Another TBB post featuring the most eclectic links around the web such as average salaries around the world, the rideshare mafia, the top flight routes, more new sweetened card offers, sleek salesmen selling dreams, the risks we miss, LVMH’s Arnault story, the tragedy in the Bangkok Grand Hyatt, best lake towns and much more and of course always all of the most important developments in the crazy world of miles and points. See you next next week, enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or visit our LINKS

You like my blog? Send a link to someone please! No clickbait. No sponsored posts. Also, no AI!

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to a curated at least weekly post of the best web content along with my commentary. Here to Educate primarily, sometimes Entertain and if I get to Inspire you, well, that is a bonus.

This is a one man labor of love operation, enjoy it while it lasts.

PERSONAL FINANCE

The Wall Street Journal lately has been publishing some articles that make my blood boil. Like this one: Investors Keep Faith in America’s ‘Apartment King,’ Even in Tough Times. Brad Sumrok’s pitch drew thousands of people seeking riches in rental apartment buildings but trouble now looms for many. You may have noticed I have a very strong dislike for people selling a dream to others and making money off of them. And doing it in a clearly arrogant way like this guy. Dead giveaway when this guy was inspired by Robert Kiyosaki! And he met his wife at an event by another guru salesman, Anthony Robbins, I guess it was love at first sight smh.

During a 2021 recruitment video, the year before rates began to climb, Sumrok lifted a fist and cinematic string music swelled.

“We’re gonna do what’s called an incantation,” he told the crowd, initiating a call-and-response.

“I am a millionaire apartment investor,” he said.

I am a millionaire apartment investor, the crowd responded.

“Yes, you are,” he said. “I am financially free.”

I am financially free, the crowd echoed.

“I live life on my terms.”

I live life on my terms.

Excuse me, I took a break. To barf, yikes. Anyway, there are always suckers out there:

His training programs, costing as much as $35,000 a year, gathered thousands of followers…

And then interest rates rose and you won’t believe what happened next. Here is the direct link to the article for you with a WSJ subscription. Some of the comments are great.

Jonathan Clements, the founder of Humble Dollar and former columnist for the Wall Street Journal for many years, recently revealed he has terminal cancer. And the quality of his articles is increasing, which was hard to top I think. The Risks We Miss.

We’re laser-focused on certain risks. Stock market crashes. Auto accidents. Our home burning down. Big medical bills. Losing our job. Hefty home repairs. All this drives the size of our emergency fund, the insurance we carry, and the sum we allocate to bonds and cash investments. But what if the risks we’re trying to contain aren’t the risks we get hit with?

Limiting one risk can open us up to others—such as the cash-loving investors who fear stock market turmoil but end up getting decimated by inflation.

Dangers arise that never even occurred to us. [Pandemic, 2008 GFC, 9/11, LTCM collapse]. The lesson: Purportedly low-probability events seem to happen with surprising frequency.

Some of our biggest financial hits come from an unlikely source: our own family.

The apparently mighty often collapse with shocking speed. [Lehman, Enron, WorldCom].

Folks often get into big trouble not because they purchase insurance that offers too little coverage, but because they completely neglect to buy certain policies.

I view the long Japanese bear market as perhaps the seminal financial event of my lifetime. Could something similar happen in the U.S. or Europe? Probably not—but it is indeed a risk, one ignored by those whose home bias leads them to stick largely or entirely with their own nation’s stocks.

If leverage is involved, our financial life can unravel fast.

