Another TBB post featuring the most eclectic links around the web such as riding hot stocks, more retirement financial myths, insane AI demand, the last nomads, 5 IHG Free Nights, most expensive real estate markets, crypto dudes doing criminal things, FBI artifacts, Williams Syndrome, best hole-in-the-wall restaurants, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This is truly a one man labor of love operation, enjoy it while it lasts.

By supporting this independent blog you are taking action to strengthen civil society and democracy. Everyone can read this blog independent of income since its inception. Consider becoming a monthly Buy Me a Coffee supporter.

BLOG HOUSEKEEPING

In case you missed it, I had a rare second post earlier this week on Tuesday: Mental Freedom, AI Energy, 10 Best Hiking Trails, Capital One Venture X Incredible Value. Not sure if this will continue but please come back here often so page views go up to make more money from ads. Oh wait, I don’t have any ads…

PERSONAL FINANCE

Over my long career in wealth management, I have come across several situations with prospects who come to me owning a way too large amount of an individual stock. And wanting me to do magic while letting them keep it. Nope. We sell all of it right away and immediately diversify. Or, if there are substantial tax consequences involved with selling all of it right away (which is usually the case), we come to an agreement and a timeline of selling it all over a certain period of time (to minimize the tax consequences as feasibly possible). With specific dates and number of shares to be sold. And they must sign off on such plan. If they can’t do this, we will not work together. And I have walked away several times from prospects that colleagues thought I was crazy. Anyway, here is Jason Zweig at the Wall Street Journal: You Have Too Much Money In That One Hot Stock.

If you need to ask whether you have too much money in one investment, the answer is yes. [Perfect opening sentence]

Of the more than 28,000 U.S. stocks whose returns can be tracked between 1926 and 2022, nearly 59% earned less than U.S. Treasury bills over their full histories, according to research by Hendrik Bessembinder, a finance professor at Arizona State University. All the stock market’s excess return over cash has come from fewer than 4% of the companies. [Shocking stats #notreally]

Another two clients retiring this year. So this is appropriate: 6 More Retirement Financial Myths to Avoid.

1. It’s Not OK to Do a Big Splurge

2. It’s Best to Leave Money to Charity After Death

3. It’s Best to Spend Less

4. You Must Pay Off Your House Before Retiring

5. You Should Avoid Reverse Mortgages

6. A Stock Market Crash Is Your Biggest Financial Risk

Wearing my CFP hat, I need to add my two cents on the above, I just can’t help myself. Yeah, do a big splurge. I am thinking to do a crazy trip when I retire, maybe Antarctica or African safari. I practice and encourage clients to help family members and charities while alive instead of at the end. Because it is very likely they need the help sooner rather than years later. We have done things the right way over the years. Which of course includes spending below our means. So, when people who have done this over so many decades finally get to the point where they can now freely spend and enjoy the fruits of their nest eggs…it is incredibly hard. Much harder than they anticipated. I always encourage to enter retirement without any debt, so this is one myth not to avoid imho. Reverse mortgages could make sense for a very small group of people. But the products are still complicated. They have gotten better though. When there are no paychecks coming in, your portfolio should probably not be as aggressive. So, a stock market crash should not crash you. Just take care of your health and avoid the biggest financial risk, dying too soon. Second biggest financial risk? Living too long, lol.

