Another TBB post featuring the most eclectic links around the web such as a primer on Coast FIRE semi retirement, the US National Debt, Instagram fakery, new Capital One Bank credit card offers, how to avoid online scams, dishing out personal finance advice, we travel back to Hong Kong’s Kowloon walled city, stupid airline crashes and much more and of course always all of the most important developments in the crazy world of miles and points. See you next next week, enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No sponsored posts. Also, no AI!

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to a curated at least weekly post of the best web content along with my commentary. Here to Educate primarily, sometimes Entertain and if I get to Inspire you, well, that is a bonus.

This is a one man labor of love operation, enjoy it while it lasts.

PERSONAL FINANCE

I have written before how I am no fan of the Financial Independence, Retire Early FIRE movement. For several reasons. Now we have a variation of it, Coast FIRE. What is Coast FIRE? The Ultimate Guide to Semi-Retirement. Very good post, I learned what it is. I guess it makes a little more sense than straight FIRE. But sometimes I wonder if this is all, you know, marketing. Entrepreneurs online trying to find a niche to market to. Looks like the FIRE gurus online crowd became too crowded and it became way harder to differentiate to create a fan base? So, here we go with this Coast thingie? Isn’t it peculiar how many of these gurus online who supposedly retired early are busting their butts working online lol?

Maybe I should start my own movement but what I am gonna call it? Any ideas? In the meantime, this is what I have done with my personal finances and advising clients. We all can not believe what happened next!

Maximize retirement plan contributions, no exceptions whatsoever

Maximize what the government gives you and take all free money (as in self employed SEP IRA/Solo 401k contributions, HSA c0ntributions, all matches, etc.)

Always have a solid cash emergency plan

Rule: The more you invest, the earlier, the better

Stick with a monthly regular automatic investment plan to a taxable account that is high enough to make you uncomfortable (which will lead you to live below your means) as early as you can

Apportion a part of the amount above to revert to college 529 plan accounts as soon as the kids are born and stick with it every month

Diversify, never ever put all your eggs in one basket

Avoid all debt, other than home mortgage. And please never EVER carry credit card debt

Have an asset allocation plan and rebalance twice a year at set intervals. This is hard!

Use broad based very low cost ETFs. Avoid individual stocks, active mutual funds and exotic investments. Always choose simplicity over complexity. Boring is better

Look at your portfolio as less as possible. The more you look at it the higher the probability you will make a mistake which could be very damaging and sometimes fatal

Stay healthy, prioritize it.

Find something you are good at, keep working at it and keep improving and go all out on service. Take pride in your work!

Have something else to be passionate about, it should not be all work related

And, enjoy the ride along the way always

Something like that. It is not rocket science. You don’t need gurus to listen to and buy what they sell you. Just read my blog for free lol. You are welcome.

I thought about writing a book about all my personal finance knowledge and philosophies around it and life in general. At some point I started writing things that popped into my head with the intent to get back to them and start developing all these writings into a book. Maybe when I quit blogging one day…

Actually, I had developed a method to retire comfortable AND never run out of money. I do have these notes somewhere, maybe I develop that into an article one day.

It is hard to believe Jonathan Clements is going out on a fantastic career with some of his best personal finance material dealing with end of life matters. A Money Guru Bet Big on a Very Long Life. Then He Got Cancer. Jonathan Clements, a longtime personal finance columnist for The Wall Street Journal, has a lot of savings. He’s not mad that a fatal illness will keep him from spending it. When I started my wealth management career, I used to clip his Wall Street Journal articles and mailed them to my clients. Yeah, been around for a while in this space. One point that is very important is:

Indeed, aside from one obvious contributing component — having had two full-time employers with excellent benefits, something too many people lack through no fault of their own — the biggest factor in Mr. Clements’s success as a retirement saver was his modest living. “I spent years in a house that cost far less than what I could afford,” he said. “Those initial decades in a mediocre house in the New Jersey suburbs is what set me up.”

and this of course:

“I haven’t worried about money in more than 20 years,” Mr. Clements said. “The No. 1 thing money can do for us is to give us a sense of financial security, and the way it does that is not to spend it and to hang onto it.”

Thank you Mr. Clements.

