Another TBB post featuring the most eclectic links around the web such as how America saves, the computer science bubble, what is next for Iran, RV tripping, the premium credit card wars, AI rotting our brains, Sly Stone tragedy, laws of economics, road trips at US national parks, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This blog is for curious minds. Everyone can read this blog independent of income since its inception. Consider becoming a monthly Buy Me a Coffee supporter.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

Due to new severe credit card affiliate restrictions, there will not be any credit card links in the body of the blog posts other than Capital One Bank credit card links and my personal referral links going forward. You can always get to credit card links from other banks by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the big beautiful “We make finding a new credit card simple” on the right sidebar. Or, you can receive new offers in your email inbox by signing up to receive alerts HERE to avoid clicking several times to find the one credit card you want to apply for. Or you can always email me, thanks for your support.

PERSONAL FINANCE

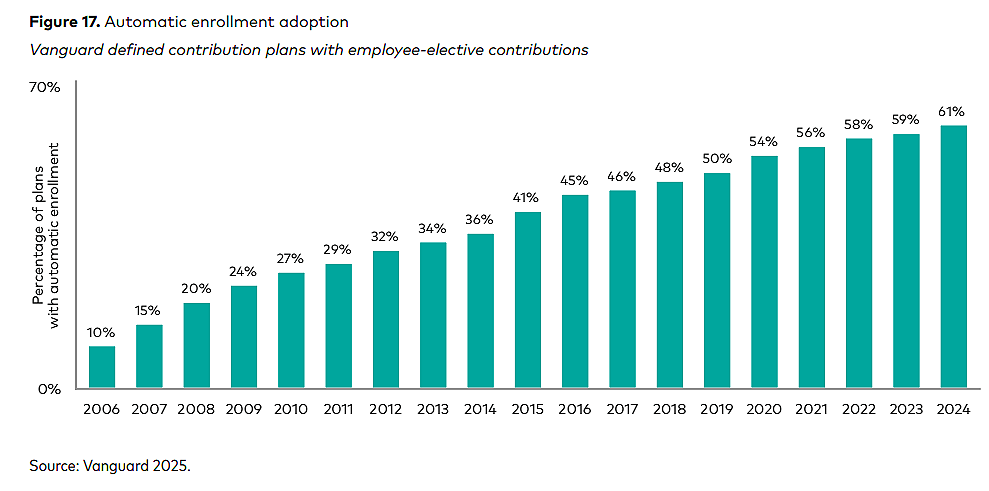

Markets are back to near market highs. And I am wondering if the changes outlined in the latest Vanguard “How America Saves” is structurally (at least partly) responsible for this. Anyway, very interesting post analyzing the study: We Are Automatic.

…the findings underscore the extent to which retirement plan investing has been mechanized. People get auto-enrolled, auto-escalated, auto-company-contribution-matched, auto-asset-allocated, auto-rebalanced, and auto-glide-pathed. And you know what? It seems like they’re better for it.

Nearly Two of Three Plans Auto-Enroll Participants

Auto-Enrollment Boosts Participation

People Are Saving More (Without Necessarily Even Trying)

Money Is Pouring Into Set-It-and-Forget Portfolios

Set-It-and-Forget-It Has Worked for Investors

Takes a lot of guts for Callie Cox, the Chief Market Strategist at Ritholtz Wealth Management, to post about her personal struggles with money: My Money Story. I certainly would not write such a personal story here. And it’s not because I don’t have any, we all do.

I am incredibly insecure about money, and my insecurity has defined my life for as long as I can remember. And in the most twisted irony of all, I’m a market expert who makes a living off teaching people about money and investing. Essentially, how to become – and stay – rich.

I’m obsessed with money.

How people make so much of it, and why I could never get enough.

Another excellent post by Morgan Housel: Different Kinds of Smart. So many gems in here, just a few excerpts below:

Being an expert in economics would help you understand the world if the world were governed purely by economics. But it’s not. It’s governed by economics, psychology, sociology, biology, physics, politics, physiology, ecology, and on and on.

A good storyteller with a decent idea will always have more influence than someone with a great idea who hopes the facts will speak for themselves.

Delayed gratification isn’t about surrounding yourself with temptations and hoping to say no to them. No one is good at that. The smart way to handle long-term thinking is enjoying what you’re doing day to day enough that the terminal rewards don’t constantly cross your mind.