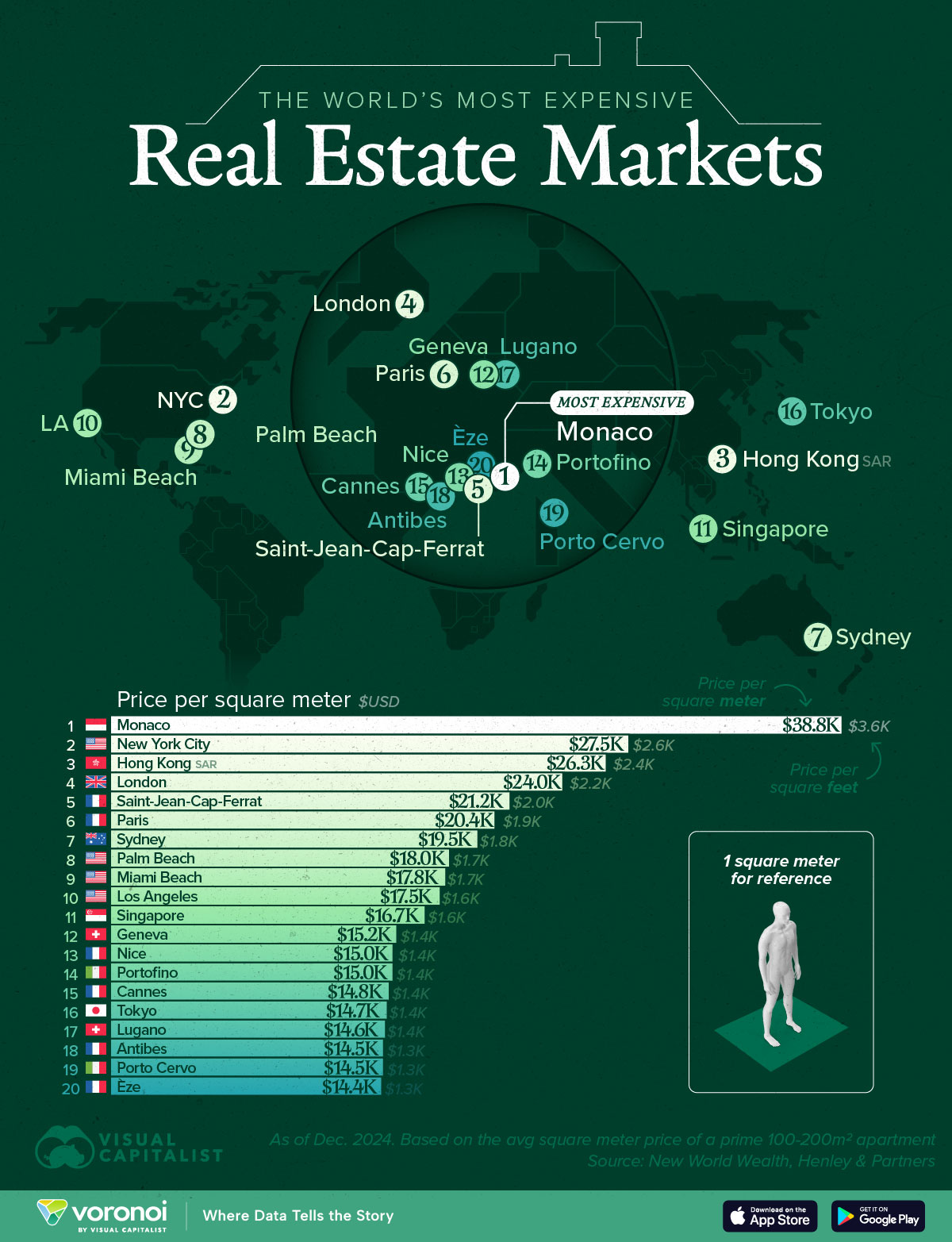

I must admit I had never heard of a few of these places: The World’s Most Expensive Real Estate Markets. And I sure expected Tokyo and the two cities in Switzerland to be much higher on the list.

SCAMS/CRYPTO/AI/TECH

Why does the crypto space attract such assholes? Crypto king accused of torturing Bitcoin millionaire known for dropping $100K at erotic NYC nightclub.

The crypto king accused of torturing an Italian Bitcoin millionaire in a posh New York City townhouse was known for dropping $100,000 in a single night partying it up at an exclusive erotic nightclub…The pair, who were spotted there multiple nights in a row, would spend up big — dropping anywhere between $80,000 to $100,000 each time, according to the sources.

OpenAI just made a deal with the United Arab Emirates government: Introducing Stargate UAE.

Under the partnership, the UAE will become the first country in the world to enable ChatGPT nationwide—giving people across the country the ability to access OpenAI’s technology.

