Another TBB post featuring the most eclectic links around the web such as how ETFs are killing mutual funds, more scary AI scams, forever Putinism, March Madness is underway, things to be aware of building a diversified portfolio, the latest on Bitcoin, a wine scammer targeting billionaires, the Tesla Cybertruck is a tragedy on wheels, latest on climate change, the top 10 expat types in Thailand, more on marathons and of course always all of the important developments in the crazy world of miles and points and a lot more. Enjoy the weekend and get started on your taxes now!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or visit our LINKS

I use and recommend Proton VPN <—– REFERRAL LINK

You like my blog? Send a link to someone please!

No ads, no clickbait. No sponsored posts.

Welcome to my quirky original authentic blog. It all started back in 2012 focusing on my crazy hobby addiction of frequent flyer miles, hotel and bank points. It has since evolved to a curated at least weekly post of the best web content I find along with my commentary. Here to Educate primarily, sometimes Entertain and if I get to Inspire you, well, that is a bonus.

This blog publishes on Fridays. Sometimes it is a Thursday if I am traveling. This is a one man labor of love operation, enjoy it while it lasts. I may post on a Tuesday too going forward if I get to it.

PERSONAL FINANCE

It is starting to get a little out of hand out there with unrelenting market highs. I wonder what would have happened if Nvidia had not taken a turn for a crazy run on everything AI…

Meanwhile, the AI thing is spreading and news like this should not surprise us at all: Two ‘RIAs’ that allegedly falsely advertised using ‘artificial intelligence’ to aid investment decisions cough up real SEC settlements and censure. New term to watch out for is “AI washing”.

“Delphia and Global Predictions marketed to their clients and prospective clients that they were using AI in certain ways when, in fact, they were not,” said SEC Chair Gary Gensler in a release. There’s a problem with throwing around the latest technology buzz as an investment come-on, he added. “We’ve seen time and again that when new technologies come along, they can create buzz from investors as well as false claims by those purporting to use those new technologies. “Such AI washing hurts investors.”