Another memo by Howard Marks: More on Repealing the Laws of Economics. You can ignore the first two sections about “Rent Control” and “Fire Insurance in California”. And really pay attention on the main section which is all about tariffs. And the memo ends with the usual warnings about the non sustainable deficits and stuff like that. I don’t agree with everything but do love his writing style.

The bottom line on all the above is that free-market economies don’t produce perfect solutions, but efforts to significantly control them make things much worse. There can be no solution that gives everyone what they want. All things considered, however, the laws of economics lead to the best solutions that can be attained.

SCAMS/CRYPTO/AI/TECH

Remember when computer science and software engineering college majors were all the rage? Well, not anymore: The Computer-Science Bubble is Bursting. Artificial intelligence is ideally suited to replacing the very type of person who built it. Or maybe the explanation is that…

The tech industry frequently goes through booms and busts. The biggest companies exploded in size when the economy was good. Now, with high interest rates and the specter of new tariffs, executives are likely holding off on expanding, and workers are reluctant to leave their job,…

Maybe I carve out an AI section? Here is another one telling it like it is: AI is rotting your brain and making you stupid. The author ends the article with this quote by Ted Chiang:

“We are entering an era where someone might use a large language model to generate a document out of a bulleted list, and send it to a person who will use a large language model to condense that document into a bulleted list. Can anyone seriously argue that this is an improvement?”

What a story: The Incredible Rise and Fall of the Infomercial King.The true story of the con man, the karate champ, and the workout videos that changed fitness forever. I remember some of the shit this guy was selling. Some humans are just born to deceive others smh.

Wild stuff in Monaco with all the dirt spilling out: The Prince, His Money Manager and the Corruption Scandal Rocking Monaco. He safeguarded the family’s fortune—and their secrets. Now, it’s all unraveling. Monaco is such a different planet smh.

You like my blog? Send a link to someone please!

ODDZ & ENDZ

Fantastic podcast, if you are interested on the subject: What Comes Next for Iran? Karim Sadjadpour on how the Islamic Republic is losing its grip, and what might come next.

Frankly, I thought Sly Stone died years ago. What a sad sad story: The Rise and Fall of Sly Stone. The soul and funk legend leaves us today at age 82—but the deeper story is that he abandoned his audience more than 50 years ago. What a talent and what a long painful way to self destruction smh.

Stunning story of two French ladies being sent to Nazi concentration camps: “We’ll make it out together”. Brace yourselves.

Winners of the 2025 Big Picture Competition.

TRAVEL

Road trip anyone? 8 Road Trips Through Iconic U.S. National Parks.

Some of these go way back when safety standards were, cough, a little lax: 37 Terrifying Amusement Park Rides That Remind Us of Our Childhood Summers. I do remember when Magnum XL-200 (shown at #29) opened at Cedar Point in 1989, that first drop was indeed a terrifying moment…back then. And of course that ride at the Stratosphere (shown at #32) in Las Vegas.

I don’t do RVs. I remember watching the movie RV way back and decided right there that RVing is just not my thing ok? We are all different: America’s best RV trips for the summer.

I prefer safe beaches, preferably attached or near a Hyatt lol: Ranked: America’s most dangerous beaches.

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS

Here we go…

Good IHG One Rewards promo to earn 3x points in selected brands, register HERE.

And another good Choice Hotels promo: Stay 2x, Get 10,000 Bonus Points, register HERE.

If I was younger I may go for this crazy promotion: 25th Anniversary Sale by JetBlue. Fly up to 25 JetBlue destinations by the end of the year to earn up to 350,000 miles plus the lowest level of elite Mosaic status for 25 years. Well, if you think this airline will be alive next year…ok! You may even get lucky if another airline buys it and grandfathers the elite status. Again, if I had the time and energy I would do crazy things like this just for the pure fun of it alone. Wait, these flying promos are becoming a big hit; Turkish Airlines is working on its own 1 million mile promo wow.

Well, it didn’t last long smh: Brutal: Virgin Atlantic Doubles Fees on Biz Class Awards, Raises Others.

Without a word of warning, Virgin Atlantic just doubled the taxes and fees you’ll pay for a one-way business class redemption over to London.

Here is the Thursday evening weekly video by Traveling on Everyday Spend recapping everything (except the Chase Sapphire Reserve developments, he made a separate video for that, see next section below).