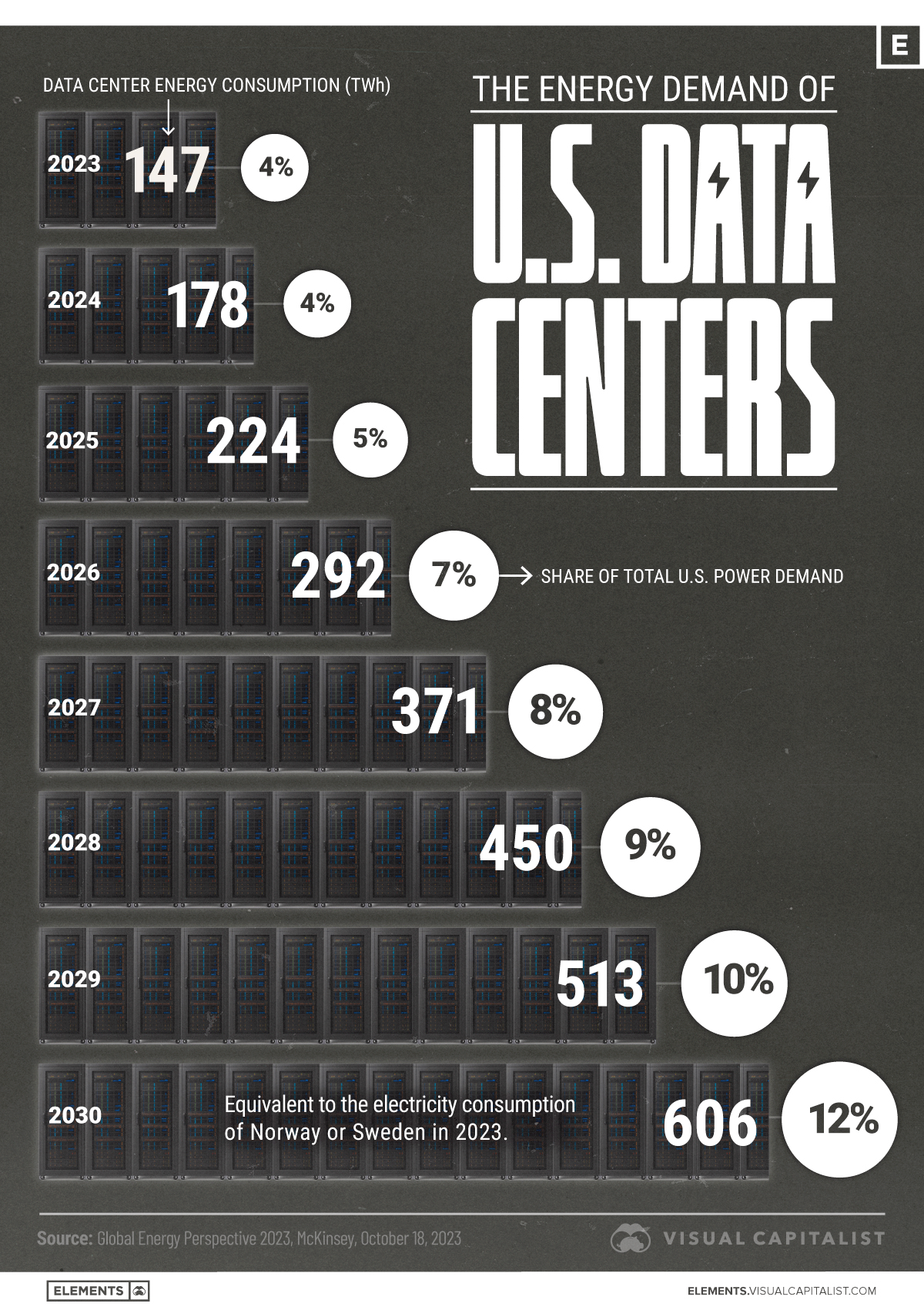

I don’t know where all this AI craze will lead but this seems significant. I think. A lot is happening really fast, this could be the beginning of an era that will change everything. Just as the beginning of the Internet was. Or maybe not, we’ll all find out. Fact is, there has been an absolutely insane increase in AI demand out there.

To match the demand, hyperscalers are deploying more than $300b in capex this year to fund data centers, which interestingly, NVIDIA calls AI factories…To date, the algorithmic improvements that reduce the overall model sizes are helping to staunch some of the geometric explosion in demand for AI, but it’s clear that both the demand for AI and more sophisticated reasoning are outpacing those advances.

Full disclosure: I did not know about this guy. Darn bankers, always finding a way to make it out of the shit storms they directly cause: The Banker Who Caused the 1929 Crash.

