TBB Mission: To Entertain, Educate and Inspire. Aim to at least do one well!

If you like what you see here, please let others know by passing them a link to my blog, thank you!

TRAVEL

31 Haunting Images of Abandoned Places That Will Give You Goose Bumps By Bored Panda. Some are new here!

Oregon Coast in Spring. By Lenticular Travel

Two dudes from California go on an epic trip across 13 countries. Awesome pics and a long video of their trip.

One World Trade Center rises again…in 119 seconds!

MILES/POINTS

Reason #875 to hate Delta: Agents require to see the card that was used to book the award ticket, seriously? (HT to Million Mile Secrets)

View from the Wing lays out some three non affiliate offers for the AMEX Platinum card w/ about 50k Membership Rewards points bonus. Pfft! My wife will wait for 75k…or 100k (dreaming).

Part 2 of how to plan a trip to Asia with AA miles by The Miles Professor.

Apparently I missed all the excitement about the $0 United fare mistake. Look, if it is not honored please do not sue ok?

ON MY MIND

My life is busier than ever right now. I am doing my best to keep up the blog quality. Thank you for your understanding and support 🙂 I am just trying my best not to fold like a cheap suit lol.

Alexa ranking hit a new best: 176,371 with 103 sites linking to TBB. I am honored, thank you!

ODDZ & ENDZ

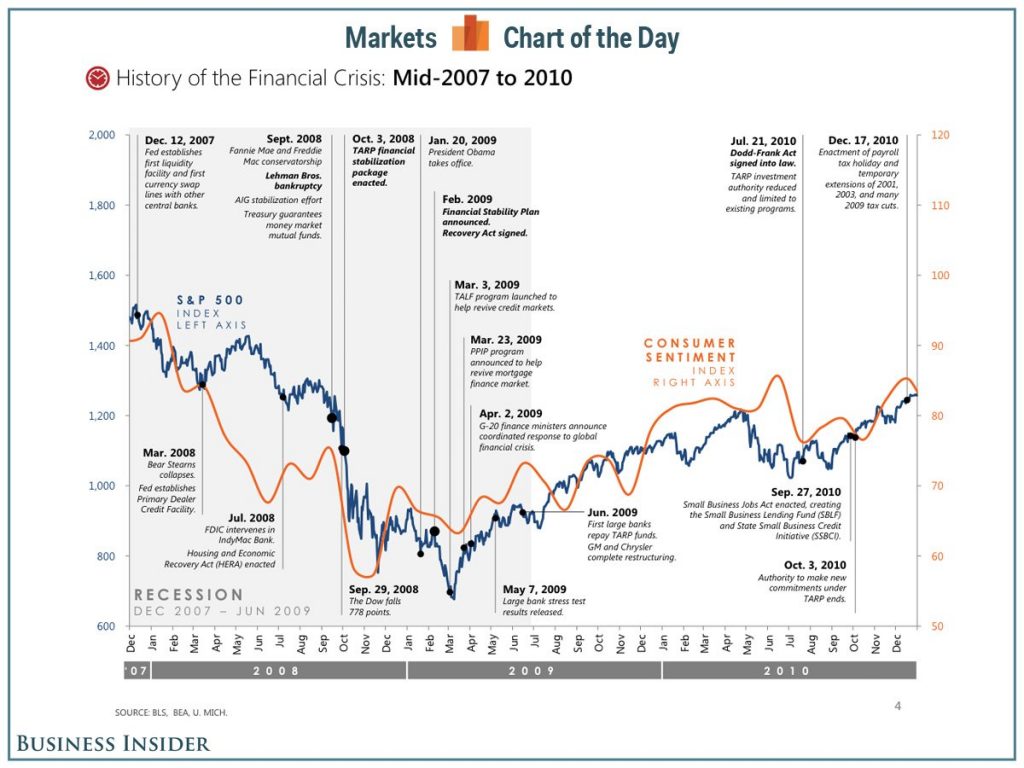

The Complete History of the Financial Crisis in One Chart.

The frog photo bombed the LADEE launch and got fried!

