Another TBB post featuring the most eclectic links around the web such as avoiding bad financial advisors, using God to steal, the best US delis, another 250k Amex points, the largest sovereign debt defaults, the Canadian Bernie Madoff, the death of the magazine, we have photos of Michigan and the supermoon and much more and of course always all of the most important developments in the crazy world of miles and points. See you next next week, enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No sponsored posts. Also, no AI!

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to a curated at least weekly post of the best web content along with my commentary. Here to Educate primarily, sometimes Entertain and if I get to Inspire you, well, that is a bonus.

This is a one man labor of love operation, enjoy it while it lasts.

PERSONAL FINANCE

The financial services industry is crammed with thieves and is worthy of its bad reputation. We are not all the same of course and some of us do take seriously our fiduciary purpose advising clients. But, nevertheless, we are always fighting against the thieves out to harm people any chance they can trying to separate them from their money. So, this article is right on purpose: Avoiding Bad Guys. Singling them out like this:

Red Flags. If a prospective investment is too difficult to understand, or if there’s anything that strikes you as odd, you might want to move on.

Personality. If a fund manager seems to be using emotional appeal as part of the pitch, be wary.

Track Record. If an investment fits in the “new and interesting” category, it may be worthwhile—but there’s no rush. Allow it time to prove itself before committing.

Public. Always caution against private funds…the risk level is always going to be higher in a private fund, where there are fewer eyes on it.

Faith. Peter Lynch, the legendary fund manager, offers this advice to investors: “Never invest in anything you can’t illustrate with a crayon.” It’s a simple but valuable lesson.