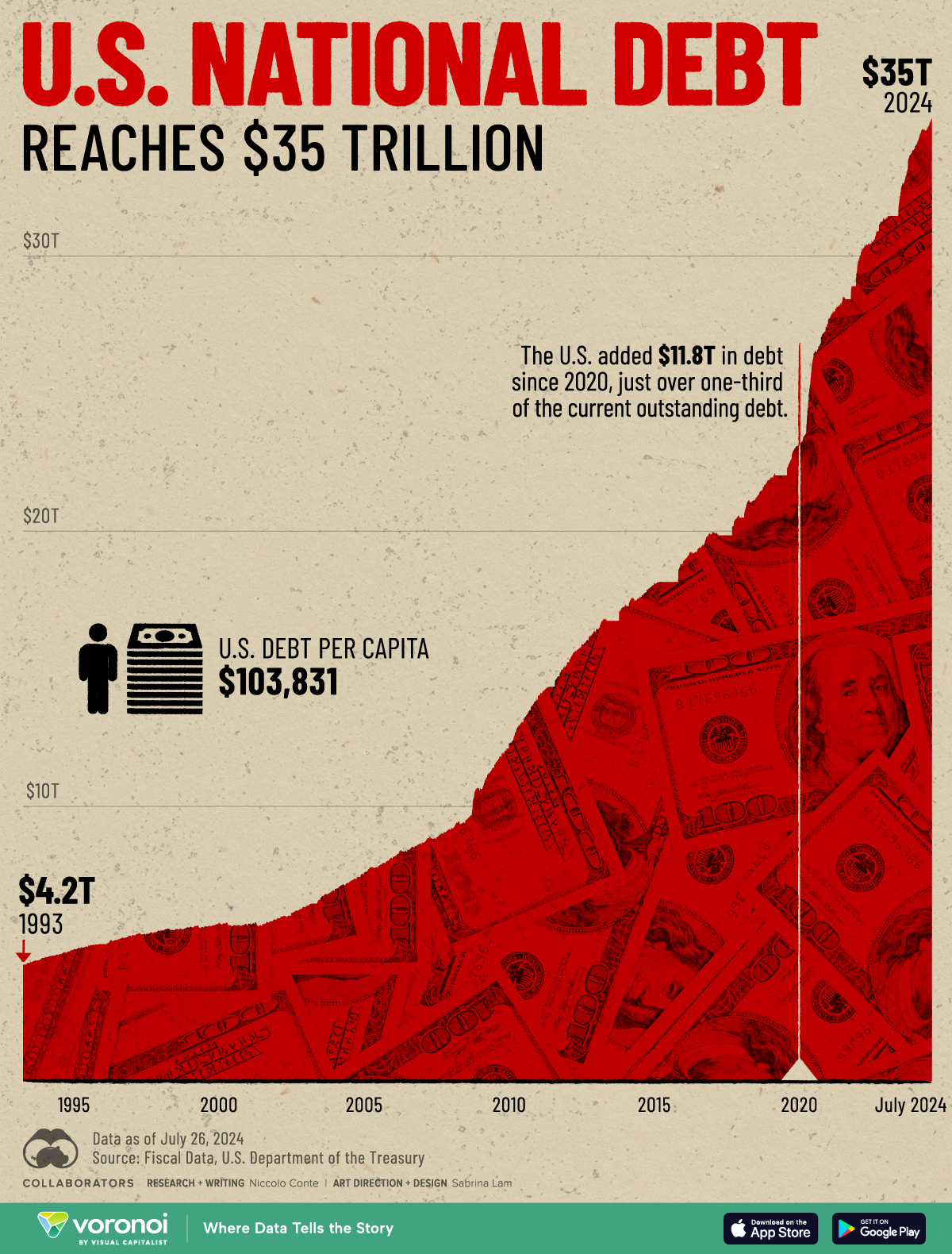

Many self proclaimed gurus have been ranting about how the US is going down because of so much debt. You know, disasters with famine are right around the corner. And yet, nothing has happened. At some point this will matter. I think. I have no idea when if ever. And none of these gurus know either.

SCAMS/CRYPTO/AI/TECH

It is getting really dangerous out there, always be vigilant. Especially with elder loved ones: How to Avoid Online Scams and What to Do if You Become a Victim. Here are tips on how to dodge some of the most devastating schemes and what to do if you or someone you care about becomes ensnared.

Talk about getting stuck living it up. And then having to keep this up because that is what you are selling online. The more I am online the more I see this fakery going on. Like this couple, what a sad story with the husband killing himself and the wife in her oblivion about personal finances, it just boggles the mind. How an Instagram-Perfect Life in the Hamptons Ended in Tragedy. Candice and Brandon Miller showed the public a world of glittering parties and vacations. The money to sustain it did not exist.

