Another TBB post featuring the most eclectic links around the web such as trading stocks, AI Darwin awards, the Lonely Fans company scaling, the long awaited AMEX Platinum Card refresh is finally here, US interest rates history, AI making us rich or not, tax shelters are back, movie twists, tallest hotels, trips to take in retirement, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend and stay cool.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

Due to new severe credit card affiliate restrictions, there will not be any credit card links in the body of the blog posts other than Capital One Bank and personal referral links going forward. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the big beautiful “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE to avoid clicking to find the one credit card you want to apply for. Or you can always email me, thanks for your support.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

Currently traveling in Larissa, Greece.

PERSONAL FINANCE

We are living in a meme world. And it appears many are just taking shots with their money trading non stop. Including the financial advisors of Congress members: Why You Don’t Want to Trade Stocks Like a Member of Congress. The opening paragraphs of this article by Jason Zweig of the Wall Street Journal is great writing:

The peak of a bull market and the bottom of a bear market have one thing in common: Buy-and-hold investing starts to feel like a waste of time.

Just look at how many investors seem unsatisfied that stocks are merely setting record highs day after day. They want more and more, faster and faster.

As the cartoonist Walt Kelly’s character Pogo said back in 1970, “We have met the enemy and he is us.” For some individual and professional investors, the fruitless pursuit of fantasy profits never stops—although it should. Sooner or later, the quest to get rich quick with rapid, risky trading ends in tears.

And these crazy stats:

Out of 672 launches of new exchange-traded funds so far this year, according to FactSet, 28% are tied to a single stock and 25% are leveraged, amplifying the daily gains or losses of the underlying asset.

Retail traders account for about 50% of daily trading volume in zero-day options tied to the S&P 500

And this final excerpt is something you should think hard about how you invest. I stick with enterprise and leave entertainment in other ways, like say…travel 🙂

Investing can be an enterprise, or it can be an entertainment.

Investing as an enterprise is a lifelong endeavor to build wealth with patience and prudence; your long-term odds of making money are close to 100%.

Investing for entertainment is a roller-coaster ride of trading ups and downs. It’s sure to give you thrills in the short run but likely to leave you shaken in the end; your long-term odds of making money are close to zero. That’s why fast money should be, at most, only a tiny slice of your portfolio.

You can invest both as an enterprise and for entertainment, of course. Just make sure you don’t fool yourself into thinking that investing for entertainment is the enterprise.

Let’s continue with the same theme that investing can be very complicated…only if you let it: Inventing Problems.

Complicated investments are often hard to categorize, and that makes them less-than-ideal from a risk perspective.

To the extent that funds are pursuing so-called tactical strategies, that should be of particular concern. According to a study by Morningstar, tactical funds are among the most risky out there. This is how Morningstar summed up the performance of this category: “They Came. They Saw. They Incinerated Half Their Funds’ Potential Returns.” [LOVE this headline by the way lol]

Read more in the article beating up on interval funds and all kinds of “alts”. And at last:

Fundamentally, the challenge with all of these new funds is that no one has a magic wand. Especially when there are more funds than there are stocks, there just aren’t that many new ways to combine investments into something new and better than what already exists. Despite that, Wall Street continues to roll out new offerings every day. How should you respond? Morningstar’s Jeffrey Ptak puts it best: “The more rhapsodic the sales pitch, the more you should plug your ears.”

Some very interesting stats in this one: Stocks, Housing & Social Security: What Matters Most?

The top 10% owns 87% of the stock market in the United States and 44% of the housing market.

The bottom 90% owns 13% of the stock market and 56% of the housing market.

The bottom 50% has been consistent. The biggest change is a shrinking share of wealth in the 51-90% group and a growing share for the top 1%. The remainder of the top 10% has been more or less unchanged. So basically all of the wealth inequality we’ve experienced has gone to the tip of the spear.

The way I would summarize all of this data looks like this:

- Stocks are the most important financial asset for the upper class.

- Housing is the most important financial asset for the middle class.

- Social Security is the most important financial asset for the lower class.

