Another TBB post featuring the most eclectic links around the web such as the overvalued stock market, AI bubble talk, the vanishing college premium, the new CITI AA Globe card, the US consumer balance sheet, speculative fever gripping the nation, top 40 jobs at risk from AI, learn eleven new words and about misophonia, must visit places in 2026, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Enjoy the weekend.

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This blog stays in business with clicks only from readers for credit cards and coffees. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE . Or just email me.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

QUOTE OF THE WEEK

“The best things in life are free. The second-best things are very, very expensive.” – Coco Chanel

PERSONAL FINANCE

With the stock market reaching new market highs every other day or so, we are all asking ourselves: Is The Stock Market Overvalued. First, let’s look at some facts from history:

…the market has had a remarkable run. Since the market bottom in 2009, the S&P 500 is up about 1,200%, including dividends. Over the past 10 years, it’s gained more than 14% a year—far above the long-term average of 10%.

And also realize that there is no Stock Market Timer Hall of Fame. And there will never be one as we all just plain suck at market timing. Therefore, maybe you just stick to your investment plan. Assuming you have one. And the plan should be properly diversified, rebalanced at set intervals, low cost and tax aware. And ignore the pundits everywhere screaming for attention. Corrections and bear markets are a necessary and integral part of investing. Latest client portfolio investment reviews all had us taking some gains from stocks off the table for obvious reasons. Be careful out there, fight that greed emotion, you can do it. Yes, it’s not easy.

Part of comprehensive financial planning is looking at all personal finance areas we all need to deal with. And an important part of this is estate planning. You know, dying. And this is a great article: 10 questions to answer before you die. If you have parents who just won’t go there, maybe you should send this article to them. Even better, send them a link to my blog post and tell them not to miss the second article in the PERSONAL FINANCE section, thanks!

5 questions to ask:

1. What method of body disposition feels right for me?

2. What kind of goodbye would feel meaningful for me and for the people who love me?

3. Who should be notified if I die tomorrow?

4. Who do I trust to make medical decisions if I can’t?

5. Is there anything I’ve left unsaid? Who do I need to say it to?

and

5 Things you can do right now that will make your inevitable death easier:

6. Set up your iPhone Legacy Contact & Gmail Inactive Account Manager.

7. Set up a password manager—and share the master password.

8. Name a guardian for your kids or pets.

9. Make a bank account “payable on death” (POD).

10. Write down what matters most.

This article may be almost a few months old but some of the market charts and stats in it are fantastic. And most of its content is still relevant. Some I excerpt are below:

We’ve now seen 13 straight years with at least 1 all-time high, surpassing the epic 1989-2000 streak (12 years).

US Auto Insurance rates have increased by 94% over the last decade, far above the 35% increase in overall consumer prices.

US companies are projected to buy back over $1.1 trillion in shares this year, another all-time high. The biggest single purchaser? Apple @ $100 billion.

