Another TBB post featuring the most eclectic links around the web such as US Dollar currency reserve myths, bank CEO pig butchering victim, CrimeCon, all market forecasters suck, 401(k) millionaires number hits new high, most wealthy countries, the origins of uncovering the McDonalds Monopoly fraud, 15 remote islands, tiniest hotel rooms, 120k Chase Ink Offer expiring and much more and of course always all of the most important developments in the crazy world of miles and points. See you next next week, enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No sponsored posts. Also, no AI!

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to a curated at least weekly post of the best web content along with my commentary. Here to Educate primarily, sometimes Entertain and if I get to Inspire you, well, that is a bonus.

This is a one man labor of love operation, enjoy it while it lasts.

PERSONAL FINANCE

Most people are not rich because emotions get in the way. Meaning, their own brain cells interfere in many ways. And with the hyperactive media world that has moved online bombarding us with messages it is very hard to, you know, calm down and just invest in a simple low cost way and not mess with such a proven boring system. It is boring by design! You should leave excitement for your hobbies, not for your investment portfolio. And never convince yourself that you know better. Stay humble. Easier said than done, we are humans afterall. Anyway, don’t be like Irving Fisher: A Cautionary Tale of Forecasting. For the record, when I am asked for a market prediction, I always respond “It will fluctuate” and I am always correct haha. If you don’t remember who Irving Fisher was, he was the guy who said this on October 15, 1929:

“Stock prices have reached what looks like a permanently high plateau… I expect to see the stock market a good deal higher than it is today within a few months.”

So please:

A weird thing happens when confidence and optimism get distorted. We overestimate the likelihood of a good outcome. Fisher had both in spades. He believed his forecasting approach was superior. He also believed in the New Era ideology of the time. He overestimated his ability to predict the future and that future looked bright. He was also brilliant and knew it.

And please diversify because this can happen:

Fisher lost everything and never recovered. The belief that he could predict the future, combined with massive margin debt, was his downfall.

When people start bitching about the US dollar and, you know, the “US reserve currency” blah blah blah…my eyes roll and I look for the exit to get away as far as possible from these people. Why? Well, this guy really explained it well and I am in full agreement. Read Part 2) Reserve Currency Myths That Refuse to Die.

Meanwhile: Number of 401(k) ‘millionaires’ reaches new high.