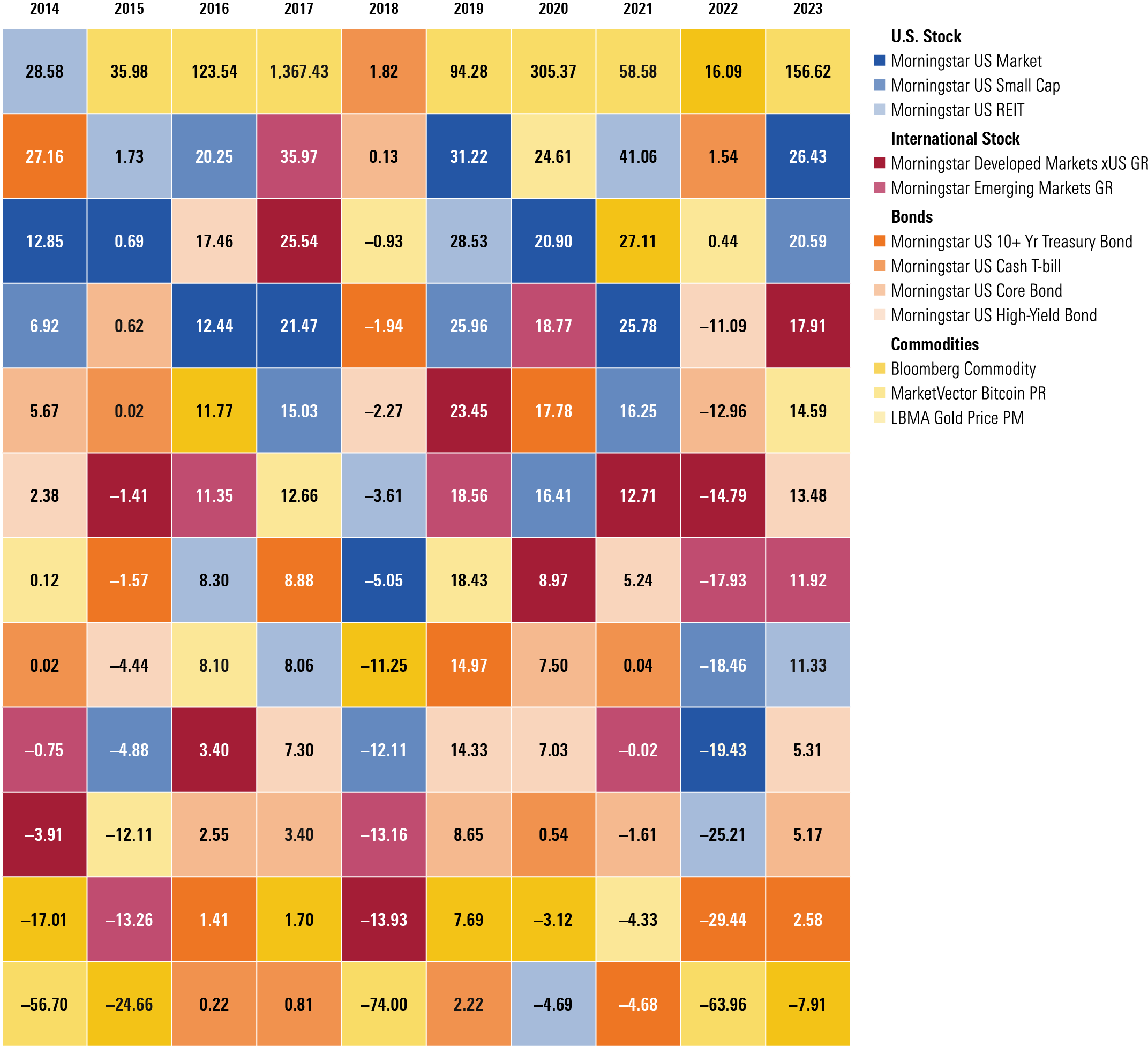

I have been around for a long time to see many fads go poof. So, maybe you should diversify instead of getting carried away from the hype that is spreading? Top 10 Things to Know About Building a Diversified Portfolio. And just chill out a bit by sticking to your plan that should include portfolio reviews at set intervals and yes, rebalancing. Which means parting with some of your winners and redeploying to assets that have been sucking lately. Of course this takes discipline. Never forget: It’s impossible to predict which asset class will do well (or not) in any given year.

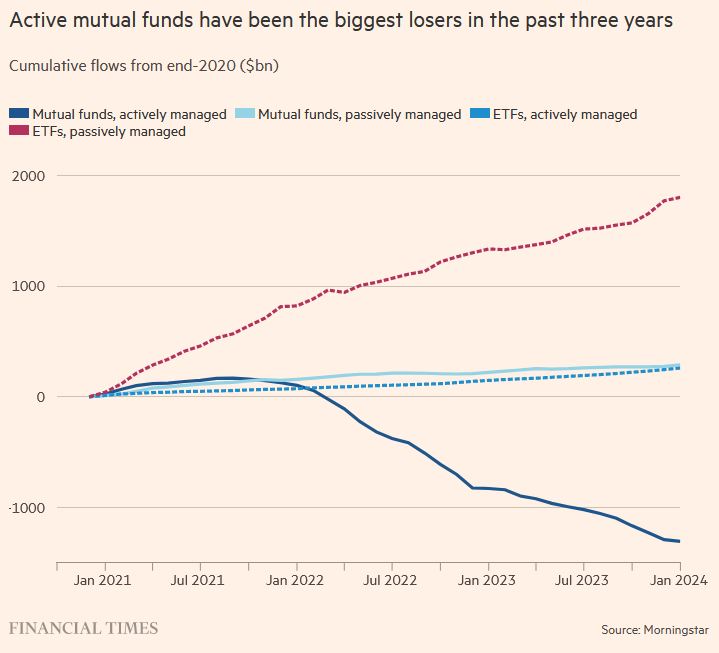

Personally and in my own firm I have been using ETFs exclusively for a very long time. Actually, I have been doing it for so long that I still remember a colleague during a NAPFA conference session when I revealed I am doing this and he asked me in a somewhat raging fashion “How do you trust these things?”. So it is kind of weird to see how ETFs are dominating the investment landscape. And not surprised. At all. So, here we go: The mutual fund at 100: is it becoming obsolete? Just one graph captures it all:

I know you are all feeling happy looking at your portfolio these days. Stop. Because when the next correction happens you will remember how much higher you were and you will feel like crap. Focus on what you can control and look at your portfolio way less often. Because, you are in this for the long term right?