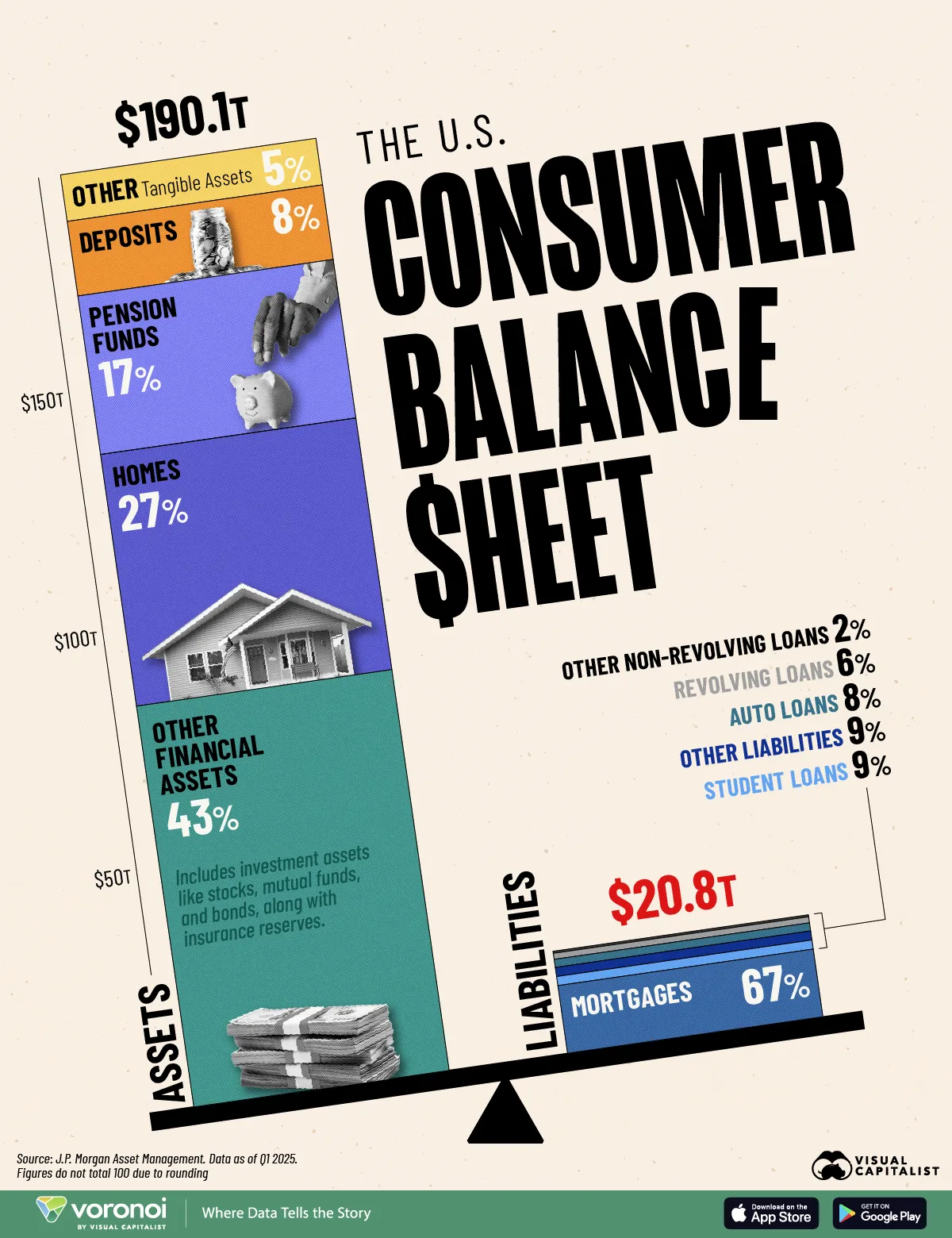

And one more from the Visual Capitalist:

SCAMS/CRYPTO/AI/TECH

Well, the headline is right on imho: From Sports to AI, America Is Awash in Speculative Fever. Washington Is Egging It On.

The speculative fever has spread well beyond the usual stocks, bonds and property. Crypto, a brand new asset class, is now valued at some $4 trillion. Americans bet $150 billion on sports last year, up 24% from 2023, according to the American Gaming Association. Gold, a hedge against bubbles, is looking bubbly itself. Speculation has become woven into today’s political, economic and cultural psyche.

Maybe I should separate the AI in a separate section? Because, here is another one: ‘It’s going to be really bad’: Fears over AI bubble bursting grow in Silicon Valley. Yeah, it may/will eventually. But when someone says things like that, please ask them of the date and time when the bubble will burst, ok? And…always diversify!

Incredible investigative journalism in this WSJ article, can’t wait for the movie: How a Handyman’s Wife Helped an Hermès Heir Discover He’d Lost $15 Billion. Nicolas Puech says his wealth manager isolated him from friends and family and siphoned away a massive fortune. Then came the clue that began to reveal the deception. This Nicolas dude may have been the biggest fraudster since Madoff wow. When finally cornered he committed suicide. Just reading what he was able to do over so many years is shocking. And never ever let any advisor have so much control over you!