At their 10th wedding anniversary “Midsummer Night’s Dream” party, they celebrated with a few dozen friends in the backyard of their 5,500-square-foot vacation home in the Hamptons. Beautiful women in gowns watched with their handsome husbands as the couple renewed their vows near a swimming pool strewn with peonies and rose petals beneath a canopy of lights. It all culminated in the kind of envy-inducing images anticipated by the roughly 80,000 followers of “Mama and Tata,” Ms. Miller’s popular Instagram feed, which featured a near-constant stream of photographs and videos of her glittering life. The Midsummer Night party was in 2019. Five years later, the glamorous image that Ms. Miller cultivated and promoted has disappeared, replaced with heartbreak, anger and a mountain of once-secret debt.

Even when the husband’s business was substantially impacted with the fall of commercial real estate after Covid and managing to sell their home for $9 million, they just could not stay away from doing this:

Instead, they rented a 4,382-square-foot, five-bedroom apartment on the corner of Park Avenue and East 71st Street, according to court records — keeping up appearances for $47,000 per month. They decorated with rented furniture for which they paid $180,000 for one year, according to a lawsuit filed this spring, and $12,000 per month after the first year…The Millers continued to entertain in high style. In August 2022, they hosted a “Love Boat” party at Duryea’s, a beachfront restaurant in Montauk. Ms. Miller posed for photos with friends in a sleek white dress.

So tragic, so unnecessary.

Meanwhile, over in New Zealand: Kim Dotcom’s Extradition to the U.S. Given Green Light By New Zealand. This guy is one of the most arrogant loud assholes in the crowded crypto space. This is good news for humanity but don’t bet on it happening anytime soon as he has been fighting this since 2012. And he promises he will continue to do so and he has assured his moron fans that he has a plan. Whatever that will be, it will make news.

This blog is not going to blog itself. I rely on you readers helping it grow as I don’t have time to do any marketing. Which leaves the content clean of intrusive sponsoring posts and stupid ads and stuff like that. So, please:

You like my blog? Send a link to someone please!

ODDZ & ENDZ

A killer collection indeed: Private Collection of Cigarette Packs. I must admit they look cool. Here is the cigarette pack collection from Greece. As an idiot, I used to smoke and I recognize some of them. I quit smoking on December 31, 2001. Looking back I can not believe I paid money to inhale cancer smh.

I had never heard of this happening in Canada. Maybe I am a sucker for things like this and tend to believe them that these people are not faking anything and a higher power is behind it covering it all up: They All Got Mysterious Brain Diseases. They’re Fighting to Learn Why. Doctors in Canada have identified dozens of patients with similar, unexplained symptoms — a scientific puzzle that has now become a political maelstrom. A very disturbing read.

TRAVEL

SAVE $100 FOR 2024 THE EXTRAORDINARY TRAVEL FESTIVAL

Follow me on Instagram please. Subscribe to my YouTube channel.

I never made it to Hong Kong’s Kowloon Walled City. And oh, how I wanted to. This is very educational and fascinating: The Strange Saga of Kowloon Walled City. Anarchic, organic, surreal, this enclave was once among the most densely populated places on Earth. Especially after recently watching the 2024 film “Twilight of the Warriors: Walled In”.

I was aware of most of these but still, reading about them made me kind of angry, so many died by the actions of morons: 5 Airline Crashes Resulting from Tomfoolery.

Hopefully one day we can experience this but I think many of us will not be around for it. WATCH: Stunning timelapse of moon setting captures aurora borealis from above. Wow!

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/CREDIT CARD CORNER/MY ACTION

We have a lot to cover in this post today. I am going to start with the same General News/Promos/Newbies section and then add a few more new sections today: A Section with the much higher Capital One credit card signup bonus offers and then a deep dive on the new Chase World of Hyatt business card. Then have the regular Credit Card Corner Section. And then proceed with a new section titled Devaluations as we had several recently sadly. Then end with My Action Section and we have a lot of it to discuss this time. And then we end with the Advanced Section as always. So, let’s go!

GENERAL NEWS/PROMOS/NEWBIES/ETC.

I really enjoyed this Wall Street Journal article: Everyone Needs a Frequent-Flier Friend on Speed Dial. Do you know why? Because this sounds like me! I have been doing all these travel stuff for decades; if I had a dollar for every time I assisted with something travel related…

Always nice to have more lounges: American Express Will Open New Centurion Lounge at Salt Lake City International Airport in 2025. And this one is going to be BIG, as in 16,000 square feet big.