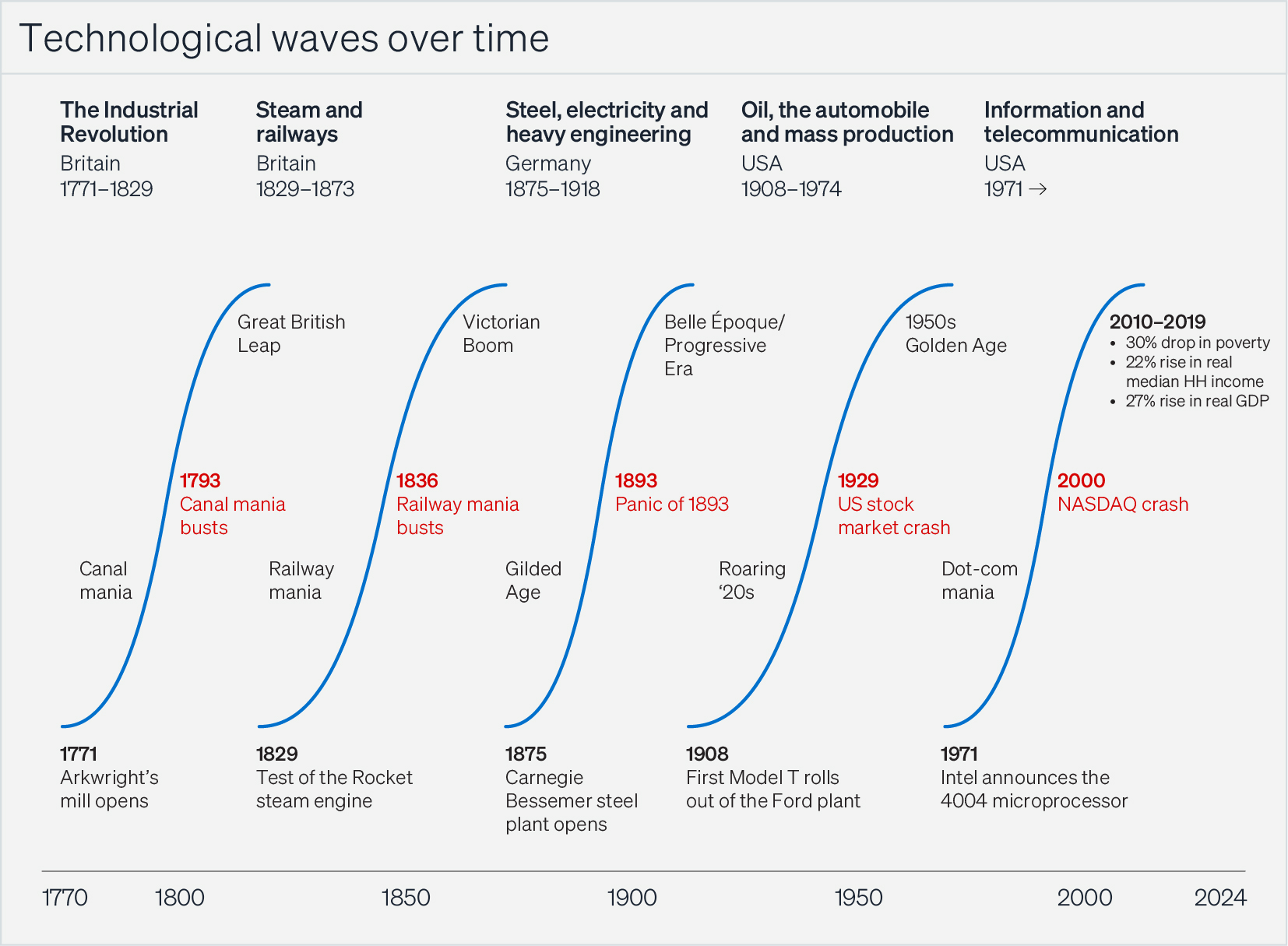

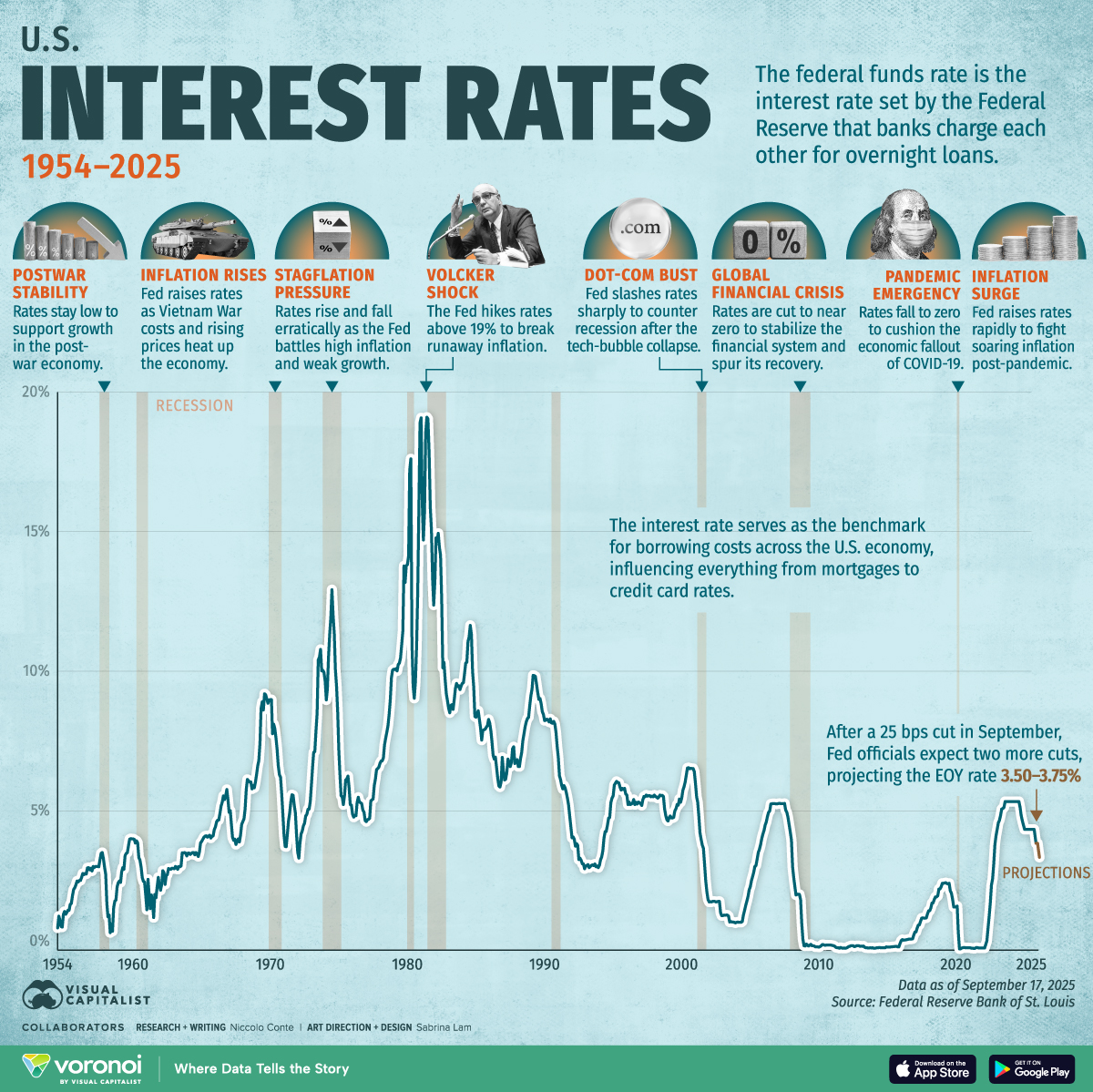

Since the Fed and interest rates are in the news, this is relevant:

SCAMS/CRYPTO/AI/TECH

I really liked this balanced article: AI Will Not Make You Rich. Which goes over the history of prior technological innovations in great detail.

