Another TBB post featuring the most eclectic links around the web such as FIRE and retirement costs, Bitcoin believers, tallest bridges, all the massive Sapphire Reserve card changes, the new ugly marketing strategy, life lessons, the 1904 St. Louis Olympics were weird, the best natural wonders, epic Taiwan train ride, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the rest of the week and weekend ahead!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This blog is for curious minds. Everyone can read this blog independent of income since its inception. Consider becoming a monthly Buy Me a Coffee supporter.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

I usually post on Fridays. Unless I am traveling or something major happened. Well, I am traveling to New York City to attend my brother in law’s retirement party. Which is on my birthday so I guess it is double celebration. In addition, Chase decided to massively change its flagship premium Sapphire Reserve cards so I am posting today, enjoy. We have all the changes except…the Signup Bonuses to be announced on June 23, 2025. And we expect them to be massive as well.

PERSONAL FINANCE

Excellent and timely thoughts: My Baptism by FIRE: Lessons on Financial Independence. As I am entering that phase of life contemplating the R word (retirement) along with guiding almost every client of mine to it, lots of similar thoughts are swimming in our brains. I never understood people staying in a job they absolutely hate. I always thought if your job is impacting your health negatively you should not stick around, life is too short. Unless, in extreme cases, the money coming in is so high and you are so young that you can take some abuses to sock away money in such a fast clip that could make it worth the (short sacrifice) while finding ways to cope in such an “awful” job. Of course this applies in extremely limited cases.

Another point I would like to make about financial independence. FI means having plenty of flexibility and choices available to you. Including choosing to work (or not). Never underestimate the huge health benefits of actually working on something that brings you joy. And of course purpose. A final point is…a big reason people don’t retire is fear, the fear of the unknown. Maybe one day in another blog post I could expand on that…

Hilarious post: A loss is just a gain that has not happened yet. In today’s volatile markets, you need to effectively communicate your performance to external stakeholders. Dreading that difficult conversation? Here’s a quick cheat sheet to help you describe your returns. Click if you want to laugh…

Oh dear God: Fisher Investments launches ‘fiduciary.com’ to ‘educate’ clients and RIAs, but site smacks of ‘naked lead-gen,’ says Fiduciary Institute’s head. Beware of the marketing…I better not say anything else because these guys have lawyers smh. I would rather jump off a bridge than refer anyone to this company. For the record, this is my personal opinion only.

