the mainstreaming of alternative investments is a financial innovation that is here to stay. When used correctly, they say, alternatives provide individuals with some of the same benefits that have made them attractive to institutions.

Critics say just because individuals can now invest in alternatives doesn’t mean they should. Many of these products come with high fees, too much risk and little transparency, they say, adding that over time it is hard to beat the inherent advantages of a low-cost indexed portfolio rebalanced regularly.

Klaas Baks, executive director of the center for alternative investments and an associate professor of finance at Emory University’s Goizueta Business School, says alternatives can provide individuals with some of the same benefits that have made them attractive to institutions. George Papadopoulos, a fee-only wealth manager in Novi, Mich., says they are too risky and expensive for most individuals.

No: They Aren’t Worth the Expense and Risks

By George Papadopoulos

To hear the salespeople tell it, alternative investments provide great diversification benefits and high rewards, along with protection against steep market drops.

But the next time you get a pitch for a hedge fund or nontraded real-estate investment trust, consider this: Exotic assets may make a portfolio seem a lot sexier, but they may not get it to perform better over the long term. Factor in risks and expenses, and alternative investments just aren’t worth the trouble.

The alternative-investment category is broad and can include tangible assets (precious metals, antiques, art, wine) and financial assets (private equity, venture capital, hedge funds, commodities). In recent years the Wall Street marketing machine, hungry for sales commissions, has broadened its target market to include regular investors by repackaging alternatives in the form of mutual funds and exchange-traded funds.

Alternatives may come in many different forms, but the disadvantages associated with them are similar. In general, here is why alternative investments aren’t appropriate for most individual investors:

Risks: Investing in and regularly rebalancing a low-cost investment portfolio of broad-based index and exchange-traded funds is hardly water-cooler material. We’d much rather brag about the “To the Moon Hedge Fund” that returned 59% in three trading sessions last week. Let’s be blunt here. The nature of the alternative structure tends to encourage managers to take risky leveraged bets to maximize returns and their own management fees, and it keeps attorneys who specialize in financial-adviser fraud very busy. Beware.

Fees: High management fees are only the beginning as you are led to believe you are buying into an exclusive club of investment-manager geniuses (see Long-Term Capital Management, the hedge fund with its two Nobel Prize-winning economists that failed spectacularly in the late ’90s). When you add trading fees, juicy sales commissions, marketing costs, and leverage, you are starting with a big disadvantage that isn’t easily overcome even through high returns. A client attended a free dinner where a salesperson put on a slick presentation about a nontraded REIT. When he asked me to research it, I discovered that it had 10.5% upfront sales commission and 7.5% ongoing annual fees. “Run fast from this one,” I advised. Later we learned that the sponsor company has been involved in litigation recently for “breach of fiduciary duties.”

Lack of transparency: I owe it as a fiduciary to my clients to fully understand any investments I recommend, including all related fees and risks. Heads up to marketers pitching alternative products: If your pitch includes any reference to “proprietary” techniques, please don’t bother me. Nothing personal.

Lack of liquidity: Imagine we are back in the dark days of late 2008-early 2009. You had invested in a “hot” hedge fund and now are being told you cannot access your money. You panic and lose sleep. You sell at a loss at your first opportunity. I am not saying investors sticking with boring strategies weren’t scared back then, but it’s easier to stay the course when you understand what you are invested in and are comfortable with it. Alternative mutual funds and ETFs may address the liquidity concern—but they also come with an average expense ratio of about 1.77% of assets, according to Morningstar Inc., which is several times higher than what my clients average.

Higher taxes: When you invest in an alternative investment, you give up the flexibility to control your own tax management. You are at the mercy of the manager who often trades too frequently. You can be assured of a much higher tax-preparation bill, too.

Some alternative investments outperform, but seldom consistently. As time goes by, it gets tougher to beat the inherent advantages of a low-cost indexed portfolio rebalanced regularly. While alternative investments may provide some diversification, especially with the U.S. markets at all-time highs, the negatives vastly outnumber the positives.

By the way, my client ran from that nontraded REIT despite repeated follow-up calls from the salesperson. He sent me an email afterward to thank me: “Why I hired you…to protect me from myself.”

I had not thought of Long Term Capital Management for years. The Fed decision to bail it out was such a disaster. Private gains, social loses. Ouch

Enjoy the cave!

Howdy from the good ole USA. Still got pretty strong jet lag but should be back in shape in by next week. A few comments:

1. I think it’s criminal what the private equity firms are trying to do to allow 401k’s to invest in private assets. It’s nothing more than a psuedo-bailout of companies that made poor investments when interest rates were cheap and now are left holding the bag when it comes time to monetize the asset. The capital markets are closed to their typical exit of IPOs, private credit is coming off from the bubble it has been the past year, and other private equity companies don’t want to play hot potato any more shuffling assets between themselves.

And compound that with officials in Washington, who no doubt are on the take, that are pushing for these changes not knowing, or caring, the damage that will inevitably take place.