And I like how the article concludes:

There is nothing better than the beginning of a new wave, when the opportunities to envision, invent, and build world-changing companies leads to money, fame, and glory. But there is nothing more dangerous for investors and entrepreneurs than wishful thinking. The lessons learned from investing in tech over the last 50 years are not the right ones to apply now. The way to invest in AI is to think through the implications of knowledge workers becoming more efficient, to imagine what markets this efficiency unlocks, and to invest in those. For decades, the way to make money was to bet on what the new thing was. Now, you have to bet on the opportunities it opens up.

Of course smh: Trump Administration Halts I.R.S. Crackdown on Major Tax Shelters. The Treasury Department is rolling back efforts to shut down aggressive strategies used by America’s biggest multinational companies and wealthiest people.

The administration, bowing to pressure from industry groups, right-wing activists and congressional Republicans, is quickly rolling back several I.R.S. law enforcement efforts, including one aimed at a lucrative tax shelter used by companies like Occidental Petroleum and AT&T. The I.R.S. crackdown was projected to raise more than $100 billion over 10 years. [This should make you furious…I am trying to calm down right now…Serenity now, serenity now.]

Part of my blog mission is “to entertain”. Ladies and gents, I bring you the 2025 AI Darwin Award Nominees. Lol! Remember the Taco Bell AI Drive-Thru?

Taco Bell Corporation for deploying voice AI ordering systems at 500+ drive-throughs and discovering that artificial intelligence meets its match at “extra sauce, no cilantro, and make it weird.”

First.

Quality of the content here has not been impacted by my trip to Greece. At all. Imho. But the impact on me has been a bit too much, I need to concentrate on more important people and things here in my last 6 days you guys. So, judging from history, let’s see what appears here next Friday.

As always, the cc apps and coffees help soften the blows this blog inflicts in me busting my fat ass (don’t ask, have not see the gym yet, sad lol) to bring it to you.

Enjoy the weekend, off to my mother, got her new winter flip flops 🙂

Enjoy the last of your time in Greece. I’ve been looking and redemptions are a bit lean at this time. Worry about busting your butt in the gym when you get home. Live in the moment and you won’t regret it. I’ve deleted Instagram and Facebook off my phone as found having current events thrust in my face constantly was stressful. And I have found it to be a success, I have more time to do other tasks and I do think I feel lighter.

Great to hear that your mom is doing well! Yeah!

And such a great trip!

The complexity of the upgraded cards is remarkable. I

think of the distinction that Herb Simon made between

optimization and satisficing. Do I really want a full-time

job trying to figure out how to use the coupons?

I let my last Platinum card go a while back. Too damned much trouble trying to use the credits, some of which I had less than zero interest in. I’m slowing down on the travel planning as well and thinking maybe time to just relax and pay cash when I do go places. But then I have a stash of points to use yet and start getting itchy to go somewhere, so the sycle begins again.

I am glad you have had such a wonderful trip! You certainly do deserve it. Enjoy the rest of it and hope your return to the USA goes smoothly.

TBB, I found this post full of good stuff….probably because you touched on more-than-usual things I’m currently interested in.

Happy to hear you are having a fantastic time with your kids on vacation–it’s getting so hard to do now for me, as they grow older and have SOs that may tag along. And, of course, I’m the go-to guy for all the logistics (planning and paying!…thank god/allah/younameit for points and miles)

BC, are you still buying those discount Tacos? Check out La Valentina on Hwy 99 in Hazel Dell, es muy fab-u-losa

Don’t dunk on Taco Bell just yet… I have some experience with AI drive-throughs since Bojangles was testing it in our area. Two observations: (1) My wife, who is a non-native English speaker, likes it better than the human-operated drive-through because it’s easier for her to understand. (2) I also like it better because it’s easier to understand since you don’t get the distortion and cracking inherent with the normal two-way communication. We don’t go to Bo’s that much but we never had an issue with the AI order-taker. I think AI drive-throughs will be the default soon enough.

Hope you have a great time in Greece! Looking forward to the trip report!