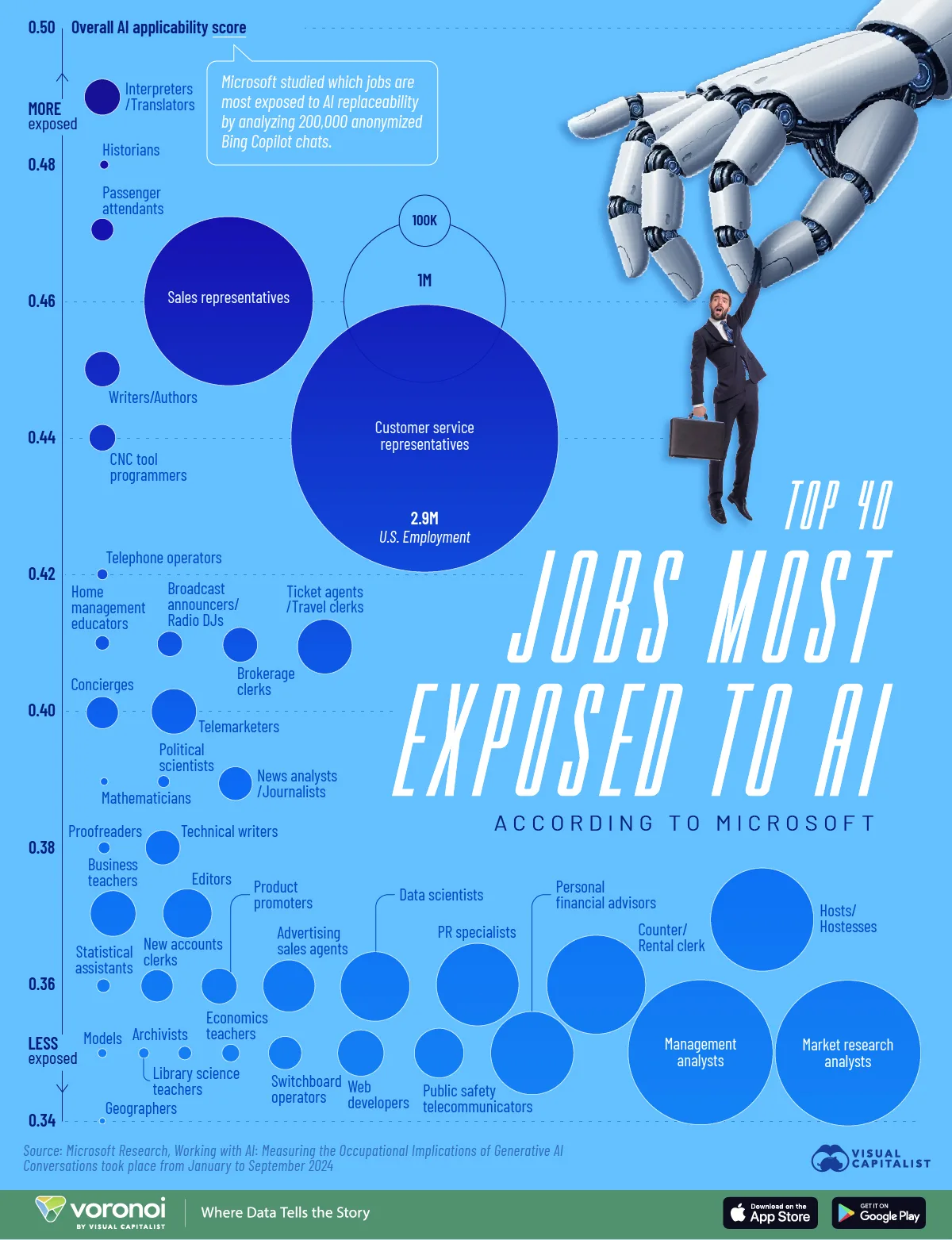

The Top 40 Jobs at Risk from AI:

10.50 am…where is everyone? Did the email from Mailchimp go out?

Sometimes I wonder if I am blogging to myself…

Wow! Much to read and enjoy from the west coast where it is a lot earlier than it is where you are, George! Retired people sleep late, too. Not to worry, we are here. Gonna have time later this weekend for a lot of the great stuff here. Meanwhile, coffee and breakfast is next up. Thanks as always for all this and I hope you have a good weekend.

You enjoy the weekend too Carl.

Sorry to be late!

Thanks for the links. Sorry to hear about your miserable experience on

American Airlines … I’ve got an AA flight coming up … going to a place

that Delta doesn’t go! Gad. I used Chase’s Ultimate Rewards with

their new valuation. Huh. I actually might renew the Sapphire Reserve.