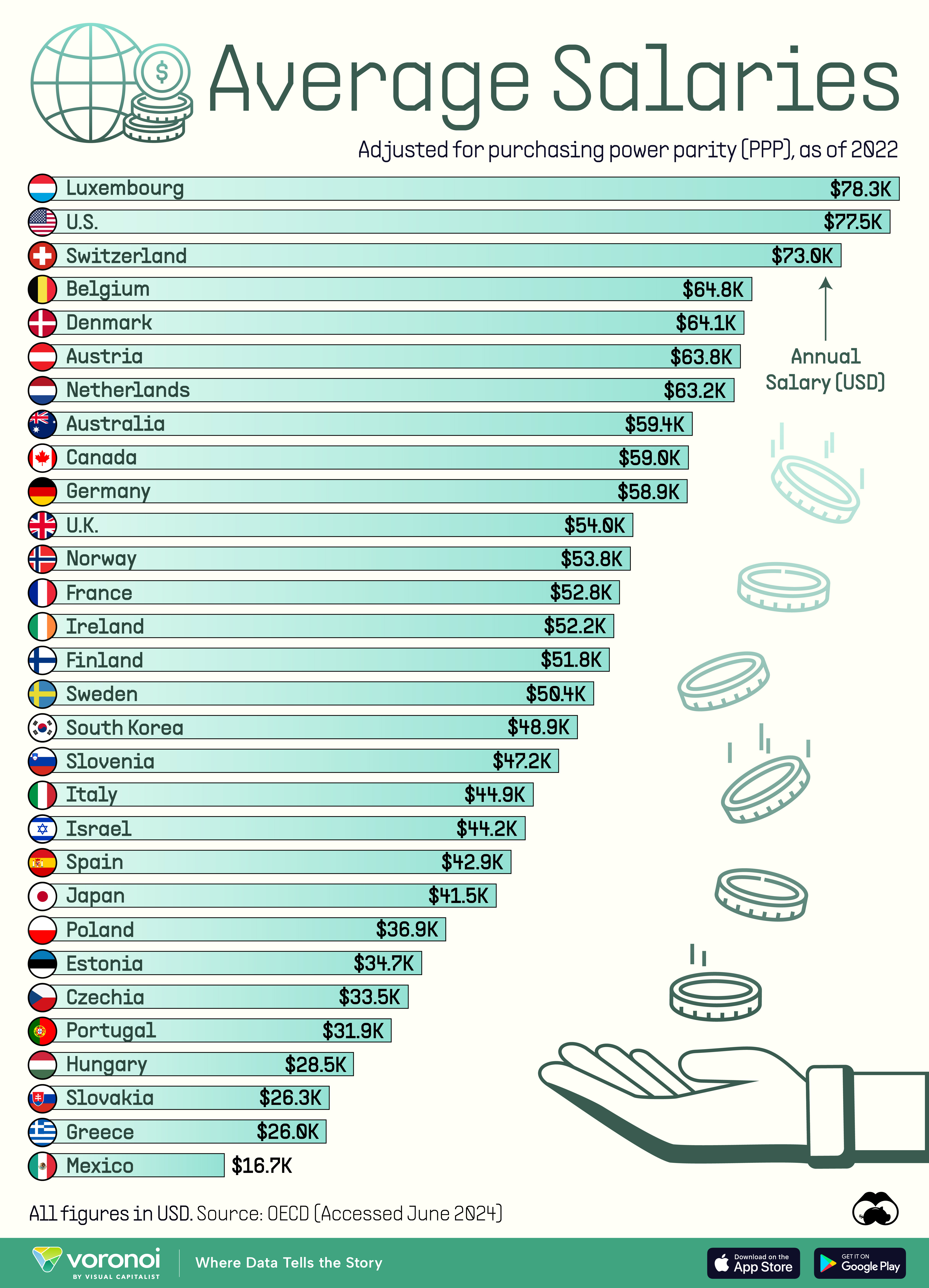

We are lucky here in the US and darn Luxembourg lol. Link.

SCAMS/CRYPTO/AI/TECH

And here comes another grifter who is likely not leaving prison anytime soon. China Tycoon Who Angered Beijing Found Guilty of Fraud in New York. Jurors agree Guo Wengui conned followers out of more than $1 billion to sustain a lavish lifestyle. I don’t know about you but I find it incredibly satisfying to see assholes like this guy rot in prison. Like we said, so many suckers out there being separated from their money. WSJ original article for subscribers.

The government said Guo leveraged his popularity in the Chinese diaspora to pitch his schemes as ways to make money and simultaneously undermine the Communist Party. His broadcaster GTV raised $411 million, an operation called G-Club $240 million and a cryptocurrency venture $517 million, the government said. The jury saw photos and videos of dazzling properties in New York, Connecticut and New Jersey, a Lamborghini, a Bugatti and a Ferrari plus a yacht and racks of Italian suits, all luxuries the government said were paid for with money from supporters. Prosecutors played music videos featuring Guo on board a yacht and next to a private jet and produced flow charts and bank statements they said showed how investor millions paid for a mansion, chandeliers, mattresses and a Ferrari for Guo’s son.

Remember when not that long ago, Uber and DoorDash were giving away lots of money to go drive for them. And then this Brazilian lady arriving in the US found herself in desperate times and then went to, well, “work”. Priscila. Queen of the Rideshare Mafia. She came to the US with a dream. Using platforms like Uber, Instacart, and DoorDash, she built a business empire up from nothing. There was just one problem. Well, she scaled up this deal and greed took over sadly.