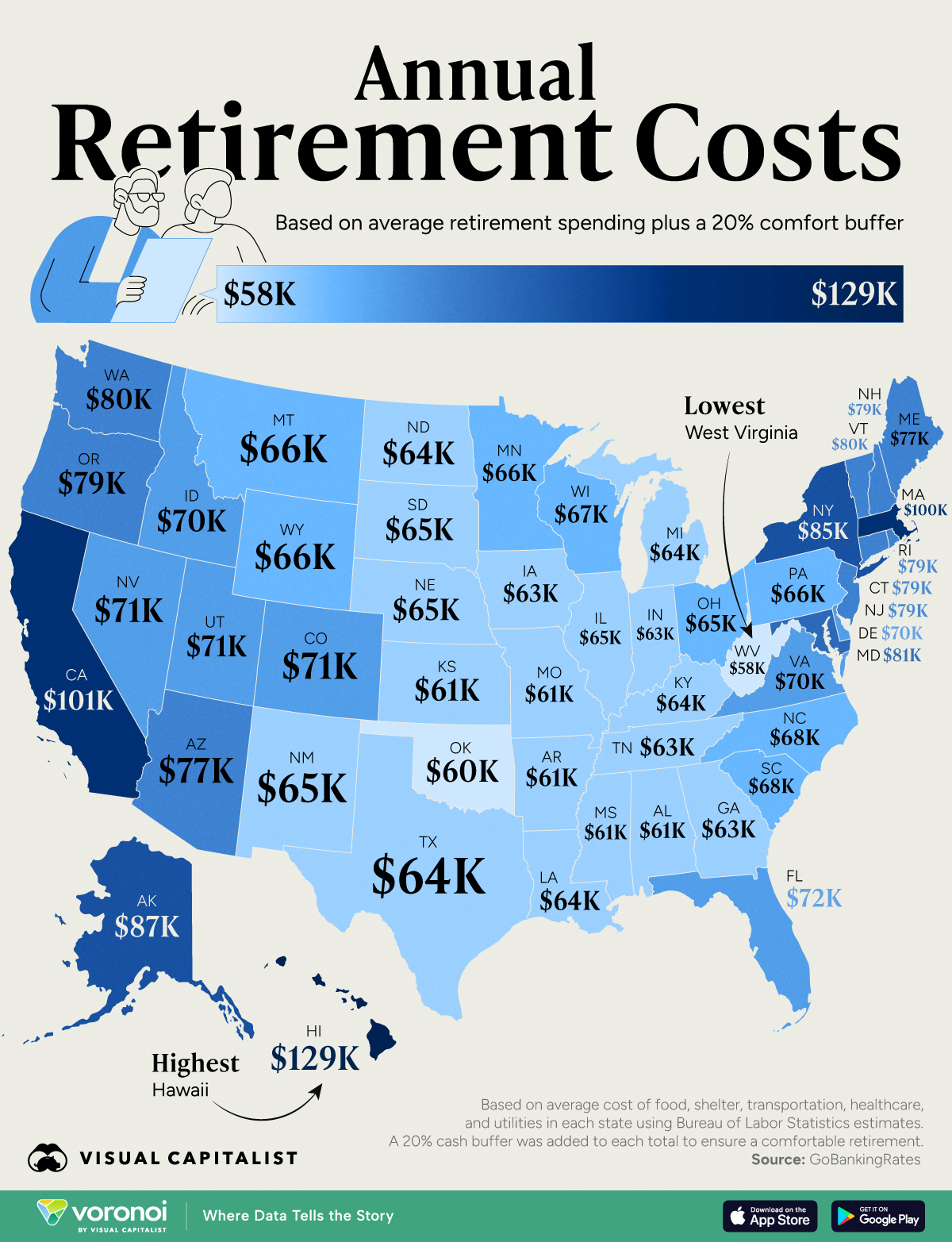

Mapped: Annual Retirement Costs by State.

SCAMS/CRYPTO/AI/TECH

This is a must read: What World Does Bitcoin Want to Build for Itself? The author goes to Bitcoin 2025, apparently the largest cryptocurrency conference in the world. And you won’t believe what happened next. Just two excerpted paragraphs below:

Here is the part of the story where I am supposed to tell you it’s all a fraud. I am supposed to point out that nobody has come up with a use case for blockchain technology in 17 years beyond various forms of money laundering; that half of these people have been prosecuted for one financial crime or another; that the game is rigged in favor of the casino and those who got there before you; that this is an onerous use of energy; that all the mystification around bitcoin is a fog intended to draw in suckers where they can be bled. All that stuff is true, but the trick is that being true isn’t quite the same thing as mattering.

There is nothing, either material or abstract, in bitcoin’s digital heart. There are no secrets. It is valuable to those who value it, because they value it. All you have to do to become wealthy is want to, and believe in bitcoin enough to trade everything for it. Argue with the circularity of that logic if you like, but it has made a lot of people a lot of money.

I guess I am not drinking the Kool-Aid…

This is sadly so right on, be careful out there and don’t contribute to more enshittification please: An Ugly New Marketing Strategy Is Driving Me Nuts (and You Too). Resist!

Here’s the new marketing playbook of 2025:

- Do NOT try to close.

- Do NOT try to sell.

- Do NOT try to persuade.

- Don’t even listen.

The goal now is merely to ANNOY. The big companies do it on purpose.

Big streaming platforms are the experts at this new marketing tool. They want you to pay for a premium, ad-free subscription. The more annoying the commercials, the more likely you are to pay.

You will pay just to get rid of the ad.

In this topsy-turvy world, the more painful the ad, the better it works. The digital platforms have studied this—YouTube has tested using up to ten unskippable ads on users.

That’s not marketing—it’s water-boarding. But they need to test these techniques. Their business model is built on optimizing the level of annoyance.

This is really cool: Historical Tech Tree.

Another social media influencer charlatan fraudster: Social media financial influencer pleads guilty to Ponzi scheme that costs investors more than $11 million. Be extra wary of people online pumping real estate.

As part of the scheme, federal officials alleged that Bossetti issued promissory notes that “falsely claimed investments were risk-free and secured by real estate” that he owned. [Promissory notes? Dead giveaway!]

Prosecutors said he used social media — he hosted the All for Nothing podcast, operated a Substack site (with an article on tax-free money posted June 8), and an Instagram account (now private) with almost a million followers…[A million Instagram followers? I have 248 lol. Well, I did have 12,000 followers on Twitter X and I walked away from that deranged platform because…Elon]

You like my blog? Send a link to someone please!

ODDZ & ENDZ

I really liked this, it is good to be reminded of all these things singled out: 25 Things About Life I Wish I Had Known 10 Years Ago. I tried to pick five:

Struggle Is Good

Exercise Daily

Don’t Care What People Think

Learn Every Day

Don’t Take Yourself So Seriously

You can find all kids of things in Wikipedia. Including a List of Unexplained Sounds.

Unusual indeed! 8 Unusual Facts About the 1904 St. Louis Olympics. They were supposed to be held in Chicago, they lasted for five months, only 12 countries showed up, the marathon was probably the most outrageous marathon in history, cheating was rampant, the tug-of-war event was back then a popular sport, a super racist ‘uncivilized tribes” event was held simultaneously and women were only allowed to compete in one event (archery).

Always the best photography in my blog: 15 riveting images from the 2025 UN World Oceans Day Photo Competition. The winning picture of the eye of a humpback whale is absolutely haunting.

TRAVEL

This is a must click. With amazing pictures and facts: The Tallest Bridges in the World.

This is great: America’s most stunning natural wonders. Which one is your favorite?

This looks like a wonderful train ride: Taiwan’s epic train ride through 50 tunnels and 77 bridges.

Thanks to blog reader Nick for providing this link: The Island That Humans Can’t Conquer. It is St. Matthew island, the most remote island in Alaska. Obviously there will never be a Hyatt built near there lol.

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS

Here we go…

Well, this was Chase Sapphire Reserve week with massive changes, see separate section below.