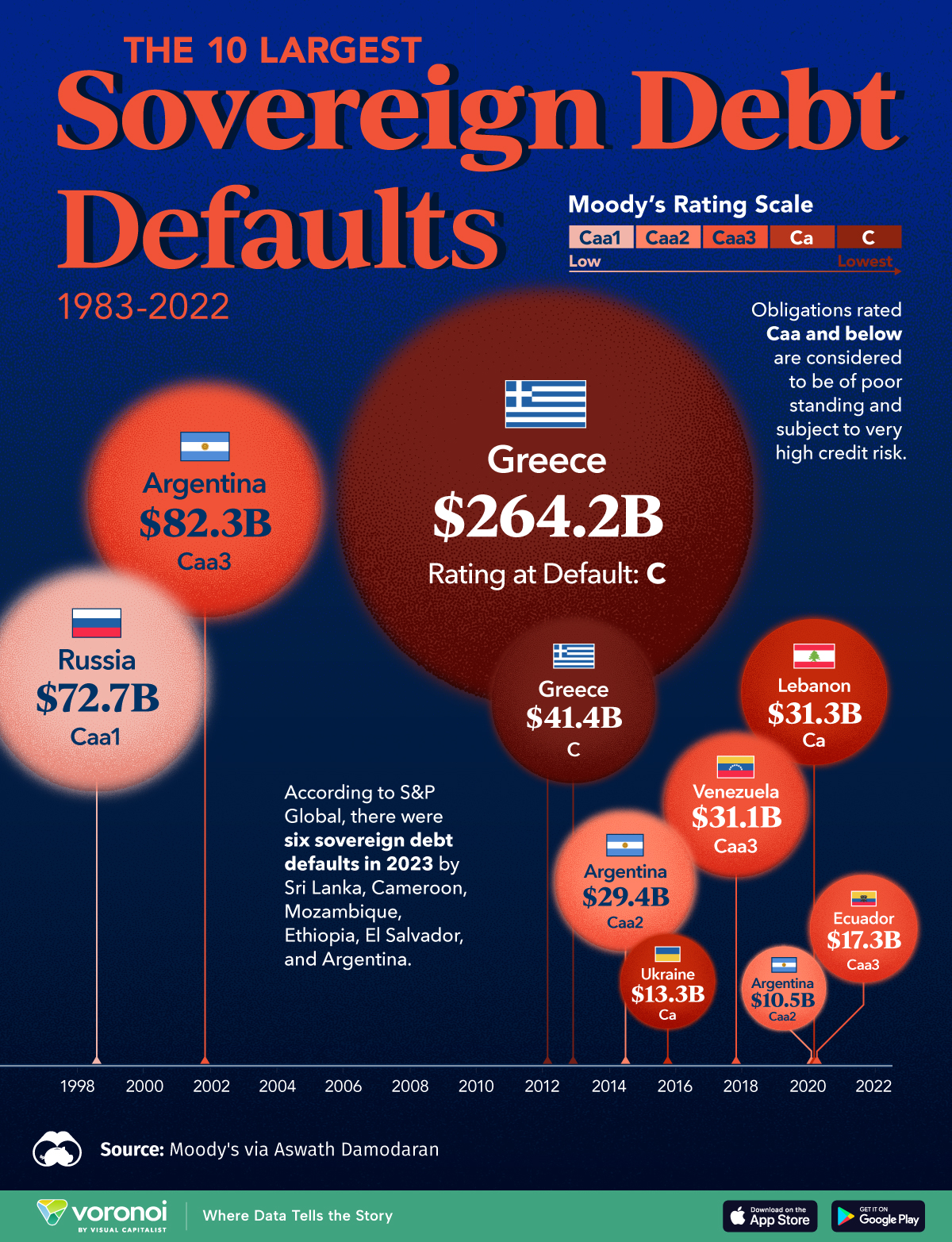

Greece is #1, sad lol. The Largest Sovereign Debt Defaults in Modern History.

SCAMS/CRYPTO/AI/TECH

I have blogged about that Texan supposedly Christian financial adviser who went by “the Money Doctor”. Who carried on a Ponzi scheme for many years and scammed way too many people. The Texas Preacher Who Used God to Steal. Many thanks to the victims who spoke out and huge respect to the state investigators who stuck with it and managed to get this guy off the streets. He was sentenced to three life sentences plus 30 years. But, at the end of the clip, we are told he has been locked up since 2019 and, please sit down, is eligible for parole in 2025. What???

Why is this guy out enjoying himself living in Dubai? ‘Canada’s version of Bernie Madoff’: The rise and fall of Greg Martel. Greg Martel was a mortgage broker who coached his kid’s hockey team and pledged money to charity. By the time he owed investors $317 million, he was nowhere to be found. Oh dear, he got started when he paid for a course with Anthony Robbins smh. Yikes:

Between 2018 and 2023, Martel had spent at least $3 million in private plane rides and $3 million in cars. Martel had nine bank accounts, according to PwC, including a Coinbase account, that had a combined balance of $2,661.35. PwC eventually recovered about $300,000 from various MMAC accounts and an unrelated legal proceeding. Martel owned two houses, one in B.C. and one in Nevada, each of which had significant mortgages and little equity. He also jointly owned a third house in Ontario with his ex-wife. All told, Martel’s combined assets were less than the PwC spent in the recovery effort.

This blog is not going to blog itself. I rely on you readers helping it grow as I don’t have time to do any promotion/marketing. Which leaves the content clean of intrusive sponsoring posts and stupid ads and stuff like that. So, please:

You like my blog? Send a link to someone please!

ODDZ & ENDZ

This is kind of fun. Type a word and click Go. Search wordassociation.org.

This is a great article about magazines and media in general: The Death of the Magazine. Look at what happened:

In 1960 the magazines with the most circulation in the US were:

- Reader’s Digest (filed for bankruptcy in 2009 and 2013)

- Life (regular print editions ended in 2000)

- Ladies Home Journal (last print issue in 2016)

- Saturday Evening Post (still publishes 6 issues per year, but print circulation is down 95% from its peak)

-

McCall’s (last print issue in 2002)

Leading to this steadily and surely…

This creates a vicious circle—it’s one of those doom loops I write about:

- Magazines lose circulation, so they cut costs and put the squeeze on writers.

- The most popular writers leave to launch their own newsletters (or a podcast or some other freelance venture).

- This creates further subscription erosion, and the magazine needs to cut costs further.

- The whole cycle repeats.

I am starting to wonder if this is the fate of blogs like this one. It is up to you, the readers.

TRAVEL

If you have a craving to eat something at a deli: The Best Deli in Every State. There was never any doubt which deli would be the one chosen in Michigan. It is our own Zingerman’s in Ann Arbor.

A collection of photos of the blue supermoon.

Love this about my home state: How do we love Michigan? Let’s count the ways in photos.