ODDZ & ENDZ

This is an excellent dive into Bernard Arnault, the richest man on planet Earth and how he came about his wealth taking his company LVMH into the stratosphere cornering all things luxury. The House of Arnault. His company, LVMH, bought up many of the world’s major luxury brands. And he’s not finished shopping. Very interesting history of how he got here. Reading this I must admit this guy must be hated by many for his shrewd business tactics. I should probably send this to my wife to see where the money spent on purses goes lol.

Well, this is pretty good. Inspiring, which is in my blog’s mission. Nothing shocking, just good to be reminded to do these things. Character is Fate: Ten Habits That Will Help You to Live and Be Better. I am going to try harder to be kind to convicted grifters above…never mind.

The obligatory photography link: The Most Hilarious Entries So Far in the Nikon Comedy Wildlife Awards.

TRAVEL

SAVE $100 FOR 2024 THE EXTRAORDINARY TRAVEL FESTIVAL

You probably heard of the six people found dead in the Bangkok Grand Hyatt: Update On The Tragic Murder-Suicide Case At Grand Hyatt Bangkok: Financial Crime Lead To Death. How tragic. They gave her money to invest, investments went south (if not scammed outright), they decided to meet to talk about how to resolve this and she poisoned them all and then committed suicide. I thought about adding this to the Personal Finance section but it was already filled out. I wanted to make the counter point to the guy selling syndicated apartment deals who was telling his suckers to stand up and say “I am free” while being in debt up to their eyeballs that…when you are in debt you can never be free. Aspire to be debt free, it is amazing, true freedom. And, for crying out loud, why would you give anyone so much money to invest in some real estate deal? Run away in the opposite direction when approached by smooth people like this.

Let’s stay in Asia, this looks amazing: World’s largest indoor ice park in China offers immersive tech experience.

Interesting: Best Lake Towns in the US to Visit in Your Next Summer Vacation. I endorse the two towns in Michigan, Marquette and Saugatuck. And I have been to Lake Tahoe of course, one day I am going to sell my blog to buy a house there. Please laugh, I am, woohoo.