Heads up for Q3 2025 5% Quarterly Categories: Activate, Offers & Suggestions (Freedom/Flex, Discover, Dividend, Cash+ & More).

I think this lounge may be the best in the US and can’t wait to visit it: Capital One to Open Flagship Lounge at JFK on June 19. It is going to be open 24 hours, wow. That Terminal 4 has all the best lounges, lounge hopping everyone?

This will likely come in handy for all you Hyatt enthusiasts: How to use Hyatt free night certificates on a multi-night stay.

Oh brother, Boarding Area now has an AI blogger and his name is Sky Skylar…and you won’t believe how much he sucks. For the record, this blog here is written by a human trying to change the world, one human set of eyes at a time. I bet AI Skylar probably out earns this human blogger, sad.

TRAVEL REWARDS CREDIT CARDS

Chase dominated the action with all things Sapphire Reserve and I am going to of course blog about them in a separate section below.

Interestingly, American Express, sensing it is about to lose the splash factor and “exclusive premium card” throne, came out with a press release the day before Chase introduced the Sapphire Reserve changes to scream we are here bitches and we will be back in the Fall to reclaim the lead lol: American Express Announces Major Updates Coming to U.S. Consumer and Business Platinum Cards® Later This Year. AND, not only that, it has increased the standard Amex Platinum signup bonus to 175,000 Membership Rewards points, see NEW OFFERS section below.

THE NEW CHASE SAPPHIRE RESERVE CARD

Chase has all the details in a separate page titled: Meet the new Chase Sapphire Reserve Card. Coming June 23, 2025.

First, we do not know what the signup bonuses will be. But expect them to also be massive as well, coming on June 23.

Before we list all the changes, I am going to just blog about my own take on the changes. First, be aware that over 95% of the businessmen bloggers/vloggers in this space stay in business selling credit cards. This blog gets 90% of its revenue doing the same thing. With a huge difference as my blog almost never sells more than five credit cards a month lol. And with recent massive changes forbidding the posting of direct affiliate links (including from Chase bank!) many of us face extinction. The difference between them and me is I am going to probably continue blogging trying to stick to the blog mission and maybe even try to break even this year continuing not getting paid for my time. Anyway, it is what it is. Off my soap box…

Having disclosed all that: Massive Signup Bonus Coming For Chase Sapphire Reserve Card On June 23rd.

So, I love this country. I love the US banks. Competing for my business. And the competition in travel rewards is fierce and we benefit. As long as we play this game right that is. Going for the big signup bonuses, keeping it simple (how we define “simple” is different, because we are all different), never ever carrying a credit card balance of course and always making sure we squeeze a lot of value out of the banks. But squeezing this value is not getting easier. Banks continue to fight back increasing annual fees, cutting loopholes/earning rates/point valuations, placing more restrictions in obtaining cards and, this blows, increasing couponization of benefits. Since the BIG benefit is always going to be the big signup bonus, you know, you can say yes to it and then…not keep the card long enough for the bank to squeeze the value you get out of it in the first place? But to make a splash, because make no mistake Chase IS making a splash, we are going to have an opportunity to get the Reserve cards even if we have the Sapphire Preferred card in our wallets and vice versa, hooray! Even with that though, Chase is now going to imitate Amex with its own “Pop Up Jail” measure, boo: Chase Will Do Away With 48-Month Signup Eligibility In Favor Of Proprietary Eligibility Determination (‘Chase Pop Up Jail’).

Again, the changes are massive, please take your time to study them all HERE.

I am just going to comment on a few selected changes…First, the main changes are:

We have a new premium card annual fee leader with both versions of the Sapphire Reserve going up to $795 (up from $550).

Earning Rates:

- 8x points on Chase Travel (replacing 5x on flights and 10x on hotels and car rentals)

- 5x on eligible Lyft purchases through 9/30/27

- 4x points on flights and hotels purchased direct (replacing 3x on all travel)

- 3x on dining worldwide, including eligible delivery

- 1x everywhere else (including on travel not included in the bonus categories above)

Amazingly, the $300 Travel Credit Remains Intact. And not only that, it remains the easiest credit in the bank space. By far. So, we are down to $495 really. And very strong travel insurance protections stay intact as well.

The Authorized User fees increase to $195 from $75.

Chase sticks with lounge access for cardholders with two guests, which I find surprising and great news. Including Authorized User cards! So, you can bring in your spouse and a kid. Unlike both Amex and Capital One.

The 1.5 cents (and 1.25 cents for the Sapphire Preferred) per point used in the Chase Travel portal ARE going away over the next two years. And replaced by a flat 1 cent per point, unless you get lucky with a supposedly automatic feature named “Points Boost” that may come up that could be worth up to 2 cents per point. Simplicity and transparency taking a big hit here…unless you get lucky that is. This is definitely not a positive development.

Earning multiplier for ALL travel drops from 3x to 1x. Very negative too. In the old CSR, it basically cost $250 after the easy $300 credit. And you could put every imaginable travel expense on the card without blinking. Not anymore, boo.

If you have the Sapphire Reserve card right now, there is an interesting timetable on how the changes and higher annual fee will hit. This is ridiculously complex, come on Chase.