CRYPTO

I have been skeptical of this shit for years. And I never invested a single dollar in it. I guess it must be fun staying poor lol.

Anyway, I really liked this article: Bitcoin goes up, so it must come down. What goes into the price of BTC? Latest bitcoin price heights may lead you to believe that there is an insane buying frenzy happening. But nope:

Market volume is one-eighth of what it was in November 2021, the last time the price was this high.

Always be careful in this space…

The bitcoin price chart looks very like someone’s trying to pump the price. You’ll see the price slowly getting walked up, as if someone’s wash-trading it up … then it hits a round number of dollars, someone tries to cash out, and the price drops several thousand. Fake dollars going up, real dollars going down. So we’re not in a bubble. We’re in a balloon, one being pumped full of hot air. It’s fun going up — but the trip down can be very quick.

And I am in full agreement with this below:

If you must hold bitcoins in the hope of getting dollars for them one day, the least-worst option is to buy into an ETF. That way you’re in a regulated market and your only risk is Coinbase Custody getting hacked. If you’ve bought into crypto, please at least cash out your principal — the cash basis that you paid to buy in. Then everything you make from then on is pure profit. When the price crashes, you won’t have lost anything. Our real recommendation, of course, is not to touch this garbage.

Sam Bankman-Fried is scheduled to be sentenced on March 29. The prosecutors want to lock him up for 50 years. The defense responded with two arguments. First, no FTX customers lost any money. Second, it will be harsh on Sam due to his autism (okay, makes sense). So, here we go: FTX Chief Accuses Bankman-Fried of Lying to Get Sentence Reduced. Some juicy excerpts:

Ray said that “even the best conceivable outcome in the chapter 11 proceeding will not yield a true, full economic recovery by all creditors and non-insider equity investors as if the fraud never happened.”

When he took over as CEO shortly before FTX’s November 2022 chapter 11 petition, only 105 bitcoins were left on the FTX.com exchange out of nearly 100,000 bitcoins the customers were entitled to, Ray added.

Bankman-Fried “continues to live a life of delusion,” Ray said in his letter. He said while his team has successfully recovered some of the assets that Bankman-Fried stole, there were also plenty other assets that they didn’t get back, “like the bribes to Chinese officials or the hundreds of millions of dollars he spent to buy access to or time with celebrities or politicians or investments for which he grossly overpaid having done zero diligence.”

