Another TBB post featuring the most eclectic links around the web such as HSAs in retirement, 12 market lessons, Bitcoin ETFs arrive, obscure islands, the best bank credit cards, safe retirement withdrawal rates and sequence risk, SEC and crypto hacks, who gets a nation and Gaza, greedy doctors and health scares, amazing street photography, best passports, making fun of runners and a lot more. See you Tuesday, enjoy the weekend.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or visit our LINKS

I use and recommend Proton VPN <—– REFERRAL LINK

You like my blog? Send a link to someone please!

No ads, no clickbait. No sponsored posts.

Welcome to my quirky original authentic blog. It all started back in 2012 focusing on my crazy hobby addiction of frequent flyer miles, hotel and bank points. It has since evolved to a curated weekly post of the best web content I find along with my commentary. Here to Educate primarily, sometimes Entertain and if I get to Inspire you, well, that is a bonus.

This blog publishes on Fridays. This is a one man labor of love operation, enjoy it white it lasts. I may post on a Tuesday going forward whenever I get to it. Update: Next Tuesday I will try to post the annual “How I Burned 1,xxx,xxx miles/points in 2023” post.

PERSONAL FINANCE

This is a great link to bookmark and refer to it often when you want to learn more about Health Savings Accounts, it covers everything about them: How to Use Your HSA in Retirement.

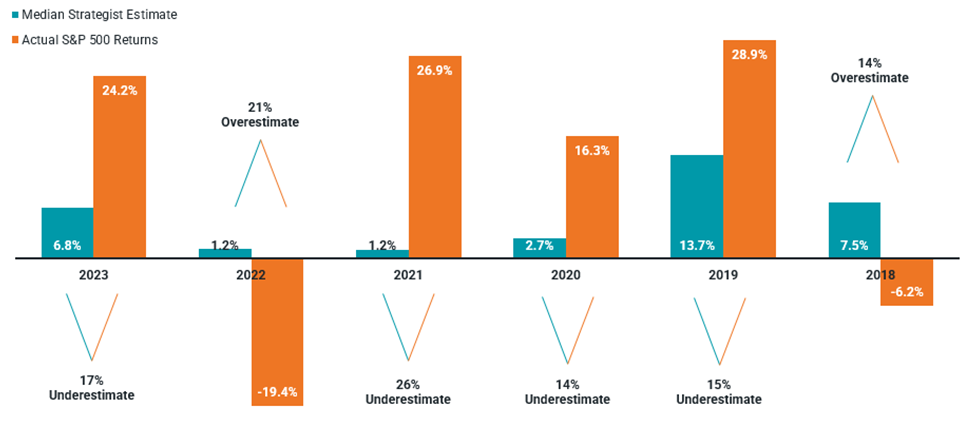

This is fantastic, I am in full agreement: 12 Lessons the Market Taught Investors in 2023. If you take one thing away from this article it must be that you must always ignore the financial experts predicting what the markets will do.

Lesson 1: No One Is Very Good at Consistently Getting Market Forecasts Right

Oh that ever elusive question again: What is the Safe Withdrawal Rate in Retirement? The 4% rule has been talked about a lot in the financial industry and, despite its shortcomings, it still remains a simple and effective target to start out with. Everyone is different of course and life events will change your plans at some point. Do you want to make sure you enjoy your retirement? You need to prioritize your health starting now. Then, to enjoy a higher quality of life which includes not having to worry about money and ensure you never run out, consider aiming for the following:

Calculate the amount of money you require to live on every year. As a guide, the 4% rule will show you what you can expect to draw from your portfolio every year:

$ 1,000,000 to draw $40,000

$2,000,000 to draw $80,000

$2,500,000 to draw $100,000

$3,000,000 to draw $120,000

and so forth.