SAVE $100 FOR 2024 THE EXTRAORDINARY TRAVEL FESTIVAL

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/CREDIT CARD CORNER/MY ACTION

We have a lot to cover in this post today again. This hobby always changes, you never get bored with it, still at it thirty years later #wow. It can be addictive as I have warned many times in the past. I am trying to cure my addiction but the banks keep providing me free crack…not that I have ever done crack, just saying woohoo.

The BIG news is that the #1 current credit card offer from my favorite bank, the 120k Chase Ink Business Preferred card, ends on September 4, 2024! You can read more about it below and you know what to do HERE. We got three of these babies in my household. Thinking about going for #4 for son…

GENERAL NEWS/PROMOS/NEWBIES/ETC.

A deep dive on Spirit’s new pricing scheme: Spirit’s New Bundle Pricing is Out, and There is a Pattern Here. I think I am getting that feeling that this airline may not be around in a year.

If you have elite airline status with American, United, Alaska or Delta, JetBlue wants you: Get JetBlue Mosaic with New Status Match Promotion. You only get the status for four months. And then you have to hit some targets to keep it. Son could go for it but, there is always a but with such promos, will he even get to fly JetBlue in these four months? Most likely, nope.

There are some gems I was not aware of in this list: Short on Points? Book These Hyatt Hotels for 5K Points (or Less!). I had not realized that the Hyatt Place in the Frankfurt airport is 5k per night. And several other surprising properties.

And just like that, Hyatt adds another five brands. Talk about hotel brand inflation lately, wow! Hyatt to Buy Lifestyle Hotel Group Standard International for up to $335 Million. Doesn’t it seem like a lot of money for just 21 properties (and more on the way)? The five brands are: The Standard, The Peri Hotel, Bunkhouse, The StandardX, and The Manner. Hmmm, do we get to earn one free night if we stay on all five of them? It looks like only a few of these brands will move to World of Hyatt apparently. So much buzz about this “lifestyle” market segment lately, whatever it is.

Anyone stayed at a Hyatt Vacation Home rental yet? Prices appear to be very high. So, Hyatt is having a 3x promotion and you don’t need to register for it, just book and stay. And you can earn 15x per dollar, even before credit card and elite bonuses come into play. Here are the locations of these properties.

If you wanted to get to Hawaii for free: The Best Points and Miles for Free Flights to Hawaii.

If you wanted to get to Hawaii for free: The Best Points and Miles for Free Flights to Hawaii.

CREDIT CARD CORNER

Please help the small independent blogs like mine continue to exist by supporting them with your CREDIT CARD clicks, thank you!

I will indicate with NEW every new section as the rest is the same from the previous blog post and will finally roll off those parts as offers expire, thank you.

NEW: Be careful with these banks! [Update] U.S. Bank Business Cards Have Confusing ‘Central Billing Account’ (Bank of America, Wells Fargo).

NEW: This is just nuts, Amex is just giving them away at this point! Amex Business Gold Card: New 175k referral offer. Nice if you can get it.

NEW: Many are asking this question lately for obvious reasons: Should You Transfer Miles/Apply For A Hawaiian Airlines Card Before The Alaska Airlines Merger?

Will list these current offers below and will roll off as they expire. First, the Capital One bank offers:

$2,000 Capital One Spark Cash Plus: This $2,000 cash back card can be converted to 200,000 Capital One Miles if you have a miles earning card like a Venture X or Venture Rewards card. This is a hell of a Signup Bonus. But, you know, what is the catch? Well, the minimum spend required to earn the $2,000/200,000 miles bonus is $30,000 in the first three months. If you can swing this type of spend, great. But wait, there is more. You can earn an additional $2,000 (or another 200,000 miles), please sit down, after each $500,000 of spend, unlimited. Ok, that may be a little out of reach you guys. Unless you have a high volume business or something. The annual fee is $159 but it is waived after you spend $150,000 on the card. There is beauty in simplicity as the card earns 2 points on everything (and 5 points on hotels and rental cars booked on the Capital One travel portal). No other gimmicks, no coupons, just straight forward earning. I think this is the highest offer on this card ever.