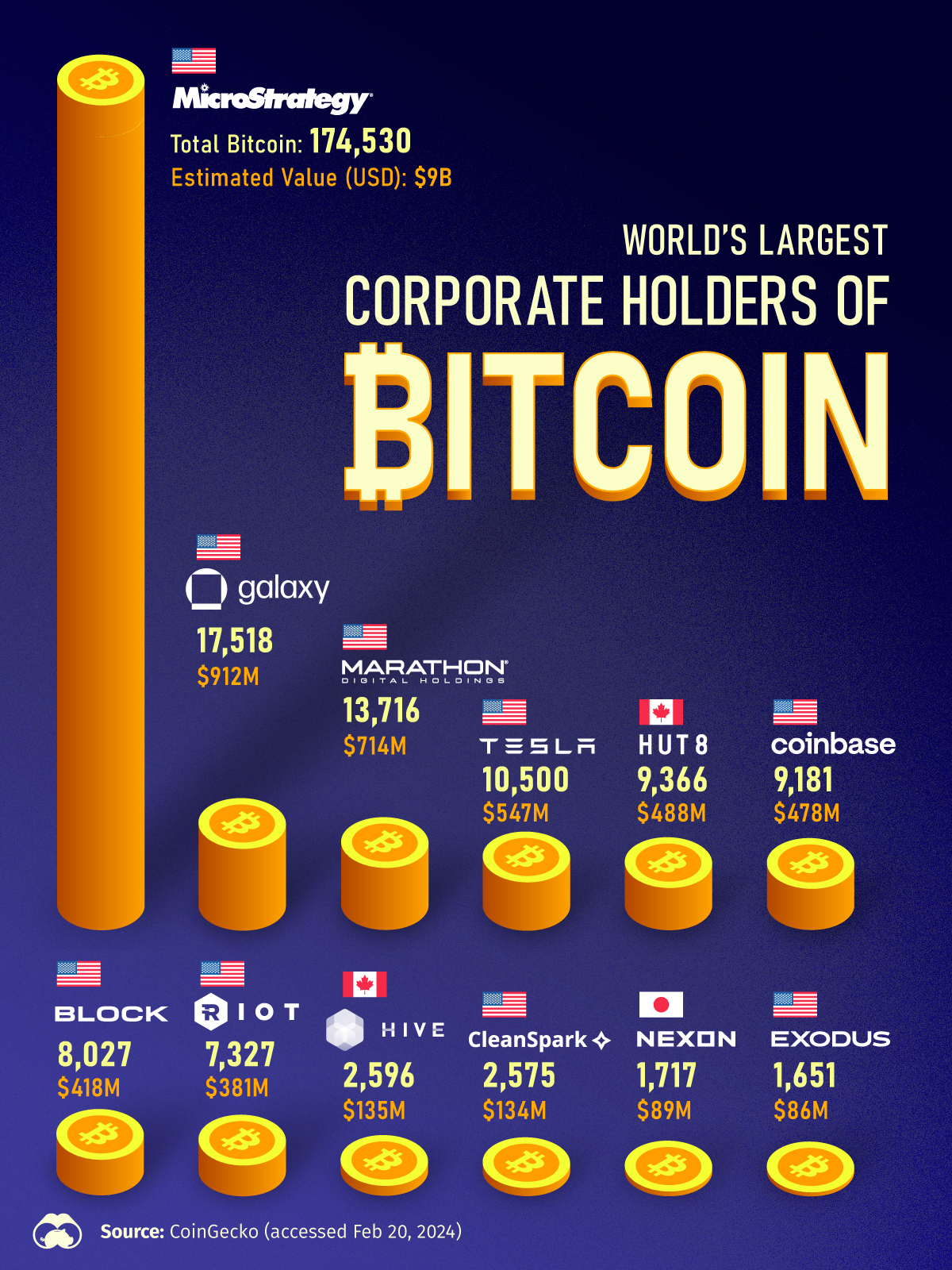

Interesting to say the least: The World’s Largest Corporate Holders of Bitcoin. There is no “strategy” behind Microstrategy and its weirdo CEO betting everything on bitcoin. Maybe some regulator should check more carefully if he is doing, you know, some pumping?

SCAMS

I just have a feeling from this New Yorker article that this is only going to get worse: The Terrifying A.I. Scam That Uses Your Loved One’s Voice. Brooklyn couple got a call from relatives who were being held ransom. Their voices—like many others these days—had been cloned.

They say criminals go where the money is and this guy sure did by targeting the mega wealthy! The $9.5 Million Hangover Did a wine-world insider swindle his Bordeaux-swilling pals? Are some people just born with scam genes or something?

If you bought a Tesla Cybertruck, please leave lol. If you want some laughs about this ridiculous monstrosity, watch this: Tesla Cybetruck: A Tragedy on Four Wheels.

GEOPOLITICS

Shocking election results in Russia, Putin won you guys! Obviously, I am being sarcastic. Forever Putinism The Russian Autocrat’s Answer to the Problem of Succession.

To borrow a phrase from Karl Marx, forever Putinism may contain the seeds of its own destruction. In an unapologetic dictatorship, there is much that can go wrong. The war in Ukraine oscillates every few months, and Russia’s fortunes there could well deteriorate. Wartime societies have breaking points that become visible only when they are reached, and Putin’s war has already brought staggering levels of human loss to Russia.