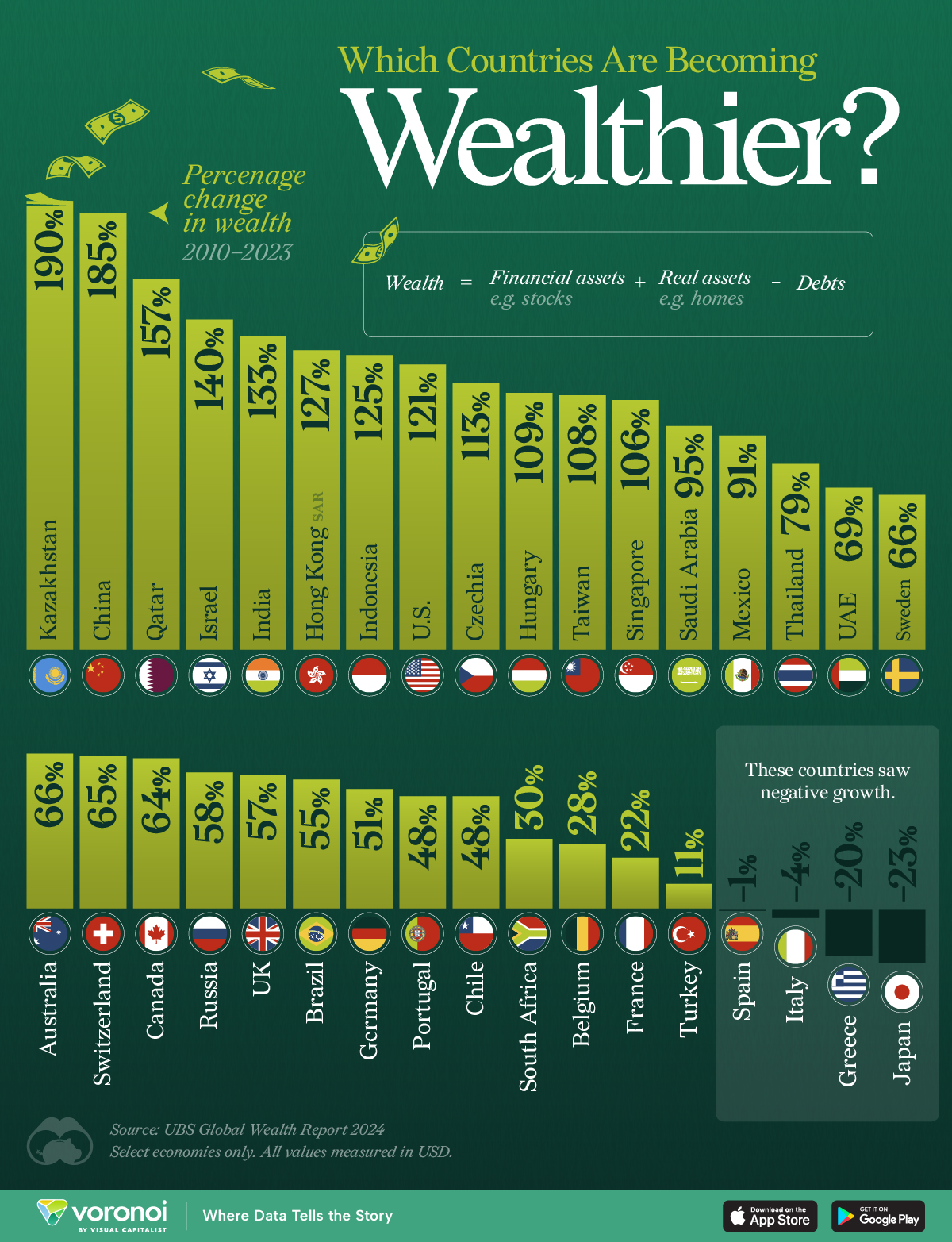

Very interesting chart, not sure I would have ever guessed Kazakhstan would be #1. And Greece at -20%, ouch. Which Countries Are Becoming Wealthier?

SCAMS/CRYPTO/AI/TECH

Remember when some time ago we learned of a small bank CEO who fell for a scam and sent millions only to lose everything and have the bank fail? Well, the cruel ending to this sad story is in: Cryptocurrency ‘pig butchering’ scam wrecks Kansas bank, sends ex-CEO to prison for 24 years. The article goes deeper into how he fell for the scam. I am reading it and I am angry because it is so obvious that it was a scam. And how he was all in and never stopped believing that he will make all the money back. And this is the bank’s CEO, wow! If he fell for it just imagine how good these scammers are. One of the saddest stories involving scams I have read recently. I am not sure 24 years is appropriate here, considering:

…Hanes never realized any profit and lost all of the money he stole as a result of the scam.

Another one from the past with a follow up article revealing juicy details. You all remember the scam behind the McDonald’s Monopoly Game. Well, here we go: How McDonald’s Found Out Its Wildly Popular Monopoly Game Was a Fraud. Learning how the executives were informed by the FBI and what happened after that in detail was amazing. So well written, thanks to the author.

This blog is not going to blog itself. I rely on you readers helping it grow as I don’t have time to do any promotion/marketing. Which leaves the content clean of intrusive sponsoring posts and stupid ads and stuff like that. So, please:

You like my blog? Send a link to someone please!

ODDZ & ENDZ

I had no idea there were conferences like CrimeCon. Where the presenters are The BTK Killer’s Daughter. Gabby Petito’s Parents. JonBenét’s Dad. I find it offensive that people will pay lots of money to attend. I can see so many other more constructive ways to cope. Your thoughts? Share in the comments.

These are great: A Few Little Ideas And Short Stories. My favorite is:

A similar story, from investor Howard Marks:

I tell my father’s story of the gambler who one day hears about a race with only one horse in it, so he bet the rent money. Halfway around the track the horse jumped over the fence and ran away.

Still trying to find a good use of this site, maybe record messages to send to myself? Or to my blog’s imaginary staff? Tuttu. Tap to Record. Record anything. Save indefinitely. Share everywhere. Completely and totally free.

TRAVEL

When my blog gets discovered, will I be able to buy one of these? Chart a yacht with faithful few blog readers and sail to Pitcairn island? Ok, I am laughing and you should be too lol. 15 Remote Islands You Can Actually Visit. This link may be a repeat, sorry. I will bring it up with my imaginary intern to be more careful going forward ok? Before she quits working for free!

Well, I prefer staying in large Hyatt suites lol. But, I must admit, these are very unique! Eight of the world’s most extraordinary tiny hotel rooms. The most stunning is this old farmhouse in eastern China reopened as a capsule hostel, bookstore and community library, sleeping 20 in tiny single bed-sized compartments concealed between bookshelves made of local bamboo.