Key to City’s strategy was its combination of commercial and investment banking. Employees at local branches would persuade customers to move money from savings accounts or conservative bonds into exotic securities or City stock, vouching for the safety of the investments. In the 1920s, the bank sold ~$20B worth of securities, a figure said to be the highest total in the country. The bounty did wonders for City Bank, which became the nation’s largest bank and saw its stock rise rapidly, and for Mitchell, who bought homes in the Hamptons and Tuxedo Park and amassed a $20m fortune (~$250m today). [You know what happened shortly afterwards and then again almost 100 years later…]

If true, it is, cough, a lot. Then again, don’t assume that every number coming from McKinsey will materialize. The Energy Demand of U.S. Data Centers.

You like my blog? Send a link to someone please!

ODDZ & ENDZ

This is just one of those rare epic reads, I have no words: The Mother Who Never Stopped Believing Her Son Was Still There. For decades, Eve Baer remained convinced that her son, unresponsive after a severe brain injury, was still conscious. Science eventually proved her right. No excerpts, just prepare to cry a river, you have been warned.

I had never heard of the Williams Syndrome: The people who are too friendly. You?

People with WS, often dubbed the ‘opposite of autism’, have an innate desire to hug and befriend total strangers. They are extremely affectionate, empathetic, talkative and gregarious. They treat everyone they meet as their new best friend, yet there is a downside to being so friendly. Individuals often struggle to retain close friendships and are prone to isolation and loneliness.People with WS are also sometimes too open and trusting towards strangers, not realising when they are in danger, leaving them vulnerable to abuse and bullying…Few people with WS live independently as adults, and many suffer from severe anxiety. There are also health problems that accompany the condition, such as cardiovascular disease, developmental delays, and learning disabilities. Many people with WS have a lower IQ than the average, for example.

Very cool government website: FBI Artifacts. Quick, before this too goes the DOGE way. Some fascinating artifacts indeed, such as the D.B. Cooper Plane Ticket.

I love this: The 100 Most Beautiful Words in English. I picked a few and added my silly commentary. Because, entertaining is part of the blog mission here woohoo.

Bungalow: A small, cozy cottage [Prefer them over the water in Tahiti or Maldives hehe]

Dalliance: A brief, love affair [When you don’t want to say “one-night stand”]

Epiphany: A sudden revelation [One day I will have one and quit blogging]

Insouciance: Blithe nonchalance [Say what?]

Tintinnabulation: Tinkling [If you knew this word, we are not worthy]

Amazing photography from NASA going back to the 2024 NASA Pictures of the Year collection.

TRAVEL

No Hyatt properties anywhere near this place: The Last Nomads. In Georgia’s Adjara highlands, a traditional way of life is slowly disappearing. Love the pictures…

I started putting together our next family trip, going to nephew’s wedding in the Greek island of Kefalonia: 6 of the best things to do in Kefalonia.

Yet another interesting and always subjective list: America’s Best Hole-In-The-Wall Restaurants In Every State.

I watch a lot of videos to keep learning about Thailand. Here is one about Klong Toey – The Harsh Reality of what is REALLY Happening. It is about the largest slum in Bangkok.

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS

Here we go…

This is a good timeline for us in this hobby and what we gotta do with a specific timeline: Big changes are coming: Top miles and points to-do’s.

I never had CLEAR, it was never clear to me (pun intended) I needed it with my beloved Global Entry membership, even though I could get it for free with a travel rewards credit card. But, you know, inflation: CLEAR Pricing Will Increase To $209; Credit Card Rebates To Increase As Well.

We knew this was in the works, let’s see how long it will be before it becomes reality: United Airlines and JetBlue announce new partnership. Here’s what it means for travelers. Maybe what they are going to be doing is actually merger talks, despite the present denials.

I wish this site was around when I had the Amex Hilton Aspire card. Because I was frustrated trying to use the Hilton resort credits that came with it. HigherAspire.com: A useful tool for redeeming the Hilton Aspire resorts credit.

Bags no longer fly free, end of an era: Southwest sets its first checked bag fee, starting at $35. I predict a substantial increase in Southwest customers getting a Southwest credit card to escape the bag fees. And it’s going to take a while while the airline adjusts to all these new ways of doing business.

