Another TBB post featuring the most eclectic links around the web such as the hot stock markets, the AI money vortex, the real China model, eleven dreamy Airbnbs, the 100k CITI Strata Elite card offer, passive investing principles, generative AI aftermath, anti 5G vigilante, the anti vaccine movement goes way back, the best romantic spots in each US state, Thailand buffaloes, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

Due to new severe credit card affiliate restrictions, there will not be any credit card links in the body of the blog posts other than Capital One Bank and personal referral links going forward. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE . Or just email me.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

PERSONAL FINANCE

And The 2026 Tax Brackets Are Here. See Where You Land. Main highlights:

The new income ranges for each tax bracket and a higher standard deduction mean that someone who earns the same income next year would likely owe slightly less in taxes, though the difference may be a few hundred dollars in many cases…The 37% income-tax rate will apply to income above $768,700. For individuals, that top tax bracket will kick in above $640,600…A married couple filing jointly could have $100,800 in taxable income, nearly $4,000 more than this year, and stay in the 12% bracket.

The standard deduction rises to $16,100 for individuals in 2026, up from $15,750. For married couples who file jointly, it is $32,200, up from $31,500.

For those of you with large embedded unrealized capital gains: For 2026, the 0% rate applies to single filers with taxable income up to $49,450 and joint-filing couples with incomes up to $98,900.

The new tax law set the federal estate-tax exclusion—or the amount an individual can shelter from estate taxes—at $15 million for deaths in 2026, up from $13.99 million this year.

A separate annual limit on tax-free gifts is $19,000 for 2026, the same as this year.

This Jason Zweig Wall Street Journal article is about a month old. And yet so timeless: How to Keep This Hot Stock Market From Melting Your Retirement Dreams. Don’t assume high returns will last, or that you will spend far less.

What investors must never forget is that market returns also have three basic phases: good to great, middling and miserable. To counteract the consequences of miserable long-term returns, you have only three choices: Save more, work longer or take more risk.

Saving more is by far the easiest and safest.

Earlier in my career I once lost a prospect to come aboard my small by design wealth management firm because, as he put it, my investing style was not complicated enough I guess for his level of wealth. This used to bother me but I quickly got over it. Because in this business client fit is paramount. Anyway, the article: At What Point Do Passive Investing (Boglehead) Principles Not Apply? The article contains lots of cautions against private market investments. For the reasons I have outlined here in the past numerous times.

…the passive/Boglehead style of investing is just as prudent, regardless of whether we’re talking about the low range of the wealth spectrum, the high range, or anywhere in between.

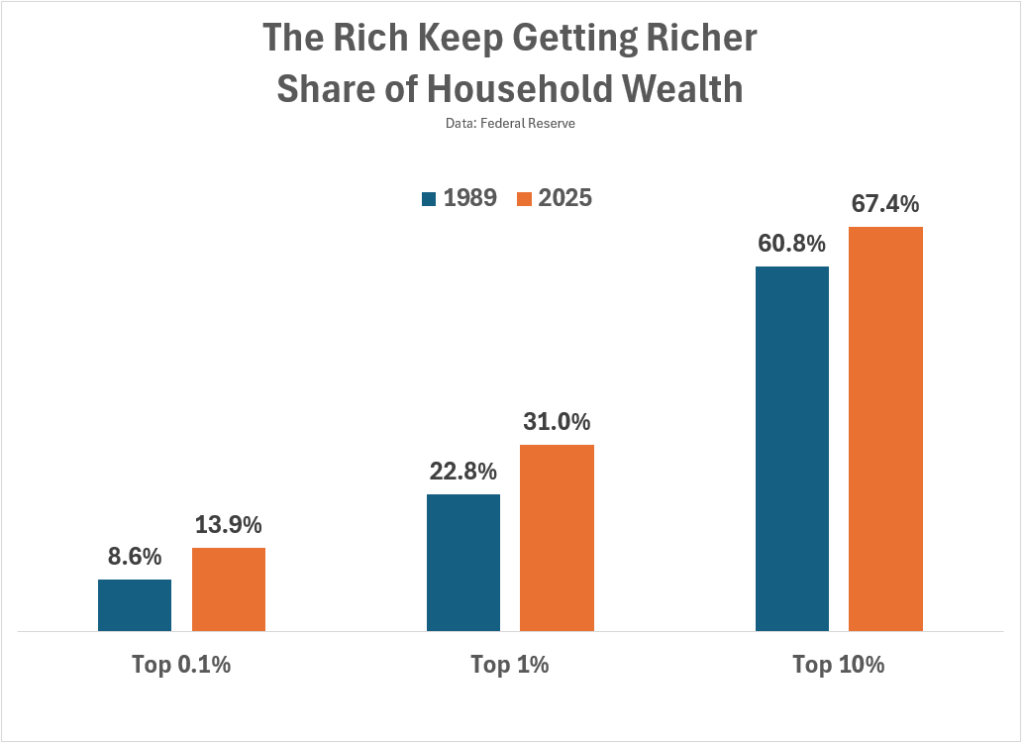

A stat and a graph that I came across in the past week that I deemed were worthy to share with you:

In 2022, only 10% of Americans actually waited until age 70 to claim their Social Security benefits, while 29% claimed benefits at age 62 and the majority, 61%, did so before their full retirement age (According to a study by the Bipartisan Policy Center).

and this:

I am surprised only 10% wait until age 70 to claim their Social Security benefits. Everyone is different but, in general, it is the right thing to do, IF you can afford to wait that is. And of course you are alive until then and live a normal life span. Don’t forget that your SS benefit goes up by about 8% each year after your normal retirement age (which is likely 67). So, you get a 24% increase by waiting three years and then you get to lock in the highest amount of benefit for life. Not a bad deal, again, if you can afford to wait. Then again, changes will eventually come to this program so who knows what that will do to the benefits. My gut feeling is most of the pain will be inflicted on our kids/grandkids.

I am surprised only 10% wait until age 70 to claim their Social Security benefits. Everyone is different but, in general, it is the right thing to do, IF you can afford to wait that is. And of course you are alive until then and live a normal life span. Don’t forget that your SS benefit goes up by about 8% each year after your normal retirement age (which is likely 67). So, you get a 24% increase by waiting three years and then you get to lock in the highest amount of benefit for life. Not a bad deal, again, if you can afford to wait. Then again, changes will eventually come to this program so who knows what that will do to the benefits. My gut feeling is most of the pain will be inflicted on our kids/grandkids.

Nothing surprising about the rich getting richer graph…

SCAMS/CRYPTO/AI/TECH

There is a giant sucking sound sucking money for everything AI: The AI Money Vortex. OpenAI is worth $500 billion now. What are its investors getting back?

The result is a disconnect between what goes in and what comes out. OpenAI is worth more than Norway’s GDP; its employees are raking in princely sums, and its expenditures on everything from development to operations to raw computing power are, by any metric, extreme. But there’s no guarantee that AI chatbots will be the revenue-inflating productivity accelerators their biggest boosters hope they will be. There’s also no guarantee that chatbots will offer the kind of life-changing support for everyday users that these companies claim. Still, the world’s biggest venture capitalists and tech conglomerates are willing to take that chance. Potential regulatory hurdles, implementation bottlenecks, bubble doomersayers, social backlash—none of that seems to matter, at least not yet.

Here comes another influencer type who got rich by selling his stupid courses online to morons. Actually, good old Ponzi type scam was behind the “business”: ‘Do You Believe I’m a Scam? Haha’ Tai Lopez became YouTube famous promising men they too could own a Lamborghini. Then came the alleged Ponzi scheme.

Authorities now claim that Lopez, Mehr, and Burkenroad had more to be cagey about than just the losses. Last month, the Securities and Exchange Commission charged Lopez and Mehr with several fraud counts for “misappropriating investor money and operating a Ponzi scheme” from 2020 to 2022 with $122 million of investors’ funds. In meetings, they say Lopez and Mehr discussed the “triage” of payments — using new investors’ money to pay back those who had already put into the pot.

Going back to AI, we can not escape it. Another article to try to wrap our heads around this thing: Generative AI might end up being worthless — and that could be a good thing. What is this article about? It tries to answer feasible (probable?) scenarios such as what if the technology never works well enough to replace your co-workers, companies fail to use AI well or most AI startups simply fail? With this parameter of course:

Current estimates suggest big AI firms face a US$800 billion dollar revenue shortfall.

This story reminded me of a dude I used to see in my hometown of Ann Arbor. At a traffic light intersection, with cars waiting at the red lights, he went around showing us all drivers a big board sign saying how 5G is killing us all and how it is a conspiracy and stuff like that. I have not seen him in the past three months or so, maybe the waves or some secret government institution silenced him lol. One Vigilante, 22 Cell Tower Fires, and a World of Conspiracies. Beware of your phone and what the algorithms are serving you. Because it does not take much to get you to be consumed by all this crazy conspiracy shit and end up ruining your life. What a sad story…

On the topic of internet algorithms causing trouble: we deleted my dad’s youtube history so it would quit suggesting terrible videos to him. The Algorithm was back to its former habits after only half a day. Sigh…

I am not sure deleting the history will do much. I saw The Roofman and really liked it. Not going to win an Oscar but still a good story and decent acting.