To account for the dangers of sequence risk and possibly leave some inheritance to loved ones, adjust the numbers upwards, by say add up to 50%. Hmm, are you short? Well, know the consequences of retiring then and consider, I don’t know, spend less and/or work longer to save more? Whatever you do, do NOT listen to Dave Ramsey on this topic please. Still with me? Good. Then aim to put away in a safe liquid account a bunch of cash. How much? Enough for five years is absolutely ideal but if you can do three years is great too. At least secure next year’s cash flow at the very minimum. You pull your annual cashflow from this account and you replenish it from income in your long term portfolio periodically. Why? Well, a stock market crash will occur at some point and you sure do not want to be selling stocks to live on during a bear market! Some bear markets can last for a while, therefore three to five years of living expenses stashed in safe cash is better.

Still with me? Ok, then aim to draw Social Security Benefits at age 70 for an even extra cushion. Finally, start doing your minimum required distributions based on your life expectancy. Boom, there you have it, you will never run out of money.

This is mostly tongue in cheek and overly simplified of course. The key is to have a plan and most importantly be able to stick with it. If it was so simple everyone would be rich. If you do the above, most likely you will not have to worry much about money and you will be in a great position for legacy stuff and splurge and stuff like that. And start thinking about what you will be retiring TO.

The above is not financial advice! Let’s move on.

And it finally happened: SEC ends crypto drama by giving the green light to 11 bitcoin ETFs. It was a matter of time after the SEC lost a court case. It will be interesting to see what happens next. If you were going to hold crypto in an ETF, why would you not go with the ETF with the lowest expense ratio? Let the fee wars begin! And of course maybe you should listen to this straight from SEC Chairman Gary Gensler who said that his agency “did not approve or endorse bitcoin” when it signed off on the new products and called Wednesday’s announcement “the most sustainable path forward” following a key court defeat on this issue last summer. Finally, one more point. Eleven companies jumped in to the dance with ETFs on the very first day, more to come. And Vanguard said it is not interested in offering one to make a buck because it will most likely hurt its customers so they pass.

And of course this would not have happened without the typical crypto BS that the SEC Twitter account was hacked and falsely announced that the Bitcoin ETFs were approved a day early. Of course, crypto and hacking fit perfectly.

Molly White‘s newsletter is a must subscribe imho. If you are interested in this space that is. The latest: Bitcoin has “no chance” of going to the moon. I laughed at this paragraph:

But even the bitcoin ETFs are approved and it fails to have significant price impact, I think we will still all be able to celebrate bitcoin achieving an important milestone towards its original goals. Finally, people will be able to turn their money into an anonymous peer-to peer asset outside of government control, to which they own their own keys and thus control completely, without having to involve powerful financial institutions like BlackRock.

GEOPOLITICS

I once had an idea that there should be an immediate cease fire on all conflicts everywhere around the globe and a conference held with all warring factions shepherded by the great powers and, with lots of carrots thrown in for all, to resolve all conflicts. In a binding and permanent manner. With immediate and huge economic benefits to each side coming to a final agreement. If not, there would be an immediate kicking out of all world bodies and full economic blockade. In other words, this is it people! And a biding timeline to start a long path to demilitarize. Just imagine if we did not spend gazillions on defense/offense to wage war and misery. And then…I woke up.

Anyway, a driver of war is nationalism. So, it comes down to Who Gets a Nation. It’s a little complicated. And maybe we should support the EU more. Faced with novel collective and planetary threats like the climate crisis, the EU’s layered architecture provides a model of international cooperation while still respecting disparate peoples’ independence.

I learned a lot about the history of Gaza in this article: Why Gaza Matters. Since Antiquity, the Territory Has Shaped the Quest for Power in the Middle East.

ODDZ & ENDZ

The greed of some people has no limits. DAMAGES. An ob-gyn in Virginia performed unnecessary surgeries on patients for decades. When his victims learned the truth, they fought back. Reading this made me highly uncomfortable. How does our health system let this doctor operate like this for so long? But this was truly shocking!

In April 1996, he was convicted of filing false returns after he claimed the value of personal items, including a Ferrari and a Mercedes, as business expenses. [Dead giveaway!]