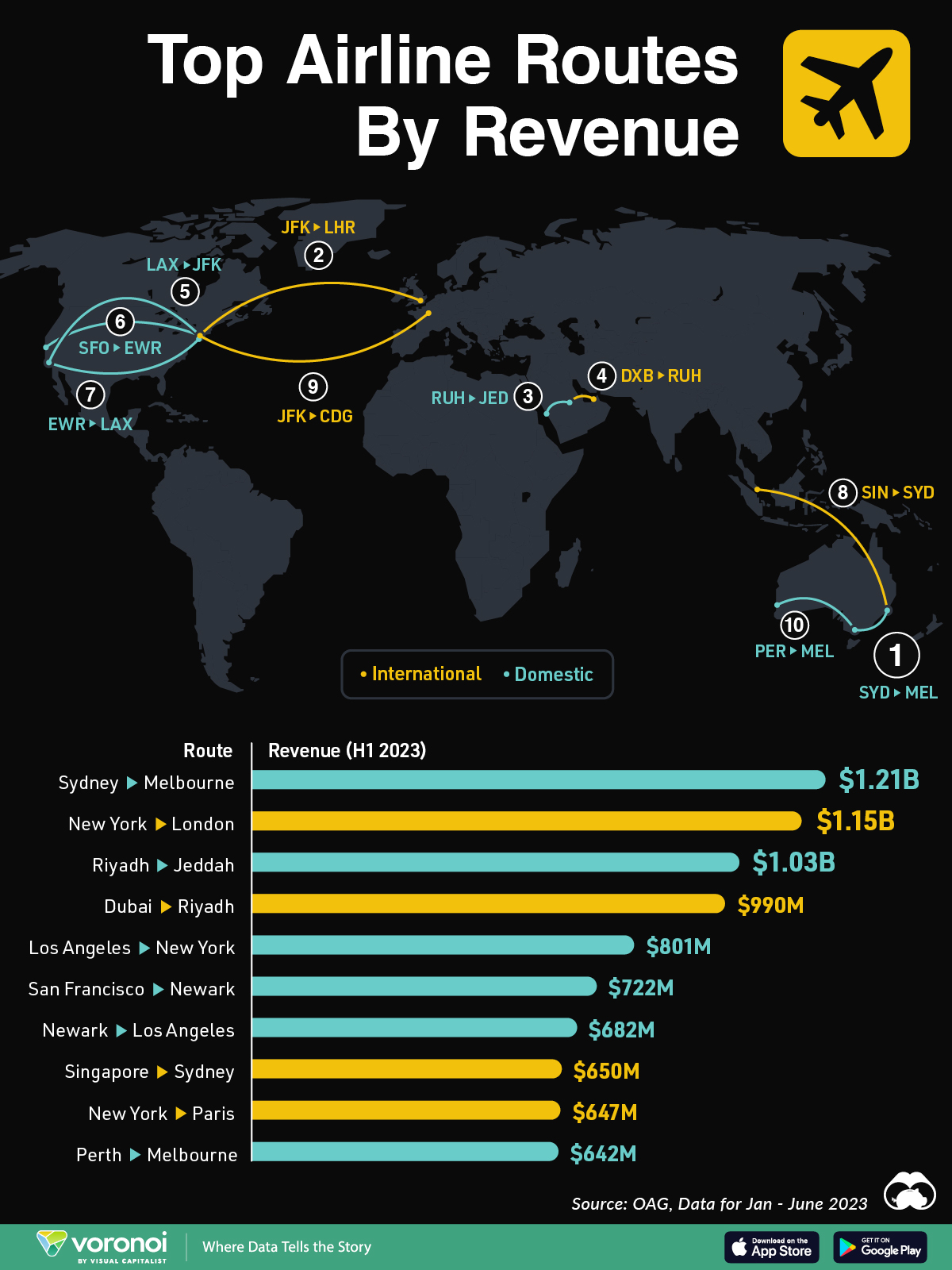

This one has been in the queue for a while: The World’s Top Flight Routes, by Revenue. I thought New York – London was tops. And surprised to see some of these routes make this list.

BUZZING

A section where I go on and on about some stuff that happens in my life and anything else that just does not fit in another section above

As I was about to push the Publish button today, it appears there has been a massive Microsoft outage worldwide impacting, well, everything. Including aviation.

We love our Detroit Airport. But the bathrooms were starting to show their age so I was happy to see this: DTW rebuilding 67 bathrooms in McNamara Terminal — occupied lights, shelves, stools, more.

Well, I was explicitly told there is nothing wrong with my feet, other than I need to let them heal and not be on my feet, so back to biking I go. I continue the physical therapy for now to correct my mechanics. I guess I could not accept that I should stop running, you know, it is difficult. But now I am in peace with this decision and will start running again only when I no longer feel the pain (mostly discomfort). In other getting older news, I got an ear infection in my bad right ear and the level of buzzing from tinnitus has scaled up. The name of my blog ends in Buzz and it so defines me, sad lol.

So, the 2024 Ann Arbor Art Fair is underway when parking downtown becomes, cough, problematic. So we rode our bikes to it and checked it out as we do at least once a year every year. Pre Covid, we had a meeting with miles and points enthusiasts every year and on the Friday night before the speakers did their presentations I used to host the attendees at my home. Good times. Here is an old post I did blogging live the 2016 Ann Arbor Art Fair DO. An interesting painting piece from this year’s Art Fair:

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/MY ACTION

I only pick worthy links to share with you. As there is so much crap out there! What stood out since last post is that new travel rewards credit card offers keep coming and they come with several sweeteners. Which is great to see, thumbs up for US banks competing, we benefit, capitalism at work.

GENERAL NEWS/PROMOS/NEWBIES/ETC.

Another year goes by and another year I bought absolutely nothing on Amazon Prime Day.

Finally! Amex Opens New Centurion Lounge at DCA on July 17. Can’t wait for angry posts about how long the lines are lol.

Pretty easy online shopping scores: Alaska/Southwest/United Shopping Portal Bonuses: Get Up To 2,500 Bonus Miles.

Another 20 properties to join Hyatt soon it appears: Hyatt In Talks To Acquire The Standard Hotel Chain.

120k CHASE Ink Business Preferred

This card has been at an elevated 100k Signup Bonus for a while, so going with an extra 20k points takes it to the TOP travel rewards credit card offer out there right now. And yes, it is its highest ever signup bonus. The annual fee is $95. Requires $8k minimum spend in the first three months (used to be crazy high at $15k!). It earns 3x on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites and search engines and 1x on everything else. No foreign transaction fees and primary rental car insurance. Points are worth 1.25 cents each if used in the bank’s travel portal. So, if you do the math: 120k plus 8k MINIMUM (if all spend was at unbonused 1x ) is 128k points times 1.25 cents gives us free travel worth $1,600. For an annual fee of $95. Ok, I did the math for you, come on! And of course you can transfer the points instead to airline/hotel partners (I prefer Hyatt, Air Canada Aeroplan and sometimes Southwest, in that order) for even higher value. Very solid cell phone insurance coverage along with strong travel and purchase protections.