2. Re: “Trump’s crackdown on foreign students and scientists will do irreparable harm to the country.” This has already been taking place for awhile going back to the days of W. Bush limiting research on stem cells. There’s a reason why professional athletes travel to Germany to help accelerate rehab for injuries. Because we’re not allowed to do that here in the US. No doubt it will continue to get worse.

3. Re: Thai. It’s part of the charm, and also opens it up to exploitation. I have quite a few friends who are on muay thai visas or thai language visas that don’t attend class. The schools take care of all the paperwork and required reporting. Though the immigration department does make surprise visits to schools to check on students. Nothing a few thousand bahts can’t take care of however. At least their corruption is out in the open compares to American’s 401ks be usurped by congress and their ‘special interest’

I also wouldn’t be surprised to see airlines try to make Thai-US work, especially to capitalize on the White Lotus craze. At a minimum Thai should introduce a LAX route given it is the largest Thai diaspora in the world. There might be enough premium demand between it and vacationers to make it work. I doubt any other city would work.

Also DML: LTCM wasn’t bailed out by the Fed, their Bank creditors bailed them out. I would encourage you to read the book “When Genius Failed” to get a better understanding of the how and why it all went down.

Hey George, at least you got a retention offer from Amex! I’ve always disliked when I have to call in and either cancel a card or get a retention offer due to the heavy sales thing that happens to get me to not cancel when no retention offer is available.

At least, I thought I hated calling in for that until 2 days ago when I chatted with Amex in regards to my platinum card on which the AF was due. Screw that chatting to do this kind of stuff, it is madness! Far worse than calling! Try as I might, I never feel like I get my money’s worth out of the card. So no retention offer was available so I type in that in that case I will close the card. The number of obviously canned responses over the next fifteen minutes nearly drove me nuts. Not to mention I am still getting over my cold and was not feeling like dealing with this. UGH! But finally successful.

Good batch of stuff here again and as always, thanks! I now for some reason am getting tons of videos on the Book of Face about Thailand. At least the part with the street full of I think they are sex workers or who knows what. So many pics of old white guys with young gals, it seems creepy. Please tell me this is an outlier kind of thing for there!

Done with Bologan and am in Verona. Had a free night at the Hotel Indigo right in the city last night (IHG Hotel) and they treated me so nice and gave me the center balcony room so I was (on my own whim) in charge of untangling the Italian and European flags on the front of my balcony. It was fun to stand there looking down at the street between the two large flags waving. I kind of felt like a president or something! (One that is not crazy/evil)

Off to Mestre (across the lagoon from Venice) Saturday for 3 days and thence to Udine. The end of the trip slowly approaches as after that there is but Milan and Paris. Having tried two different language schools on this trip though, I have a clear winner so am thinking of returning in a few months or next year for a solid couple months of school.

Don’t get lost in the caves, ok? Leave a trail of breadcrumbs or something just in case! Thanks for the good reading!

I must admit that my 2014 article still holds up very well. Ok, I am biased but still.

@ DML: I think the main LTCM guy was back at it after a few years. His partners switched careers out of shame…I think.

@ bob: I agree with pretty much all your points, thanks for taking the time to comment. I think the G in MAGA stands for grift. I think PE and crypto people will attack the 401k Plans next, I am surprised they are moving so slow, this is their opportunity. And it will likely be a bloodbath. Don’t see Thai Airways pulling it off this year, maybe late next year, they don’t have the planes until then. Looking for the UA awards seats to open up for us later this year, there is a method to my madness (to wait).

@ Carl: Your Italian trip sounds great. Oh boy, yeah, the Amex chat rep canned responses are something else indeed. Will do my best not to get lost in the caves. Not going to be the curious hero and wander off, those days are over lol. Oh, Thailand and older western men (farangs) and younger women. So much to unpack, the comment section is not the place. There are certain streets that are full of bars and “working” girls. You do see couples like that walking around and nobody cares/judges there, it is kind of an appeal of Thailand for single men. You need to experience it once and not only for that, it’s just a unique country, the land of smiles indeed. Nov-Feb is best because it is not hot as hell. And so much more affordable than Italy. I could go on but I need to pack, been a while. And this trip requires no airplanes, which is really weird.

hi

There’s a new “universal airline mile”

site: https://www.rovemiles.com/

article: https://www.ycombinator.com/launches/NMx-rove-travel-the-world-for-free

I predict it will be short-lived, but who knows, maybe there will be some (VC-funded) opportunities before its demise.

Caveman George is back!

@ Nick PFD: Very interesting find about that “universal airline mile” site. I have the same feelings as you. I bet you they are hoping someone at WellsFargo will be impressed by it lol.

Hi Tommyeralm.

Daughter is staying at a very nice Marriott property at SFO and totally forgot to enroll her in the Bonvoy Gold through her AU Amex Platinum card. So, it is now Pending and she is checking out tomorrow. I am losing my touch you guys. The property charged her early checkin fee for checking in one hour early LOL. Told her to make sure she picks another property but it is the conference hotel so she did not, her first experience of getting Bonvoyed, welcome. This is a work trip.