150k Capital One Venture X Business: A Signup Bonus over 75k gets my attention. When you get to over 100k it gets even more of it! The Signup Bonus for the Personal Venture X is only 75k points so you know we need to at least talk about this one doubling it. But, you knew a but was coming, the minimum spend is again a high $30k over three months. It has the same $395 annual fee as the personal Venture X card. And of course it comes with the same easy $300 annual travel credit and a 10,000 point bonus at each card anniversary. Meaning, Capital One pays us $5 to have a Venture X type card #winning. I have a detailed review of the personal 75k Venture X card at the bottom of this PAGE. Venture X cards allow free authorized users and lounge access as well. The beauty in Capital One cards is the simplicity in just pulling it out without over thinking it (looking at you Amex) and just earning 2 points on everything (and 5x on flights and vacation rentals, 10x on hotels and rental cars booked in the Capital One travel portal).

Capital One has come out with a lucrative 75k Capital One Venture Rewards card PLUS a $250 Travel Credit. The annual fee is $95 and the minimum spend required is $4,000 in three months. Capital One cards usually earn a simple flat 2 points on every dollar. This card earns 5x on hotels and car rentals booked on its own travel portal, which is no big deal. No foreign transaction fees. Get $100 credit towards Global Entry or TSA Precheck. Most importantly, you can transfer the 75,000 points out to airline and hotel partners. Or just erase travel charged on the card for $750. And then of course you get the $250 travel credit. Basically, $1,000 of travel for $95. No Priority Pass lounge membership, just 2 visits allowed to Capital One or Plaza Premium airline lounges. Very tempting indeed. For diversifying purposes as well if you have enough miles and points elsewhere as it is always nice to use this card to pay for a trip and then use Capital One miles to erase the charges. Capital One can be, well, finicky in approvals. If you are denied, you can not call to ask them to reconsider, it is all done by algorithms so, good luck! Finally, YES, you can have both the Venture X and the Venture Rewards cards.

Remember, Capital One pulls your credit from all three credit bureaus. And you can apply for only one Capital One card every six months.

Then, on to a Hyatt card offer from my favorite bank Chase:

Up to 75k Chase Hyatt Business Card: Chase kept the same “60k points for $5k spend” offer and added a sweetener to earn an additional 15,000 World of Hyatt points for a TOTAL $12k minimum spend in the first 12 months. The annual fee is $199. The card earns 4x on Hyatt stays and 2x in the top three spending eligible categories (becomes top two spending categories after 12/31/24). These eligible categories are: Dining, airfare, rental cars, local transit and commuting, gas stations, internet, cable, social media/search engine advertising and shipping. Discoverist elite status while you keep the card open. Can get $50 statement credits on Hyatt stays twice a year, which essentially turns this card into a $99 annual fee card. But here is the key differentiator for big spenders and Hyatt fanboys and girls. You can get 5 elite qualifying night credits after each time you spend $10,000 on the card. Interestingly, this card does NOT give you 5 elite night qualifying credits automatically and no complimentary free night as the personal Hyatt Visa does. Finally, when you cross $50k of spend you can get 10% back on redeemed points for the rest of the calendar year (up to 20k points back per year). This offer ends 9/26/24.

Then, on to current Amex offers:

155k Marriott Bonvoy Bevy: Earn 155,000 Points. I am no Marriott Bonvoy fan. But it is the largest hotel company in the world, so you can not avoid it. This card has a $250 annual fee and you can get a nice 155,000 points after you complete $5k in spend in the first SIX months. Gold elite status, 15 elite night credits and 1,000 bonus points with each stay. The 155k points is not the highest ever but it matches it. Will it be enough to make me go for it? No way. And I am not going to be like so many bloggers faking my enthusiasm making an ass of myself in order to make a sale so I can get paid. Read more about the offer if you are interested and apply for it HERE to help support the blog if you decide to go for it, thank you.

185k Marriott Bonvoy Brilliant: Again, read the paragraph above for my feelings about this program. This is a premium card for people who stay in Marriott properties a lot, like many business travelers. As a premium card, it comes with a premium annual fee of $650. You get 185,000 points after you spend $6k in the first SIX months. Platinum status. Wait, is this six month period becoming standard lately? Comes with fairly easy but annoying $25 per month credits on restaurants worldwide up to $300 per year. 25 elite night credits. 1 free night every anniversary year. Priority Pass lounge membership. Again, this card could fit some heavy Marriott hitters. Read more about the offer if you are interested and apply for it HERE to help support the blog if you decide to go for it, thank you.

