Another TBB post featuring the most eclectic links around the web such as the new tax deductions, AI bubble, the 10 most haunting hikes, Amex empire of plastic, US wealth by generation, the value of advice, the murder guide book, the scale of life website, the human stain remover dude, the 50 best restaurants, the geeky world of plane spotting, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend and stay cool.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

Due to new severe credit card affiliate restrictions, there will not be any credit card links in the body of the blog posts other than Capital One Bank and personal referral links going forward. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE . Or just email me.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

“Every day you live, you make a difference. You matter. You’re here for a reason. Find the reason. And do your bit. Then, we can save the world.” – Jane Goodall, RIP

PERSONAL FINANCE

Brace for all the New 2025 Tax Deductions. I can see many law-abiding challenged employers trying to get around the new regulations of what constitutes overtime. And tips income #goingtobewildoutthere.

I am adding this link because I am biased, full disclosure. The Emotional and Time Value of Advice. I think having a good financial advisor is well worth it. And I quote:

Using a survey of 12,443 investors (including 7,746 advised clients), we found that:

- Advised clients are less financially stressed than self-directed investors. Advised investors are roughly half as likely (14%) as self-directed ones (27%) to experience high levels of financial stress.

- Advice delivers emotional value to clients through more peace of mind. 86% of advised clients report having greater peace of mind when thinking about their finances, compared with managing them on their own. Advice improves investors’ positive emotions and seems particularly effective at lessening negative emotions regarding personal finances, such as feeling overwhelmed and worried.

- Advice saves clients time. 76% of advised clients say advice saves them time — namely, a median of two hours per week (or over 100 hours per year) — from thinking about and dealing with their finances.

- Advice saves employers time through employees’ reduced financial stress. Workers in employer plans report spending an average of 3.8 hours per week distracted at work by financial stress, leading to a yearly productivity loss for employers of $5,950 to $6,775 per employee. Half of the advised clients in employer plans say advice reduces financial stress at work. Overall, advice saves clients almost two hours per week at work (over 100 hours per year), improving worker productivity by $2,200 to $5,850 per year.

Okay, I swear, this is the last link about Jonathan Clements. I think. Anyway, the best was left for his friend (and successor columnist at the Wall Street Journal) Jazon Zweig to write about Jonathan In Memoriam. And it is a wonderful tribute indeed:

His pen was sharp as a needle, but he wielded it with humor, grace and a confessional, personal touch. Readers felt they knew him—because they did. More than any commentator before or since, Jonathan made personal finance personal.

He knew, from painstaking reporting and exhaustive research, that the claims that were central to the financial industry in the 1990s and 2000s were not only bogus but bad for investors. [Count me in as one of those whose investment philosophy was highly influenced/changed by Johathan. And it is so absurdly weird how all those heretical beliefs back then are now treated as gospel, amazing.]

In Jason’s article, he includes Jonathan’s first ever “Getting Going” column from way back in 1994, it is an absolute gem.

Ok, one more, I can’t help it. Here is a collection of the Best of Jonathan’s HumbleDollar Posts.

Saw this somewhere online (Bloomberg article I think) that blew my mind:

There are 19,000 private equity funds in the US. There are 14,000 McDonald’s in the US.