We can go on and on about all the new couponized benefits. I think we sensed the space is going all in on couponing considering the success Amex has with it. But we also see competition here with Chase even pointing out that their coupons are better lol. As in, fatter over 6 months instead of tiny monthly ones. We all hate them but, make no mistake, we will go through every single one and most likely make an effort to use them to brag how much value we get out of these cards lol. So, I liked Frequent Miler‘s deep dive on the couponified CSR benefits. I mean, some will definitely use at least a few of these and most will go out of their way to find a way to use them I think…after bitching about them non stop.

Again, the $300 easy travel credit remains. I did not expect this one to survive actually.

IHG One Rewards Platinum status, enjoy your free water woohoo. And I guess this goes away 12/31/27. Good to see Chase entering the airline/hotel elite status benefit space, it sure was lacking vs Amex. I was joking about the free water, IHG One Rewards Platinum is not really a bad status to have. And it is “free”…if you do not forget to activate that is.

Free subscription to Apple TV+ and Apple Music. Valued at $250. I think my daughter would not mind this at all.

Two $150 credits every six months to have a big dinner in a high end restaurant. Valued at $300. You know, I could go for that. I thought this new Chase Resy-like entry into dining would cover a few cities (New York and Los Angeles, maybe Miami too) but I was shocked that Detroit was well represented. Heck, just went to one of the Detroit area restaurants last week to celebrate Father’s Day and I could easily pretend I am eating for “free” twice a year lol. So I may add yet another entry in my ever growing list of couponized (or is it couponified) benefits I keep track of in an Excel spreadsheet yikes.

The Edit credit. This is like Amex’s FHR Fine Hotels and Resorts. Same frustrating deal trying to find a decently priced hotel to use this credit. Anyway, it is two $250 credits every six months for prepaid bookings which should not be that hard. Valued at $500. BUT you need to stay for minimum 2 nights, boo. So, taking advantage of this will be too much of an effort and will likely still require a hefty cash outlay. Anyway, couldn’t they come up with a better name for this, WTF is “The Edit”? Brings visuals of scientists trying to edit some genes or something, probably the dumbest name for a benefit feature ever?

Same two $150 credits every six months at Stubhub & viagogo. Valued at $300. You know, I would not even bother but I can certainly volunteer to pay for my kids’ concert/event buys twice a year. For the record, I had never heard of viagogo. And that spreadsheet of couponizing entries just enters lol complexity now smh.

$5 – $10 monthly DoorDash/DashPass/Lyft: Don’t get me triggered.

Monthly $10 Peloton credit: Lol.

$120 Global Entry/TSA Pre/Nexus credit: All premium cards have this benefit it appears. No change from old CSR.

Reserve Travel Designers: Oh, come on, more concierge types. May be a a good topic for a blogger/vlogger to research putting them to work. Expect…nothing. Chase values it at $300 lol.

I understand banks adding benefits for high spenders, in this case over $75,000 per year. But I never understood how Chase picked things like IHG One Rewards Diamond status and, please sit down, Southwest A-List status and $500 Southwest travel credit. Out of all airlines…Southwest, really? And another $250 credit at The Shops buying way overpriced and unnecessary shit. I guess The Shops is a better name than The Edit lol.

Again, as a reminder, cardholders AND authorized users can enter all Chase and Priority Pass lounges WITH 2 guests. You don’t have to split the family anymore, looking at you Amex and Capital One. Surprisingly, the BUSINESS Sapphire Reserve differs on the authorized user cards as they are free (personal CSR authorized user card fee is $195) AND do not have lounge access.

BUSINESS SAPPHIRE RESERVE CARD

Oh, yes, we also have a Brand New Chase Sapphire Reserve for Business Card.

For a deeper dive on the new Business Sapphire Reserve card: The new Chase Sapphire Reserve for Business surprises, but doesn’t delight. Frankly, I could care less about being delighted as long as the Signup Bonus delights me wink.

The Business CSR is almost the same as the personal CSR with a few differences. We mentioned the Authorized User/Lounge Access difference above. It replaces the 3x earning category for dining with online advertising. No free Apple TV+ and Apple Music. And no Stubhub/Peloton/fancy dining coupons which have been replaced with $200 ZipRecruiter credits every six months, $200 annual Google Workspace credit and an easy $50 giftcards.com credit every six months…if you remember to do it that is. You know, like you remember to buy a pair of socks at Saks.com with your Amex Platinum every six months lol. With the Business CSR for high spenders, you do get an increased $500 credit (up from $250) at The Shops on top of the same benefits that apply to the personal CSR. But the definition of “high spender” goes up to $120k in the business CSR instead of $75k on the personal CSR.

I must admit that the business related coupons in this card leaves lots to be desired, especially if you happen to have the $95 Chase Ink Preferred. I think the personal CSR is better if it came down choosing one or the other CSR cards fwiw.

I am looking at this from this angle: We all have the CSP card in my household. It is a keeper card and anchor card that keeps us transferring out our points to some airlines and Hyatt. Me and my wife had the CSR years ago when the signup bonus was 100,000 points. And since then we were shut out getting a Sapphire type card ever again. Until now. With four of us, we are looking at a potential bonanza of Ultimate Rewards points to be earned with 8 different Sapphire Reserve cards to be had. I need to sit down and make a plan of attack.