These are available but it is not as straight forward as it may appear at first glance. I remember I tried for a free hotel during a stopover in Istanbul some years ago but somehow I was off by an hour or two for my layover to qualify. So, read the fine print and read this whole post to learn more: How to Claim a Free Hotel and City Tour with the Turkish Airlines Stopover Program in Istanbul.

Register for the new Hilton Honors promotion to earn 2,500 bonus points on all stays for stays between September 3 and December 31, 2024 HERE.

CREDIT CARD CORNER

I will indicate with NEW every new section as the rest is the same from the previous blog post and will finally roll off those parts as offers expire, thank you.

NEW:The Master List of Credit Card Partners. Great reference, I added it to the Best Resource Links in the Miles & Points Resources Page.

DEVALUATIONS

Ouch, a separate section for devaluations, buckle up!

BRUTAL! The End Of Avios Bargains: Qatar Devalues AA/Alaska Award Chart By As Much As 64%! I was going to transfer my British Airways Avios points to Qatar but I knew this was coming so I did not bother. This is what happens when bloggers scream about amazing sweetspots! And it just continues non stop. Tell me again why bloggers scream about amazing credit cards earning Avios points again? Oh, the sales commission? Oh yeah…Anyway, I think I was caught with my pants down with about 180k British Airways Avios I will use one day…maybe. RIP Avios. Wait, there is more!

Avianca Lifemiles Devalues Award Chart Without Notice, Some First Class Awards Up By 50%! Ouch. But what do you expect from this program that has done this repeatedly without notice? And right after screaming “Buy Points” deals to stick it to members? I don’t interact with shitty companies like this. I am still traumatized years ago I had an issue with a flight that it took forever to resolve that left me in almost tears. You have been warned.

If you buy points from bloggers pumping their affiliate links, it only leads to more devaluations!

MY ACTION

I don’t give a shit if an airline will serve me caviar. And I certainly won’t be making posts about it here ever.

I never understood making posts/videos unboxing a new credit card. Why does anyone even care how a credit card looks or what material is it made of? I guess we are all different.

So, there was an issue with the move in date in my daughter’s new place in Seattle. It appears she needs a place to stay for 9 nights. And, you know, she asked her dad for help. So, I did have some Choice Privileges points that came over from Radisson (which came from Club Carlson which came from a great US Bank Club Carlson Visa card, back when this program had an amazing “Book one award night, get one free” award). I have been trying to use these points for a very long time. And suddenly, boom! I burned 120k Choice points for a Country Inn hotel near her workplace with good reviews. I had to transfer about 10k points from Amex to have enough to book this. I have now only 579 Choice points left, good riddance!

We need another two nights for her. We identified a very convenient Cat 3 Hyatt House and gave my daughter a lesson by giving her homework: Open a World of Hyatt account, link it to Chase, transfer some of her Chase points to it and try to book it. And, again, not available with points. Which is becoming a very annoying program feature lately. We have time. And maybe the landlord will come through with another arrangement that may make more sense and we could possibly cancel these awards. Which will lead me to have them Choice points to deal with again. I am so done with this program.

Actually, I am staying at a Comfort Inn Choice property this weekend in Ludington, Michigan. I booked this months ago and it is perfect actually. I don’t do well in a tent or RV you guys, I need my bed and A/C and hot water lol. I should have some pics posted over the glorious Michigan weekend coming up on Instagram.

I then went on a spree with my few Alaska Airlines miles and booked a few RT awards Detroit – NYC LaGuardia flying American Airlines. Each segment is only 4.5k miles. These are the awards I used to burn British Airways Avios points for numerous trips over the years. Only for that deal to slowly get murdered and now is at a ridiculous 12k Avios (from 4.5k!). I now wish I had more Alaska Airlines miles in my arsenal. Looking to book a few more trips in 2025 before this sweetspot goes away soon #hint.

I bought another $50 Hilton gift card with my Amex Hilton Surpass card to take advantage of the quarterly statement credit. These can be a bitch to use at checkout. Maybe I use it when I choose to pay with points & cash. Or go in a Hilton restaurant and have a magnificent dinner. No worries, I will get use out of them.

I am growing a beard for the first time in my life. Other than the itching, it is going well. My family seems to like it way more than me but I am willing to stick with it. Never stop evolving you guys.

I saw the new Alien film Romulus. The worst Alien ever, I am done with this series, retire it please.