More health material. The author wrote in Intelligencer about his medical ordeal and it is terrifying: My Unraveling. I had my health. I had a job. And then, abruptly, I didn’t.

Do you remember the song Brand New Cadillac by Vince Taylor and His Playboys? Well, you will not believe what happened to Vince Taylor. If you wanted yet another reason to learn that drugs can really mess you up, this is it. The Real Ziggy Stardust Who Lost His Career to Acid.

Taylor had slipped into Acid psychosis, he’d taken too much, had reached behind the veiled curtain and become lost in the darkness. Vince Taylor wouldn’t be the only one, like Icarus who had flown too close to the sun, by the 1970s, the casualties of the counterculture were just beginning to be realised. Mind expansion could sometimes come with dire consequences and like Pandora’s box, once opened, could not be closed again.

The 500 Greatest Albums of All Time.

Amazing Street Photography, enjoy.

TRAVEL

With the Big Three car companies based in Detroit, the city has always been unfriendly to public transportation. And it still boggles the mind that there is no way to get to downtown Detroit from the airport cheaply. Until now? Nonstop Detroit to DTW bus pilot program will launch in spring. Hopefully this sticks.

I found this site fascinating: Obscure Islands. Enjoy exploring them.

Always interesting: The Official Passport Index Rankings. Oh, I need to renew my Greek passport.

Another interesting one: 8 Geometrical Wonders That Are Also Houses.

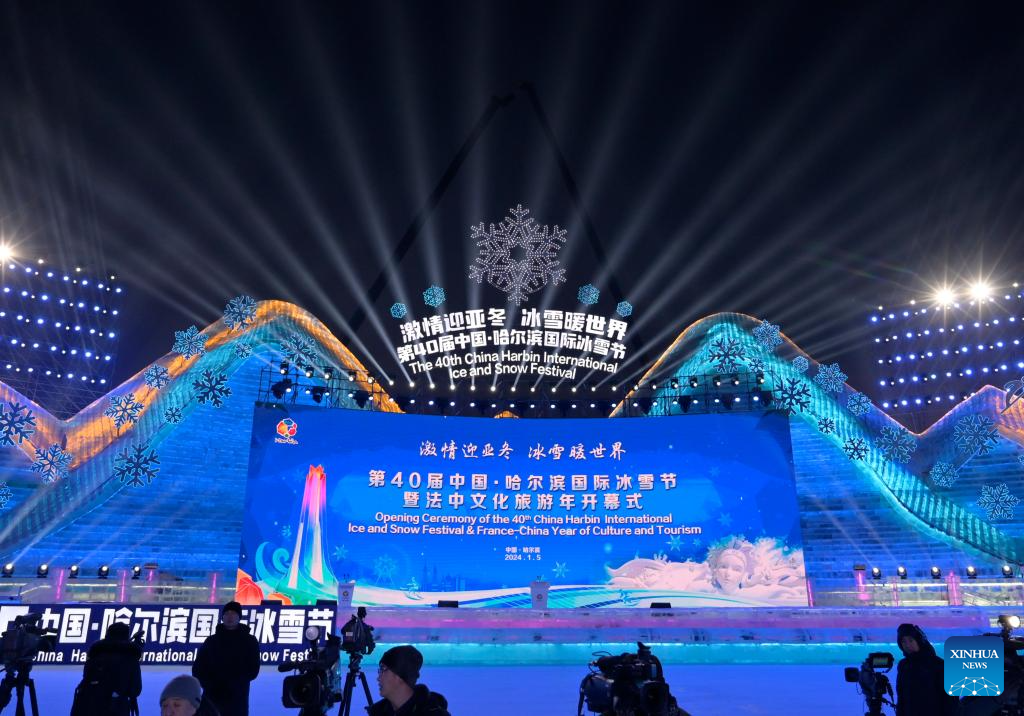

One day I need to visit this: 40th Harbin Int’l Ice and Snow Festival kicks off in NE China.