How to Extract Maximum Value From the 120k Ink Business Preferred Card Welcome Bonus

Me and my wife are going for it have already applied and been approved, we’ll see about our kids who now are off on their own. We did have this card years ago and did not end up keeping it. Let’s see if we end up keeping it this time since we all have the Sapphire Preferred card which we are definitely keeping for the duration. This of course assumes we will be approved. Bloggers will rage how amazing this card offer is. And it is. The difference is that they ALWAYS “review” credit cards on their sites and always recommend every freaking card in order to get paid. I try to keep it real and tell you what I do playing this game. And of course appreciate any support to keep my blog baby going!

NEW: For updates on our own applications please see MY ACTION section below.

CREDIT CARD CORNER

Please help the small independent blogs like mine continue to exist by supporting them with your credit card clicks below, thank you!

I will indicate with NEW every new section as the rest is the same from the previous blog post and will finally roll off those parts as offers expire, thank you.

NEW: We are being hit by more travel rewards credit card offers. What stands out is a 75k Capital One Venture card and a 50k Alaska Airlines Visa card. But wait! The banks are offering juicy sweeteners on both cards, see details below in this section.

NEW: Meanwhile, this is a good post on how to go about downgrading/product changing credit cards from different banks: Downgrade Paths: How to keep your card but break up with your annual fee or find a better fit. Also, suddenly, Capital One just killed the Savor card.

The right way to go about earning miles and points is of course to aim for the signup bonuses of bank credit cards earning their own points currency. Think Chase/Ultimate Rewards, American Express/Membership Rewards, Citi/ThankYou points (what a dumb name!), Capital One/CO Miles (should be points lol), etc. Because they are more flexible by nature. When you get an airline or a hotel rewards card you are limited to that company and, you know, they devalue a lot more frequently. So, you should expect more goodies to sign up for airline/hotel cards. And we have been seeing different benefits being tested to figure out what works/sticks.

NEW: And you thought card offer variations/sweeteners were done. Nope. Capital One has come out with a lucrative 75k Capital One Venture Rewards card PLUS a $250 Travel Credit. The annual fee is $95 and the minimum spend required is $4,000 in three months. Capital One cards usually earn a simple flat 2 points on every dollar. This card earns 5x on hotels and car rentals booked on its own travel portal, which is no big deal. No foreign transaction fees. Get $100 credit towards Global Entry or TSA Precheck. Most importantly, you can transfer the 75,000 points out to airline and hotel partners. Or just erase travel charged on the card for $750. And then of course you get the $250 travel credit. Basically, $1,000 of travel for $95. No Priority Pass lounge membership, just 2 visits allowed to Capital One or Plaza Premium airline lounges. Very tempting indeed. For diversifying purposes as well if you have enough miles and points elsewhere as it is always nice to use this card to pay for a trip and then use Capital One miles to erase the charges. Just like I did for my upcoming trip to Thailand using Capital One miles to fly from Detroit to Bangkok in November. Capital One pulls and reports to all three credit bureaus. And they can be, well, finicky in approvals. If you are denied, you can not call to ask them to reconsider, it is all done by algorithms so, Good Luck! Finally, YES, you can have both the Venture X and the Venture Rewards cards.

NEW: Wait, there is more! The streak of unique sweetener offers continues. Pure airline cards must be suffering I am guessing. So, here is Bank of America with a unique sweetener offer: Buy One Get One and 50k Alaska Airlines Visa Signature card. Ok, let’s get into it. The annual fee is $95 and the minimum spend is $3,000 in the first three months. Well, you buy one but you don’t get the other ticket for free, you just have to pay the taxes and fees starting at $23. At each anniversary you get to use a Companion Fare at $99 plus fees/taxes, which could be a great deal. Earns 3x on Alaska Airlines, 2x on gas, EV charging, cable, streaming and local transit, 1x on everything else. Free checked bag and priority boarding for up to 6 guests as long as you use the card to pay for your ticket. 10% bonus on all your purchases annually if you have an eligible Bank of America account (checking or savings will do). 20% off on in flight purchases. No foreign transaction fees. Bank of America website and its Bill Pay feature can be very annoying, always watch them.