ADVANCED

Good post: Here Are The Best Ways To Book American Or Alaska Award Flights Within The US And Canada! One word for you: Alaska. Go to work before this moves up to the Devaluations Section, tick…

I don’t do market friendly moves with my blog. Such as doing cross appearances on podcasts and stuff like that. Frequent Miler reciprocated recently having a Chris Hutchins with his Favorite Life Hacks. I don’ t think this was a good fit but hey, I am sure it led to more readers. Anyway, I had to comment:

MILES & POINTS

HOT CREDIT CARD OFFERS: 120k CHASE Ink Business Preferred, 75k CHASE Ink Business Cash, 75k CHASE Ink Business Unlimited, 75k CAPITAL ONE Venture X, 75k CHASE United Business, 75k CAPITAL ONE Venture Rewards AND $250 Travel Credit, 150k AMEX Business Platinum, 200k CAPITAL ONE Spark Cash Plus, two 120k CHASE Southwest Business cards, 150k CAPITAL ONE Venture X Business, $1,000 Cash Back CHASE Ink Business Premier, 15k AMEX Blue Business Plus and many more!

As of today, I have burned 1,343,957 miles/points year to date (1,148,286 in 2023) and have 4,225,670 miles/points in the bank. Some do drugs, I do miles lol!

WELCOME OFFERS & TRANSFER BONUS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer and/or a lender releases (or is about to remove) a transfer bonus with one of their partners? If yes, I highly encourage you to sign up if you haven’t yet.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click through one of the two links above

2. Create an account

3. Subscribe to the email notifications of your choice

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

You should write the book on personal finance!

You know so much about the scams that trap the unwary. Really! The old literature on efficient markets — I’ve been away for a long time — didn’t really address the role of scammers. One of my old friends — a performing magician — used to teach frauds in his class. He got a lot of crap from colleagues who claimed no one would fall for a ponzi these days. He did not live long enough to “enjoy” Madoff.

That book was preceded by this blog, sadly.

And this blog is doing so splendid financially (5 cards sold in August, one is our own and five coffees sold), insert laughs, that the one thing to top it would be, here it comes, write a book on personal finance lol.

The people who inflict scams on others should be persecuted and severely punished. It still amazes how some people can do this repeatedly without remorse. It has to be a gene thing. Genetic defect. Or something. Also, all the people who fall for obvious scams is…something also very noteworthy. Probably genetic too?

Gotta pack for my two nights at a Hyatt Place and Comfort Inn in West Michigan this weekend. Sadly, no caviar on the horizon for us lol.

It’s hard to feel sympathy for silly fools who live beyond their means to impress others. One advantage of being older is not caring what others think. There is something satisfying when you are able to get rid of the last of your points in a program you despise and shut that one off forever. Felt good when we donated the last of our United points and removed those accounts from our spreadsheet. The other things I would add to the finance tips would be don’t make it too complicated, because if one spouse is clueless and the keeper of the finances departs first, it could get very messy.

Yes, it was incredibly satisfying to wipe out those Choice Privileges points. I hope we don’t cancel that reservation lol.

I kept adding to that personal finance segment at the top of my post today. And got really long. And you are right about keeping it simple, I added this line:

>>>>>>>>>>>>>Use broad based very low cost ETFs. Avoid individual stocks, active mutual funds and exotic investments. Always choose simplicity over complexity. Boring is better

You are so right about taking into account the less financial savvy spouse. I am working on that. It is not easy and a really long process. This has led to me cutting down on banks/credit cards lately to keep it a bit sane for her if I depart suddenly. I need to stick with it even though I love taking from the banks, they make it is easy 🙂

Damn, I wish I could get all those “rules” you posted across to my daughter. She and husband make great money and she is a gummint worker with a Thrift Savings Plan to use as well as Pension. Maximizes nothing. Drives me nuts!

Good stuff all through here and that crashing airplanes thing proves there are idiots in even the most particular kind of jobs! but it *all goes*

Thanks as always, George! Gonna have to head upstairs to me office to buy a coupla cups!

It’s kind of nice to be a weirdo who doesn’t feel the pressure to keep up appearances. Speaking of which, we recently replaced our 2008 Hyundai Entourage minivan with a 2020 Toyota Sienna. Talk about luxury!

Started reading the “coast FIRE” thing but it just sounds like working until you retire but with more spreadsheets.