TRAVEL REWARDS CREDIT CARDS

We have so much to cover after Chase blew up this space with the introduction of two Sapphire Reserve cards, buckle up.

First, from the Wall Street Journal, we are underway: The Most Exclusive Credit Cards Are About to Get Even More Expensive.

Top credit card companies have stumbled on a winning formula at odds with almost every other sector of America’s inflation-obsessed economy: Raising their prices is good for business. Already sold by the status the cards convey, a large number of customers are willing to eat the costs.

According to the latest data from the Consumer Financial Protection Bureau, cardholders earned over $40 billion in rewards in 2022, yet more than $33 billion went unclaimed—a 40% jump since before the pandemic.

“We’re all about getting customers to redeem 100% of their benefits,” said Allison Beer, CEO of card and connected commerce at Chase. [LOL]

Competitors to banks keep coming, here is Mesa Homeowners Card introducing two transfer partners, Air Canada Aeroplan and SAS Eurobonus.

Wait, one more! Ramp Business Platform: $1,000 Bonus & 10 Airline and Hotel Transfer Partners. Mesa and Ramp will not be the Chase and Amex killers but appreciate the competition, bring it. UPDATE: Holy &*#$! The Rove guys have a lot of VC money to burn it appears. They ventured into the Reddit Churning pit and, I must admit, they are taking the shots very well. They are brave or crazy. Or, it appears, ready to burn some serious $. Maybe they are banking (pun intended) on Jamie Dimon of Chase to buy them out or something lol. Ok, ready to dive in? “Enjoy”: Introducing Rove Miles – Earn Up to 25x on Hotels + 10k First Booking Bonus + Miles at Over 7k Stores.

Where is Amex? Oh, here it is taking away from us smh: American Express Business Platinum Will No Longer Earn 35% Rebate On All First & Business Class Bookings. After taking the Dell credit down to $150 from $400 per year, another big hit. Come on Amex. Also, I passed through your Centurion lounge at NYC LaGuardia and the food was pathetic, get it together please.

Finally, this is actually a good move, taking this stupid card out of its misery: American Express To Discontinue ‘Clear From American Express’ Credit Card.

CHASE SAPPHIRE RESERVE

I wanted to avoid a separate section again for the CSR changes. But…

Great video recap on What Do We Do NOW With AMEX and Chase? AND MUCH MORE.

Yeah, it is getting confusing:

Trying to make sense of it all you guys: Chase Will Do Away With 48-Month Signup Eligibility In Favor Of Proprietary Eligibility Determination (‘Chase Pop Up Jail’).

Oh wait, I guess Chase has a lot to learn to “perfect” its own popup: (Update) Chase is opening Sapphire Reserve cards for customers who don’t want them.

Welcome to the new “enhanced” way to redeem your Chase points: (Update) Chase Sapphire Reserve ‘Points Boost’: Removes 1.5% Travel Redemption, Adds Boost Feature For 2% On Select Travel. It is interesting. But it is only the beginning, I expect it to get worse, way worse: Evaluating Chase’s new Points Boosts.

And a deeper look at The Edit I guess is in store: The Edit by Chase Travel℠ is suddenly interesting…

And learn more about dining with Chase to get them credits: Sapphire Reserve® Exclusive Tables.

The Business CSR does have $100 for gift cards, the list of the companies is out, I see Panera, I am good lol. Details on Chase Sapphire Reserve For Business $100 Giftcards.com Annual Benefit.

We are starting to get some clearance on the CSR apps it appears: Chase’s new application rules for the Sapphire Reserve aren’t working.

What we can say is:

- If you’ve ever had the Sapphire Reserve, it’s very, very unlikely that you’re going to qualify for the current welcome offer.

- If you currently hold the Sapphire Preferred, the best practice would be to downgrade it to a Freedom Flex or Freedom Unlimited before applying for the Sapphire Reserve.

- None of these eligibility restrictions (outside of 5/24 status) apply to the Sapphire for Business.

NEW OFFERS:

We have several new offers, they never stop.

Amidst all the hype about the new Chase Sapphire Reserve cards, it was interesting to see Chase increase the Signup Bonus on the Sapphire Preferred card to 75,000 points (up from 60,000 and way down from a brief 100,000 points bonus).

But wait there is more, maybe Chase should sponsor my blog, hello? A Few Chase Signup Bonus Updates Coming Soon (Sapphire Preferred, Freedom Unlimited, United Explorer).