Looking forward to the signup bonuses to be announced with 100,000 to be the absolute floor. I am guessing anywhere between 120k to 150k. Actually, after thinking about the new cards for a while yesterday, I think we may see 150,000 points signup bonuses to move the needle because, let’s face it, the card changes coming at $795 are just not that compelling. Which is disappointing to say the least. I think Amex in the fall may come out and they have the weapons to bury Chase #exciting.

I am very curious to find out if me and my wife will be welcomed into the new Chase pop up jail territory. I think both of my kids will not have any issues getting them. The thing is, they are not like their dad but we do need to sit down and decide whether my son will keep his Amex Platinum (making the CSR a one and done type card) and it was actually time to get my daughter to step up and get her own premium card so it is going to be tough deciding between the three banks. Of course if it was me I would say all lol having my usual predatory mindset to grab and run cancel/close. While keeping my Amex Business Platinum for now, even though the Dell credits went down.

My daughter loves airline lounges by the way so Amex wins having almost triple the number of lounges. And it appears it is building new ones (three were just announced) at a higher pace than both Chase and Capital One still. But Chase wins by allowing two guests (and my daughter loves guesting her friends). And Capital One still wins currently because the bank pays you $5 to have the card, it does have great lounges but only five so far and sadly no free guests anymore. Decisions, decisions…And I can only keep it sane you guys juggling them all and there is a ceiling on that minimum spend I can do. And going away for two long trips in the months ahead. First world problems again.

NEW OFFERS:

We have several new offers:

The STANDARD Amex Platinum offer is now 175,000 Membership Rewards points. We have been able to find higher offers several ways in the past. I got my Business Platinum card when it was going for 250,000 points in some obscure link I found online. I have not seen any of these links floating lately. The annual fee is $695 and the minimum spend is $8,000 over six months. 5x on Airfare and Hotels and 1x on everything else. Superior Centurion lounge coverage and of course Priority Pass lounge membership. No foreign transaction fees. A long list of couponized credits, up to $1,800 if you took advantage of every single one. Which you won’t. The easiest credits are the $200 airline fee credit, the $240 Digital Entertainment credit, up to $200 Uber credit and $100 for Saks credit (free socks!)…and many more.

Brand new offer is the CAPITAL ONE Spark Cash business card. Signup Bonus is $1,500 Cash Back once you spend $15,000 in the first 3 months from account opening. The signup bonus has doubled since last time. The annual fee is $95 but it is waived for the first year. Card earns a flat 2% cash back on everything and it is unlimited, it can’t get simpler than this. And it also earns 5% on hotels and rental cars booked at the Capital One travel portal. And if you have a Capital One card that earns miles you can indeed transfer these points out to partner airlines and hotels and could should get more bang. After the minimum spend is done you will have $1,800 cash back or 180,000 miles to transfer to travel partners. No foreign transaction fees. Cell phone protection up to $800 per claim after a $50 deductible.

EXPIRING OFFERS:

Another round of new Hilton credit card offers without any Free Night certs at this go round. Other changes are that both Aspire and Business cards went up to 175k points, the Surpass card has the annual fee waived in the first year and the no annual fee card is now offering 100k points AND a $100 statement credit for only $2k spend. All offers now give you 6 months to meet the minimum spend which I think is a true enhancement and hope it sticks around.

The best offer is the Marriott Bonvoy Boundless card offering 5 free nights (up to 50,000 points each). The annual fee is $95 and the minimum spend is $5k in three months. Note that the free night certs expire in one year and they can be topped with 15,000 points per night. Read all the details about this offer and the card HERE. I have no affiliate link for this card, thank you in advance for showing an interest to apply to help this blog. This offer expires 7/16/25. I am no fan of the Marriott Bonvoy program. But, you know, this can be a free 5 night vacation, just like the IHG One Rewards Premier card offer below. Question: I believe there is a Marriott property at Machu Picchu, can a reader identify that property and whether this card will cover a stay there with this card offer? Thank you.

And there are now a whole bunch of new decent Limited-Time Welcome Offers on Delta Cards, Earn Up to 110K Miles. These offers also expire on 7/16/25. To recap:

Personal Gold: 70,000 SkyMiles after $3,000 spend in six months, waived annual fee

Personal Platinum: 90,000 SkyMiles after $4,000 spend in six months

Personal Reserve: 100,000 SkyMiles after $6,000 spend in six months

Business Gold: 90,000 SkyMiles after $6,000 spend in six months, waived annual fee

Business Platinum: 100,000 SkyMiles after $8,000 spend in six months

Business Reserve : 110,000 SkyMiles after $12,000 spend in six months

Please help the small independent blogs like mine continue to exist by supporting them with your CREDIT CARD clicks, thank you!

#1 OFFER STILL PAYS FOR ITSELF:

The 75K CAPITAL ONE Venture X card has a minimum spend of $4k in the first three months. If you like simplicity and looking for one (premium) card, I highly recommend this card (and yes, I have it myself!). It has an annual fee of $395 but it comes with an easy $300 statement credit for travel booked on its own travel portal, essentially turning it into a $95 annual fee card. But wait, there is more! On each card anniversary you earn 10,000 points essentially making it FREE! Every dollar of spend earns 2 points and flights booked on the travel portal earn 5 points per dollar. You get access to Capital One and Plaza Premium airport lounges and a Priority Pass Select lounge membership and, this is important, you can add four authorized users FOR FREE who can also have their own Priority Pass Select airline lounge membership and, this is BIG, they can bring in unlimited guests with their FREE Priority Pass card! You can transfer your Capital One points to up to 18 Transfer Partners. No foreign transaction fees. Free Hertz President’s Circle rental car top elite status. Cell phone protection and PRIMARY rental car coverage. Awesome seats at baseball stadiums for just 5k points each. And lots more. If you prefer, this is my personal referral link.