Amazing site, I always wanted to visit this part of Greece. I better do it before I get too old. Anyway, sometimes I wonder about these monks, what happened to them to just completely shut off from the world and live here alone? One monk has not left his tiny shack for 64 years! The Hermits of Karoulia of Mount Athos.

SAVE $100 FOR 2024 THE EXTRAORDINARY TRAVEL FESTIVAL

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/CREDIT CARD CORNER/MY ACTION

I will feature many expiring credit card offers today in a separate section, there is always a lot going on, this hobby is never boring.

GENERAL NEWS/PROMOS/NEWBIES/ETC.

In this hobby you never forget the feeling the first time you fly Business class knowing you only spent some miles and almost everyone around you paid thousands of dollars. It is a euphoric feeling indeed. Want to fly Business Class? These Are the Easiest Flights to Book With Points.

If you were looking to go in that part of the world: Best ways to get to Australia, New Zealand and the South Pacific using miles.

Bilt gets way too much press than it deserves. Especially for a company that never gave a Signup Bonus on its credit card! Anyway, you wonder why it does not even get more than a mention in this Wall Street Journal article lol: Pay Your Rent, Get 2% Cash Back: Landlords Join Craze for Rewards. And of course they get way too much press for nothing burger type “news” such as the new partnership with Walgreens, zzzzz. And of course yet another boring Rent Day which starting next month become THE nothing burger indeed with a maximum earning of only 1,000 points instead of 10,000 points. Finally, if you are a blogger pumping the transfer bonus to Avianca and Virgin (two of the most horrific devaluations recently) while pushing you affiliate links, shame on you. Not that this will stop you, it just makes me feel better about myself.

A bunch of promotions to register for:

Register to earn up to 20,000 Bonus Points at hotels within The Unbound Collection by Hyatt

Marriott Bonvoy Fall Promo: Earn 2,000 bonus points on stays of 2+ nights worldwide

Best Western Double Points on every qualified stay

Best Western Earn 7.700 Bonus Points on every stay booked online

Bunch of Southwest elite promotions, log in to see if you are targeted to earn status faster.

CREDIT CARD CORNER

I will indicate with NEW every new section as the rest is the same from the previous blog post and will finally roll off those parts as offers expire, thank you.

NEW: So many hacks happening everywhere all the time these days. In case you need to do this: How to Freeze Your Credit for Free and Why I Finally Froze Mine.

NEW: Looks like a 90k Ink Business Unlimited offer is coming…

MY ACTION

Since Delta moved into Seattle to compete with Alaska Airlines we consumers have benefited. Especially on the direct Seattle – Detroit flights with both airlines going at it, more please. Also, for several years Delta Airlines has run a promotion giving away Delta Skymiles based on the outcomes of the popular Seattle Seahawks NFL team games but only to Washington state residents. And every year very briefly I wished I qualified. But last week my daughter moved to Seattle so I alerted her to change her address in her Delta Skymiles account to the rental residence she is about to move into. She did and then boom, I took care of it and looking forward to some free Delta Skymiles, go Seahawks! Also, this year promotion participants get to enjoy Priority Boarding with Group 5 on Delta flights, sweet.

Many in this hobby have been wondering about this: My big bet on Hawaiian Alaska Mileage Plan. I think I am going to pass for now. The time lag before these Hawaiian miles become Alaska is just too long imho. Who knows what happens until then! I don’t have that many Amex points anyway, about 100k only. But expecting close to 275k next week when my 250k Amex Business Platinum bonus posts. And yes I did think about going for some of the easy hanging fruit of the credit cards. But, I am trying hard to limit my mental bandwidth in this space you guys. I have way more than 4 million miles at this point, I recently closed three accounts but opened new four ones and don’t want to add to this and the cards earning Hawaiian miles are with Barlcays bank and I don’t want to get into a ridiculous back and forth with them, this bank is such a pain to do business with. I alerted son to the 20% transfer bonus from Amex to Hawaiian and he said he will think about it. And most likely do nothing. Which is ok I think. Alaska Mileage Plan will definitely devalue in the near to not too long future.