Wait, we have more new offers being thrown at us. As I was saying, banks are trying to sweeten periodically the offers to pure airline and hotel cards. And we have seen how Marriott Bonvoy keeps bringing back the 5 free night cert offer almost regularly. And now, please sit down, we have IHG doing so too! I don’t remember IHG offering free night certs in the past but I could be wrong. You can learn more about the specifics of the offer in this post: Chase IHG Premier: Five Free Night Certificates (Up To 60,000 Points Per Night). If you have a specific IHG property in mind to spend five nights in for free $99 and you can use the points and some of the decent benefits, I mean, go ahead. I am trying to take IHG out of my life and am down to enough IHG points to get me two free nights at best these days. Or, after the latest devaluation may get 1.5 free nights at best, sad lol. No direct linking to the card, I feel so dirty already with so many such links in this post, I am sorry. Or just pass and move on and go for juicier and more flexible cards.

I am bringing this to your attention for completeness purposes only. The no annual fee Marriott Bonvoy card is the Bold card. And this one has a new offer out there too: Chase Marriott Bonvoy Bold Card 60,000 Points + Free Night Certificate + Card Changes. I think this may be the highest offer on this card or close to it. And you should still pass and not waste one of the precious 5/24 Chase slots on it.

I keep receiving emails from Chase trying to get me to apply for the Southwest personal credit cards. Offering only 50k Signup Bonus. Never do that, just wait until the bonus goes much higher ok? Or you can read below how the Signup Bonus for the two Southwest business cards is now 120k. Friends don’t let friends apply for 50k Southwest credit cards! And here we go with two Southwest offering business cards offering 120,000 Points.

Southwest Rapid Rewards Premier Business Credit Card and Business Performance Credit Card are offering a signup bonus of up to 120,000 points:

Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from your account opening.

Plus, earn an additional 40,000 points after you spend $15,000 on purchases in the first 9 months

Best credit card offers STILL remain the same, see below my TOP FOUR travel rewards credit cards right now:

Temporarily, the 120k CHASE Ink Business Preferred card goes right to the top.

The next offer NOW is the 75k Capital One Venture X card. It is amazing what you get for free with this card actually, see more below.

Next we have the 75k CHASE Ink Business Cash and 75k CHASE Ink Business Unlimited cards.

Always check my TOP TRAVEL REWARDS CREDIT CARD OFFERS RIGHT NOW below.

MY ACTION

Follow me on Instagram please. Subscribe to my YouTube channel.

I recently closed three credit cards: son’s Citi AAadvantage, wife’s Chase Ink Business Cash and my own Chase Ink Business Unlimited. So, you know, I have more capacity. 🙂

So, then off I went. I applied for the 120k Chase Ink Business Preferred card and I did not get instantly approved. Which was kind of expected. I tried to call Chase Reconsideration on the Monday after the Friday I applied for and I had a kind of bizarre and very unusual chat with a Chase rep. I was going to call back again on Tuesday to chat with a different agent and try to push through a decision. But on Tuesday at 11.14 am I received an email that my application was approved. I called Chase and talked to a nice rep this time and I asked to expedite the card to me. I received the card via UPS on Thursday. I also told the agent to change the statement close date to make it the same as my other cards.

And then, I was going to wait a little bit to decide what to do next but, you know, I am itching to go for another one. It is a known symptom of milesaholics, hehe. When I logged in to my wife’s Chase account I noticed an area titled “You’re already approved”. And I saw the Ink Business Preferred card already there. So, that led me to believe that if she applies now for it she will be approved, likely instantly. So, this is what we did, boom, instant approval. Immediately sent a secured message to ask for three things: 1) Expedite the card, 2)Transfer some credit line from her Ink Business Unlimited card to make them more even and, 3) Change the statement close date. No response yet from Chase on the secured message. Hopefully she does not have to call because she would rather have a root canal instead.