This is a fantastic infographic about climate change. Which is of course messing with geopolitics and our whole planet: Energy & Climate Intelligence Unit’s IPCC Explainer: Climate change synthesis report. A visual tour of what you need to know from the IPCC’s Sixth Assessment Report cycle (2021-2023).

ODDZ & ENDZ

This is cool: United States Power Outage Map. You can take a look how many homes have no power right now in the US. It appears most are in Texas every time I checked it.

Also, very cool: The Largest Cities Throughout History: Every Year.

Amazing photography: This Year’s British Wildlife Photography Awards Revels in Oceanic Journeys and Flamboyant Courtships

TRAVEL

This was written in 2020 but was recently reposted. Because it still remains so relevant: The Top 10 Types of Expat in Thailand.

Wow, that’s deep! The Five Deeps, the deepest point in each of Earth’s oceans.

If we could only burn miles or points for this lol. The World’s Most Expensive Meal Will Cost You $495,000—and It Will Be Served in a Space Balloon.

SPORTS

Oh, it is that time of year again. NCAA March Madness. Here is a live bracket. And it is so amazing to see a Michigan school beat Kentucky with his universally liked coach who has been at the school for 40 years! Jack Gohlke, Oakland basketball stun Kentucky in NCAA tournament, 80-76. I am very familiar with this school as I took some classes there in the mid 90’s to help me prepare for the Certified Financial Planner (CFP) exam. I guess they helped because I passed the exam in my first try #nottobrag. Also, Michigan State won its opening game. But no surprises about this with legendary coach Tom Izzo making it into the tourney for 26 straight years.

The Euro 2024 soccer tournament is almost complete, except three teams that are battling for these remaining spots. Greece is in the running and needs two wins. Well, now down to one win after destroying Kazakhstan 5-0 last night in Athens in a sold out stadium. It was a magical night, everything went our way, I felt sorry for the Kazakhs. Next game is on Tuesday in Georgia. For some weird reason we always have problems with the Georgians. Anyway, it will be a hell of a game, the winner goes to Euro 2024 in Germany this summer.

I hope one day I can run another one. 66 Celebrities You Didn’t Know Are Marathoners. I feel defeated after learning George W. Bush ran one faster than me lol.

BUZZING

A section where I go on and on about some stuff that happens in my life and anything else that just does not fit in another section above

In 35 years only 17 runners have actually finished the legendary Barkley Marathon. This is the latest documentary of one of them, a dentist from Belgium. To Finish the Barkley Marathons. I loved it. He had failed twice and this was his last shot. Never give up.

Speaking about never giving up, I have been focusing on getting deep tissue massages on my feet lately and it is helping a lot. So much in fact that I have started walking the past three days, 7 miles total. Foot is feeling a little better as in, not bothering me as much. CT scan scheduled next Monday. Gym routine is going well with cardio and biking and weights. And I am getting used to intermittent fasting lately. Oh, weight loss is going great too. I wonder when I will break down to have pizza and tacos lol.

I really liked the movie Love Lies Bleeding.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/MY ACTION

It was another week with a lot happening but no event jumps out to define the week..

GENERAL NEWS/PROMOS/NEWBIES/ETC.

Register for the new IHG One Rewards promo HERE. You can earn 2k points every 2 nights. Exciting zzzzzz.

It appears more non flight thingies are offered at United’s long standing sucking Mile Play promo. See what you get and good luck.

Speaking of United, they announced with great BS buzz that the airline is introducing Mileage Pooling. Only to take everything down lol. Oh, and it was going to work only on United metal, not partners. Which makes it kind of useless anyway. And I think most bloggers still have not updated their posts glorifying this smh.

As I am progressing slowly earning more Hyatt elite night credits, this post is a good reminder of what is at stake: World of Hyatt Milestone Rewards: Everything You Need to Know.

Good post for reference: Complete List of Transferable Points Partners.

To this day, I have never used a hotel award search engine. In case you may have a need for it, here you go: Which hotel award search tool is best?

MY ACTION

I continue to burn my huge miles/points vault.