@ Carl: Thanks again for the coffees. When this blog is discovered one day and sold for gazillions I will not forget you. I am all about maximization, including travel 🙂 Posting this from the Hyatt Place Grand Rapids South where I made sure I got two bottles of water yesterday and today while waiting for the breakfast to open, here on son’s expiring Hyatt free night cert he got after I coached him to hit 5 Hyatt brands to earn it. Tried an Italian restaurant yesterday and I had a craving for a simple spaghetti marinara which turned out great accompanied by the most amazing hot bread. Sadly, the waitress did not cooperate to bring us another round of the bread. I still tipped her well. Anyway, on the way to Ludington area in a few hours where some friends are camping in RVs. Unfoturnately, it has been raining a lot since yesterday which will affect the hiking plan. And the biking. We shall see.

Talking about crashing airplanes,I had an intense nightmare last night. A plane above us was flying out of control and it was obvious it was going to crash. And just as we were shocked about its path…another one started coming, you know, closer and closer and…then I woke up. Now I need to forget all about this vivid dream/nightmare, yikes!

@ NIck PFD: We leased a new Lincoln Nautilus last month, wife’s car as she now has to drive twice a week to work. As the 2011 Ford Edge was just not adequate, you know. We drove it today for the first time for a long distance trip and we loved it. Your comment about Coast FIRE made me laugh, thanks.

Alaska miles have occasionally come through for me in some very nice ways, so it’s a program I like to keep topped up. I have a gazillion AA miles languishing year after year in comparison.

Have a movie to recommend: Kneecap. A trio from Belfast raps in Irish, and they play themselves in the film. Really good on many levels.

Thanks again for all the work you put in to put this blog out, Buzz.

I’m still trying to figure what to do with my 275,000 Choice points left over from Club Carlson back when you could stay at a nice Radisson in Budapest for 8,000 points a night. I’m considering Norway next year to see the Northern Lights for the first time, maybe in September.

At the risk of being argumentative I do like eating caviar on a flight since It’s the only time I ever get to eat the stuff. Props to Qatar for doing this IMO.

Hey Buzz,

Thanks for the great post.

Yes please write “King George and his Definitive Guide to Simple Investing and Maths”. I think I hear the distinct chime of an MBE.

Tragic story of the troubles in New Brunswick. We were considering a move to Canada as the pandemic unfolded, to the Maritime provinces but decided against it as the health system is overburdened there as well. Another shameful cover up by people who apparently don’t have enough wealth yet. I’m guessing they haven’t read your book.

Looking forward to reading the rest of your post, and thanks again!

@ Christian: Yeah, it took several years to use those old Club Carlson points. I must admit I had a really nice stay at the Comfort Inn in Ludington, Michigan so maybe who knows down the road Choice points may come back in my arsenal. Just in case. But right now I am perfectly fine with having only 579 points left in my account and move on. No bid deal on caviar, we are all different. Speaking strictly on taste of it, I just never liked it.

@ David: The book will have to wait until I am reincarnated into a different life form lol. Yeah, that New Brunswick story was disturbing to say the least.

Just back from Ludington Michigan and oh crap, I need to prepare a post for tomorrow. I did gain a new subscriber. And thanks Carl’s sock drawer card for the three coffees.

@FullMoon: So true about Alaska miles, I need to get more. And oh i hear you about languishing AA miles as I have almost 800k of them and I can’t remember the last time I spent any. Thanks for the Kneecap recommendation! I did look at it and looked interesting, will look to see it. I also want to see Cuckoo, which appears to be very off the wall, my kind of movie.Thanks for the kind words, this blog continues even thought the wave of Google’s algorithms have moved blogs into a torrent of clickbait shit…not sure for how long and, it has been like this for a while 🙂

Hotel Aquarius Venice, Italy for 20,000 Choice points in a suite. Three stays for 17 nights in past three years.

Suites in Prague, Ceske Budjovice and Liberec in Czechia for 8,000 points per night.

Rooms for 10,000 or 16,000 to 20,000 points at Clarion Collection Principessa Isabella Rome and Quality Hotel Hampstead London.

20,000 points for The Thief Oslo.

I find plenty of high value reward redemptions with Choice Privileges points.

Glad you are still finding value in this program. Daughter just checked out today from a Country Inn in Seattle and am so glad to be finally down to 537 Choice points after blew 120k Choice points for a 7 night stay there. She liked her stay actually at that Country Inn.

Just now seeing posts how Choice Privileges bumped the Preferred rates to 110+ up from 85k a few months ago up from…you know.

Thanks for reading.