I am seeing this now and it’s great.

You can now register for the latest Marriott Bonvoy promotion HERE.

After the recent death of Bluebird and Serve cards, we say goodby to Simon Malls RIP: Simon Malls Will Stop Selling Gift Cards. Veterans of this hobby know; going to miss visiting my local mall #notreally.

It appears bloggers most likely killed yet another award sweet spot. This time it is Iberia’s 34,000 mile business class award from the East Coast of the US to Madrid, Spain.

On Thursday evenings this YouTuber makes a video summarizing what happened in the prior week in this ever changing world of points and miles. You know, you can save a lot of time by just watching his video and reading my blog, you are welcome 🙂 .

Apparently, airlines charging single passengers more is a thing smh: [Update: AA And Delta Match United’s Solo Passenger Surcharges] Forget Hidden City Ticketing, Have You Tried Hidden Passenger Ticketing?

Remember when SAS had that promotion to earn 1 million miles flying 15 alliance airlines? 42,718 people registered for the promotion and over 900 became millionaires. The youngest was one kid 4 years old, can you imagine the parent dragging the kid along? Or the kid must really love flying lol. Anyway, Etihad got jealous it appears and has kind of a similar promo. But very different. And stupid imho. Because you are not guaranteed in winning if you visit 15 Etihad locations; what matters is the speed. So yeah, like I will sign up, bust my ass flying to all these places and then realize I came fourth (first three win 5, 3 and 1 million miles). Nope. And one of these locations is Sochi, Russia. Exsqueeze me? I can vision Putin goons waiting at the gate to welcome new hostage meat smh.

TRAVEL REWARDS CREDIT CARDS

If you are new in this space, sooner or later you will hear the term “5/24”. It is important. So, here you go: Chase 5/24 Rule Explained: What It Is and How to Work Around It. This is why many of us go for more business credit cards these days (see above).

Probably one of those big moments in this space…assuming this company can make it: Mesa Credit Card: Earn Points On Mortgage Payments, Various Freebies + 50,000 Points Signup Bonus. The freebies that come with it are crazy for a no annual fee card. And up to 100,000 points per year when you prove to them of your mortgage payment. Transfer partners suck. And must have $1,000 spend per month to get the freebie points on mortgage payments. But still, wow, talk about innovating here. And, did someone say Bilt? Lol.

Good to see this trend to require the SignUp Bonus required spending to stretch over six months instead of just three: Amex’s Long Game: The Strategy Behind Its Generous Bonus Timeline.

#1 OFFER STILL REMAINS:

The 75K CAPITAL ONE Venture X card has a minimum spend of $4k in the first three months. If you like simplicity and looking for one (premium) card, I highly recommend this card (and yes, I have it myself!). It has an annual fee of $395 but it comes with an easy $300 statement credit for travel booked on its own travel portal, essentially turning it into a $95 annual fee card. But wait, there is more! On each card anniversary you earn 10,000 points essentially making it FREE! Every dollar of spend earns 2 points and flights booked on the travel portal earn 5 points per dollar. You get access to Capital One and Plaza Premium airport lounges and a Priority Pass Select lounge membership and, this is important, you can add FOUR authorized users FOR FREE who can also have their own Priority Pass Select airline lounge membership and, this is BIG, they can bring in unlimited guests with their FREE Priority Pass card! You can transfer your Capital One points to up to 18 Transfer Partners. No foreign transaction fees. Free Hertz President’s Circle rental car top elite status. Cell phone protection and PRIMARY rental car coverage. Awesome seats at baseball stadiums for just 5k points each. And lots more. If you prefer, this is my personal referral link.

MAJOR UPDATE: That amazing free ride accessing all the Capital One and Priority Pass airline lounges is over with the 6/3/2025 announcement finally, it was heavenly while it lasted. Basically, no more free lounge visits other than primary cardholders effective 1/1/2026, please see details HERE.

Here are my three TOP CREDIT CARD OFFERS:

The 75k Capital One Venture X card. It is amazing what you get for FREE with this card!

The 75k Chase Ink Business Unlimited card.

The 75k CHASE Ink Business Cash card.