You can refer Amex cards from within your Amex account. Sometimes the referral bonus you earn referring others to Amex cards can be very lucrative. And sometimes the offers you can sign up for can also be very lucrative. And they can vary wildly! Sometimes different offers show up when you use different browsers, incognito mode, desktop or mobile browser or app, it is maddening! So, I will drop here my own personal Amex REFERRAL LINK. You can use this referral link to apply for ANY Amex card. You just click on Learn More and then click on either “Personal Cards” or “Business Cards” at the top. And act accordingly if you see a crazy high offer!

Still the #1 BEST OFFER out there right now, we got three of these babies in my household: 120k Chase Ink Business Preferred card. It is its highest ever signup bonus. The annual fee is $95. Requires $8k minimum spend in the first three months (used to be crazy high at $15k!). It earns 3x on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites and search engines and 1x on everything else. No foreign transaction fees and primary rental car insurance on business trips. Points are worth 1.25 cents each if used in the bank’s travel portal. So, if you do the math: 120k plus 8k MINIMUM (if all spend was at unbonused 1x ) is 128k points times 1.25 cents gives us free travel worth $1,600. For an annual fee of $95. Ok, I did the math for you, come on! And of course you can transfer the points instead to airline/hotel partners (I prefer Hyatt, Air Canada Aeroplan and sometimes Southwest, in that order) for even higher value. Very solid cell phone insurance coverage along with strong travel and purchase protections.

Best credit card offers STILL remain the same, see below my TOP FOUR travel rewards credit cards right now. For a DETAILED explanation of the features of these cards below, please click HERE and read about them at the bottom of that page.

Temporarily, the 120k CHASE Ink Business Preferred card goes right to the top. Offer ends on 9/4/24!

The next offer NOW is the 75k Capital One Venture X card. It is amazing what you get for free with this card!

Next we have the 75k CHASE Ink Business Cash and 75k CHASE Ink Business Unlimited cards.

Learn how to apply HERE to support the blog.

MY ACTION

Well, I resisted coming back into the Amex fold you guys for several years. But, after repeated attempts by Amex to lure me back showering me with increasing offers I “folded” and applied for a targeted Amex Business Platinum card for 250,000 Membership Rewards points I received via snail mail. I had until 10/1/24 to apply but with the third quarter Federal estimated tax payments coming up by September 15 I decided to go for it. These offers just kept going up and I guess I just could not say no when the latest one reached 250,000 points. Which translates to a minimum $2,500. Of course I have to pay the annual $695 fee for a few years and now I have to sit down and plan how to best capture the statements credits. First, son needs to cancel my Authorized User personal Platinum card he pays $195 for me (and his mom, way to pay us back for still being on the TMobile cell phone family plan). Then, I have to retire the actual physical Amex Platinum and Priority Pass lounge cards. Then plan to capture the $200 Airline credit, likely going with the United Travel Bank on this one. And then see what crap I need to buy from Dell at $200 every six months (need a wireless mouse and new keyboard next). I need to see how I can get the $150 Adobe credit as I do have an Adobe account. No $10 cell phone monthly credit for me as I pay it via bank ACH to avoid the extra fees. No Indeed credit, who uses that? I guess maybe it is time to enroll in CLEAR as the full $189 gets credited. I do have Global Entry of course, do I need CLEAR too? So, I think I am going to do just fine here you guys.

I recently closed three credit cards and have now added four into my portfolio (three Chase Ink Business Preferreds and one Amex Business Platinum). I should cancel one more credit card so I don’t add to the mental bandwidth…but I need to identify one as none jump at me right now (closing another Ink so close after receiving the three new Ink Business Preferreds may not be prudent).

The spending for the third Chase Ink Business Preferred is going slow as I keep checking my insurance company’s website to see if the new annual invoice is posted. Every day. Will it post before the statement closes on September 4th and get another 120+ Chase Ultimate Rewards points? We shall see.

I finally uploaded two videos in my YouTube channel:

Ludington Michigan Comfort Inn

Grand Rapids South Hyatt Place – I did notice in prior videos that whenever Mrs. TBB appeared in them there were a lot more clicks. So, going forward, Mrs TBB will be in them and we are starting with this one. Hopefully this leads to a lot more subscribers and a new modeling gig for her. With only 29 YouTube subscribers the sky is the limit lol.

