Another TBB post featuring just a few eclectic links around the web such as our yo-yo economy and how weird everything has been after the pandemic, ridiculous hustle bros now selling AI, credit card rewards truth and how to win in this dangerous game, veterinarians and all the killing they do and a deep dive on Japan after the assassination of Abe Shinzo and the history behind it all.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or visiting our LINKS or Donate

You like my blog? Send a link to someone please!

This blog publishes every Friday and some Tuesdays.

Welcome to all new blog readers from George, your diligent curator of the BEST web content I find and share with you. No ads, no clickbait.

The Yo-Yo Economy

I have been blogging here how the pandemic has changed, well, everything. It has thrown us all off center and we have been trying to get back to normal ever since I guess. We are getting there. Slowly. All in our own pace. We have all changed, it sure is weird…

I said the rental market was being weird. I said home sales were being weird. I said consumers were being weird too. At one point, I threw up my hands and cried uncle by saying we live in the “everything-is-weird economy,” hoping to save myself some time. Then calls for a recession came pouring from the heavens, and I was forced to say those were weird too.

One theme across sectors is that people assumed the pandemic would forever change the way we live. In fact, what we experienced was more like a dramatic interruption of existing lifestyles than an acceleration of some new future.

Another theme has been the consistent mismatch between supply and demand, with companies struggling to anticipate and satisfy consumer preferences.

An economy that yo-yos in so many ways is a beast to deal with. It’s hard to manage if you’re the Federal Reserve, which was clearly late in deciding to raise interest rates to fight inflation (and might now be late in recognizing that the inflation crisis is over). It’s hard to campaign on if you’re the Biden administration, which has struggled to emphasize ascending good news (unemployment is down!) when there’s always some indicator of yo-yoing in the opposite direction (services inflation, yikes!). It’s hard to predict if you’re an investor; various indices are near their inflection point, but it’s not entirely clear when they’ll peak or bottom out. It’s hard to deal with as a procurer or an inventory manager struggling to find the Goldilocks zone between headline-grabbing shortages and profit-murdering gluts.

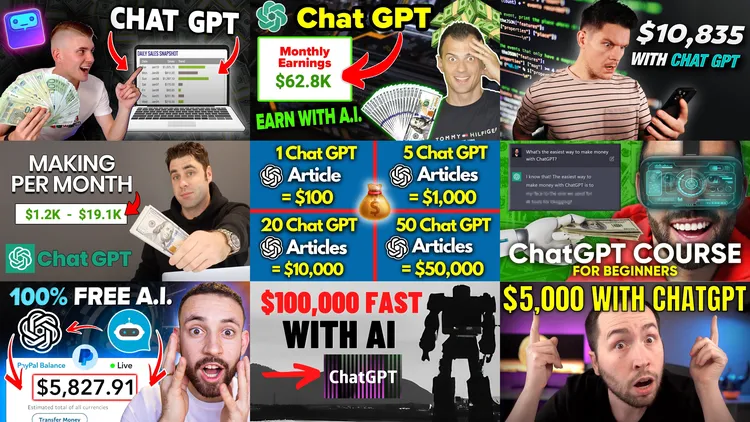

Hustle bros are jumping on the AI bandwagon

Oh boy, here come the scammers again! I get triggered seeing all these pumpers online, maybe I have a problem and should seek a therapist. Or maybe I am taking my anger out in this blog, self therapy in a way, lol! It is amazing how hot things attract legions of get rich quick schemers and charlatans. And so repulsing!

“It’s one of the craziest softwares I’ve ever seen on planet Earth, and you can become a millionaire just using ChatGPT I guarantee you,” advises a young man in one video wearing a “CEO” beanie.

“If you start today, you could literally have a million-dollar course creation business by this time next year,” says a woman in another tagged “#investinyourself,” #6figuresidehustle,” and “#7figurebusiness.”

Skim their advice and some patterns quickly emerge. One common scheme is to sign up to various freelance marketplaces — Fiverr, Upwork, etc — and advertise your skills writing blog posts and ad copy. Then, when a request comes in from a client, just plug their brief into ChatGPT and send over whatever it generates. If your client doesn’t like the results, just ask them for notes, feed those into the chatbot, and send the results back again. As CEO-beanie puts it: “At that point, you’re having a robot do the work for you. It literally costs you zero freaking dollars. The ChatGPT just builds the freaking paragraphs. All you gotta do is keep presenting it to the guy until he freaking likes it.” [Whaaaat? I need to hit something right now, so many morons falling for this crap, never ceases to amaze me!]

