I started working on the Friday post and first up was an article in the Wall Street Journal about raising interest rates and then I decided, since conversions have been going so well this month, to just stick with this article and my commentary and publish today Wednesday. We’ll see what happens next Wednesday, do not bank (pun intended) on it. Monday and Friday Buzz posts are safe here, so see you Friday!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS and visiting our LINKS!

You like my blog? Send a link to someone please!

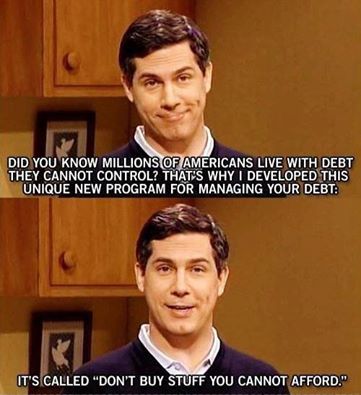

This hobby here in the US has had an unbelievable run. All because the banks were willing to give card holders huge rewards. And they can still do that because many card holders here in the US are awful with their money. And their credit. And they carry balances and then get mauled by ridiculously confiscatory interest rates! The Wall Street Journal had an article recently titled: Interest Rates Are Falling—but Your Credit-Card Rate Could Be Going Up. Since most of you can not read it because it is behind the WSJ paywall, I have picked some interesting excerpts for you with my own commentary in [brackets]:

…banks’ generous card rewards programs, offering free travel and other perks, have been eating into lenders’ profitability. To offset that pain, banks are charging cardholders more to borrow. [If you are playing this game while you pay interest to the bank, the joke is on you, please leave now and do NOT return until you pay off that balance, go!]

The average annual percentage rate, or APR, on interest-charging credit cards is about 17%, according to Fed data. That is near its highest in more than two decades…Interest rates on private-label credit cards, which can be used only in certain stores, also are rising. The average APR on these cards reached 27.5% this year, a record… [Look, other websites exist to sell credit cards and get paid by banks very handsomely. Do you think they will let them write about the dangers of credit cards and not to EVER EVER carry a balance? Of course not!]

Credit-card debt has surged in recent years. U.S. households with card balances owed an average of $8,602 in the second quarter, up 8% from the same period of 2015 when adjusted for inflation… [You know what else has surged? The posts appearing at The Points Guy, coincidence?]

Card issuers essentially recruit two types of consumers: Affluent customers who spend a lot and pay their bills in full each month, and those who make at least their minimum required payment every month and carry balances. [ You want to be in the first camp. AVOID the second camp. Sadly, if it was not for the second camp this hobby would probably not have existed for so long and for that I feel awful sometimes. There are other bloggers out there who pump the second camp to oblivion, they enable them, they give them rope all in the name of earning sales commissions from the weapons of mass destruction they are selling them so they can fly for “free”. I think the world would be a better place if the pain inflicted to the ones belonging in the second camp was not there. But then it would not be the United States of America ladies and gents….Insert SAD LOL next!]

Card issuers essentially recruit two types of consumers: Affluent customers who spend a lot and pay their bills in full each month, and those who make at least their minimum required payment every month and carry balances. [ You want to be in the first camp. AVOID the second camp. Sadly, if it was not for the second camp this hobby would probably not have existed for so long and for that I feel awful sometimes. There are other bloggers out there who pump the second camp to oblivion, they enable them, they give them rope all in the name of earning sales commissions from the weapons of mass destruction they are selling them so they can fly for “free”. I think the world would be a better place if the pain inflicted to the ones belonging in the second camp was not there. But then it would not be the United States of America ladies and gents….Insert SAD LOL next!]

Big card issuers, including JPMorgan Chase & Co. and American Express Co., in recent years rolled out large sign-up bonuses and other incentives to attract these wealthier customers to premium cards, by which points can be redeemed for airfare, hotel stays and other perks. But the cards weren’t the profit bonanza that companies hoped for. [Really? Maybe they should stop paying bloggers so much to push product on exclusive deals and stuff like that, just saying!]