BONUS OFFERS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click on the link above

2. Create an account

3. Subscribe

MY ACTION AND BLOG BUZZING

There is a lot going on, fasten your seat belts, here we go:

My daughter visited us over Memorial Day weekend. And flew Alaska Airlines. After she returned to Seattle, Alaska emailed to congratulate her for meeting the MVP Elite status challenge that she enrolled in back in late December. She is now also an elite Alaska Airlines flyer as her brother (who is MVP Gold). Both took advantage of the recurring targeted promos dished out to employees of large tech companies. If you had told me that both my kids would be elites with Alaska Airlines while their dad has been a regular non elite flyer ever since giving up on Northwest Delta Airlines I would not believe you. And here we are…

I transferred another 100k Chase Ultimate Rewards points to my World of Hyatt account. Because there is some serious burning to happen #stay tuned.

I am doing spring cleaning at home. I killed my shredder earlier this week after shredding a drawer full of closed credit cards along with a bunch of zeroed out gift cards. How many? Probably several hundred #donotjudge. Tip: Do NOT do this, give your shredder a break, break up the shredding. You are welcome.

I have two big trips to put together later this year, one to Greece and one to Thailand. With so many separate bookings to take place. I need to get my wife back to Detroit and my daughter back to Seattle from the tiny airport in the Greek island of Kefalonia (airport code EFL). And son to Thessaloniki and back to Honolulu. Of course I need to get myself booked separately as I plan to stick around home longer to look after my mother and take care of some business. And we need to get from my hometown in Larissa over to that island, which is not easy. Rental cars, hotels/Airbnbs, perhaps domestic flights from Thessaloniki-Athens-Kefalonia. I am stressed as I type this you guys.

I have Google Flight alerts set up for all the flights already. Since there are so many bookings ahead I am going to take a different approach. Instead of trying to keep the cash outlay to zero or bare minimum, I am going to step up and pay cash if the stars align. As in, it makes sense instead of burning miles/points. And especially if the itinerary routes fit the trips. So, I got a Google Flight Alert email and jumped on it to book my wife and daughter to fly from Detroit to Frankfurt on Lufthansa and then on to Thessaloniki, Greece on Aegean. It is a United fare with absolute perfect times, about $1,000 all in. I purchased the tickets with my United business card and they will earn some miles too. I was reminded again that in order to use United Travel Bank cash you have to be flying on United metal. Anyway, a lot more bookings to take place #stay tuned. If I did not have this blog I would be all done with these arrangements. Look at what I do for my blog readers, please take that into account when you want to show support for your favorite bloggers ok?

Oh, I burned 16,000 World of Hyatt points for 2 nights at the Hyatt Regency in Thessaloniki, Greece. We all recover from the flights in my favorite Hyatt property and will likely book more nights here.

I took my daughter to see the latest (and last) Mission Impossible movie. We both agreed it was way too long clocking at 2 hours and 49 minutes. And the plot was beyond stupid. The action usually saved this franchise but, I don’t know, Tom Cruise showed his age and I think we can all agree that it is a good time to end this so we can all move on. Then again, you know, he may come running back lol.

I enjoyed the movie Friendship a lot more. It has some hilarious scenes. But also, it is very disturbing…

Enjoy watching the Top 25 Premier League Goals of the 2024-25 season.

This blog sold 5 credit cards in the month of May (one was mine) and 11 coffees to four readers. First, thank you. Second, due to the recent beatings restrictions imposed by my favorite bank that starts with a C and ends in an E, revenue across many content creators has collapsed. At this rate, 2025 revenue will be about one fourth of 2024 at best. I can’t believe I am still blogging. If you were thinking to start a blog, DON’T. It is what it is, stay healthy everyone, it is what really matters.

HOT CREDIT CARD OFFERS:

75k CHASE Ink Business Cash, 75k CAPITAL ONE Venture X, 75k CHASE Ink Business Unlimited, 150k AMEX Business Platinum AND $500 statement credit, 200k CAPITAL ONE Spark Cash Plus, 5 Free Nights CHASE IHG One Rewards Premier, $1,000 Cash Back CHASE Ink Business Premier, 90k CHASE Ink Business Preferred, 75k CAPITAL ONE Venture Rewards, 120k CHASE IHG One Rewards Traveler, 80k CHASE Southwest Performance Business, 15k AMEX Blue Business Plus and many more!

