Here is another post with six Best of Web links I have found worthy to share with you all dealing with investing, speculating, stock market volatility, investor behavior, long term investing vs short term trading and just general advice to help you weather the inherent volatility in investing in stocks, something we had not seen for a long time as we have all been on a rocketship it appears.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or visiting our LINKS or Donate

You like my blog? Send a link to someone please!

The Best of Web posts are much shorter in length with material that is a notch or two above what you see in the regular TBB posts.

Click on the headline for the link!

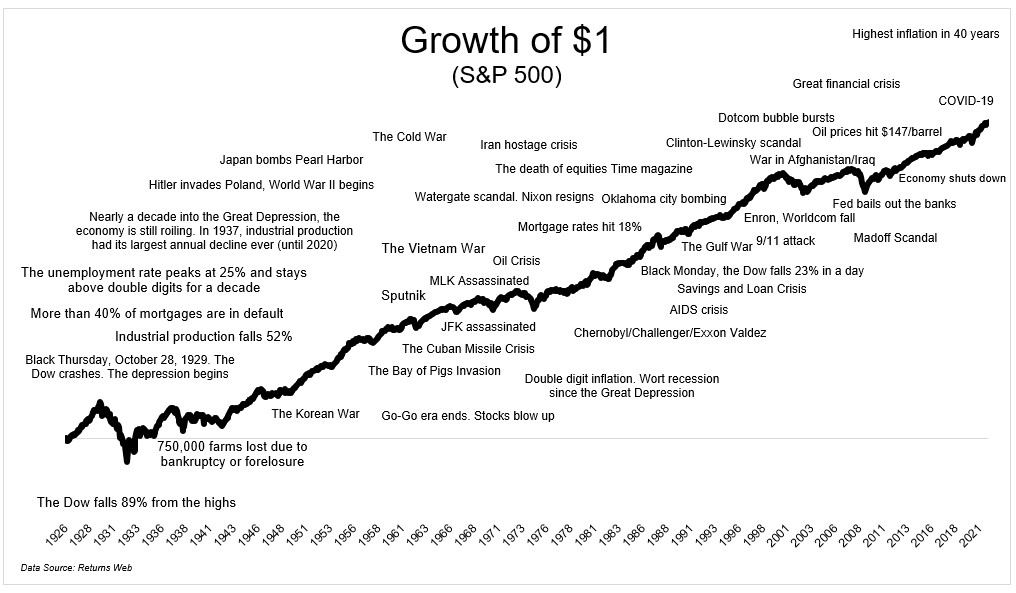

I wanted to post these last week when the stock market took a nosedive with extreme volatility in some trading sessions, 1,000 point moves intra day in several back to back days. But I was in Kauai and time was limited so now that I am back with a major snowstorm raging outside in Ann Arbor, Michigan I am posting this today because these are great articles that you should read and save to help you for the next downturn. Because there will be more as it is the nature of the beast, the price of admission for better long term returns. Remember, it is how you behave that is the major determinant of how successful you will do in investing. When red turns into a flood, it can mess with your head. Same thing happens when we reach new highs every other day. Remember, anything is possible in the short term. Be careful out there!

Are you Investing or Merely Speculating

I would say turn off everything and just focus on more important things!

The article starts with this great quote:

“Whether you’re excited or nervous when your favorite asset falls in price marks whether you’re investing or merely speculating.” – Naval Ravikant (Founder of AngelList)

I miss these good old days when I was getting more excited more often lol.

If you have a long enough time horizon and a diversified portfolio, buying at lower prices will increase your long-term return potential. Which is why a stock market crash is actually the best thing that could happen to young investors.

Holding stocks for a day or a week is not much better than a coin flip (only positive 53/57% of the time). If that’s your time frame, you don’t have the luxury of waiting for stocks to come back and any decline should make you nervous.

In contrast, holding stocks for 20-30 years has never yielded a negative return, even for investors who bought at the peak in 1929 and held throughout the Great Depression. Given those odds, long-term investors should be excited when stocks go on sale – and the earlier the sale, the better.

Reframing Volatility

Stocks appear less volatile the less you look at them.

If you can help it, stay away from checking your portfolio when you’re losing money. Stocks won’t stop going down just because you’re looking at them, and the more you see your money evaporate, the more likely you are to do something to make it stop. But an investor’s job is not to avoid the pain but to endure it.