The flights to Orange County, CA in September are done. I decided to fly Southwest with one stop in Denver both ways instead of paying way too much to fly non stop on Delta. Burned some Southwest points in the process. We always return with lots of swag from conferences and having the bags fly free was certainly a factor.

Son burned some of his Amex Membership Rewards points to book Honolulu to San Diego on Alaska Airlines to check out the city with +1.

I thought I found a use for my Choice points (which were transferred into Choice from Radisson) finally. But nope. I forgot we can not book stays more than 100 days in advance, which must be one of the most ridiculous hotel loyalty program policies out there. I wanted to book one night in the Holiday Inn Express in Luddington, Michigan in mid August because there was no way in hell I will burn 54,000 points per night for it, what the hell? But this is Michigan in mid August, peak tourist season. So, keep that in mind when you visit our state.

Trying to get a more definite plan on our November/December schedules with relatives visiting from Singapore. While trying to see if we can return to Thailand to check out a few more places, like Hua Hin, Koh Samui and Pattaya even. Places like Hua Hin Hyatt Regency and Koh Samui Hyatt Regency and Andaz Pattaya Jomtien Beach. I am thinking to combine it with a travel conference held in Bangkok in mid November. Because I can expense it and turn my blog into a loss for the year for sure lol. Very preliminary thoughts at this point. And of course yes, requalifying for World of Hyatt Globalist elite status may have something to do with this plan… 😉

I proactively transferred 100k Chase Ultimate Rewards points to my World of Hyatt account, leaving me with “only” 1.2 Million of them #nottobrag.

Son is MVP Gold elite with Alaska Airlines and recently asked about status matching with other airlines. And he reads my blog so this is a good article to learn more about the subject: Want to Switch Your Airline Loyalty? Here’s What You Need to Know About Frequent Flier Status Matches. Delta or United status matching may make sense but only if there is upcoming travel with the airlines and/or any chance of hitting the challenge requirements. Which will likely take away from elite requalifying on Alaska Airlines again. I think he can make MVP elite status this year. Which is really not that big of a deal. This is primarily on business travel by the way.

I used one of the five Guest of Honor awards we Hyatt Globalists received this year on son’s next business stay in the Hyatt Centric in Mountain View, CA. I was glad to find out that I would get one night credit, one step closer to 60 to requalify as Globalist lol. How elite status messes with your mind. So glad I kicked this elite habit with airlines more than ten years ago after Delta Skymiles destroyed Northwest Worldperks.

I checked to see the availability of 3,500 World of Hyatt points awards in Category 1 hotels in my area. I decided to book two nights for 7,000 points at the Flint Hyatt Place to get me 2 more night credits for that Globalist run again. With my upcoming night in the Dallas Hyatt Regency this will get me three nights total for the Bonus Journeys promo, which will earn me 3,000 World of Hyatt points. So, not too bad at all. Actually, the Bonus Journeys promo goes through the end of April. So, maybe I can do three more nights nearby. Or six or nine lol. But availability of these 3,500 awards is very spare lately and almost never stringing alone more than one night.

ADVANCED

For everyone having issues getting approved for a credit card by Capital One Bank, there may be hope? .

Bloggers are so overly generous for everything coming from Bilt. Which is probably one of the most over rated entities in this space in years. So, when something negative comes out they tend to under play it. And then they right away blog about anything positive coming. Like this: Bilt adds Alaska Airlines as transfer partner, will offer 3x on rent payments. Without even doing the most basic homework. Like if they did they would note that that 3x on rent payments thingie comes with a 3% fee, which makes this one of the most ridiculous “enhancements” ever. This is what happens when companies like this prefer to spend the marketing budget on wining and dining bloggers instead of offering, you know, a fat Signup Bonus. So, be careful out there!