Big card issuers, including JPMorgan Chase & Co. and American Express Co., in recent years rolled out large sign-up bonuses and other incentives to attract these wealthier customers to premium cards, by which points can be redeemed for airfare, hotel stays and other perks. But the cards weren’t the profit bonanza that companies hoped for. [Really? Maybe they should stop paying bloggers so much to push product on exclusive deals and stuff like that, just saying!]

Many savvy consumers game the system, reaping rewards before moving on to the next card. [Dear TBB readers, please rise, and lets hear the applause about…us lol]

The extra charges paid by those who carry balances can help offset the profit hit that card issuers incur from the rewards programs. The interest charges borrowers rack up often wipe away the financial benefits they would receive from rewards programs. [I don’t need to repeat this, do I?]

The extra charges paid by those who carry balances can help offset the profit hit that card issuers incur from the rewards programs. The interest charges borrowers rack up often wipe away the financial benefits they would receive from rewards programs. [I don’t need to repeat this, do I?]

Charging higher rates already has helped boost card divisions’ returns. Profitability had been declining for several years but ticked up in 2018, when broader interest rates rose and banks also raised their margins on credit-card rates…also predicts that credit-card APRs will rise slightly over the next two years. [In an era of unprecedented falling interest rates with some countries now experiencing negative interest rates, these banks CAN charge higher interest rates to these card holders! What a country!]

Charging higher rates also is a way for lenders to protect themselves against future loan losses. Rising charge-offs weighed on profitability in 2016 and 2017, and several lenders responded by tightening underwriting standards. [My crowd has been waiting for that UNtightening underwriting standards for a while now…hurry up, will you, come on! We used to get a CitiAA credit card every 31 days in the good old days, COME ON!]

Confession: I missed you last Wednesday here. Oh, the Southwest three 60k and one 80k offers end today. Supposedly. It may be your LAST chance. No, it won’t. They will probably come back 🙂

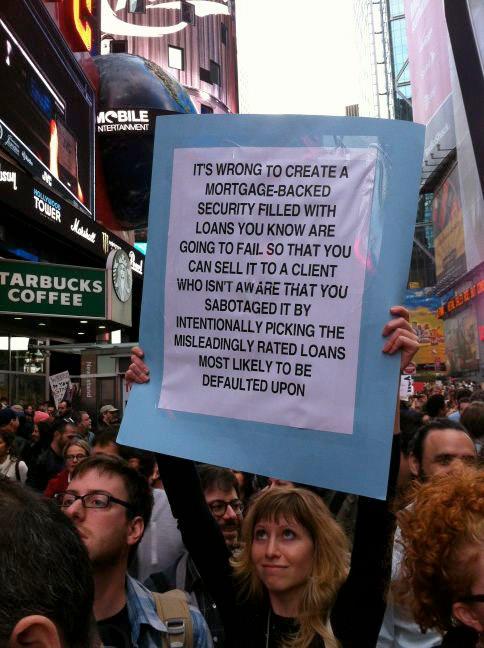

And I leave you with the best sign from the financial crisis, hard to believe it’s been so long, thanks Obama!

TBB

TBB

travelbloggerbuzz@gmail.com

Follow TBB on Twitter @FlyerTalkerinA2.

You can subscribe to TBB below, winners only!

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Nice to see TBB back on Wedesday!

You thought the FM 40kFaraway posts were done? WRONG!

Instant approval for the Southwest 80k Perfomance card yesterday, enjoy the moolah. And thank Mrs. TBB for letting you educating, entertaining and inspiring us all.

Thank you for blogging.

P.S. Your tweets last night about the DemDebate were hilarious. And I agree with most of them. I think the winner of these debates is Trump 🙁

Thank you!

Lets all hope the 40kFaraway barrage is over soon 🙂

The Dem field is sad…

Weds post!

Glad there have been some conversions.

Bronze from Verona! Another great posting!! Glad to see you on a Wednesday!

What a nice surprise for a Wednesday! Great article, too.

Lady with the sign was wrong. Nobody went to jail for that.