Daughter in her second day at Microsoft received the same juicy targeted promo for Alaska Airlines elite status for Microsoft employees. It is the same exact promotion her brother received for Meta employees. So, she must sign up by December 31, 2024. She receives MVP elite status right away. And then she has six months to do some flying on Alaska Airlines: 2 round trips to earn MVP, four round trips to earn MVP Gold, 10 round trips to earn MVP Gold 75k. Whatever she qualifies for will be good until 12/31/25. Regardless, she keeps MVP for six months. She is currently not scheduled to do any business travel like her brother who managed to hit MVP Gold fairly easy when he enrolled in this promo last year. The fine print in this promotion is that Saver Fares do NOT qualify. She has a few trips scheduled on Saver Fares before the end of the year that she can try for an upgrade (long shot) if she enrolls in this promotion before she flies. But the six month clock starts. We don’t know yet when she will enroll, developing. I sent her this page in the Alaska Airlines website listing all the elite benefits. Never in my wildest dreams I would ever think that both of my kids will be elite flyers with Alaska Airlines, amazing.

I started looking at using the statement credits of my new Amex Business Platinum card while waiting for the 250k Signup Bonus (plus the points from meeting the spend) to post next week. So, I switched paying my TMobile cell phone bill via bank ACH because paying via a credit card no longer qualified for the $30 automatic payment discount. So, I’ll take the $30 discount any day and give up on the points (and possibly insurance benefits that hopefully I will not need). I guess I could try to make one time payments online using my Amex card to use my $10 monthly credit but this may mess up my present arrangement and it is definitely not worth my time to worry about. I bought $100 in my United travel bank. When this is credited back, I will do it again for another $100. Hopefully, this still works and boom $200 off the annual $695 annual fee. New Priority Pass club lounge card is on its way to me. I told my daughter to find something she really needs on the Dell website and send me the link so I can buy it with my Amex to claim another $200 credit, waiting. I get Hilton Gold with my Amex Hilton Surpass card. I enrolled to get Marriott Bonvoy Gold, even though I was still Gold, just in case I ever stay at a Marriott to get free water lol. I have Global Entry of course, do I even go for CLEAR, even if it is free?

Still no insurance bill posted online. I am counting on it to finally finish the minimum spend on daughter’s Chase Ink Business Preferred so she can have another (almost) 130k Chase Ultimate Rewards points. I tried to prepay it online but it is not possible. I am going to call them today to see if I can pay it over the phone. Maybe I just enjoy these bigly additions of miles and points to my arsenal you guys #addiction.

I am loving the new Fontaines DC album “Romance”. My two favorite tracks from it are Death Kink and of course Starbuster. I was looking forward to see them live but my ear doctor recommended my right ear to take it easy. I guess love of loud music over the years caught up with me, protect your ears I keep telling my kids now.

Maybe I post this in the final post of each month?

August 2024 Blog Stats:

Buy Me A Coffee coffees sold: 13

Credit Cards sold: 7 (one is mine)

Credit Card referrals: None

Other revenue: $0

Email subscribers: 555

Instagram followers: 133 (I try to post here regularly, actual current travel and also past travel photos)

YouTube subscribers: 28 (TBB enterprises recently added Mrs. TBB to help attract new subscribers, lost one, not working, should she be let go? If not, Subscribe!)

If you have any suggestions on how to improve this online marketing thingie please let me know. I was an accounting major in college and it shows lol.

Current thinking is I take a break from blogging when I leave for Thailand. And then move on because I am tired after almost 12 years! I have been saying this for years so we see what happens. I put a lot of work into this and when I see other bloggers full of crap making infinitely more from their blogs and me scraping for every click to reach minimum wage, well, you know, after a while it gets old. So, at the very least, I enjoy reading comments and emails telling me my blog helps you, it’s these psychic rewards that have kept me doing this all these years really.

ADVANCED

This is a really good reference: All About the 50 Airlines You Can Book Using Aeroplan Points. I added this link to the great (in my own biased opinion) TBB Miles and Points RESOURCES Page.

A person I know got TSA Precheck. After repeatedly told to get Global Entry (that comes with TSA Precheck). So, how do you get Global Entry now while you have TSA Precheck? If you know, please let me know.

MILES & POINTS

HOT CREDIT CARD OFFERS: 75k CHASE Ink Business Cash, 75k CHASE Ink Business Unlimited, 75k CAPITAL ONE Venture X, 75k CHASE United Business, 150k AMEX Business Platinum, 200k CAPITAL ONE Spark Cash Plus, two 120k CHASE Southwest Business cards, 150k CAPITAL ONE Venture X Business, $1,000 Cash Back CHASE Ink Business Premier, 15k AMEX Blue Business Plus and many more!

As of today, I have burned 1,446,957 miles/points year to date (1,148,286 in 2023) and have 4,155,374 miles/points in the bank. Some do drugs, I do miles lol!