I don’t like this new Amex practice of instituting offers featuring “Up to xxxxxx Points”. The system will tell you how many points you are eligible for before you submit your application. And don’t be shocked if you are offered a lower amount, boo!

The STANDARD Amex Platinum offer is now up to 175,000 Membership Rewards points. The annual fee is $695 and the minimum spend is $8,000 over six months. 5x on Airfare and Hotels and 1x on everything else. Superior Centurion lounge coverage and of course Priority Pass lounge membership. No foreign transaction fees. A long list of couponized credits, up to $1,800 if you took advantage of every single one. Which you won’t. The easiest credits are the $200 airline fee credit, the $240 Digital Entertainment credit, up to $200 Uber credit and $200 hotel credit…and many more.

Same deal with the STANDARD Amex Gold card now up to 100,000 Membership Rewards points. The annual fee is $325 and the minimum spend is $6,000 over six months. This card’s main appeal has always been its earning power at 4x for dining worldwide and groceries and 3x on airfare. Crazy couponing comes with it, such as $7 per month on Dunkin Donuts, $10 per month on Uber Cash, $10 per month on 5 Guys/Grubhub, Cheesecake Factory, Wine.com or Goldbelly, two $50 Resy credits for dining per year and $100 hotel credit per year.

You know where to find my Amex credit card links. Or you can try my Amex Referral link HERE. It should bring up an offer for an Amex Business Platinum for 200,000 Membership Rewards points AND a $500 Statement Credit after you spend $2,500 on qualifying flights booked directly with airlines or through American Express Travel. Or you can click on “Personal Cards” or “Business Cards” at the top to find the Amex Platinum or Amex Gold or any other Amex card you want.

EXPIRING OFFERS:

The best offer is the Marriott Bonvoy Boundless card offering 5 free nights (up to 50,000 points each). The annual fee is $95 and the minimum spend is $5k in three months. Note that the free night certs expire in one year and they can be topped with 15,000 points per night. Read all the details about this offer and the card HERE. I have no affiliate link for this card, thank you in advance for showing an interest to apply to help this blog. This offer expires 7/16/25. I am no fan of the Marriott Bonvoy program. But, you know, this can be a free 5 night vacation.

Please help the small independent blogs like mine continue to exist by supporting them with your CREDIT CARD clicks, thank you!

#1 OFFER STILL PAYS FOR ITSELF:

The 75K CAPITAL ONE Venture X card has a minimum spend of $4k in the first three months. If you like simplicity and looking for one (premium) card, I highly recommend this card (and yes, I have it myself!). It has an annual fee of $395 but it comes with an easy $300 statement credit for travel booked on its own travel portal, essentially turning it into a $95 annual fee card. But wait, there is more! On each card anniversary you earn 10,000 points essentially making it FREE! Every dollar of spend earns 2 points and flights booked on the travel portal earn 5 points per dollar. You get access to Capital One and Plaza Premium airport lounges and a Priority Pass Select lounge membership and, this is important, you can add four authorized users FOR FREE who can also have their own Priority Pass Select airline lounge membership and, this is BIG, they can bring in unlimited guests with their FREE Priority Pass card! You can transfer your Capital One points to up to 18 Transfer Partners. No foreign transaction fees. Free Hertz President’s Circle rental car top elite status. Cell phone protection and PRIMARY rental car coverage. Awesome seats at baseball stadiums for just 5k points each. And lots more. If you prefer, this is my personal referral link.

Here are my three TOP CREDIT CARD OFFERS:

The 75k Capital One Venture X card.

The 75k Chase Ink Business Unlimited card.

The 75k CHASE Ink Business Cash card.

BONUS OFFERS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click on the link above

2. Create an account

3. Subscribe

MY ACTION AND BLOG BUZZING

I could not help myself. I applied for the Business CSR because, you know, 200,000 Chase Ultimate Rewards points was too much to resist. I did not get the popup and got the “we are working on it” notice. I am not that hopeful I will be approved. But ya never know until you take your shot. I will update this post soon with Chase’s decision. Or I may call Reconsideration and I have ready my plan of attack “take my Ink Business Preferred out, there is no reason to hold both”, blah blah). Update: Chase approved me for the Business CSR, hooray!