It’s no fun when stocks are going down. But if you understand, not just intellectually, but in every fiber of your portfolio, that this is part of the deal, then you’ll be well-positioned for when they start to go back up. I don’t know if that’s tomorrow or next year, but I know that in the meantime you have two choices: try and avoid it, or accept the fee. Choose wisely.

It’s no fun when stocks are going down. But if you understand, not just intellectually, but in every fiber of your portfolio, that this is part of the deal, then you’ll be well-positioned for when they start to go back up. I don’t know if that’s tomorrow or next year, but I know that in the meantime you have two choices: try and avoid it, or accept the fee. Choose wisely.

Coping with two conflicting realities

Among other things, investors have to cope with two seemingly conflicting realities: In the long-run, things almost always work out for the better; but in the short-run, anything and everything can go very badly.

However, it can’t be reiterated enough that 5% pullbacks and 10% corrections happen more often than not in any given year. Bear markets, where stocks fall by more than 20% from their highs, are less frequent, but they are something that long-term investors are likely to confront during their investment time horizons. Unfortunately, it is incredibly difficult to predict when stocks will fall. And exiting stocks in an attempt to avoid short-term losses can prove incredibly costly to long-term returns.

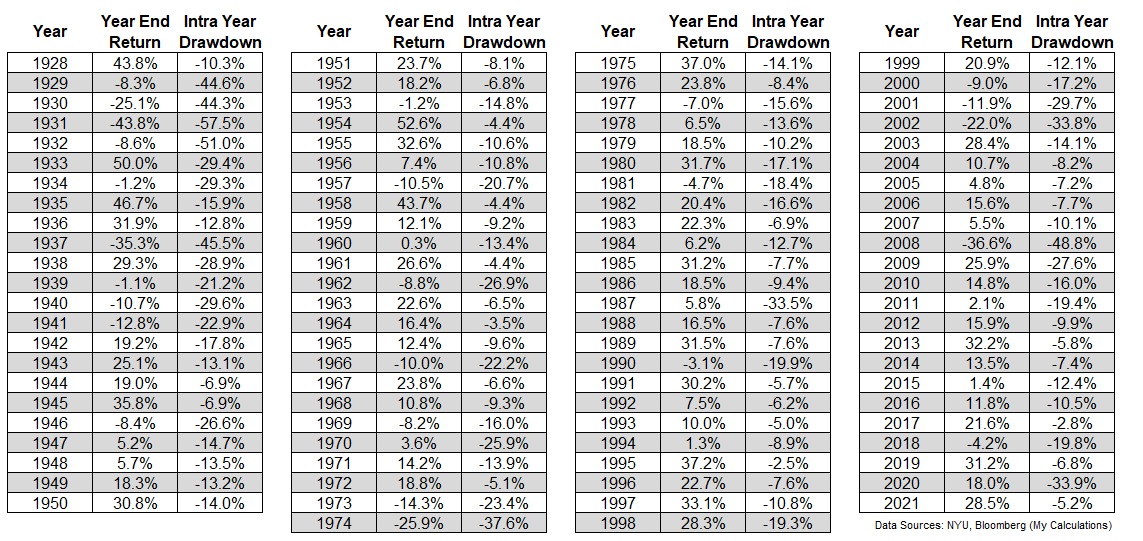

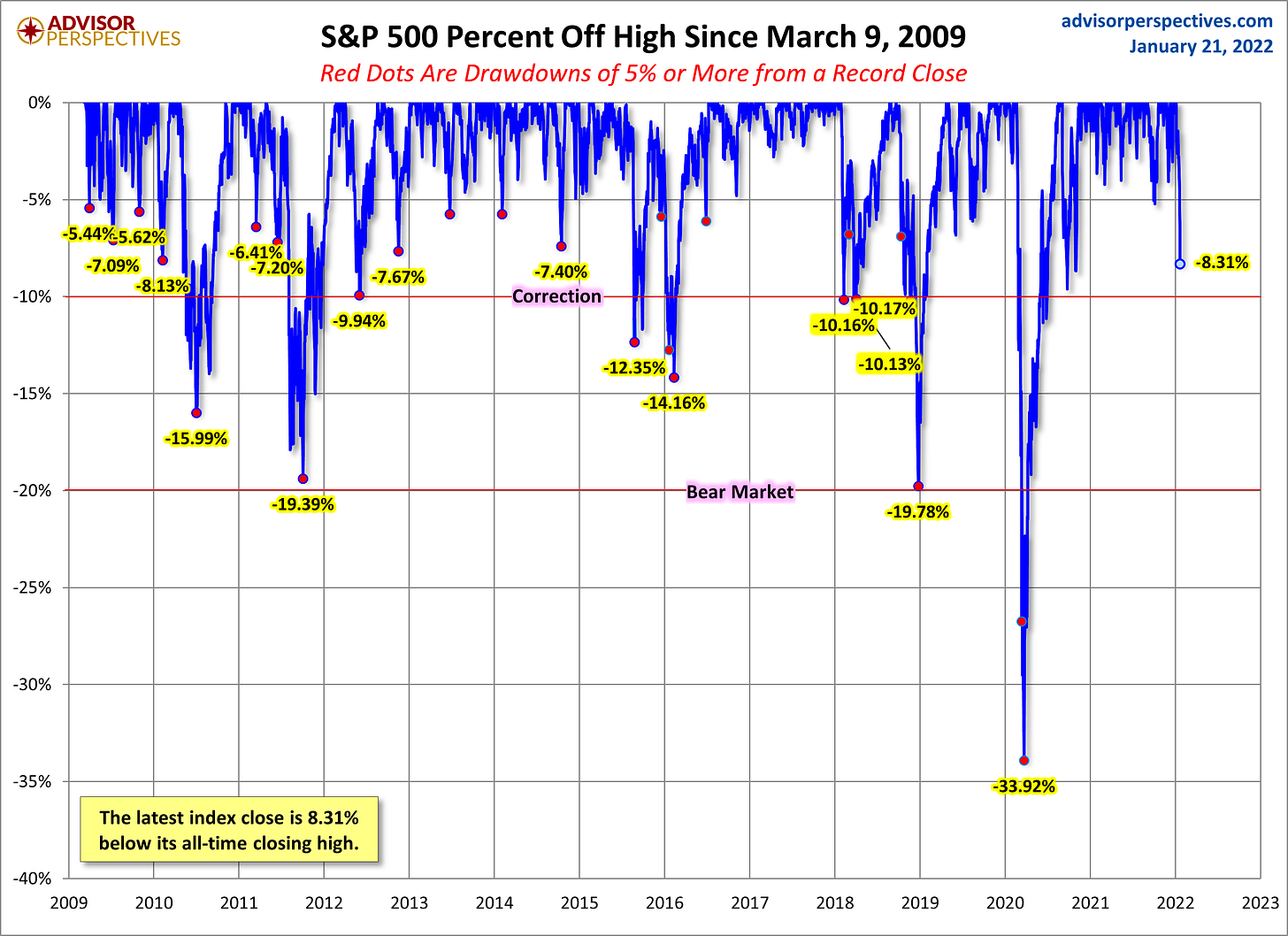

What was the story behind the 10% drawdowns in 2018, the 14% drawdown in 2016, the 12% drawdown in 2015, the 10% drawdown in 2012, the 19% drawdown in 2011, and the 16% drawdown in 2010? [I bet you don’t even remember them!]

If you’re not able to stomach short-term volatility or if your portfolio can’t handle short-term unrealized losses, then investing in the stock market might not be for you. These short-term challenges are the price investors pay for long-term riches.

This is Normal

Here are the annual calendar year returns for the U.S. stock market along with the intra-year peak-to-trough drawdowns:

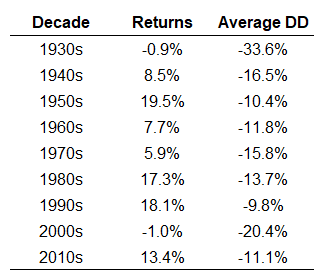

This is a look at the annual returns and average intra-year drawdowns by decade:

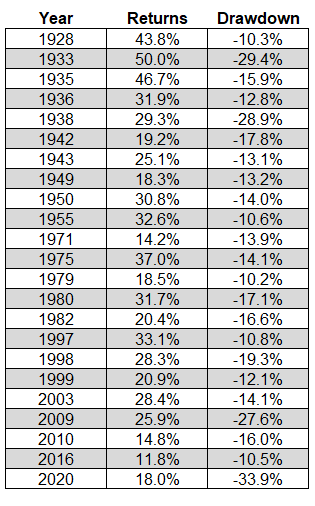

And 2 out of every 5 years has experienced a double-digit correction but still finished the year with double-digit gains:

What to do When the Market Feels Crashy

1. Revisit your financial plan and goals.

2. Revisit your max pain point.

3. Remember that perfect is the enemy of the good.

4. Talk about it.

The Price of Admission in Stocks

From the March 2009 low through the high earlier this year, the S&P 500 gained 818%. That’s an annualized return of nearly 19%.