I live in the Chase credit card ecosytem and I am doing fine. It has been a while since I ventured into applying for Amex plastic. I am not one of those bloggers who have several Platinum cards by the way. We are all different. Anyway, it is widely known that Amex has been fighting a war against us “miles/points enthusiasts”. The company even has its own department for doing that, infamously titled RAT (Rewards Abuse Team). Now when you apply for an Amex card, if you have been at this hobby for a while, you pray you do not get the dreaded “popup” informing you that there will be no Signup Bonus, oh the horrors. We refer to these people who get this popup as being in popup jail. And it is getting worse! Shifting a lot of spend to co-branded Amex cards has always been a possible way to be free from this type of jail. And maybe now there is another one? The Alternative Pop-Up Jailbreak, AmEx Style.

To get out of pop-up jail, close all of your cards with American Express, wait 90-ish days, then start-over like you’re a new customer.

Good luck!

MILES & POINTS

HOT CREDIT CARD OFFERS: 75k CHASE Ink Business Cash, 75k CHASE Ink Business Unlimited, 75k CAPITAL ONE Venture X, 75k CAPITAL ONE Venture Rewards, 100k CHASE Ink Business Preferred, 80k CHASE Southwest Performance Business, 100k CHASE United Business, 60K CITI Premier, $1,000 Cash Back CHASE Ink Business Premier, 60k CHASE Sapphire Preferred, 60K CHASE Sapphire Reserve, 155k AMEX Hilton Surpass, 15k AMEX Blue Business Plus and many more!

This section is about my hobby addiction of collecting frequent flyer miles and hotel points since the early 1990’s! SKIP if you are not into it!

As of today, I have burned 309,308 miles/points year to date (1,148,286 in 2023) and have 4,547,806 miles/points in the bank. Some do drugs, I do miles lol!

Remember, you are NOT allowed to ever carry a credit card balance if you ever get a credit card here!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please pass it on to a family member or friend. Or Buy Me a Coffee, thank you!

TBB

travelbloggerbuzz@gmail.com

You can receive each blog post by entering your email address below and then clicking on Subscribe below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

I spend hours bringing this content out only to be greeted by an email I lost another email list subscriber, phuck!

Then seeing the credit cards sold with new credit card provider is still stuck at just one, smh.

Promised wife if I get kicked out from new cc vendor due to low volume I will end this blog pronto and save me this mental pain.

Ok, going to the gym to administer some real physical pain to my body, you all enjoy your weekend.

I will come back tomorrow, need a little detox from my blog addiction here…

Glad that there is hope for the foot!

ETFs are making such a difference. One of the most interesting jumps from academic economics / finance is how the random walk hypothesis moved to passive investing even though all sorts of folks (brokers!) has their income seriously challenged.

Thanks for keeping the faith.

The CEO of MSTR is doing a pump-and-dump–buying Bitcoin with MSTR and then selling his shares in the stock.

My marathon-running friend here in Charlotte just learned he’s got a torn meniscus and gets to go under the knife in a week or so. I said to him, “And you want *me* to run marathons?” Anyway, good luck with the injury. My friend spent a few months doing physical therapy before he got an MRI which showed the tear. The doctor was surprised he wasn’t in more pain.

Glad you are making progress on the foot!! Patience and time and the work will help, I am sure.

I am worried though on that intermittent fasting thing as I have been seeing some articles indicating that it might not be a good thing. Please be careful!

Sorry you lost a reader, but hope some more will sign up soon to make up for it! I honestly cannot recall how I initially found your blog, but I am continually glad that I did.

Stay tough!!

Sorry about the lost subscriber. I pretty much always read your work every time anyway but if it makes a notable difference to you I can subscribe instead.

Out of curiosity, why the vast decline in mutual funds vs. ETF’s? I have a couple of legacy mutual funds from some years ago and it doesn’t bother me to keep them but if there’s a solid reason to dump them it’d be helpful to know.

I am long time reader of tbb. I have been investing over 40 years and retired over 15 years. I like mutual funds for these reasons:

1) You buy a mutual fund at the closing price, you don’t have to worry about the spread, whether you got a fair price. This a hidden cost of an etf.

2) Fractional shares makes it easy to buy or sell at even dollar amounts. You want invest or withdraw $10000, or invest monthly $2000, it is easy with a mutual fund.

3) Buying and selling are easy because of the day end price and fractional shares; it takes no extra mental effort.