- Found here

Take a tour of the Ivanpah Solar Generating System. This is the largest solar installation in the world! OMG, this is incredible! Click it and take a look at these amazing images, wow!

BLOG BUZZ

Every time I read one of the posts of The Points Guy I shake my head in amazement how many credit card links can be inserted in just one post! Amazing.

And the whole credit card carpet bombing continues in force. I go through the blogosphere and lately I am just disgusted of the controlling influence of the banks and how content is influenced. I need to do a post on which blogs TBB believes you should be helping with your clicks to encourage better blogging practices and not reward aggressive pumping/weak content/absolute drivel. One day TBB will be on top of the list because I need to pay off my mortgage too 🙂 Not going to pull out the charity line lol. Oh, you are darn right I am going to appreciate it! Heck, I ‘ll buy you dinner not just a cheap cup of coffee!

Ok, as you noticed, I am holding back because there is just so much crap I see every day. But this one I got to say something. In Feedly there are two headlines right after the other by Johnny Jet. And they are:

>>>>>>Attending the 2013 US Open with Starwood American Express

>>>>>>Starwood American Express Card: Easily Earn 25,000 Starpoints

I kid you not…

If I had a dollar for ever time I saw a link for a Chase Ink card…

1?

Yes! We always remember our first time 🙂

that was also on a friday the 13th….

Lol

Thank you! You like my pictures – I like you 🙂

Still looking for that check for the banner ad, come on! 🙂

Just come to LA!

Here is this weeks edition of……..RAMSEY’S STOCK PICK OF THE WEEK………………………………… ……………………………………………………..HUY FONG FOODS INC. ……………………………………………..

Makers of Sriracha Hot Chili sauce, you know the delicious red bottle of sauce you see in so many casual restaurants nowadays. It’s everywhere here in PDX. This stuff is awesome and addictive and is going mainstream, in fact, I just bought Sriracha flavored Lays Potato Chips. Huy Fong inc.owns the market!! There is no competition. They just filed an S-1 with the SEC for a future planned IPO this Fall. IS it popular in your neck of the woods? Bet the College Fund on this one.

>>>>>Bet the College Fund on this one.

If I had a dollar for every time i heard “bet the______ (take your pick) on this one” I would be filthy rich lol.

It will face competition from large food conglomerates soon.

http://articles.latimes.com/2013/apr/12/business/la-fi-himi-tran-20130414

Reading the comments on your previous blog entry with my morning coffee I realised that personal finance is a topic that everyone can talk and have an opinion about, similar to taking commercial flights. Sad that people didn’t learn from the dot com bubble and stopped playing with the stock market (most Germans did). Every time I see idiots like Cramer doing their booyaa-s I cringe. Speaking of which, who is the Cramer of the ‘travel with cc points’ blogger gang? Dan? Ingy? Gary?

@2002, who is the Cramer of the ‘travel with cc points’ blogger gang? Thats easy Extra Pack O’ Peanuts, he’s nuts.

You praise the Germans? What a hoot! They were the very last fools on the planet still buying all the “AAA” garbage that WS Banksters were unloading.

The Germans were incredibly naive and were a major reason the mortgage debacle got so big, as they kept on buying “no risk AAA paper” even as everyone else was running for the hills. Several German banks went under because of their “riskless” investments, lol.

Absolutely 100% correct. Germany was the main target for most stupid, crappy investments. The German investment mentality was to develop a comprehensive checklist and as long as the investment “fit the box” they would load up on it massively. So by way of simple example they might say we will buy up mortgages where average credit score is 680. So they got stuffed with all the crappy 500 credit scores padded out with higher scores to shift the crap. But they have done a great job of sweeping it under the carpet. It makes me laugh when people talk of the strength of the German economy when I know their banks continue to be laden with god-awful assets at grossly over-stated valuations.

But I do agree about the stock market point though, as I stated in the prior post. Though TBB seems to somehow think I am advocating being a stock picker when I say that the majority of your retirement portfolio should be in treasury bonds??? (I think it’s called “deflection”)

You are advocating that via research stocks can be picked that will outperform the market and juice up investment returns in investment portfolios. Yes it can be done by exceptional people every year. I do not believe it can be done consistently and the vast majority of investors are better served buying an index, keeping the costs low and concentrating their time and energy in activities that enhance their quality of life. That’s all.