WELCOME OFFERS & TRANSFER BONUS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer and/or a lender releases (or is about to remove) a transfer bonus with one of their partners? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click through one of the two links above

2. Create an account

3. Subscribe to the email notifications of your choice

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

Good morning Buzz,

Looks like I’m in the running for a medal today.

I’m definitely curious about the travel conference in Thailand, never been, I hear it’s lovely.

Maybe take up swimming?

Have a great weekend, and thank you as always

Thanks for the heads up on the McDonald’s monopoly fraud. Wow!

Let me put in a plug for the IHG hotel group. In the last few years I’ve stayed

a three of their brands and all of them have been very good value for the points I spent. .

I prefer Hyatt but IHG has replaced both Hilton and Marriott in my ranking.

For those of you with Max, there’s a good documentary about the McDonald’s fraud called “McMillions”.

Hey I liked that thing with the short stories and ideas! Might have to go find that book the Monopoly excerpt is from, too. Great stuff on the blog today and as always, Thank You!

@ David: The ETF conference is full of hardcore travelers. I feel inadequate among them 🙂

Gym with pool is closed, opens on Tuesday. Went there a few times, I just dread the whole experience…but I need to force myself to go there often.

@DML: Glad IHG works for you. For me, maybe it moves up to a distant 3rd 🙂 Yeah, I was shocked abt that Monopoly article, blown away.

@ Nick PFD: Maybe when wife gets a 250k Amex Platinum…it will be added as an entertainment credit so we can afford it lol.

@ Carl: I almost cut that Short Stories link, it was a late addition.

Thank you for taking the time to comment, much appreciated. Lately it feels like the world of miles and points has passed me and relegated me to the zone of a few clicks and slow painful death. Your comments help!

I did GE entry with preexisting TSA Pre Check. Just do the normal application on line . When you receive approval they told me to continue using the existing pre check number until it expired then use the GE number. Haven’t tried it to see if it works as my pre check only recently expired and not sure if we will ever return to the USA again. One tip, when I was looking for an appointment after receiving approval, they were few and far between but were readily available in Singapore so you if are serious about it get your skate on and make it happen and interview there.

For GE you just apply like normal. There’s no benefit/short cut if that’s what you mean. My mother is one of those people.

It’ll never happen but I’d love for the bloggers pushing Bilt and saying that the horrific recent devaluation isn’t so bad to clearly specify their relationship and compensation from Bilt. It’d be nice for it to be clear so we know whose side they’re on when they write on the subject. I don’t mind someone making money off me; I just want to know how and have some idea how much.

@ Vicky: Good info to know, thank you!

@ Sexy_kitten7: Aware no benefit shortcut, was just wondering what happens when you already have Precheck and shortly after apply for GE. Good info to know here. Will tell him to proceed or maybe just wait until Precheck expires and then just do the right that should have been done all along, apply for GE.

@ Christian: I am sure Bilt executive team will be right on it. Lol. All those bloggers wined and dined on the private island feel obligated, this is how marketing works. Even after repeated beatings by the program, they still can’t come out and say that Bilt sucks. Still can’t believe watching the CEO just waffling for almost 7 minutes “responding” to direct questions when that Wells Fargo story came out. And now Bilt is saying it won’t have info on what you order at Walgreens. Yeah, riiiiiiight.

The credit card clicks here have been totally silenced since 8/16/24. I mean, absolutely dead. And I feel horrible for having so much content here trying to sell them. Why do I suck so bad in marketing? Ok, don’t answer that. As this continues, I may even get kicked out from my second credit card vendor before the time comes to travel to Thailand and then my conscience is clear.

Lots to read, trying to be more eclectic to dial down the time spent on this blog to align with $ coming in. Always losing this battle lol.

Spent more than two hours with daughter on Whatsapp helping her enroll in the Microsoft benefits, 401k, HSA, etc. She hardly will have any $ left on her paycheck after fully maximizing for the year both 401k and HSA lol.

In case you missed it, the 120k Chase Ink Business Preferred ends very early am on 9/5/24.

Check it from my favorite bank here: https://travelbloggerbuzz.com/credit-cards/

Happy Labor Day

P.S. My beard has grown and starting to resemble a lot more of Santa Claus instead of George Clooney woohoo.

Holy crap are people stupid: https://nypost.com/2024/09/01/us-news/tiktok-chase-bank-glitch-shows-people-trying-to-exploit-atms/

Indeed, sometimes I wonder about humanity smh.