As of today, I have burned 382,156 miles/points year to date (2,027,816 in 2024) and have 4,690,291 miles/points in the bank.

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

Do I have to cancel my beloved $49 IHG card to be eligible for the premier? If so how long to wait before appying for new card?

I think the standard answer is 30 days. Recently, Frequent Miler addressed this but for a Chase Sapphire Preferred card, he product changed to a Freedom card and then reapplied after “a few” days. So, my 2 cents. Anyone else want to add to this?

I am thinking about it…Any locations that are amazing to use the 5 free nights? I mean, it is a vacation 🙂

Hi Buzz,

I have 6-7 boxes of zero balance gift cards to shred. There’s a place down tge road with a commercial shredder that will do them for $5 a box. And-this is key-they give you goggles and you can watch the items get turned into dust.

Simon malls and no GCs? Why shop at all.

$5 a box to shred? I could use it, I think my shredder is finished lol.

For a while there, this was the only reason I made it to a mall period. I highly preferred it than going to WalMart lol.

Thanks for the link to the Hyatt app promos. I did not know of its existence. The YT clip on Klong Toey was interesting, not an area I am familiar with. I wonder what the relocation really involves. I’d imagine when it comes time the residents will be forced out involuntary and they won’t be offered multiple choices for a future residence.

Yes, great Hyatt IT addition indeed. I like how it keeps track of the progress in each promo. If they would only allow transfer of points between members online one of these years…

Klong Toey, very interesting area indeed. Maybe holding out will lead to a better offer? I am not sure. But maybe we visit that place soon before it disappears.

great content as always. regarding the IHG card, 5 60k nights is very different than 300k points IMO. You can’t top off those nights so you’ll have to use them is <60k places, not very appealing for me.

I'm getting concerned about the hotel point environment. Hyatt still good, but lots of point inflation and awards becoming more dynamic all the time. Still solid value and crucially, transfer partner for Chase. Now, my #2 option was always Hilton, `but they killed the outsized value at aspirational properties by removing the 150k/night limit, huge blow. There's no #3 that gives more than 1cpp that I know of. So basically if Hyatt caves to full dynamic the hotel game is up for me.

Yes, very different indeed 330k pts vs 5 nights at 60k per night (or less). Prior card offer was at a pitiful 40k pts per night so 60k is a winner. I’ve been out of the IHG game for a while. Anyone who can identify any worthy 60k properties please let us know. I am sure some full time bloggers are working on this rn.

I am in full agreement with your three points. Just watched a YT video how someone burned high 100’s for a night in the Rome Cavalieri (Hilton property). Where we stayed many years ago for 5 nights for 100k points I believe…total. Things have changed… a little.

I share your concerns. The IHG cc certificate, I always used to use it at the CP Changi yet these days every time I need a stay even 6 months out no rooms for certificate use. Add in the Hyatt certificates being stuck at cat 4 whilst they inflate most properties to cat 5 and above one has to question where is the motivation to do the actions needed to claim these certificates. I think we are very much in an earn and burn as you go, no point saving for a rainy day. Best to save $s now.

I am seriously thinking to go for the IHG Premier card for the 5 Free Night Certs. But these are five night credits taken away from World of Hyatt Globalist run 🙂

Hmmm, maybe use them in 2026 when the WoH program will finally devalue? If you have any idea where to burn them 60k certs please let us know.

Sorry to be late!

Lots of terrific links today. Thanks for pointing out the Hyatt app promo counter. That could be really useful.

The question of rebalancing your portfolio after one of your holding lurches up is really interesting. Since there is an obvious tax hit, you would be buying insurance against

increasing downside risk. Perhaps selling stock options would be an viable alternative. I know I’m too far gone into a random walk world view!

Thanks again!

Marked tardy 🙂

That one holding won’t lurch up with a current client. Because it would not be allowed in the first place. This sometimes occurs when a young person just gets super lucky, a tech employee just loads up on company stock because they are too busy and don’t know any better. And, more often, it is due to an inheritance (which makes the tax issue less painful). Selling stock options could be a viable alternative. But the emotional bandwidth and hold this will have on the client will be too much. And sometimes excruciating. I find that coming up with a plan to get rid of it and reinvesting the proceeds (of course with a tax plan the client could live with) makes more sense. And it could be liberating. Oh, and when this happens we do not look back. Forward, only forward.