Hey Buzz,

I heard that UA may restrict Business Class redemptions to holders of the UA credit card. That’s a real coupon for you.

I don’t have time to keep track of all that Amex Plat stuff. Too busy watching my stocks go up.

Finally uploaded a video to my YouTube channel! This is where we stayed for 8 nights in Kefalonia island:

https://www.youtube.com/watch?v=ZYJX0vkitBY

@ Vicky:

Award availability still sucks…five days out. I may keep the 40k UA economy ticket; SKG Hyatt still sold out. Been checking every day now with all my different miles stash 🙁

I need to thank Elon Musk for buying Twitter and forcing me to get rid of it. Lost 12,000 followers but gained back part of my life. I do IG for TBB now and still have FB but only post once a quarter at best. I have a relevant link in next post, maybe hopefully by next Friday. We all need to spend way less time on our phones.

@ DML: I think the bang from all the new Amex Platinum credits is bigly enough to withstand the “pain” of tracking them. I find the value for the personal Platinum compelling now, imho of course.

@ Carl: Finding that I can easily “force” myself to take advantage of the credits now. Which more than make up the ridiculous $895 fee. I just now need to find me a no lifetime language offer for the Schwab Amex Platinum version…

@ Bluecat: This trip came out so beautifully that it is almost magical. I am so blessed, kids just loved it all, especially reconnecting with their five 2nd cousins. The only icing on the cake that remains is me finding a Business class award ticket combined with another night at the SKG Hyatt Regency. Now if my AEL FC team wins tomorrow a huge game that would be so lovely.

@ Nick: OK, taking a rain check on Taco Bell’s AI then 🙂 Oh, yeah those trip reports from the past, they were great as they lasted. Now they are on to IG posts, something about attentions spans and lack of time you know.

@ Sam: Valid point on the UA restrictions.Managed to easily go over $10k on the no annual fee UA Gateway card so it’s all good. With all these new Amex coupons, I think I can take it. Or maybe I am just hopelessly addicted and need to enter an AA like program (not American Airlines) lol.

@

Hey Buzz-

How about going home through London using BA Avios? It ain’t free and BA is barely business class but it’s better than lasagna in UA coach.

Issues has always been departing from Thessaloniki SKG. I think I can stick with lasagna for now,did another round and found nada. Next is to check United again.

Great post Buzz, and great to hear about your trip with the family.

Have a great time at the game today and good luck to your team!

Enjoy the rest of your trip and time with your mom.

Thank you. Four days out now and it always gets hectic. We need lots of luck in the game today.

One personal theory I have on stocks in this current age is that there are so many intuitional investors and managers of huge 401k blocks that have to put that money somewhere. I think this serves to give long term success to long term investors, even with short term falls like 2008, etc. Day traders may get burned at times but long term blue chip type stocks should hold and gain value long term.

Add to that the supply and demand issue. Relatively speaking, there are fewer publicly traded companies today than 20-30 years ago.

Buzz,

Can you get to Madrid? From there you might find room on AA, IB or BA (thru LHR).

Getting Yelled At by Dumbasses

https://www.hamiltonnolan.com/p/getting-yelled-at-by-dumbasses

Rest in peace RIP Jonathan Clements

I can not believe in late September I could not book me a Business Class award to get back to the US from Greece. To add to the insult, my fav Thessaloniki Hyatt Regency is sold out! Both of these facts are shocking to me. And they lead to me thinking this hobby is on its way out. Judging also that this site sold only two credit cards and 10 coffees this month to date and also losing another subscriber and…

going to be doing lots of thinking in my Swiss airline transatlantic coach seat you guys smh.

@ Sam: Don’t want to be splitting pnr’s, family stuck me with a big luggage to check.

Got the Thessaloniki Hyatt Regency day before I needed it, phew! For only 6,500 points per night that is #winning.

If I could get me a business class award seat to open up in one PNR SKG-DTW on 9/26…hours remain before I can cancel my coach UA award.

I can cancel and get miles back up to actual departure or is there a 24 hour no cancelation period/lose my miles period…Never cut it so close!