Dude, I am so far behind. Maybe one day we can talk about this stuff in person over beverages. And no this is not “deflection” 🙂

Yes I advocate for a retirment portfolio that is at least 60% liability matched treasury bonds. I’d likely advise people to do 60% treasuries, 10-20% high grade corporate debt, 10-20% in well selected individual stocks and max 10% of playing in whatever sandbox they want to. If people do not have the time or intellect to asses individual stocks they have no place investing in indices. What you are basically saying is if you aren’t smart enough to assess one stock, you should just buy them all. Sounds great right? 🙂 So if you can’t do the 10-20% stock picking piece, then I’d recommend you just up your US treasury allocation.

Offer of beverage accepted 🙂

>>>>>> If people do not have the time or intellect to asses individual stocks they have no place investing in indices.

Or maybe THIS is the reason why they SHOULD invest in indices?

Clearly we (respectfully) disagree. There are different ways of doing this. I like my way. It has been working for me and my clients. You are set in your own ways. Debating about it will not change anything. Thank you for the investment advice 🙂

I am not set in my ways – I am ALL EARS as to why equity indices are more appropriate than treasuries for retirement planning. “It has been working for me and my clients” is no explanation – it worked for Bernie’s clients for about 30 years too 😉

We need someone else to join the debate, maybe a referee. Where’s Matt from Saverocity when you need him?

Maybe you are right. The only way to decide if your way is better than my way is to place in our calendar September 13, 2046 and have someone audit the results and declare the winner.

In the meantime, our discussion is irrelevant. We don’t know what the future holds, we all think what we think is GOING to be best.

So, lets declare this a tie I guess and lets both move on to more important things such as “Is TBB the Nest of Discontent” as a veteran of this “hobby” appears to think so? 🙂

” people do not have the time or intellect to asses individual stocks”

{waving hand} Me! That would be me!

I inherited a small manufacturing company, a large (mortgaged) house and a large debt-load when my beloved husband died two years ago. I do NOT have time to look into a boatload of stocks (and the companies and their earnings and their plans for the future and and and….) HOPING I can somehow figure out how to pick a good one. (Alas, my dear husband thought he’d found a sure winner, so the $30k IRA (of mine!) that he threw into it is now worth $14k! And he had a bigger and better educated brain than any ten people on the web!) I also have some CDs (at, alas, 6.5% interest) that mature early next year. I am trying to keep myself, my biz, and my life afloat — so I do NOT have time to learn how to gamble in the stock market!

Do you, MA, recommend that, since I don’t have time (I DO have the intellect, if not the interest) to do all the footwork to find just the right stocks, I just put my money into a savings account at 0.19% and PRAY some miracle happens? (I’m 57, it had better be a damned QUICK miracle!)

(But I’d love to sit at the table behind you two as you drink your beverages and discuss this stuff… It’s interesting, even if I DO have to just go for an index and pray!)

Elenor:

Impossible to say without taking a comprehensive view of your finances. There are good fiduciary financial planners out there who will not suck your blood. You can start at http://www.garrettplanningnetwork.com. A short engagement may really help you put it all together and give you some direction where you stand. You see, this financial planning stuff is about the overall game plan, the foundation, the compass, or whatever you want to call it. The individual stock or bond or fund or index fund or ETF or whatever…that is like the furniture. The plan dictates the furniture 🙂

I would at least hold on those 6.5% interest rate CDs until the very last second allowed.

Do NOT deal with individual stocks. There is a long trail of bodies. I have dealt with many such body bags in my career. Most were very intelligent (doctors, etc.) but investing can mess with your mind and you…make mistakes. The one profession that I see more in the long trail of bodybags is…dentists. To this day, I have no idea why dentists fall for so many scams trying to hit it “big”. Maybe they are too bored looking at others’ teeth all day. This remains a mystery to me.