MAJOR UPDATE: That amazing free ride accessing all the Capital One and Priority Pass airline lounges is over. Basically, no more free lounge visits other than primary cardholders effective 2/1/2026, please see details HERE.

Here are my three TOP CREDIT CARD OFFERS:

The 75k Capital One Venture X card.

The 75k Chase Ink Business Unlimited card.

The 75k CHASE Ink Business Cash card.

BONUS OFFERS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click on the link above

2. Create an account

3. Subscribe

MY ACTION AND BLOG BUZZING

Not much has happened since last Friday. And the Chase Sapphire Reserve card changes have dominated everything and I elaborate greatly about my take on the changes and my own personal situation above.

To reiterate, the juice in this game has always been the fat travel rewards Signup Bonuses. And the more I am in this game the more determined I get to take them from the banks and then drop them like discarded merchandise lol. And at the same time attempt to simplify my life. Which are kind of mutually exclusive. I am trying to quit this drug but once you are addicted…

With the premium card annual fees about to approach $1,000 (looking at you Amex in the fall) and couponization reaching insane levels…are we on a path to say phuck it and just say no to these travel rewards cards? And instead just pounce on one cash back card and just buy our travel going forward? I don’t know. In other words, the banks along with airline/hotels better take notice and keep us playing along. Because they will likely need us again to fill up their planes and hotel rooms and pulling the cards out. This may sound controversial but this space needs a tough recession for our species to shine lol. I remember the time after 9/11, those were the glorious travel hacking years you guys.

Going to be in Brooklyn for about a week and I may have time for lunch or dinner with any blog readers, email me if you are around.

The initial design meeting for the big home renovation project is history. Waiting on the first plans and the sticker shock coming next lol.

Son is getting his new passport super fast, like two weeks wow.

My birthday is Saturday and have a dinner at Laila Bayridge Syrian restaurant in Brooklyn, NY. Party of 10, including wife and my two kids. Thanks for the Happy Birthday wishes in advance. Best birthday gift from you is the sale of a travel rewards with my links to keep my blog baby rolling 🙂

Can’t wait to see 28 Years Later, premiere is Friday June 20.

HOT CREDIT CARD OFFERS:

175k Amex Platinum, 75k CHASE Ink Business Cash, 75k CAPITAL ONE Venture X, 75k CHASE Ink Business Unlimited, 150k CAPITAL ONE Spark Cash, 150k AMEX Business Platinum AND $500 statement credit, 200k CAPITAL ONE Spark Cash Plus, 5 Free Nights CHASE IHG One Rewards Premier, $1,000 Cash Back CHASE Ink Business Premier, 90k CHASE Ink Business Preferred, 75k CAPITAL ONE Venture Rewards, 120k CHASE IHG One Rewards Traveler, 80k CHASE Southwest Performance Business, 15k AMEX Blue Business Plus and many more!

As of today, I have burned 625,648 miles/points year to date (2,027,816 in 2024) and have 4,520,037 miles/points in the bank.

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

A bit of nostalgia:

First.

I miss Ingy 🙂

Following Sam’s lead… Silver! For the Pacific Northwest!

Thanks for all the good reading, this will carry me to Friday!

Carl:

Not posting this Friday so I hope you can find another source to carry you through the weekend man.

Oh shoot, I better start packing.

What do you all think about the CSR changes?

Argh. Just saw this when looking to see why no post today! I’ll struggle through the weekend but it won’t quite be the same without you!

As far as the CSR, I do not have that card and now I never will. Cancelled my last Platinum and only high-end card I have is the Venture X.

Good afternoon!

One really interesting thing about the CSR change is the timing of the benefit

changes. We can still get the 1.5x bump up on UR points for a few more months.

Lots to think about.

Well .. we live in interesting times!

Can you write like 20 or 30 more articles on the Chase Sapphire Reserve card? I need to know more and I can’t find anything on it with the mainstream points and miles bloggers.

Working on a 53rd part blog series, thank you Chase Sapphire Reserve Enthusiast. Love Jaime. And Boarding Area, we are the best collection of bloggers in the galaxy.

Your newsletter mentions your birthday, but I didn’t see a date, so Happy Birthday, whenever.

Saturday, first day of summer. I know I threw everyone off with a Wednesday post.

Stuck in the Detroit Lufthansa lounge. Thunderstorms rolling through. AA flight (booked with 4,500 Alaska miles already delayed 1 hour…and we could be here for a while. I swear this lounge has the crappiest tasting food…but it is “free”.

Well, after repeated delays and eventual cancelation we drove back home. And rebooked for Friday very early am because wife did not want to fly through the day Thursday and take a day off work. Major weather issues in Detroit and it appears a ground stop at LGA. We just had a “free” meal at the Detroit Lufthansa lounge where we stayed for hours.