First, let me just say that my nephew was signed to a professional contract by the Italian soccer team Juventus, one of the most historic European clubs. I watched him play as a kid and I am not surprised by his development. His family is very proud and so is everyone in my hometown Larissa and our village too. Looking forward to watch him play, maybe he can get us some Champion League game tickets lol. I must admit I despised Juventus but no more.

Still doing physical therapy to solve the issue with my feet. At this point, my goal is to walk more than a mile without discomfort/pain. It should not be that hard but it is. I am coming to terms that my running days are behind me. Which obviously sucks BIG time. On top of that, if that was not bad enough, my right ear tinnitus has suddenly deteriorated and my ear doc is sending me for an MRI to see what is going on. He told me that I need to protect my hearing. So, to translate, my live concert days are finished. I think that may have contributed to my ear issue as I went to a few concerts this year after a long absence. So, no running and no live music. So, when blogging goes what the hell am I going to do? Sad.

Son is home and we are saying goodbye to our daughter moving to Seattle this Saturday morning. I may post a family pic next week. With my new George Clooney bearded look, you have been warned.

ADVANCED

If you expected Bilt to give a heads up notice, you have not been paying attention: Bilt Loses Hawaiian as Transfer Partner.

In case you have had issues booking American Airlines flight with your Qatar Airways Privilege Club miles, maybe you should read this: .

This is good advice, I would steer clear: Why I’m Cautious About Pepper Rewards Deals.

MILES & POINTS

HOT CREDIT CARD OFFERS: 120k CHASE Ink Business Preferred, 75k CHASE Ink Business Cash, 75k CHASE Ink Business Unlimited, 75k CAPITAL ONE Venture X, 75k CHASE United Business, 75k CAPITAL ONE Venture Rewards AND $250 Travel Credit, 150k AMEX Business Platinum, 200k CAPITAL ONE Spark Cash Plus, two 120k CHASE Southwest Business cards, 150k CAPITAL ONE Venture X Business, $1,000 Cash Back CHASE Ink Business Premier, 15k AMEX Blue Business Plus and many more!

Learn how to apply HERE to support the blog. Or email me if you have any questions about any cards, I’m happy to help, thank you!

As of today, I have burned 1,370,957 miles/points year to date (1,148,286 in 2023) and have 4,206,971 miles/points in the bank. Some do drugs, I do miles lol!

WELCOME OFFERS & TRANSFER BONUS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer and/or a lender releases (or is about to remove) a transfer bonus with one of their partners? If yes, I highly encourage you to sign up if you haven’t yet.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click through one of the two links above

2. Create an account

3. Subscribe to the email notifications of your choice

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

Lots today! Thank you.

Hope you are able to walk long distance without pain.

Yes, Mrs TBB ought to be featured on the YouTube posts.

Nice as always to see this pop up in the inbox! I’ll be reading though as the day goes since I am stuck at home sick. 5 days now and I am tired of being sick and tired in general. Biggest outdoors event of the year is tomorrow for me and I think I ain’t gonna make it so I am peeved.

I didn’t realize your daughter was moving to Seattle. You and Mrs. TBB ever come out to visit and decide to head north a bit towards Bellingham, Lunch or Dinner is on me!

Thanks as always for all the good stuff here!!!

Carl, have you been tested for Covid? If not, could be a good idea.

Re: My Action – You can (likely) pay the full amount of you cell phone to get the insurance benefit & the platinum $10 while still having your ACH linked for the discount

Wow, congrats to your nephew!

Anyway here in Charlotte there’s a rumor that Ryan Reynolds of all people is moving to Charlotte, or at least buying a house here. I don’t understand why he would do that but that’s been the rumor the last few weeks. And apparently his wife was spotted in a local eatery yesterday.

https://www.charlotteobserver.com/charlottefive/c5-people/article291311510.html

Thanks Buzz for the weekend read.

A Canadian in Dubai? Nah, no snow.

Awesome news regarding your nephew and his football journey.

Good luck with the healing and have a great weekend.

Don’t waste time feeling frustrated that your running days might be over, rather feel proud of what you did achieve and move onto the next thing. Aging is a bitch, but it is a privilege and all of us need to learn to adapt so we don’t end up without any interests or hobbies. You have reminded me that I do need to cancel some more cards. By years end we will likely be down to our last half dozen and they will see us out for the rest of our days. Motto of my life is to simplify.