You need a game plan, you do not need furniture 🙂

I need to crank out tomorrow’s blog post. Maybe I can sneak myself to a movie, need to relax!

Have a great weekend!

@Elenor – yes absolutely I would recommend at your age and your situation to be heavily invested in cash. The current stock market is in another bubble and would absolutely not surprise me to see a 25-40% drop maybe in one, two, five years time. Don’t know when but for sure gravity is going to kick in.

You are at a different point in your life to the kind of person I have been talking of in that I have been thinking of the person planning for retirement whereas you are getting much closer. The one other product I would recommend for someone in your position is an annuity. Nothing fancy, just a straight lifelong annuity from a very strong life insurance company (something like New York Life or Northwestern Mutual). Do not touch indexed or variable or anything else stupid like that. But we all face our own mortality risk and we are all living much, much longer (my condolences for your husband). Simple annuities where you simply pay an upfront amount to an insurer in return for a guaranteed monthly lifetime income are a great way of transferring this mortality risk from you to an insurer.

But your tone does raise an interesting point and one which George has still completely and utterly failed to answer. Why do you think you *should* invest in the stock market if you can’t even analyze one company? You are falling for the same failure large pension systems have fallen for. They simply did not have enough money to cover obligations given prevailing interest rates, and so felt compelled to put their money into riskier investments because they needed the return. You can invest in equities for sure but you would be investing in risks by your own admission you do not understand.

Do we all remember how the equity market began? It was people with capital giving money to entrepreneurs who had business ideas but lacked capital. In return they promised the capital providers a share of the profits (hence the name “shares”) in the form of dividends. Then when some of these enterprises became very successful the capital providers found they could sell their equity stake at a profit to other investors keen to participate in the enterprise. The problem with today’s equity market is all people think about is that last piece… that somehow equities will always rise in value. They forget that to rise in value the enterprise has to grow it’s profits and distribute that in the form of dividends back to the shareholders. So sure go ahead and blindly invest in equities, be it individual stocks or broad indices…. either way you are betting on the growth of the companies you are investing in with no real clue about why you are taking that position. I will let you all decide for yourself if that is rational 🙂

(BTW I do have one rational argument for investing in indices but I am not giving away the answer that George has continuously failed to deliver. I think I am becoming the Rick Ingy of the finance side of this blog lol)

Elenor:

Don’t listen to MA. He knows enough to be dangerous 🙂

You need a comprehensive assessment of your current situation first. Then zero in your goals. Then a game plan.

>>>>>>> I think I am becoming the Rick Ingy of the finance side of this blog lol

That was awesome, I am still laughing.

>>> You need a comprehensive assessment of your current situation first. Then zero in your goals. Then a game plan.

TBB is spot on the mark here. Without knowing more of your circumstances, hard to give any real advice. But I wish you all the best of luck, I can appreciate it is very daunting.

TBB I think we just agreed on a finance point 🙂

Your pal Miles “ingy” Abound (BTW I still like Rick – owe him a huge debt of gratitude as his blog really opened my eyes to how far you could take all this)

Yes, I praise Germans, since I’m one… BTW I was praising German individual, not institutional investors. As far as the reasons for the Lehman crisis… I think the Fed pouring cash into market and nutpots taking the 15th mortage on their overpriced house they flipped 5 times had a far larger effect.

U voting for Merkel? Please don’t let her kick out those hapless Greeks out of the EU 🙂

Fed and nupots and warped Wall Street conflicts of interest all added to the blow up. But index investors who did not panic and even added to positions have done extremely well since then 🙂 Have no idea where we go from here. No crystal ball lol.

Nope, never voted for Merkels party, will not this time either. Looks like the anti Euro Party AfD is stealing her lead and we are getting a national unity government again.

I did not realize the anti Euro party is doing that well. I have a feeling she will do better than expected.

Cramer of the “travel with cc points’ blogger gang”?….Hmm, I need to give this some thought. Apparently,lots of people still tune in to Jimmy so Ingy does not qualify on several grounds: not even entertainment and nobody cares (trying to get him out trolling my site again—>contributes to the TBB Entertainment mission!).