And now, you know, I am itching for more. I am debating whether to just take a shot applying for the 75k Capital One Rewards card. Another $4k of minimum spend and it is now getting a little hefty you know to meet all that. Capital One pulls your credit from all three bureaus which sucks. And there is no guarantee that I will be approved because you just never know what Capital One will do. I do know I should wait at least a week before applying for it, so maybe next Wednesday. This is 75,000 Capital One miles AND a straight $250 travel credit. So, $1,000 free travel credit at least (if not transferring the points out to partners) for an annual fee of $95. Works for me! I do have the Capital One Venture X card by the way which I am keeping. So, I don’ t really need this card but I will keep it for one year at least. And then likely close it and I hope Capital One does not put me on a black list or something. Or, heaven forbid, close my Venture X card and tell me to take a hike. The reason I am hesitating here is…

Amex still tries to get me back. And now we are up to 250k on the Amex Business Platinum card. I am fine swimming in the Chasesphere you guys. I only have an Amex Hilton Surpass and an Amex Blue Business Plus card. Me and my wife are Authorized Users of personal Amex Platinum cards from our son’s personal Amex Platinum card that costs him $195 times 2 and we pay for that with Amazon Prime and family cell phone plan for him. But, you know, 250k is really really hard to resist! We are talking “free” $2,500 without transferring the points. But of course it comes with a $695 annual fee. And a bunch of credits which I find extremely annoying to keep them mentally straight. Like, I mean, I have to force myself to buy $400 worth of crap from Dell, try to use the $200 airline credit (I guess United Travel bank still works?), and maybe even go for CLEAR ($189 credited). The rest of the credits (Adobe, Indeed, $120 cell phone credit) are meaningless to me. And then I have to cancel the authorized user card, get new Priority Pass cards blah blah blah. I have been doing fine without my own Amex Platinum in my life for a while. But, you know, I have the packet in my kitchen counter looking at me and the 250,000 number screams “Are you an idiot, just take me for a year, come on!’. Anyway, this offer is good until 10/1/2024 so I have some time to think it over. I guess next thing I should check is “Lifetime Language”. And check my records when I had this card before, I am pretty sure it has been more than seven years.

I spotted my daughter about 200,000 Chase Ultimate Rewards points and told here she can go ahead and use them in the Chase Travel portal for fares under $250. And then boom, she booked three separate one way flights already, 14,359 points Seattle to New York JFK, 11,479 points New York LGA to Denver, 11,879 points Denver to Seattle for the Christmas holiday and then she spends New Year’s in Denver with friends. She assured me she will not cancel them to avoid dealing with the Chase travel reps. Oh, I need to book my own way to New York area for the holidays. And now we can’t use British Airways Avios to fly on partner American Airlines flights since British Airways devalued killed this. Wife has hers booked as she changed her United Seattle trip to New York, all this from a $500 United voucher last year.

ADVANCED

If you have status on any of the 19 airlines listed, this is a great opportunity: Get SkyTeam status now – and Star Alliance status later – via ITA’s new BA status match.

Interesting: How to find SLH hotels bookable with Hilton points & free night certificates. I guess I should take Rooms.aero for another spin.

MILES & POINTS

HOT CREDIT CARD OFFERS: 120k CHASE Ink Business Preferred, 75k CHASE Ink Business Cash, 75k CHASE Ink Business Unlimited, 75k CAPITAL ONE Venture X, 75k CHASE United Business, 75k CAPITAL ONE Venture Rewards AND $250 Travel Credit, 150k AMEX Business Platinum, two 120k CHASE Southwest Business cards, $1,000 Cash Back CHASE Ink Business Premier, 15k AMEX Blue Business Plus and many more!

Learn how to apply HERE to support the blog. Or email me if you have any questions about any cards. I’m happy to help, thank you!

This section is about my hobby addiction of collecting frequent flyer miles and hotel points since the early 1990’s! SKIP if you are not into it!

As of today, I have burned 1,147,230 miles/points year to date (1,148,286 in 2023) and have 4,139,537 miles/points in the bank. Some do drugs, I do miles lol!

Thanks to US banks, very lucrative travel rewards credit card offers come and go all the time. This section will act as a reference point on the best CURRENT offers. I will designate new material preceded by NEW.

TOP TRAVEL REWARDS CREDIT CARD OFFERS RIGHT NOW

The Chase Ink Business Preferred card offer a 120,000 point signup bonus. See above for more extensive coverage of its features.

The Capital One Venture X card offers a 75,000 point Signup Bonus after a minimum spend of $4k in the first three months. If you like simplicity and looking for one (premium) card, I highly recommend this card (and yes, I have it myself!). It has an annual fee of $395 but it comes with an easy $300 statement credit for travel booked on its decent travel portal, essentially turning it into a $95 annual fee card. But wait, there is more! On each card anniversary you earn 10,000 points essentially making it FREE! Every dollar of spend earns 2 points and flights booked on the travel portal earn 5 points per dollar. You get access to Capital One and Plaza Premium airport lounges and a Priority Pass Select lounge membership and, this is important, you can add FOUR authorized users FOR FREE who can also have their own Priority Pass Select airline lounge membership and, this is BIG, they can bring in unlimited guests with their FREE Priority Pass card! You can transfer your Capital One points to up to 18 Transfer Partners. No foreign transaction fees. Free Hertz President’s Circle rental car top elite status. Cell phone protection and PRIMARY rental car coverage. Awesome seats at baseball stadiums for just 5k points each. And lots more.