4) According to bankrate.com the fees for S&P 500 index mutual funds is lower than the comparable ETF, 0.05 percent vs 0.16 percent.

Thank you Les for taking the time to comment.

Just want to say a few things. Mainly, you are not wrong. But I just want to add a few things to your post.

Mutual fund costs have come down due to the competition from the ETFs. If it wasn’t for the ETFs pounding them, well, it would not have happened.

For buy and hold investors, trading costs are minimal to almost totally immaterial. And primarily because of that the little extra mental effort to sell, say close to $50,000, is okay imho.

Holding mutual funds in taxable accounts does not make much tax sense anymore.

Don’t listen to Bankrate = Don’t read The Points Guy, same corporate entity 🙂

@ DML: Thank you for always taking the time to comment here. It really helps keeps this blog going. Because it makes me feel that someone cares!

@ NickPFD: I always wondered if (when?) one day we will wake up to news that that dude is under investigation. Ouch about your friend. Walked another 3 miles yesterday. My foot doc says it is a matter of physics. As in with much less weight pounding on my feet. I’ll know more next week.

@ Carl: Thanks for taking the time to comment and your sock drawer cards too, much appreciated. It is March 23 and I have not gone back to my regular “oh phuck it, let’s go on a binge gulping down pizzas and donuts”…yet? Getting used to intermittent fasting and it is kind of weird not eating for like 16 hours straight! That reader probably thought my posts were just way too long for his attention span and preferred to read shit like this:

https://twitter.com/FlyerTalkerinA2/status/1771263553992859974

@ Christian: No worries about the lost subscriber, means nothing, it just hurts my ego, that’s all. If you do read my blog please do not subscribe, you don’t need another email in your inbox. I hope I can lose about 40 email subscribers to go under 500 to stop paying Mailchimp $31 per month. If anyone reads this and you are in this camp, please unsubscribe and let me know you only did it to help me go under 500 to help the blog sustain itself and not hurt my ego lol.

ETFs vs Mutual Funds: ETFs have lower expense ratios, sometimes much lower. And when held in taxable accounts they make a lot more sense tax-wise because of their internal capital gains favorite tax treatment. Besides, you know, when it is time to sell you know what price you are selling at. When you sell mutual funds you have no idea what the price will be at 4 pm, a LOT can happen during the day from the time you place the Sell order.

A lot of firms are converting their mutual funds to ETFs, it has been going for years and it appears to be accelerating. The next frontier on this is retirement 401k Plans. It is starting to happen but it is a much slower process. Now about your legacy mutual funds. Don’t sell them if there are adverse tax consequences. Unless they don’t make sense from a diversification standpoint or you need the money to achieve a certain goal and there is nothing else to sell. It may not be too long before the mutual fund company converts them to an ETF and they do that on a tax-free basis. Hope this helps.

To all: Believe it or not, this post was supposed to be the new and improved and smaller TBB blog post era underway. Not sure if it worked lol. I am going to try to have no more than three links in each section. The thing is… I added a few more sections and I will try to fix that.

I should have two posts next week, Tuesday and Friday. Tuesday will have no more than five links and I am really trying to find Best of Web type links but I am not sure they are of that caliber as of today.

I still can’t believe my much friendly to navigate credit card provider has only had one cc sale a month in. Talk about demoralizing. I am in peace, when they too kick me out due to low sales volume this blog addiction will come to an end. Which should have been more than 10 years ago, sad.

Cancelled lunch with daughter yesterday, due to phucking snow!

Gotta run, errrr, walk I mean.

You all enjoy the weekend.

Lost another email list subscriber this morning. He probably switched to reading View From The Wing who just posted:

Hotels Keep Finding Underwear In Their Tea Kettles, And It’s A Huge Problem

One day I will just go away…like Drew of Travel Is Free did. And it won’t be to go for a salary job at The Points Guy you guys…

Serenity now…

Not returning here until I post next week. You all enjoy the weekend.

Nice to start the week with an email from a blog reader who subscribed to my email list to receive every new post in an email. No spammy shit bombarding subscribers’ inboxes from me. EVER!

TBB on!