RUNNING

Well, I am not doing much running. I will know more after my MRI this weekend. But I have been really good with going to the gym and eating better and way less. And I am avoiding going to the movies because I do not want to give in to that popcorn smell lol. I do have a hilarious link for you to share, so true, it reminded me of me: You Should Try Running, According to Me, Your Friend Who Won’t Shut Up About Running.

All the money I’ve spent on running is entirely worth it. Running cured my depression. When you’re running, all your troubles and concerns just melt away. It’s beautiful. You become really present because running wears away the cartilage in your hip, knee, and ankle joints, which causes such intense pain that you lose the ability to focus on anything else.

And that pain? It lasts at least an hour. Maybe two. Potentially longer. Your body literally thinks something is wrong on a chemical level. Your brain isn’t getting enough oxygen, so it feels like you’re in danger, like you’re one stride away from dropping dead. Just like that Pheidippides guy. But you don’t die, at least not most of the time. Instead, you start to feel this unbelievable, intense euphoria. It’s amazing.

BUZZING

A section where I go on and on about some stuff that happens in my life and anything else that just does not fit in another section above

We lost another soccer football legend last week, Franz Beckenbauer: The Complicated Legacy of a True Game Changer. The guy won at all levels and then for his final act he decided to get some money being involved with FIFA.

We are still on Cloud 9 here in Ann Arbor from the college football National Championship the University of Michigan won in a dominant fashion. And this sums it up well: The Legacy of This Michigan Season Will Live On Forever.

Do you know what else will live forever? Photographer Waits Three Years to Capture Stealth Bomber Flying Over College Football Game. This photo:

We are also all looking forward to watch the Detroit Lions play a home playoff game. Could this be the first playoff win in thirty years? Coming after the UofM National Championship? Oh wow, that would be great orgasmic. And what a setup the NFL refs calling the game in Dallas managed to do! Get former Detroit Lion quarterback Patt Statford to come back after the mega trade that brought us our current quarterback Jared Goff and a bunch of draft picks that fast forwarded this team’s resurrection from the ashes. And this hilarious video is just pure perfection: Detroit Lions/Matthew Stafford PSA.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/MY ACTION

I am separating this Section this way:

GENERAL NEWS/PROMOS/ETC.

So, American Airlines announced the 2024 changes to its AAdvantage program. Which were surprisingly super minor. Which sadly solidifies the new “Loyalty Points” scheme as a success. Which makes the moniker “frequent flyer” extremely misleading. There is nothing about frequently flying in the AA program anymore, it is all about frequently charging on its credit cards. This is straight from AA about the changes.

Do you have elite status? Check out this site for potentially matching your status with other programs: StatusMatcher.

I bet Amex still intentionally leaves some of these intact because it is good business: How To Easily Use the Amex Airline Fee Credit.

If you were ever interested: Accor Hotels’ Brands, Explained.

And here we go: Hyatt’s “Guest of Honor” changes are now live. I am starting to think that this will create too much work for Hyatt due to tech issues and/or, cough, gaming by members that they will have to scale it down?

NEWBIES

Pretty good post for newbies here: Our Top Go-To Credit Cards For Everyday Spending, Explained For Beginners! Please come back here to apply to support the blog so I can finally score approvals that span the fingers of my second hand as it has been many months since this happened lol. So, here are some baselines:

If you don’t want to bother with the work that goes into miles/points, maybe you will be be better off with the pure 2% cash back Citi Double Cash card.

If you don’t want to bother with the work that goes into miles/points but you do want to have some travel benefits, you will be well served with the Capital One Venture X card. It is basically free each year with the $300 annual statement credit and the 10,000 anniversary points to offset the $395 fee. Each dollar earns 2 points, it can’t get any simpler than this. And you get Priority Pass lounge membership for yourself and you can even get it for four other people FREE by getting them a free Authorized User card which enables them to enjoy the card benefits.