In Extra Pack of (salty?) Peanuts he goes on a major latenightcableTV like advertisement selling a course on how to become an expert for $249, down from $349. So many freebies thrown that the first (and only) commenter asks: “Do we get an extra set of ginsu knives with this?” Lol

It is a fact that German banks ate lots of crap Wall Street arholes sold them!

I have no idea what all of you are talking about. *LOL*

Scariest day of 2007 Financial Crisis……http://www.youtube.com/watch?v=ERtDaAtkvhQ

Mega LOL…for some reason, I had never seen this before! I almost spilled my coffee all over my keyboard this morning. Thank you for the laughs….CLASSIC

All I see when I look at that solar farm, is F*@! – massive boondoggle courtesy of taxpayers, couched behind “green” energy ludicrousness. Who benefits? Not utility payers, not the environment. But WS Banksters sure make a bundle, along with the lobbyists and the legislators with their hands out…

I just really liked how that place looks and how they make this stuff with these cameras! I ripped the WS bankers a little bit above 🙂

It’s Gary Leff’s birthday today (HT Gary’s Facebook page)

It was yesterday I think and wished him happy birthday already

A is for Alcoa

TBB I am going to ask one company per post for you to justify to me why or anyone else should invest in. Because you recommend investing in index funds, I am going to go through the components of DJIA. Just because it’s hidden in an index does not mean you are not explicitly recommending an investment in this and all the other component companies.

So what can you tell me about Alcoa and why I should be betting my retirement on them? What is your basis for justifying that this stock will outperform US treasury bonds over the next 20-30 years?

(and remember, it all with a 🙂 )

That is missing the whole point of what indexing is all about. It is NOT about individual companies, its beauty comes in a total package=index 🙂

I need to backtrack in two Fidelity funds and figure out cost basis as client has absolutely no records from 1984 through 1992 #shootinginthedark

No TBB – YOU are missing the point that indexing puts you in all of these companies. Just because they are hidden in an index doesn’t mean you are not buying their equity!? Are you somehow advocating obfuscated investment!? I thought you were all about transparency 🙂

If you do not think you are investing in these companies (which clearly you are, but you don’t seem to believe), then what exactly *are* you investing in? The “market”?? What exactly is that. And then again, please explain to me why you are confident that will beat treasuries over a 20-30 year time period.

I’m all “ears” 🙂

See my response above. We are investing in an index (actually, several). I don’t get your point about about transparency. How can investing in the S&P 500 not be transparent? We are investing in a way that, in my judgment, will maximize the probability to achieve cherished long term goals. I see your point and is just not my style. We are all different. Hope you achieve your goals, this is what is about.

I think you should get your own RIA license and start advising others 🙂

New clients’ account apps & transfer forms on the way. Could not wait to leave broker & work with a fiduciary advisor who is fully transparent (their words) #winning

The point about transparency is the idea of investing in an index in it’s own right, as if it’s some standalone entity. Are you a buyer of Delta Airlines, Tripadvisor, PetSmart stock? Well if you buy a S&P500 tracker, yes you are! Indices are not a team sport, the whole is not greater than the sum of the parts, the whole is exactly the sum of the parts. But somehow you don’t feel that you are investing in individual stocks?

It’s a little bit like mortgage backed securities back in the hay-day. Delta, TripAdvisor and PetSmart might be dogs on their own, but if I package them up with 497 others, some good, some bad, hopefully people will think the net result is somehow superior. Of course when things go bad, they all go bad together and the diversification doesn’t help. If a German banker can’t understand once individual US mortgage, he has no business investing in a pool of 500. If one budding US retiree cannot understand the business model of one company, he has no business investing in equities.