Sorry all, will respond on Saturday, the boy is home and we have a lot to catch up with and we are going to dinner now and we say goodbye to his sister.

Also, boy plus 1 are joining us in Hua Hin, Thailand for Thanksgiving 2024, hooray! Another 76k points burned, nearing 1.5 million #winningbyburninglol

For category 1 Hyatt hotels, I really like the Alila Manggis in Bali, the Hyatt Regency Merida, and the Hyatt Regency Kinabalu, although the latter is past its’ prime it is still nice and a superb value at category 1 if you have club lounge access and/or breakfast.

Ink Biz Preferred 120k would get a better PYB rate if transferred to Aeroplan (if you’ve got that card). First even without a transfer bonus, you’d get 10% more for any >50k transfer just for having the Aeroplan card. Second, you’re not stuck with Chase’s portal, you get to just pay with your card.

@ DML: Well, she is not helping attracting new Youtube subscribers, still stuck at just 29, sad.

@ Carl: Get better please. No plans to visit Seattle this year but that may change. Delta and Alaska Airlines are going at it between Detroit and Seattle, which is great! Will meet at some point and all on me, time to repay them sock drawer cards lol.

@ Ben R: Yeah, thanks for the tip, I may try to do that. Also, looks like Amex will be totally redoing the Business platinum credits after 12/31/24. So, developing.

@ Nick PFD: Whatever that Ryan guy touches turns to gold, as the saying goes. Very interesting dude to say the least

@ David: Yeah, thank you. He is a good kid, told his dad to watch all the Italian women around there lol. Yeah, the healing will be slow it appears. And gym is closed for two weeks. Wife got donuts from the same place I used to take my kids (best donuts in Michigan) and….I resisted the urge to eat any of them. And I am so proud of myself for that.

@ Vicky: I agree with your statements about aging and stuff like that. I had a client whose attitude was awesome “Another day in paradise, sure beats being six feet under”, I miss that guy. I am already +1 on cards and it bothers me. And, oh oh, thinking to go for the Barclay Hawaiian Airlines card, 70k with just one purchase. Worth to burn a 5/24 slot? And +2 on the cc count? Darn US banks, stop it. Lol

@ Christian: Very interesting suggestions, I will check them out online, thank you.

@usernamedchuck: At this point, I am holding off to the Chase points. And aiming to burn remaining United and Hyatt points first. Hoping for a bigly transfer bonus. Have not taken the plunge into the AirCanada Aeroplan credit card yet. So few 5/24 slots, so precious 🙂

Hoping to do some more burning this weekend aiming to book our return from Kuala Lumpur and maybe take care of daughter’s trip to Thailand from Seattle.

Daughter is off to Seattle. Big mess with Delta, she thought she bought bags using the Delta app but did not go through. So, unnecessary crap doing that at the airport. Do not buy bags with the Delta app!

Going to see Blink Twice this weekend.

Enjoy the weekend!

Award searching KUL – DTW Dec 7

Absolute bat shit nada with AA miles, expected.

60k economy with Aeroplan, with overnight in IST, lol. Nothing else

United 110k economy, 200k economy, no business class with the same TK flight overnight in IST.

And this is the state of the game folks.

I can blow about $880+ buying TK tickets. And business class is about $2.7k and, again, I am thinking about it. Because it is time to enjoy the fruits of my labor or, in other words, getting too old? Lol.

The $ cash fares above are on the TK app, fyi.

I almost got pulled into the AMEX->Hawaii->Alaska excitement. Dansdeals transferring 1M points….. there are only so many 4.5k trips one can take until the award chart is destroyed. Realized business class to JP is 200k-300k Alaska points… DD seems to have short memory, first class CX to HKG used to be a sweet spot. And Emirates first class… but yea, 200 short distance flights in economy can also be amazing!

I am doing nothing rn for Alaska miles, I think the 4.5k sweetspot is not going to last long.

Weekly Monday email with traffic numbers for the blog were the lowest ever, how about this mental boost to start the week smh. And no new Youtube subscribers, so much ading Mrs TBB to the staff, may have to fire her lol.

Strange Darling – Best movie of the year imho