There have been 27 corrections since the March 2009 low of more than 5%. Of these, 9 were larger than 10%, 3 exceeded 20%, and 1 was more than 30%.

There have been 27 corrections since the March 2009 low of more than 5%. Of these, 9 were larger than 10%, 3 exceeded 20%, and 1 was more than 30%.

In simplest terms: risk is the price you pay for the possibility of higher long-term reward.

In simplest terms: risk is the price you pay for the possibility of higher long-term reward.

…there’s no free lunch. The premium you earn from owning equities over bonds/cash is primarily due to the higher volatility and drawdowns you must stomach over time.

Another way of looking at this is to view the historical odds of varying intra-year drawdowns. We have seen a decline of at least 10% every other year, and a 20% decline every 4 years on average.

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” – Peter Lynch

And I leave you with this…

Thank you for reading my blog. If you enjoy it please pass it on to a family member or friend, thank you!

Some of the links are behind a paywall. You can try to read them using Archive.is. Or use 12ft Ladder. Or the Firefox browser.

TBB

travelbloggerbuzz@gmail.com

Follow TBB on Twitter @FlyerTalkerinA2.

You can subscribe to TBB below, winners only!

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Thanks for the volatility links!

Much wisdom in the cautions.

Perfect timing, thank you for the links.

Have a great day Buzz.

Silver for the Saguaro, I’ll take it

Bronze! For the Pacific Northwest!

BEST collection of Finance stuff you’ve ever done, I think and also SUPER handy and well timed!

As the guy on Camp Runamuck used to say, “Thanks! I needed that!”

Should have listened to Ingy…and named my blog Money Blogger Buzz 🙂

FTG’s page has been dead since March 23rd 2020. I’m surprised the owner hasn’t written it off yet. The value of the page is $0.

I don’t think it’s “normal” that the stock market keeps going up so much, so quickly. Remember the glorious 80s and 90s. It was followed by 10+ years of no growth. The PE numbers are high…

I’m surprised that the ad company Google grew revenues by a lot especially compared to the other ad company, Facebook.

And finally, this is a daily reminder to NOT screw your employees (Jeff Zucker, CNN and Mark Schlissel in Ann Arbor).

I should buy it for $20 and hire the Boarding Area ghost blogger to just pump away 🙂

Stock market is inherently abnormal. Anything is possible over the short term.

So glad have been unloading RSUs every three months for META client. Not going to bother answering “why don’t we hold it as it keeps going up?” questions lol.

Apple, Google and Microsoft results are just unreal. I am not sure this is healthy overall…at the same time, it is awesome this is happening here and not anywhere else…

What if the employees enjoyed the screwing? It is a rhetorical question 🙂 Relax everyone!

We are pummeled with snow all day…wow!

$115k/year writing about CCs (travel) at TPG

https://twitter.com/vikkie/status/1488885376374743040?s=21

I could apply and in one year I could make a lot more than what this blog earned in 9.5 years…sad lol!

FTG is worth more than $0. My blog was never successful, I haven’t touched it in years, and it’s still bringing in a small amount of Adsense revenue despite being a zombie site.

You are right. However, Internet Brand would be better off just writing it off. It’s extremely hard to rebuild an audience (MySpace). Regarding, your speculation in the energy sector, big WARNING, Jim Cramer is now gung-ho about that sector! The ride up may be over…..

LOL, saw that Cramer comment and a bunch of us are concerned about it. I think there was a Barron’s cover about commodities recently too which is another contrary indicator. We’ll see…

Why are you even listening or even caring what comes out of Cramer’s mouth.

Meanwhile, over in META….oh

I bet ya FTG made more than this blog did…since Jan 20…as I earned $0 lol.

1099s are in, mega tax season rush is ON….see you maybe Monday….one Monday….maybe after the next conversion….hobby is SO boring lately….zzzzzzz.

Tired of shoveling snow, should have stayed in Hawaii!

It snowed here three times in January! First significant snow in about three years. I don’t even own a snow shovel as it usually melts quickly enough when it does snow.