The only thing I can conclude is that, as I said before, you are investing in the “market”. i.e. you are just ultimately assuming that there is enough demand in aggregate to drive prices up at a rate above the low risk rate of return I get in my treasuries. As you freely admit you and your clients are not able to select companies to invest in individually, so the only thing you can be pinning your hopes on is that the overall collective price increases. And that is totally irrational, no matter how well it has served you and clients. I think I can articulate exactly why my methodology works, I can very carefully asses the risk and I can now with a large degree of certainty the outcome. I can go on etrade today and buy 20 year zero coupon treasures at 39 cents that will pay me $1 each in 20 years time. Barring US government default (which will completely screw up your equities anyway) I know that is going to happen. This is not irrational. Until pension funds got greedy and started underfunding because of outsize equity returns, this is how sober pension funds always invested. But I have yet to hear the argument as to why one should invest in “the market” in the hope collective prices will rise – with no justification as to why they should – instead of the more prudent and certain approach. It’s pretty much like religion – you just gotta believe 😉

I believe. There is plenty of research online that explains passive management. You are not buying it. That’s fine. C’est la vie. Lets move on.

BTW the picture of Michigan Central Station… very sad, very beautiful station. I hope that story has a happy ending

Yeah it is a fantastic building. Not sure what will happen but it will likely not be good.

Looks like you can get 5K points for referring people for Chase cards

Considering the onslaught of posts that occurred due to an extra 5K SPG points, I assume the bloggers will similarly flog this topic to death?

Maybe Deals we Like or MMS will do a 12 or 950 part series respectively on this?

Yeah, maybe not. Expect it to be “just 5000 points” this time around, and maybe a brief mention of it in 1 post, if that

I think you read my mind 🙂

Reflecting on the(last) Ingy post from yesterday, I believe he had one good point in there: if you believe that part of your mission is to help educate/warn the newbies, then you should have a succinct statement somewhere on your site that explains exactly what “the problem” (travel blogs might appear to be giving impartial advice but they are usually infomercials) and how to avoid it.

—Digression:—at a job interview 20 years ago, I was getting a hard sell from the guy who was itching to hire me. After he spoke to me and told me all the reasons I needed to work for him, another employee pulled me aside on my way out and said “Now let me cut through all the bullshit he just told you…” How refreshing! And that’s what you could be doing.

Ingy is right in that, if some newbie stumbles across your blog and is looking for the “cut through all the BS”, he won’t find it. He just gets people like us complaining about those business and, to them, we may look a little “angry” (especially when compared to those friendly marketing shots of MMS in his bowtie, etc.)

What do you think?

Great feedback, thanks!

I started this by…endorsing The Flight Deal recently 🙂

I have a piece of paper with my Top Blogs and Bottom Blogs to avoid. Trying to put it all together and obssesively trying to keep up with the Buzz posts, along with my other commitments, is not easy bluecat.

But I definitely get your point and will look to start educating more….I GOT the message!

Thanks.

I like this idea: caveat lector for those new to this hobby-cum-business.

When I get around to it. Tomorrow morning on my plate is: crank out some stuff for the other esteemed blog I am involved with…

And on it goes…

Remember those wacky FREETRAVELGUYS? Checked in on them to see if they are still in business. Fascinating? post on a mileage run to Seattle where he had Thai Food for the first time? with photos of his meal ……Some world traveler, where has he been living in a cave?

I still get FTG (that other blog) in my Feedly and I just don’t bother even marking for review…

As much as I hate the name and tag line, it’s probably one of the better blogs for family points travel. Shockingly, they take their whole family with them on vacation, and don’t just spend time in hotels. It’s written like a true blog, not the typical BoardingArea travel porn/corporate marketing “blog”.

TBB, you should have an open thread on days you don’t post especially on Fridays so we can complain about MMS interview. I thought I was at the bottom of the barrel when I was interviewed.

Yeah, I feel bad even saying something. I liked Lenticular Travel’s comment at MMS 🙂

That interview was a thorough embarrassment – to the guy and MMS. MMS chose to not publish my comment – basically, I said that I was happy he got over his fear of flying and asked him how he could have been involved in points and living in the UK and NOT know about the departure tax?! Seriously, to put something like that when you say that you have been doing this for a while is pretty sad. And why all of these recent interview with people who just started like yesterday (with the exception of Andrew @ Lenticular Travel who is just cool!)? I know there are many blogs out there that have been around for a while that he has not interviewed yet. I’m guessing he doesn’t want any competition – especially since he has been phoning everything in for some time now. He must really be banking on that maximizer thing taking off. Probably like TPG and his travelcreditcards website – remember that? He lost all his big links there 🙂

The MMS interviews are odd. Last week he ran a piece listing some European blogs, including mine, so he knows all these people exist. And then he interviews people who run ‘blogs’ which are effectively just a list of credit cards, or who only got started in the game last week. Weird.