You know you are late when retired Carl beats you to it 🙂

Going to be very hard for us to risk flying on AA to NYC again…

If you like techno with banjos, you may like “Take Me Back to Your House” by Basement Jaxx: https://www.youtube.com/watch?v=JYAkoZeV75I

On the topic of words that sound silly and made-up, I’m partial to mollywop and flibbertigibbet.

Had to google both of these words. Basement Jaxx sounds ok but doesn’t beat the banjos in my link 🙂

Hey Buzz,

I haven’t been bumfuzzled since Carol in high school.

MVL comment of the day, most valuable laugh 🙂

What did Carol do to you Sam? Did she bring her grandpa’s snickersnee to your first date? woohoo

Curious why are you so keen on the 125k Amex Schwab Platinum card? Is it the Annual Schwab Appreciation Bonus that makes it better than the regular personal platinum card?

Correct. The regular personal Plat credits are great. You add that Schwab Appreciation Bonus now that some of the accounts have grown (and now both Revocable Trust and IRA type accounts count which was not the case for a while I think) and this card becomes a no brainer imho. I just don’t want to give up the 125k but I just might, reapplying on Nov 1st.

Nice stuff today. The Hyatt Cat 1-4 list is nice but could be a lot longer.

I’m torn on whether to try for either the new AA or fancy expensive Citi cards. I’m over 5/24 so that adds to my ambivalence.

Thanks Christian. I think the AA Globe card is definitely one and done. The other Citi cards probably too…but could work for some as keeper cards for longer than a year. Will hang around the first half of the year and going to become this blog’s biggest revenue generator next year by getting back to replenish some of my banked miles/points vaults 🙂

When your weekend starts with an email informing that a Judy unsubscribed from my blog email list…I guess my content was not good enough for her smh.

I will get over it if my hometown soccer team wins the first game of the season to get out of dreaded relegation zone!

Dang…it’s cold here!

I have already 2 TOP stories for the Oddz & Endz section…that it will be very difficult to replace them.

Another vote for AA being absolutely the worst. Last month my AA outbound was repeatedly delayed, though eventually did go out, and I made it to my transatlantic connecting flight, which was booked with AA miles. I was assured by both AA chat and my onboard FA that my F seat would be waiting for me & not to worry. But that F seat on that TATL? Nope, they gave it away. They gave away all the seats in C too. I was put in the back of the bus. The compensation? 23,671 miles. As if anyone could upgrade from economy to F on a TATL for 23,671 miles. If that were true, I’d be flying F for the rest of my days, given the number of AA miles longstanding in my account–nearly impossible to use for anything useful to me.

Friend is flying tomorrow Detroit to Chicago to catch Cathay Pacific flight to Hong Kong. I wished her good luck and to have Plan B arrangements set. And award availability to BKK and KUL-DTW remains non existent smh. Looks like that AA executive who bolted to UA is taking its former employer to the shed.

Finally my hometown soccer team AEL FC from Larissa, Greece won its first game of the season. And put together a complete performance, we were due! And that first goal may end up being the Goal of the Year in Greece, wow. Highlights:

https://www.youtube.com/watch?si=nFoycK3cVAbJ80YP&v=UXHqe_X7Zoo&feature=youtu.be

I’m trying to see about getting a Hyatt personal card for P2 but your link shows:

“Not Currently Available at Your Best Credit Cards

This card is not currently available on Your Best Credit Cards. Please use our Card Explorer to find similar cards.”

Does that mean you would still benefit from her applying? If not do you have a personal link?

Yeah, that personal Hyatt Visa has not been available at my cc vendor’s links for many years. I have no idea why, just weird bank rule things.

I am not aware of personal referral links on the personal Hyatt visa. Anyone know if they are available.

I would not benefit in any way, please find another worthy blogger’s links to help them out. If they have it, not sure, can’t keep up with these aff cc rules.

That reminds me I forgot to add the new offer with the double elite night credits. Would I forget if this card paid me a sales commission? Hmmm…this affiliate cloud enters its ugly head again.

Got the 7th credit card sale this month. To celebrate, tomorrow’s post going to be the best one ever. In my humble biased opinion of course. There is a lot happening and I will have it all here. I think I have one of the best phucking blogs out there. Written by one human. No AI at all. Spread the word so people can be educated. Entertained. And inspired.

Condolences to all Vacasa lovers, RIP.