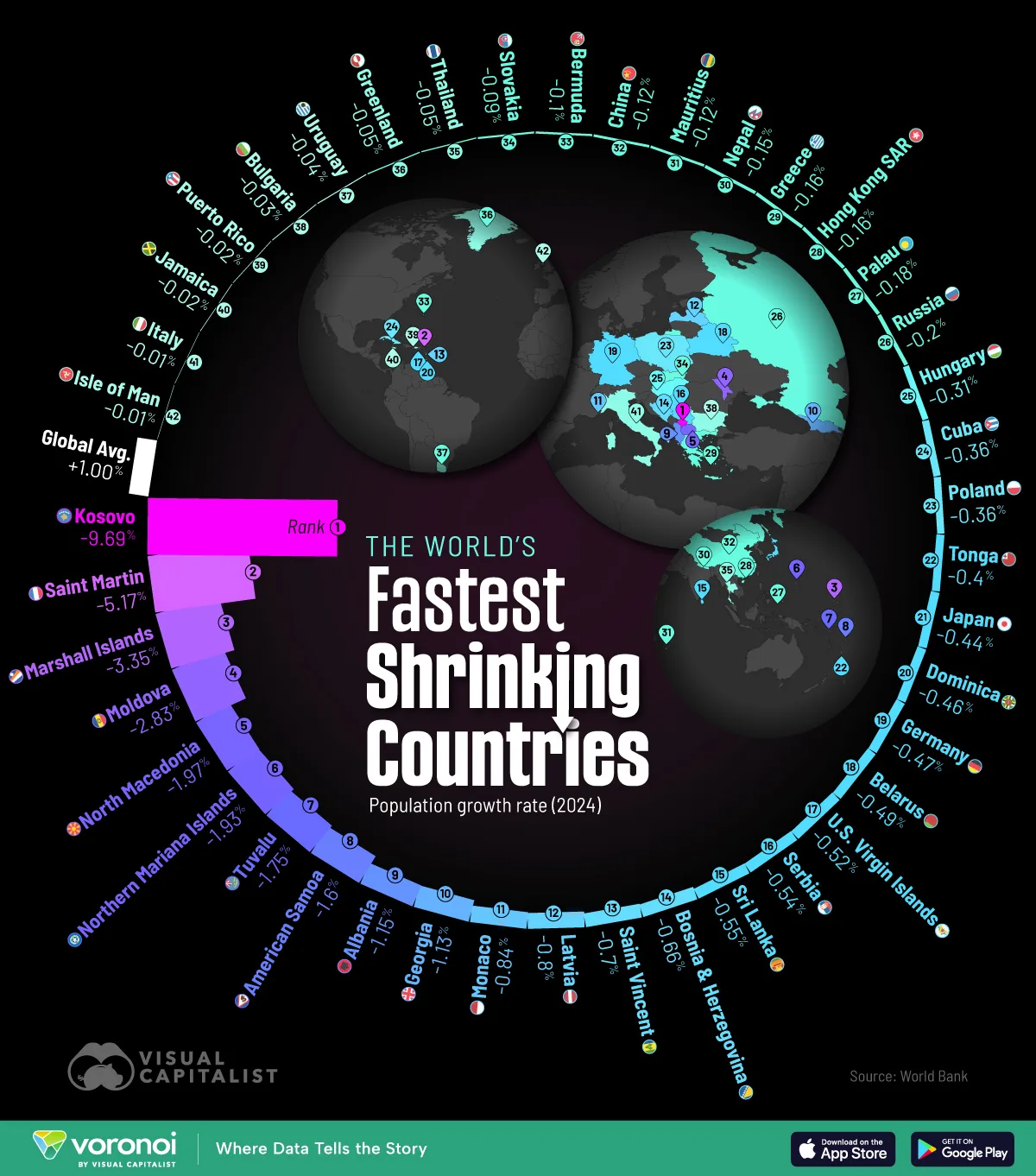

Visualizing America’s Wealth by Generation

SCAMS/CRYPTO/AI/TECH

Crime pays. As in getting locked up for years. The final chapter of obnoxious Charlie Javice who managed to trick Chase Bank to buy her flawed startup through brazen fraud: Charlie Javice Sentenced to 85 Months in Prison for Fraud. When Chase Bank sued her, she chose to hire expensive lawyers to counter sue and go on the offensive showing absolutely no signs of remorse. She changed her tune at sentencing with:

“I accept the jury’s verdict and take full responsibility for my actions,”…“I have remorse deeper than I knew possible,” Ms. Javice said during the hearing on Monday. She tearfully apologized to JPMorgan shareholders, its in-house team, her parents, her boyfriend and Frank’s employees who she said were “in some way stained by their proximity to me.”

But don’t cry for her yet. She will appeal and did manage to lower the sentence from the 144 months prosecutors had requested. And I think she stays free until the appeal.

Excellent podcast about what we are all pondering these days: This Is How the AI Bubble Could Burst.

This graph in this article shows where we are these days…

Good you are getting used to watching marathons and not breaking something!

Last week I gave the class an AI assignment. Ask AI a question to which we have a photo of the answer. I did not say which AI program. About half the answers were wrong. Moral? Diversify!

Maybe we need index funds approach to AI

Thanks for the links!

Hey Buzz-

Fridays are the highlight of my week as you bring the madness back in focus.

I saw a concert years ago with Nine Inch Nails opening for David Bowie. Intermissions are for sissys-about 75 minutes into NIN’s set, they played a long song, smoke pouring on the stage and the roadies switched the instruments from NIN’s to Bowie’d. He then walked out from the smoke and sang the last verse of the same song as NIN members walked off. Tough to describe but way cool to watch.

I need to read that AI article as I need to see how AI is viewed as risky (other than being overvalued).

I read that FM article on Amex and thought ‘right on’. Now that Chase has tossed me in the trash, I think Amex is a better source of transferable points anyway.

Leff wrote this week, seeming to agree with Southwest changes. The logic is that the old SW had run the course on free bags, open seating and credits that don’t expire. He didn’t explain why I’d ever want to fly them again.

Good afternoon Buzz,

Thanks for another great post. Looking forward to the reading this weekend especially the links for Mr Clements.

Charlie, what an utter waste of talent, and the grifter will probably only do a year or two I imagine. 144 months is too short, just sayin.

Sorry that you will only be a spectator, but a brisk walk goes a long way to your health all around Buzz.

Have a great weekend!

Woot! Lots of great stuff again! Many thanks. Catching up from having company. Love to see people but god does it throw a wrench into a regular schedule. Phew! Thanks so much and good luck on scheduling all the trips for family.

On the topic of wild real-life stories made into movies: there’s a movie opening next week called “Roofman” based on something that happened here in Charlotte, and it was filmed here as well. This dude named Jeffrey Manchester did a whole bunch of robberies, though apparently was generally a polite robber. He was eventually caught and sentenced to 45 years in jail. He escaped and secretly lived in a Toys R Us before moving into an empty Circuit City next door. He started planning a big robbery while also becoming a member of a local church and dating someone there, telling her he had a secret government job. Wild stuff, here’s the Wiki entry:

https://en.wikipedia.org/wiki/Jeffrey_Manchester

The movie’s getting decent reviews so I’m hoping to see it in the theater.

Way too much going on so I will get back to the comments…soon.

Quick question:

Should I book a UA award to get me back to the US from KUL on….Ethiopian Airlines business class, KUL-ADD-IAD both on the Dreamliner? 3 hours stop in ADD.

Apparently Ethiopian makes a1/5 stops in both SIN and LFW in first two flights!

Maybe I should make it a place holder, thoughts?

Update on applying for the 125k Amex Schwab Platinum:

After applying in 3 different browsers/methods and getting the dreaded popup…today I applied via Chrome incognito and got “your application is pending further reviews”!!! So, do I call recon now or wait it out? I would wait it out with Chase, not sure with Amex, been away from this camp for a while 🙂

Never give up!

Following! Curious the outcome on this one!

I assume those ‘pending review’ messages mean the algorithms didn’t knock me out. I usually wait since I can call after a rejection to offer ‘additional information’.