Yeah, I am not sure there is any quality control done in this MMS website feature. I think he just cranks them out. They are very easy, the interviewee answers the questions by email, a few pics and links and voila, Friday is covered.

There are clearly bloggers out there who should not be blogging, they will be better served focusing their energy in other matters.

Maybe even me lol..

You don’t even realize how much I value a comment like this. I knew I had one shot at this whole blogging thing and I knew you guys could have easily… not accepted what I decided to share… Yeah, this interview is really strange, this guys just completely wasted a chance – get extra traffic and present something interesting… Outside of the non-existing content, this thing alone is simply very weird…

Hi Andrew, I have been traveling the last month and didn’t have time for reading blogs other than scanning the headlines in Feedly. Yours looks really good! I am interested in improving my photography and unfortunately my subject of choice is one of the most difficult to do well – birds! I’ll be reading your blog over the next few days as I get my daily life back to normal.

Welcome back! Looks like you missed the amazing 30k SPG offer 🙂

Thanks George! I already have a SPG card but got an Amex PRG in my Aug AOR. I managed to manufacture $2500 of spend (BB/VR) spread over 3 cards between California & Maui.

PS: I heard about your misadventures with Ad-nonsense. You beat my record, took me just over a month to get banned after I asked some Facebook friends to click my links, LOL! You’re damned if you do, damned if you don’t since most people have Adblock Plus these days.

@Tara: AdSense is more like NonSense 🙂 Apparently some “devoted” readers got a little too happy clicking away on the ads. I self reported that but never heard from Google. I also filed an appeal and still nada from them. It was a learning experience.

Tara thanks! I went through a period of photographing birds and I’m quite good at this, I don’t mind helping you if you need help 🙂 Unfortunately it is harder to travel and shoot birds as there is no shortcuts – you need a long telephoto and those are super big and super heavy…

Super heavy is right! I have a Canon 60D and use the 100-400mm for birds. I recently got a Tamron 18-270 as an everyday travel lens, has enough reach for interesting birds in cities. I kind of know theoretically what I am supposed to do but limited by lack of physical strength and stamina. So I shoot burst and hope some of the pics come out ok! I do Ok with birds perched in the open but when they hide in trees or fly overhead at the speed of light, I’m in trouble! I know my West Papua pics are pretty bad but I think I got better ones in Central America. I would appreciate a critique when I start uploading them if you don’t mind?

Well, this was much better than one a few months ago where the guy put up a page full of credit card affiliate links and NOTHING else! That was just beyond weird. MMS should at least do some minimum quality control for this feature.

In 2013 you and Mile Adventures got a good thing going and, from my observer/reviewer of this space, have stood out. The hard thing in this blogging “profession” is how to keep on doing it at a consistent high quality level and not go completely insane lol.

George, thanks for your encouragement, yeah we talked about it, it takes so much time and I’m really not gonna cut any corners, so it does require a full time attention. It sucks I like my job so much LOL I guess I’m gonna write a post about how “busy” I am, should be a hit!

>>>>>>>>>> I’m gonna write a post about how “busy” I am, should be a hit!

Don’t. Readers don’t like it. I need to cut that down myself, sounds whiny 🙂

I actually just weeded down my RSS list… Takes too much time (genuflection toward TBB; I’m a complete tyro compared to you!) and so much of it doesn’t apply to me at this stage. Started by dumping the Peanutty guy (all I’m getting are ads for his class) and that spread!

Class just has 30, if you act now I am sure you will get lots of extra freebies kicked in on top of the $100 discount. Perhaps even some ginsu knives too!

This comment section is f’in nuts.

Sounds like it is entertaining then? 😉