Dang, I could have saved the Wednesday post and posted it as usual on Friday, oh well.

TBBon

Καλημέρα from Irakleia. The tour has continued to another island. Its population was officially 148 inhabitants at the 2021 census and it very much seems like 1/4 of the island turns out every night to sip raki and ouzo at the local mini mart/grocery/travel agency/coffee shop. Did a 9 mile hike around the island today and saw a grand total of 2 other hikers in the 4:30 it took to complete a loop. A quaint little spot, still protected from the tourist hordes until August from what I understand. But difficult to get to beyond maybe a ferry every day, most skip it on the way to Ios or Santorini from Piraeus, and not much to do beyond 2 beaches walking distance to the port and a handful of hiking trails. Wi-fi and cell service has been hit or miss. Much warmer without the wind!

Sad to see Chase going coupon mode, such a gimmick and entirely lame to have to keep up with.

Happy early birthday!

I had to look up that island. Sounds very nice. Greek ferries, have not been in one in such a long time. I remember them being so chaotic.

The couponing phase is going strong and is here to stay I am afraid.

Today felt like a Sunday.

Saw 28 Years Later. Great. But I expected more. Much more.

Yes, the ferries are still very chaotic. You line up, dodge people and vehicle getting off the ferry coming toward you, and scramble to get someone to check your ticket, toss your bags you don’t want to carry up stairs anywhere you can find space on the car deck, and scramble to find a place to sit. There is assigned seating that no one follows, unless someone wants their seat in which case a worker kicks you out and you have to go find somewhere else.

Then leaving the ferry basically mimics the opening scene of Saving Private Ryan. Everyone queues up after taking 5-10 minutes to get their bag out of the massively accumulated pile of bags that everyone stacks on top of one another, the door drops open, and then it’s everyone for themselves getting off the boat as the workers rush you off the ship!

I guess there is a method to the madness in the sense that the turns getting on/off the boat are incredibly quick, so they usually are ‘somewhat’ on schedule, barring rough seas where the boat can’t go as fast. I’m amazed how well the semi-trucks and commercial vehicle get on and off in what can’t be easy conditions. I guess it’s a way of life for them but still have to think they have episodes where things go awry. I even noticed a garbage truck getting on the ferry to Naxos the other night plus an armored car getting off in Amorgos. How all the supply chains work here to sustain life on the islands would be an interesting read.

Greece has made lots of progress. I guess ferry boat transportation is not one of those improvements. Enjoy the rest of your time in Greece.

Happy Birthday!

I’m about to open a HSA and looked at Fisher Investments. Glad you mentioned that they suck. Is there a company you would suggest?

I like the retirement cost map but I do wish that the median costs would be listed rather than the average since the very rich skew the numbers, making them a lot higher.

Like you I loathe the AI Boarding Area blogger, not least of which because it says “I” in things like “I really enjoy…” WTF? Now I just avoid those posts at all costs.

I tried applying for an up to 175K Amex card from your links but got the dreaded popup. I guess it hasn’t been enough years yet.

Fidelity has a self directed HSA, which I’ve found to be pretty rare of the ‘big’ brokers, I’ve been happy for the most part with it and them. I’m even looking at consolidating all my investment assets on their platform because of how I like them not nickel and diming you at every opportunity.

Thanks!

https://www.morningstar.com/personal-finance/best-hsa-providers

Agree with Fidelity, daughter’s company uses it and it’s great. Avoid Health Equity, consistent bad experiences with several clients.

There are surprisingly a lot of those Chase restaurants in my home city of San Diego where I can use the credits.

Yes, agree on that. Which is very surprising. Even Detroit has several nice one, having 2 nice dinners every year is easy. Add the $300 easy travel credit, both kids do use $300 Stubhub and daughter pays for Apple TV+. Add in the annoying doordash and Lyft credits and, well, pays for itself? Always pays for itself for first year, even assuming a minimum 100k points SUB. The thing is…is it a keeper after the first year? I guess we’ll compare with the AmexPlatinum refreshes coming in the fall. Surprised to see a consensus building that Chase may have over reached here. Judging from financial $$$$ perspectives…I am not so sure. And WSJ I will link to at the next TBB post will clearly show this. Just fascinating developments in our little corner…and where we go from here.

Enjoying some quiet family time in Brooklyn,NY. And doing lots of thinking about life in general. While awaiting the ax to fall from my 2nd cc vendor and joining a bunch of bloggers due to the latest severe Chase affiliate “compliance” changes. Derek Thompson left The Atlantic to start his own Substack. So he can write for himself he said. Seriously thinking to join that boat because how can I continue losing my ass here? 3 cards sold and 0 coffees month to date. And this is before Chase implemented the latest crap suffocating small bloggers. Of course, big bloggers get the pass because, you know, sales volume is compliance-friendly ^%$#*!!. Google SEO changes have been killing blogs and things have been moving to TikTok, YouTube and Instagram Reels. Basically,enshittifcation is taking over and people just don’t read anymore. You guys are the select few and this is not going to carry even a tiny blog like mine with small expenses. No wonder the blogs surviving are now big businesses with multiple staff. I am just a one man show and have been bringing it hoping this operation could break even (while allowing me to deduct some expenses I would otherwise not been able to do so without the blog business). I think the blog is adding unnecessary stress in my life and impacting my health with my super focus on finding super quality content online to share with you. It was fine all these years but the most severe beatings/restrictions started in late 2024 with the big bank affiliate restrictions, which have now fatally accelerated.