One strategy involves using ChatGPT to answer popular questions on Q&A sites like Quora (e.g., “how to lose weight”), then stuffing your profile with affiliate links in the hopes some curious soul will click through. [Wait, I have seen this before in so many other blogs lol]

As with all get-rich-quick schemes, each video raises an unanswered question: if your method works so well, why are you telling me? But if you’re an influencer, you make your money not by following your advice but selling it, through paid newsletters or video hits. [Yep…and so many fall for this is shocking!]

Your credit card rewards might not be worth it

They are not worth it for most people out there. It does not apply if you are good at them. And readers of this blog, including yours truly who has been at this for thirty years, are really good at this!

Rewards can come at a hidden cost, often to lower-income consumers and people who pay in cash after merchants, who pay higher swipe fees for fancier cards, pass on extra expenses. But rewards cards also come at a cost for people who, to put it plainly, aren’t very good at using them. With all the websites dedicated to the ways to game the credit card system, it’s easy to overlook all the ways that, if you’re not careful, the system is gaming you.

Rewards cards are only really useful for consumers who are generally credit-savvy. Less financially sophisticated consumers — meaning people with higher unpaid balances or who don’t pay off their cards month to month — ultimately end up losing out. They wind up subsidizing the rewards of people who are a little better at credit, wherever they fall on the income spectrum. More than half of credit card customers are “revolvers,” meaning they don’t pay off their full balances each month. [DON’T be a revolver! NEVER EVER!]

How much bang people are getting for their buck, if any, really shifts across the credit spectrum, according to Presbitero and his colleagues’ research. They found that people with super-prime credit (those who have a FICO score of 780-850, the upper limit) on average earn $9.50 in rewards and pay $7.10 less in interest each month on rewards cards compared to run-of-the-mill classic cards. Subprime consumers, meaning people with credit scores below 660, earn just $1.80 in rewards and pay $6.40 more in interest. “We estimate an aggregate annual redistribution of $15 billion from less to more educated, poorer to richer, and high to low minority areas, widening existing disparities,” their report reads. [In thirty years doing this I have never paid any interest to the bank, be like George!]

Whatever the case, when people screw up with rewards cards, they pay a price — and that price ultimately helps pay for the rewards of people who don’t. [Sadly, it has always been this way…]

I wish the system was fairer because lots of the little guys are getting hurt…Get educated and help others get educated too. It takes a village…oh wait, maybe I should not start that next…

Our Business Is Killing

I never understood why veterinarians are at such a high risk of suicide. Until I became one.

If we ever get another pet I am going to be super nice to my veterinarian. Not that I wasn’t of course when we had our cat Fluffy. Saying goodbye to Fluffy was one of those life changing events in my family. And the pain is stopping us from getting another cat. Or a dog. Reading such stunning articles makes me more at peace not becoming a pet owner again. We’ll see what happens…

Reading this from the vet’s side is raw and, you are warned, may make you emotional reading what the owners of an injured dog named Lacey went through and what they decided at the end…

Until I started working, I never understood why veterinary medicine has such a high suicide rate. Female veterinarians in clinical practice are 3.4 times more likely to die by suicide than the general population; male vets are 2.1 times more likely. Three-quarters of these deaths come from vets in small animal practices like mine. There are a number of reasons for this. Poor compensation is a major factor. Another is the crushing expectations of clients. Then there are the long hours, lack of work-life balance, and isolation from colleagues. And the euthanasia gets to us. Really gets to us. Cases like Lacey’s haunt you. I didn’t see her owners again, but I know they have more pets. They just won’t bring them here.

Yamagami Tetsuya’s Revenge

Yamagami Tetsuya is the troubled man who assassinated former Japan Prime Minister Abe Shinzo. And you will learn a lot about the background of his grievances towards the Japanese political system who he deemed responsible for a, well, really troubled family life. His father and brother committed suicide and his mother basically was scammed/bankrupted by the Unification Church. The article takes a deep dive between the influence of this church and the Liberal Democratic Party LDP, in power for ever it appears. It is very educational and learned a lot about religion and its influence on the whole country.

Yagamami invoked no broader ideological agenda, which has made it easy for sympathizers to focus on his personal story of revenge against the Unification Church and its patrons. The basic narrative of Yagamami’s sympathizers is one of catharsis and revenge: those who have run the country into the ground have faced consequences for their actions. Petitions have come in for leniency. At the detention facility, Yamagami has received a steady stream of cash donations to fight his case.

To the extent that Yamagami’s case generates sympathy, it is largely because he embodies the slow decay of the Japanese social order: the failed son of a despairing salaryman, his inheritance siphoned away by one of the nation’s most powerful organizations. As society decays and Yamagami’s enemies tighten their grip, there are fewer and fewer ways for people like him to improve their state. The Japanese family is evaporating, along with the future generations of the Japanese population—a problem now common to Asia and much of the rest of the world. The LDP’s hold on power is a signal that this status quo is only set to continue.