If you love Chase as I do, well, the fun can deepen lol. You should probably have a Chase checking account, it really helps with card approvals. Plus, it is a national bank that will likely never fail. Or, more precisely, it is so big that it will never be allowed to fail. You should have an anchor card that you will keep at all times and it should be the Chase Sapphire Preferred card. This card enables you to shift all Chase Ultimate Rewards points to it and then you can either transfer out to airline and hotel transfer partners or use the points at the Chase travel portal and they are worth 1.25 points per dollar. Then you can add the Unlimited cards (personal Freedom Unlimited or Business Ink Unlimited) for a flat 1.5 points earned per dollar.

So, if what you are about to spend on is not bonused spending on the Sapphire Preferred card, you pull out an Unlimited card to earn 1.5 points per dollar. Therefore, all your spend should never earn only one point per dollar, ok? You want to earn even more on your regular spend? You add the Freedom Flex for quarterly 5% categories or, way better, you add the Business Ink Cash card that allows 5 points per dollar on office supply stores (and a few other categories) and, this is important, you can buy gift cards in your local Office Depot store of your favorite vendors you regularly shop at, say Amazon? And then, you know, do what we do in this space by (at your preferred pace) cycle through cards and family members that have huge Signup Bonuses, close them after a little while and then keep cycling through all family members, boom!

If for some reason you also want to play in the Amex sphere, the one card to get and keep for the duration is the Amex Blue Business Plus card. Why? Because all Amex Membership Rewards points you earn will never expire as long as you have this card. And then you can cycle through Amex cards just like I described above with Chase cards. If you adhere to its increasingly annoying restricting rules you will be okay.

Of course, have a system and NEVER do more than what you can be comfortable with. Peace of mind in life is important. If you get flustered maintaining more than one credit card this hobby is clearly not for you.

And, never forget this, from the post above:

DISCLAIMER: IF YOU DO NOT PAY OFF BILLS MONTHLY OR SPEND MORE THAN YOU CAN AFFORD BECAUSE OF CREDIT CARDS, DO NOT OPEN ANY CARDS! Anything you earn in rewards and benefits will be quickly replaced with interest payments and debt.

MY ACTION

Not much happening on my end, I have been really busy with my day job that pays the bills. Just a few notes:

Son made the first redemption in 2024 booking a trip on Alaska Airlines with his Amex points. This will be flight #8 that will satisfy a 6 month elite status challenge that he enrolled in. We screwed up here because we originally thought he had completed the requirements after taking a round trip in mid December but one of the eight flights was a Saver Fare which is not a qualifying flight for this promotion. I somehow missed it, maybe I am losing my edge in reading the fine tiny print in the Terms and Conditions. Actually, I was aware that Saver Fares did not qualify, we just missed that one of the flights was on a Saver Fare. Five of these flights were for Business paid by his company, for the record. Hopefully next week his elite status will turn to Alaska Airlines MVP Gold. Any ideas on how to status match with other airlines?

Wife’s Chase Ink Business card is finally here and I paid one business invoice and I got four new tires in our Ford Flex car and boom, we are 5/6 on the way to complete the minimum spending requirement. Another 100,000 Chase Ultimate Rewards points will arrive soon, it never gets old. Now, do I go for another Ink card for my daughter before January 18th?

I tried to close wife’s Barclay AA Aviator card sending a message online and the bank replied telling her to call. I guess we will hold it for a few months longer and cancel before the annual fee hits. But I did close mine after calling and not getting any retention whatsoever. I was told to look in the “Offers” section of my account online but I am not seeing anything at all, I almost fell for it. And asking for a refund of the annual fee was like asking for the moon, I think the rep was offended. Ok then, I said close me now. Boom, one less card to keep track of. And in a few months one less bank, progress! And why Barclay reps are nowhere nearly as nice as Chase reps?

Any suggestions on how to book airfare to go climb Machu Picchu? With miles of course. I guess the best hotel to stay in is a Marriott which will force me to check out Amex Marriott Bonvoy cards after a very long time. Hopefully that 5 Free Nights Signup Bonus offer comes back!

ADVANCED

This is important and sure not getting easier: Avoiding Phantom Award Availability.

An old favorite is saying goodbye: AwardMapper. Thank you old friend.