The Chase Ink Business Cash and Chase Ink Business Unlimited card offers are back down to a 75,000 Signup Bonus! These are NO ANNUAL fee cards.

The Chase Ink Business Cash earns 5x on office supply stores and internet/cable/phone services and 2x on gas and restaurants. Why don’t you go to Office Depot and buy gift cards of the stores you usually shop at, hello 5x Amazon! The card now offers the 75k Signup Bonus in two stages (and a 10% relationship bonus if you have a Chase business checking account) after $6k spend in the first six months.

The Chase Ink Business Unlimited card works differently, it just earns 1.5x on everything. So if you were going to use a credit card to earn 1x why don’t you pull this one out instead? Bottom line, I think these are still the BEST business travel rewards cards out there right now! The 75k Signup Bonus can be earned after $6k of spend on the card in the first three months.

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com and tell me what you like and don’t like about my blog and, more importantly, what you would like to see changed and/or what you would add or delete. All feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

Huh! Gold! For the Pacific Northwest! (Hadn’t said that for a while.)

Lots of great stuff here and I will spend some good time reading a lot of the articles. Thanks as always, George!

Hello from JFK in the delta one lounge. Quite spiffy! One way to deal with overcrowding is the restrict entry for Delta one tickets.

We stayed at the Santiago intercontinental. IHG points

Thanks for the links!

.

Thanks guys, enjoy the weekend. The weather here the past two days has been absolutely magical.

Best of luck for anyone flying today. Looks like a clusterphuck out there. When my daughter gets to Seattle to start working for Microsoft she will fix it 🙂

It could be worse!

Give me an hour and I’ll say just how!

The security firm has a bad reputation but that will come out

Greetings from 30,000 feet! After gorging myself at the AAdmirals club I took my very slightly more comfortable main cabin extra seat as my family and I are headed for our dream vacation in… BUFFALO!

Enjoy Buffalo 🙂

Nice links. I was pretty shocked about the average salary in the USA until I realized that it’s probably pretty skewed. I wish they had listed the mean salary instead.

I agree, definitely skewed. I swear I posted it and started the title with it because it would drive clicks. So, I am not sure it qualifies as “clickbait”. And this is how the online world is changing us all 🙂

Ok, can we put this leak baby to rest for good, come on!

https://www.thelancet.com/journals/lanmic/article/PIIS2666-5247(24)00206-4/fulltext

What a disaster with Crowdstrike – an event just waiting to happen.

Anybody remember that movie with Sandra Bullock -“The Net”?

I have a strong feeling Putin may have been behind it. Therefore, the VERY quick statements that came out to blame Crowdstrike. Of course, we will never know most likely.

I do remember the movie back then but I don’t remember much of it.

When I was asked what keeps me up at night, my answer was: Civil War and major cyberattack.

For any blog issues I would like to blame the third party responsible (Crowdstrike). 🙂

Going to make my Tuesday posts shorter, aiming for half the length going forward. Just sticking with even more eclectic stuff.

I am also going to share with you the latest music video I discovered today from an amazing band…from Singapore! Really raw sound, I am blown away. This should lead more to unsubscribe for sure lol.

And thanks to Joe Biden, thank you for four amazing years and saving us from the dotard. And now…hang on, it is going to get even more crazy!

Hey Buzz, been awhile. Thanks for the great links lately. The Castaneda story, creep, and not surprising. And Priscilla, wow! Talk about cojones.

Good luck with the rehab, glad you made the decision before it was too late.

Looking forward to hearing the band from Singapore, keep up the great work, we do appreciate your efforts.

Thanks David, email me to arrange a time to chat.

I am playing that band from Singapore again while I type this 🙂

Humbly submitted for TBB: a Turkmenistan trip report because you don’t see too many of those.

https://www.asiafrontiercapital.com/travel-reports-2024/july-2024.html

Looks interesting, will add it to the queue, thanks! Hope you are not flying Delta.

AA thankfully. My brother’s currently delayed by a few days on an unrelated Delta trip though.