I turned off watch history – now I get no suggestions but I just subscribe to channels I’m interested in

Interesting, thanks.

Update: I added a link to One Mile at a Time in the “My Action And Blog Buzzing” section announcing the loss of his mother due to cancer. I think it is one of his best posts ever. And what a remarkable woman indeed.

On that Social Security thing. I retired when I was 51 from my federal gummint job. I could because it was law enforcement and under a special classification. (Mandatory retirement at that time at age 57) I also at that time, as part of the retirement package started receiving what they called *supplemental* social security, which was not my full amount I would get but decent sized chink to go along with my pension and other stuff.

BUT! At age 62, that stopped and it was either have a hefty monthly pay “cut”, OR start on regular Social Security. So that is what I did and ended up with a monthly pay “Raise”, but was unable to wait to collect.

It is OK though as I have been able to have what I consider a good life style and comfortable, if not wealthy, retirement for over 17 years now.

Great post again and thanks. I did already read the article on that private loan stuff and it is maddening how so many people do not understand how easy it is to get deep in debt. Good writing in it, that is for sure.

I’ll read more of the stuff over the next couple days. Thanks as always!!

Personal finance is personal. As in, it is good to have some rules of thumb. Only for an initial base to start a discussion. After that, it is all based on each person’s unique situation/biases/presentcondition/goals and I could go on and on 🙂

It is like burning miles. Don’t let anyone ridicule you for burning them your way. Ok, maybe not going for that toaster perhaps lol.

Thanks for the link to One Mile at a Time. A grand tribute.

The write-up of the Library of Congress really undersells it. Perhaps the neatest museum in the District of Columbia is the one at the top of the Library of Congress. There is the on-going attempt to replicate what Thomas Jefferson gave to start the Library of Congress … edition by edition, not just book by book. And the first map with the name America in it is there. THAT cost so much that Congress had to ask for help! The argon housing is worth the trip. You will remember from chemistry class that argon is inert … no oxygen allow here!

We went with a friend to the Freiberg museum that sold it and now only has a reproduction. He was vastly amused when he got to see the original.

I can never guess which article will be discussed in the comments. And it always surprises me. The article you mention was a very late addition to the post, I almost canned it.

I think OMAAT will now sell and reinvent himself. It is about time…

Norway will be the underdog in the WC. Haven’t been to the move theater in a long time. One thing I learnt from Dan Wang‘a book tour is that since the 80s most CCP leaders have engineering degrees. This explains their policies and thinking better, build, build, build and manufacture, manufacture.

Maybe Faroe Islands can make it….

Can’t believe we are out while Faroe Islands may make it, so sad.

https://www.youtube.com/watch?v=S9q0-kyrJmc

You can’t play well and make stupid mistakes against a team like Denmark. And you sure can’t dominate the game in Scotland and end up losing by 3 again. So, very young team, no killer instinct, stupid mental defensive breakdowns and no freaking luck at all…if we had only scored first in both of these games. Anyway, this team gave us all hope to believe. And they are very young and should continue to get better…IF we let the same coach continue.

Yeah, I can’t even remember when Norway made it to the WC. And if they did…they sure did not make it out of the first round.

Agree on Wang’s book. Engineers vs lawyers.

Hello from Adelaide. Finally off the boat and after an overnight at the Hyatt Regency in Sydney hopped on Qantas to ADL. Still pretty chilly weather compared to what I’ve been used to in the south pacific. Was 90 in Sydney but 60 in ADL.

Yeah not looking good for the Greeks, should be beating the Scots. They’re always fringe talent to make the WC themselves and Danes should be even better than them!

Enjoy Australia. See prior comment about the WC, we are in mourning in Greece. Deflated actually.

More than 7 days passed since last 125k Amex Schwab Platinum and still got the popup 🙁

Will try one more time on Nov 3rd. I may go for it without the 125k #maybe

Started this month great. Only to be met with absolutely zero clicks since Oct 7. Zilch.

13 years blogging anniversary in a few weeks, when I leave for Thailand. Maybe this is what Drew felt and walked away…