MILES & POINTS

This section is about my hobby addiction of collecting frequent flyer miles and hotel points since the early 1990’s! SKIP if you are not into it!

As of today, I have burned 26,429 miles/points year to date (1,148,286 in 2023) and have 4,470,079 miles/points in the bank. Some do drugs, I do miles lol!

Thanks to US banks, very lucrative travel rewards credit card offers come and go all the time. This section will act as a reference point on the best CURRENT offers. I will designate new material preceded by NEW.

Remember, you are NOT allowed to ever carry a credit card balance if you ever get a credit card here!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please pass it on to a family member or friend. Or Buy Me a Coffee, thank you!

TBB

travelbloggerbuzz@gmail.com

You can receive each blog post by entering your email address below and then clicking on Subscribe below, no spam ever!:

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Hope the MRI goes well! Running has been such a big part of your life.

Back from San Antonio. What an interesting city for a conference. Delta seems to have avoid the planes that were grounded. Whew. If Boeing is caught faking tests, oh my.

Thanks for the great links.

I brought the family to San Antonio for a vacation a few years ago so they could get a taste of Texas. It’s a fun place to spend a few days.

Took son to a water park outside San Antonio years ago and only stayed briefly in the city. I really liked it.

I think I blogged here those MAX planes should have been sent to the junkyard before more people died.

Silver! For the Pacific Northwest! Well, mainly because the email has the tag end from last Tuesday’s blog post in it at the bottom and is luring others away.

Lots of goodies here today, thanks! I did read the one the other day about that guy that got sick. Scary stuff!

Hope the MRI is helpful!!!

Tag from last week has what?

Emails get sent automatically by Mail chimp. And I have no idea how to fix any issues with it, sorry.

Gotta get home, my tech guy is bringing new printer, I broke the last one.

Will reply to comments later today.

Carl:

Just found a comment by Fullmoon directed to you caught in my Spam folder and just approved it. From two weeks ago lol. Sorry this site can not afford any staff to keep up with this stuff lol.

https://travelbloggerbuzz.com/2023-stock-market-charts-cycles-hyperloop-scam-best-pink-sand-beaches-easy-hotel-elite-status/#comment-426083

I see what happened. The previous blog post was added at the bottom of the email with the current post. Weird. Hope it was a one time glitch.

It looks like sports gambling is legal in NC now. Has anybody harvested lots of sign-up bonuses from online gambling sites? Is that even a thing?

Back a few years these bonuses were way higher. And I am sure people gamed this. Then again, maybe they got a gambling addiction from it so probably not worth it 🙂

Lots of great reads in this post! Any recommendations for tools that can replace awardmapper?

Might be worth adding a section to your travel resources page that talks about your favorite Travel tools.

I don’t have anything to replace Award Mapper. Which had deteriorated in recent years but it still did its job for a first pass of what is available in a targeted location.

I do have some sites listed here, trying to cater to pure Travel only for the most part.

https://travelbloggerbuzz.com/blog-reviews/travel/

And thanks for the reminder, I need to take it out 🙂

I have more to add in the Miles&Points Resources Page, I keep adding very slowly.

And Go Detroit Lions, hope I stay awake.

Yes, confirm the RMD – and % draw-down in retirement.

Proponent of the 36 month instant access cash(ish) buffer Bear Mkt hedge.

I got Venture X little while ago, planning my Turkish Biz class to Europe.

AS and AA Visa’s are now back of wallet.

Burning up my IHG account finally. No More.

Hyatt / Wyndham beckons.

Kramer, Ramsey, and Suze Orman are trash.

Happy New Year.

I was in Berlin ’86 George, as mentioned on X.

Today me and wife got emails from IHG that we have been downgraded to Club status. We were Gold for years and we haven’t stayed in an IHG property in years! Which also it means I will need to get some activity to extend the life of the points. Which is only enough for one award night, tops!

Yeah, three years cash buffer is fine. 5 years is reserved for clients while are extremely conservative.

Thanks for the comment!