Tacos for lunch today. With chicken lol

Man! Jam packed with interesting links. This is gonna take all weekend! Thanks, George! Running behind today so not much to add. Hooray for all the travel you are planning up though!

The travel plans would have been finalized a long time ago if it was not for this blog 🙂

Heh, I understand. Starting to think about my next trip. Gonna have to start spending some $$ so will be prowling your CC links with fingers crossed!

The Georgia photo thing was cool, thanks. Every time I read about Georgia I think I want to visit there.

Yeah, looks like a cool place indeed.

Καλημέρα from Naxos. Burnt out from the cruise I hopped on a ferry from Piraeus and will try to avoid the tourist hoards of the other Cyclades isles. Maybe even branch further out next week if it’s too crowded here. Best stop was probably Santorini, managed to do the hike from Fira to Oia. A massive dust storm that hit us in Crete also seems to have impacted Santoini and power washing the dust off was the thing to do amongst the locals on the day our boat was there. Mykonos was super packed with *4* cruise ships in port the day we were there. I managed to do a hike so got away for the most part.

Kefalonia looks lovely, as do the Ionians as a whole.

Funny to see Klong Toey show up on the blog, I am a frequent visitor when in Bangkok as I support Thai Port FC aka the Khlong Toei Lions, so I will go to matches if they are playing in town, I even went to an away match near Chiang Mai before leaving in April. It has a fairly decent expat support group given it is the closest club to downtown. And yeah, I’ve never felt unsafe in the area.

Naxos should be very different than Santorini and Mykonos, enjoy.

The Ionian islands have a unique and so different vibe than the islands on the other side.

I need to add Klong Toey to the ever growing lists of things to do in Bangkok. Maybe I add a Thai Port FC game. I did see a video from a YouTuber and looks like a lot of fun.

Also, felt sorry for Inter, losing 5-0 at the Champions League final was a complete embarrassment. Finally, you don’t need Neymar, Messi or Mbappe to win it lol.

I was going to go out and watch the game but just stayed in. Good thing, I think I turned it off in the 60th minute and went to bed!

The ghost writer over at Boarding Area was hard at work as always:

View From The Wing: “Move Your Arm, Miss Piggy!” Boy Sneers At Overweight…

One Mile at a Time: Ugh: 12-Year-Old Boy Calls Seat Mate on Flight “Miss Piggy”

Also noticed at the daily visit at Milesfeed.com

New posts:

View From The Wing: 5

One Mile at a Time: 8

The Points Guy: 2

Starting to think TPG may not last much longer?

To the TBB email list subscriber who unsubscribed this week, why? Well, your loss.

Awesome post Buzz, thank you sir.

As a longtime Gunners fan I appreciate the job Arteta has done even without the trophy’s. However I think it’s fair to say that he was grossly mistaken when he suggested the best team was no longer in the tournament once they lost to PSG. Hats off to Enrique, the team annd their fans, they earned it.

Fascinating the pics of Georgia, looking forward to visiting one day. And a match in Bangkok looks like a blast.

Given the massive devaluations with hotel and airline points I’m going strictly cash back, except of course maintaining Globalist until they cave.

Got the Marriott biz card last year with your links and booked the 5 free nights on the coast of Croatia. Due to the &)(;/;& lingering long Covid crap, had to cancel those lovely plans and use the free nights visiting my wife’s family in Long Beach, CA….

$20 parking

$15/room food credit

In short, ouch

Oh how the mighty have fallen

1st world problems but good for a chuckle

Enjoy the day

Thank you.

Just spent some time to look for awards out of Kefalonia to Detroit and Seattle and what I am getting is a giant pathetic turd. Getting closer to going all cash back. Both wife and daughter have specific dates, no flexibility. I may not have enough Capital One points to cover them both…Of course, this was the first pass, we’ll see.

Like you said, first world problems.

I was approved for an ink using your referral. Thanks for all you do.

Thank you so much! It is gestures and comments like this that kept this blog going for so long.

There will be a Tuesday mini TBB post tomorrow. Thanks to Nat for the cc referral above.