I burned 11,381 World of Hyatt points to treat my wife and daughter to a Hyatt Experiences Thai Cuisine Cooking Class at the Bangkok Grand Hyatt Erawan. Why not? Oh, son plus 1 decided to join us over Thanksgiving at Koh Samui, Thailand. This family trip in November and the family trip in September to Greece are very slowly coming together. I need to hurry up and really start booking. If I only did not have this blog here smh.

I did manage to get son on the same flights to Greece with my wife and daughter flying Lufthansa to Frankfurt and on to Thessaloniki, Greece. Paid for all three seats, bought on United website. I used to be insistent on paying $0 for flights and lodging for many years. Starting last year, I relented and started paying cash if everything aligned. This was one of these cases. So, I have so many more bookings to do. Hotels/Airbnb lodging in Larissa, airfare to Kefalonia island to attend nephew’s wedding, lodging at Kefalonia, car rentals in mainland Greece and on the island and of course getting back everyone to Detroit and Seattle. Looks like son will find his own way back to Honolulu it appears.

I have alerts with PointsYeah but so far only very slim pickings. The alerts I get have horrific itineraries, as in flying Air Canada or Air India (no way), tight connections, overnights in airports, etc. I am not worried…yet. Getting out of Kefalonia (airport code EFL) and getting wife to Detroit and daughter to Seattle will be a big challenge.

Burned 41,500 Alaska miles to fly son Honolulu – Las Vegas roundtrip on Hawaiian. And gifted him one of my Globalist Guest of Honor certs and booked him plus 1 at the same nights at the Hyatt Regency Koh Samui for 51,000 World of Hyatt points.

Scored an easy 5,000 miles for having wife get daughter an Authorized User card on her United Explorer card.

We had a wonderful family trip to New York City to celebrate my birthday. And we attended my brother in law’s retirement party. Flights to NYC on American Airlines (at only 4,500 miles Alaska Airlines) turned out to be a major disaster due to weather cancelations. And having the rebooked flights also canceled! It does not help that American has only a few flights out of Detroit. So, who knows, we may get back to Delta one of these days and save us all the heartache. First time this reliable route lets us down.

HOT CREDIT CARD OFFERS:

175k Amex Platinum, 75k CHASE Ink Business Cash, 75k CAPITAL ONE Venture X, 75k CHASE Ink Business Unlimited, 150k CAPITAL ONE Spark Cash, 150k AMEX Business Platinum AND $500 statement credit, 200k CAPITAL ONE Spark Cash Plus, 5 Free Nights CHASE IHG One Rewards Premier, 100k Amex Gold, $1,000 Cash Back CHASE Ink Business Premier, 90k CHASE Ink Business Preferred, 75k CAPITAL ONE Venture Rewards, 120k CHASE IHG One Rewards Traveler, 80k CHASE Southwest Performance Business, 15k AMEX Blue Business Plus and many more!

As of today, I have burned 729,529 miles/points year to date (2,027,816 in 2024) and have 4,383,227 miles/points in the bank.

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

GOLD.

Nice to see a post this AM — we’re still out there enjoying.

Aaron coming out of nowhere for a shocking golden win!

Lots of tardy readers today. Hopefully, you are all busy clicking on my credit card links lol. I know you are not buying me any coffees with only Carl doing so this month, one coffee per month…how do I look myself in the mirror you guys smh.

Anyway, my Business CSR was approved, Chase must really like me. Leaning towards not renewing my Amex Business Platinum…that was some nasty chicken in the LGA Centurion earlier this week. I will update the post when I get around to it.

Well! I’ve done 7 of the 8 road trips! Mostly in a hurry! The West Virginia one missed Harper’s Ferry. That is worth a visit.

Thanks for the links!

I need to catch up! I could if I wasn’t blogging 🙂

Hey everybody, I just secured a venue for the TBB meetup! They seem very eager for the business. https://www.cnn.com/2025/06/26/travel/north-korea-kalma-beach-resort-tourism-intl-hnk

Heard it only accepts the new Chase Sapphire Reserve. U all know where to get it #wink

Congrats to Aaron on the Gold! Also, congrats to George on the new card! Glad to read it. Starting to think about a new card but unsure what to get. Might try a Alaska Biz card since I bank w/ BofA and Alaska points are handy for me what with living near Seattle. But lazy about it all. Age and health (mainly due to age) are slowly winning the battle against me.

This week’s collection of stuff is great as always, George! Thanks so very much! I’ll be reading at it over the next couple days. Got a few projects around the house that are slowly getting to be Must-do’s as opposed to being ought-do’s. Living alone and having to do *everything* gets old sometimes, I must say.