One thing I like about Pocahontas, her stand against CC companies screwing over folks who can’t pay back their debt, over and over again.

Imagine Republicans letting her run the Consumer Protection agency, maybe she wouldn’t be a senator and in the race now.

better to let her run for POTUS so she gets exposed completely for the fraud she is. Begging for her or someone like Bloomberg to be the nominee. Trumptard will be president for 4 more years is this is the case

Warren IS dangerous. Bernie is a lunatic AND as dangerous!

Bloomberg will be an awesome President!

Don’t be fools, I ‘ll call you later lol

Latest Delta Flash sale:

https://www.delta.com/content/www/en_US/shop/deals-and-offers/north-america/skymiles-award-travel-deals.html

Only missed one Wednesday you guys.

Will get back on the comments a little later, hopefully by tonight.

TBBon!

My skepticism always kicks in whenever I read the profitability of one segment used as a justification for the existence of another unprofitable/less-profitable segment. You would expect a rational bank to already be setting interest rates at their most profitable. If raising them makes more money, why didn’t they do that earlier? If they are raising rates now, when you might otherwise not expect that to be the case, and the reward programs aren’t changing, seems like something unrelated to rewards must be going on — and bracing for an economic downturn seems like a good suspect.

The defense of high-value rewards programs is also maddening. We are three years into the CSR era — if banks were going to figure out how to profitably cross-sell products to the affluent, you would have expected them to have done that by now. I’m also somewhat skeptical of the notion that reducing credit card rewards risks losing those affluent customers; in any event, Citibank seems to be testing that theory.

Definitely seems like this article should be a warning bell for the American economy, the American consumer, banks, frequent flyer programs that have become reliant on those banks, and airlines that have become reliant on those frequent flyer programs. BUT, I do wonder if a bit of short term pain from rationalization could be a long term gain for frequent flyer enthusiasts.

Great thoughts, casual_observer. I concur across the board. It is indeed puzzling why the banks do not bifurcate their efforts to reach affluent clients with one approach, while scooping up the interest payers with another approach. My guess if that it is all big numbers to them and they’re too lazy and fat to dig into all that detail.

I too am curious about where this is all going, and also where the banks think it is going, which are not the same thing. Banks have cut the cord on the churners a bit, but skilled players are still bleeding them dry. I think we can plan on a couple more good years anyway, though I am a bit wary since getting a CSR is about as easy and common as joining Mcdonald’s Golden Arches. Pretty soon we’ll get a piece of bubble gum with those welcome kits.

I guess we will all find out as time goes by…

I am not very hopeful about that bubble gum either, sad lol.

Will SPRECHEN SIE MILES, Europas #1 Point and Mile Blog make the TBB Blogs I Love List?

Don’t be a fool. Don’t be a tough guy.

Call me later TBB.

TBB only likes old skanky socialist. He likes Liz to whisper how she is gonna raise taxes on anyone making 100k+ and it gets TBB into a lather

For the record, I am no fan of Liz and Bernie. I think their economic policies are horrible.

Thinking to change my email sig to:

“Don’t be a fool, I ‘ll call you later”

Of course I’ll call Tulsi back FIRST!

🙂

Bernie has an economic policy beyond FREEEEEEEE? At least Pocahontas has a plan for this and that. The numbers may not add up but who can complain about that when the gov is running a $1T deficit.

It’s perfectly clear that we live in an environment with limited public demand and that’s limiting economic growth. Greatly increased income inequality is a major, major growth limitation.

they arent gonna let Tulsi play in the game. Gonna lock her out

Of course Tulsi will not win.

Warren’s wealth tax is an amazingly moronic idea!

Undergoing a really busy stretch here, sorry I have not been able to respond to the comments. And I have not even started drafting tomorrow’s post.

Big thanks to the readers who got the Southwest Performance Business card. Hope the additional spend for the Companion Pass sneaky Southwest announced today will not be a problem with you.

Tulsi is not only the most attractive Democratic Presidential candidate ever but also the most fit! None comes close! And yes she has no chance. At all.

TBB

Don’t be a fool, I ‘ll call you later.