Oh boy, that was much longer than I thought it would be when I first started writing this comment.

Giving myself an internal deadline to average 5 cc sales and minimum 15 coffees per month in June, July and August. Obviously, already behind for June. Or until the ax comes from 2nd cc vendor, whichever comes first. And the ax could happen any day.

We’ve been through this many times so you guys are probably used to my bitching.

Just a heads up.

So, tonight is NBA Finals Game 7. Will stay up to watch it. We remember what happened at last Game 7 in the finals and I think Indiana may do it.

If this blog dies I am going to miss you guys the most, this interaction in the comments I cherish. Along with the supportive emails. It was ok never getting paid for my time over the years and still showing a tiny profit to stay in “business”. But now it has come to a point of paying increasing $ to bring this to you. It is not about the money, it is about my ego, it’s always been this way thanks to day job paying well. Full disclosure: I have turned down several requests to accept new clients. Because I wanted to keep my blog baby…

It is what it is…thank you for reading and stay healthy my friends.

CSR personal SUB:

100,000 Points and $500 travel credit

Min spend $5k in 3 months

CSR Business SUB:

200,000 Points

Min spend $30,000 in 6 months

Links will be you know where tomorrow 😉

Wonder if 5/24 will be strictly observed. I’ve got about a month until I’m below the threshold again.

Data points galore phase is coming…

Chase pop up jail is here.

Shots of approval are higher in the initial stages.

Do not waste any time on rumors. As in market predictions as well.

The CSR affiliate links are out, brace yourselves.

Let’s see what happens around here to save this “venture” to save my position…

CSR Data Points:

https://www.reddit.com/r/churning/comments/1li5si0/sapphire_reserve_personalbusiness_dps/

Any suggestions on a name for my Substack newsletter ahead? Because everything here has dried up!

#theendishere

Any CSR data points from blog readers? Will take my shot(s) when I get back to MI on Wednesday…

Applied for the business card through your link last night even though I’m 5/24. Went pending, no doubt in part because I’m an idiot and forgot to unlock my credit report. Unlocked it shortly thereafter. Approved a few minutes ago. That’s my 9th business card with Chase.

Thank you!

I coached three friends and they all got the popup. All personal CSR offer, not the Business CSR.

Do you have the CSP open now? If yes, when did u get the bonus?

Have you had the CSR before? If yes, how long ago did u get the bonus? Do you have it open now?

9th business card open rn? 9th over how many years?

Data points all over the board…Trying to figure out what the rules are post new CSR landscape.

Starting to see YouTubers making stronger efforts to sell channel subscriptions. And soon courses smh. I think Chase may have decided to take all the small and average bloggers out and shot them.

I closed my old CSP and reapplied a month later. That was about six weeks ago. It took substantial work but I got recon to approve me. I just got my roof redone and paid in part with the new CSP so I should be getting the 100K bonus soon. I think I got it through your links. Never had a CSR.

I’ve accumulated the cards over the past decade or so. I do put $10K+ a month on the cards so I’m spending which should help keep Chase happy.

Thanks for the data points! I think if you went for a personal CSR you would not get anywhere. But your business CSR data points gives me hope.

That is a very healthy spend on Chase cards. I should probably transfer some cash and park it in the Joint Chase checking account but I may not get around to it before applying…

I am still catching up from my NYC trip around here…I need to pull out a superman TBB effort today to publish a blog post tomorrow!

I was going to apply for a Business CSR today and my wife go for a personal CSR but did not get to it, maybe today. I am hopeful for my business CSR and wife’s personal CSR is a long shot. I need to see how far back daughter got the CSP bonus before I decide if she can throw a personal CSR app…If I didn’t have the blog all these would have been done already, sigh.

4 tickets to Greece done. Tickets back from Greece: 0

Son + 1 joining us in Koh Samui at the HR, 3 nights booked for them with my Globalist GofH cert gifted.

Slowly these two big family trips are coming together. Very slowly. Still no business class availability from Greece and to/from BKK…with reasonable itineraries that is.

Have you checked EVA flights from Europe to BKK? They’re a lovely airline and have some nonstops from different European cities. Also, if you can get the space the Qatar A380 in first class between Doha and Bangkok is pretty amazing and is a pretty good price with miles.

I have not flown EVA yet, my daughter has and she really likes it.

I am anti positioning flights in general. Which makes my award booking targets much harder in a way. I need to really speed it up next, especially the trip to Greece. Oh, threw a business CSR app in late last night, will see what happens. Time to make the donuts, eeer, finish today’s Friday post, gonna be a long one!

Last.

Last time we broke bread was in Brooklyn. If I recall, you paid! Gasp. Sorry I wasn’t paying close attention to your trip.

I’ve had the CSR since day 1. If I reading correctly, the card now has food credits as you mentioned above. Is there a minimum spend at the restaurant to get the credit, or can I just spend any amount?

By the way, will I get a notice when there’s a response?

I responded to you in Instagram. No, you will not get a response here. Please read the latest post, usually it comes out on Friday mornings.