If you ever get out this way with or without the fam, lemme know. It’d be fun to meet up!

OK, time for breakfast. Thanks again!

There is going to be a new premium Alaska Airlines credit card coming out soon, will be so interesting to see how it fares against the competition.

Every time I say it is time to slow down my favorite bank comes out with a bonus like, cough, 200k I just can’t resist man. But I do share your feelings. Maybe from here forward I just burn and burn…until…another 200k+ signup bonus makes me take another hit LOL.

Daughter just left after having some fun up North (this is what we call Northern Michigan), she is flying United via Chicago to Seattle, booked with her Chase points. She will miss that 1.25 per point thingie, which is apparently “boosted” #notreally.

We compared calendars and we are not going to make it to Seattle in 2025 most likely. Simply because we have seen her way too much already she says lol. God willing, next year and of course we will meet and dinner on me to pay you back for all the coffees.

Welcome to the CSR business club. Come on in the water’s just fine. I guess that means that we’re now important.

When I logged in to my Chase account, the way it greeted me I sure felt like a really big deal LOL.

Good to have 6 months for the min spend. Will wait for it and really use it exclusively for all the travel arrangements to benefit from the really superior travel protections. I do not like the Business CSR credits, I wish I could downgrade to the personal CSR after the first year 🙂

Also, got only a $10k credit line, I guess I am very near hitting my Chase credit limits? I am still surprised I got approved. Most likely my wife is not going to take a shot at the personal CSR since she holds the CSP. And not feeling like doing the downgrade thingie…if it was 150k I would probably change my mind 😉

And I am leaning towards not renewing my Amex Business Platinum…getting hard to score the credits with it and I am still traumatized about that chicken condition in the LGA Centurion. Maybe it is time to kick the Amex premium card addiction to the curb? Unless the refresh comes with higher/easier(lol) credits…

Just recently cancelled my last AMEX Platinum myself. Using all these stupid monthly and quarterly credit things is a PITA, plus any regular spend is 1X and that is not fun. I do twice as good just using the Blue Biz card. I can use the $695 annual fee to fund multiple other cards and thus increase what I get for that fee. Venture X can get me in PP lounges the same as Amex anyhow.

I hear you about the AMEX Platinum, let’s see what Amex does when it refreshes it. If no substantial increase in the benefits, I think the time will come for us parting ways with it. I think son will keep it and treat his sister an AU card. And oh yea, the Amex Blue Biz card is a keeper.

The Rove thing sounds incredible. I wish more information from impartial sources was available. If I understand it right, I can get 50,000 1:1 transferable points for signup plus something around 40,000 more for booking a two night hotel stay of over $500 through the site. Sure, $500 isn’t chump change but 90,000 miles on a number of programs plus a two night stay in a swanky hotel for that price is a steal. Am I missing something?

My credit limit was only $10K on the biz CSR as well.

Ramp is different than Rove, I confused them at first. Think of Ramp as like another Brex, which I think it still exists in some type of ghost out there. Ramp must be corp or LLC and park $25 in linked in a business account. The Signup Bonus is VERY juicy and I would go for it IF I didn’t have so much on my plate right now (like this blog lol).

Rove must have some VC money to burn as well, even though they say they do not. Great returns potentially on gift card buying and general online shopping. And of course hotels. But most of us in some type of hotel elite hamster wheel (looking at all the aspiring Hyatt Globalists out there lol) will be difficult to justify…unless you find a loophole/hack in that shopping thingie. For independent hotel shopping the potential value is I think the best right now out there. And I am looking at them when I shop around hotels in Cefalonia island in Greece, not willing to spend $1200 or starting at 75k Hyatt points per night in a Mr and Mrs Smith property (WTF Hyatt!).

Gondola, Ramp, Rove, Mesa, Bilt (until WF ride ends lol), LOVE the competition! I think I am missing one or two, it is early Sunday am. It will be tough to displace the banks but can’t do it without trying I guess. Could be a niche for content creators to specialize in non bank rewards programs?

I think Ramp miles transfer 1.5 to 1 in an average smaller list of partners. The only two that may be worthwhile are British Airways Avios and AF Flying Blue. Qatar Avios as well I guess. Avianca Lifemiles if you can tolerate them lol. But maybe that changed to 1:1?

RIP Chase Freedom Flex.

Tip for TBB readers.