This blog’s income comes from smart responsible readers who love the frequent flyer miles and points game and choose to get travel rewards credit cards in my site, thank you!

HOT CREDIT CARD OFFERS: 90k CHASE Ink Cash, 90k CHASE Ink Unlimited, 75k Capital One Venture X, 100k CHASE Ink Business Preferred, 60k CHASE Sapphire Preferred, 60k CHASE World of Hyatt Visa, 20k CHASE Freedom Flex, 175k IHG Rewards Premier and many more, including many AmericanExpress cards, including Delta, Marriott and Hilton cards! Please check out my Affiliate links. Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. If you do not see a credit card with my affiliate links, perhaps I could refer you?

Some of the links are behind a paywall. You can try to read them using Archive.is.

TBB

travelbloggerbuzz@gmail.com

Follow TBB on Twitter @FlyerTalkerinA2.

You can subscribe to receive every post below:

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The sadness of having to put your pet down is shared among the family and the vets. It is good not to forget that.

Thanks for the links.

Silver! FTPNW! I read that Vet story yesterday somewhere online and it sure tugs at the heart strings all right! Good stuff here today and thank you, sir!

Japan… that society is different and this article carries on from others about how things are there and sometimes I just cannot wrap my head around it all.

Carrying interest on cards is a benefit to us that do not do that! I think though that slowly, there will be reductions in the fees the card companies and banks can charge and that is gonna impact us more than anything else. But, earn and burn as they say. I been earning too long and not burning much so starting to plan some serious travel. Since my TIA late last year I have had to reconsider a lot of things, especially thinking about how long I have to DO travel!

Love seeing your post, as always! Hope all is well with you!

Regarding ChatGPT, this is just the beginning. You’ll see a lot more AI based search engines this year. It’s forcing the hand of Google, because either their AI technology was threatening it’s traditional business model (awful search engine) or they realized it’s frequently a generic BS machine. But yes, if you’re a real estate agent it can help you to quickly generate material for a Zillow listing. As for ChatGPT scammers, I can’s see this lasting long. Anyone can use ChatGTP. Speaking of scammers, I don’t think there will be any crypto ads in this Superbowl. Be like Larry David. Don’t get into crypto (FTX)!

Thanks for the comments. Been a hell of a day over here, way deep in tax mode.

Hopefully this blog appears with a new post someway somehow on Friday…

TBBGPT coming up you guys…lol.

Hey Buzz-

When I first came to TBB 10+ years ago, it was for the miles info, to help you make fun of the pumpers (Ingy-come back, we miss you), and for the occasional good story/commentary. Now it’s for the great articles that help make sense out of the crazy path we’re all on.

On miles and the hobby-I have a big pile but my current intention is to burn them off, then see where the game is, maybe 2 or 3 years from now. Awards TATL are mostly 150k and up. I ran the numbers and compared my 2.5% cash back card with applying for new cards, and I found it’s better to wait. That’s because I allowed for:

1. Discount due to award availability (cash works anytime).

2. Discount due to lousy routing on many available awards (cash works anytime).

3. Discount for risk of future devaluations.(No risk here, only certainty).

4. (The big one) ttime required to stay up on all this (cash is…well, cash).

Do you now how many households had green stamps in a kitchen drawer for years before throwing them out?

On losing our dog Kelly (who made 15 round trips TATL) (and never got either miles or status), we tell people that we are between dogs. He left us in 2009.

And here’s the key to the current universe:

“One theme across sectors is that people assumed the pandemic would forever change the way we live. In fact, what we experienced was more like a dramatic interruption of existing lifestyles than an acceleration of some new future.”

No kidding. I even got into with the manager of-get this-an Apple store. He thought I was being unreasonable to think Apple should stop sending us notices asking for our trade-in phones that we already gave them. With receipt in hand. He said “There’s nothing we can do”.

And I think he was right.

Thanks Sam for yet another great comment.

Glad to know I am not the only one who has not gotten a new pet after going through the heart break of losing one.

Yes, my blog has evolved since those early days. It keeps evolving like all of us. Would you ever have predicted Ben at OMAAT becoming a parent blogger? 😉

You make a great point on the miles/points value in 2023…Of course, you would never hear that from mainstream bloggers pumping their cc affiliate links, sad lol.

To all: Having major issues with my mother. Something is wrong with her stomach and digestive system. Looks like I am taking her back this Sunday, thanks to United miles (and business class tickets creeping up to now 81k one way). Not sure how long I will stay in Greece (if we end up going that is). Horrible timing with tax season. Aging sucks.

Maybe I get TBBGPT to pump a post here tomorrow…