Another TBB post featuring the most eclectic links around the web such as personal finance wisdom, new higher 401k limits, AI reset, Texans move to Russia, new Hilton Diamond Reserve status, to quit your job or not, crypto is a cult, the crazy economics of expert witnessing, global sinking fertility rates, Helsinki bomb shelters, mind blowing geography facts, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Have a great weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This blog stays in business with clicks only from readers for credit cards and coffees. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE . Or just email me.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

Hello from Bangkok, Thailand. I am posting frequent trip updates in Instagram. And YouTube when I get around to it.

Heading to Koh Samui next week, I may take a pass posting new content here and may throw in a few repeats, we shall see.

QUOTE OF THE WEEK

“Grief is the price we pay for love” – Queen Elizabeth II

MUST READ GEMS

One article this week: Essential Wisdom from Twenty Personal Investing Classes. If interested in personal finance and investing, this masterpiece of a post captures the essence of it all.

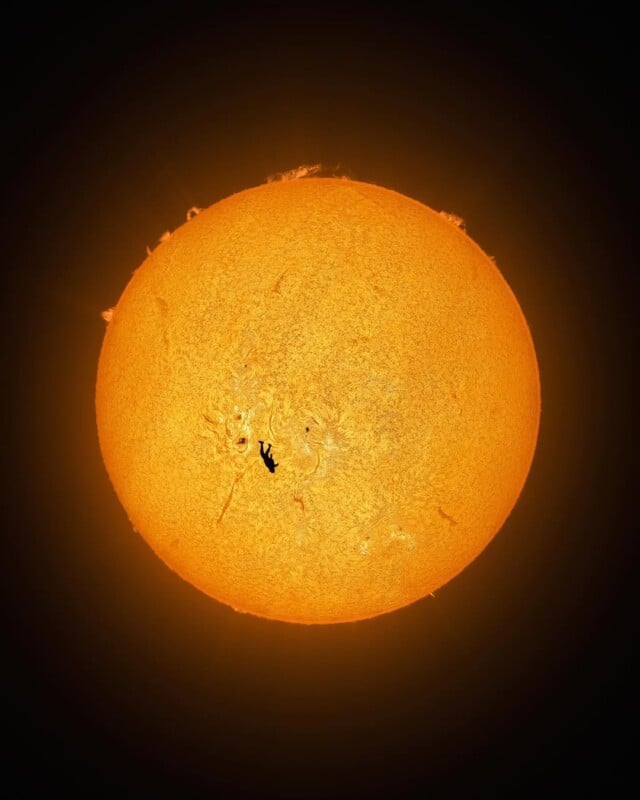

And this absolutely epic photo of a skydiver in front of the sun:

PERSONAL FINANCE

To all readers (especially in their 20s and 30s), do this: Max Out Your 401k.

Investing is important but saving has to come first. If you don’t have the ability to earn, save and retain money to invest it doesn’t matter if you’re the next Warren Buffett. You can’t build wealth without some savings.

Let’s say you had the ability to max out your 401k contributions every year starting in 2000. By the end of this year that amounts to a little less than $440k in total savings or around $16,800 a year in annual savings on average. If you put that money to work dutifully over the course of this century into the S&P 500 on a monthly basis, you’d be sitting on around $2.2 million by the end of October. In a global stock market allocation (MSCI ACWI), it would be more like $1.7 million. That’s pretty good for 26 years of savings.

The antidote to every market risk is saving more money. You can’t invest if you don’t save.

We have new higher contribution amounts for 2026 from the IRS:

401(k), 403(b), and Most 457 Plans:

Defined Contribution Plans, §415(c):

Standard deduction:

Married filing jointly: $32,200 (from $31,500)

Single: $16,100 (from $15,750)

Heads of households: $24,150

Estate tax exclusion:

The estate tax exclusion is increasing from $13,990,000 in 2025 to $15,000,000 in 2026 due to OBBBA changes.

HSA:

In 2026, you can contribute up to $4,400 if you are covered by a high-deductible health plan just for yourself, or $8,750 if you have coverage for your family to HSA.

Tax Brackets:

All tax bracket limits are increasing by ~4%. Here are the 2026 brackets:

- 12% for incomes over $12,400 (over $24,800 for married couples filing jointly)

- 22% for incomes over $50,400 (over $100,800 for married couples filing jointly)

- 24% for incomes over $105,700 (over $211,400 for married couples filing jointly)

- 32% for incomes over $201,775 (over $403,550 for married couples filing jointly)

- 35% for incomes over $256,225 (over $512,450 for married couples filing jointly)

- 37% for incomes over $640,600 (over $768,700 for married couples)

I started my own business (not this blog lol) about 25 years ago. And I went through the same issues as the author of this article: On Work and Wealth, or Why I Quit. If you did the same or contemplating about making the leap I think you will really enjoy reading this.

Maybe “follow your passion” is bad advice. But starving your life of meaning for money isn’t much better. If you make every decision a financial decision, you might end up poorer in other ways.

This stat is crazy:

There have been 2,440 ETF launches globally this year, that’s over 10 new ETFs a day. Basically every 45 minutes a new ETF is born somewhere in the world.

SCAMS/CRYPTO/AI/TECH

I am so close to starting a separate AI section. Because there is so much happening. We had Nvidia come up with yet another banger quarterly report. We are talking sales were up 62% Year over Year with Q4 revenue expected to hit $65Billion. And net income was $32Billion. Wait, there is more. How about 73.4% gross margin expected to hit 75% next quarter.

In the meantime, new AI models keep coming out and it appears Google is back in the game taking the lead with its latest Gemini release. Oh, in the meantime as well, we have all these stocks adjusting downwards. If you are making market timing predictions, be aware that you are not investing, you are speculating.

This back and forth between Hasan Minhaj and Paul Krugman is great imho. Because you know where I stand.

PK: There is essentially no legitimate use for crypto and nobody is using it for anything legitimate. Fewer than 2% of Americans have ever come made a payment in crypto. It’s purely a speculative asset or a vehicle for crime.

HM: So, you’re saying that Al-Qaida and Venezuelan gangs are just in their crypto wallets exchanging BTC?

PK: Well, actually, they’re mostly using Tether. They’re mostly using stablecoins these days.

HM: Well, if it’s so bad, why will the comments of this video be filled with people screaming at us calling us idiots?

PK: Oh, because it’s a cult.

If you can’t keep up with all what is going on with giant tech companies investing in AI companies and all doing deals with each other, here is a short breakdown: Collect Them All (AI Edition).

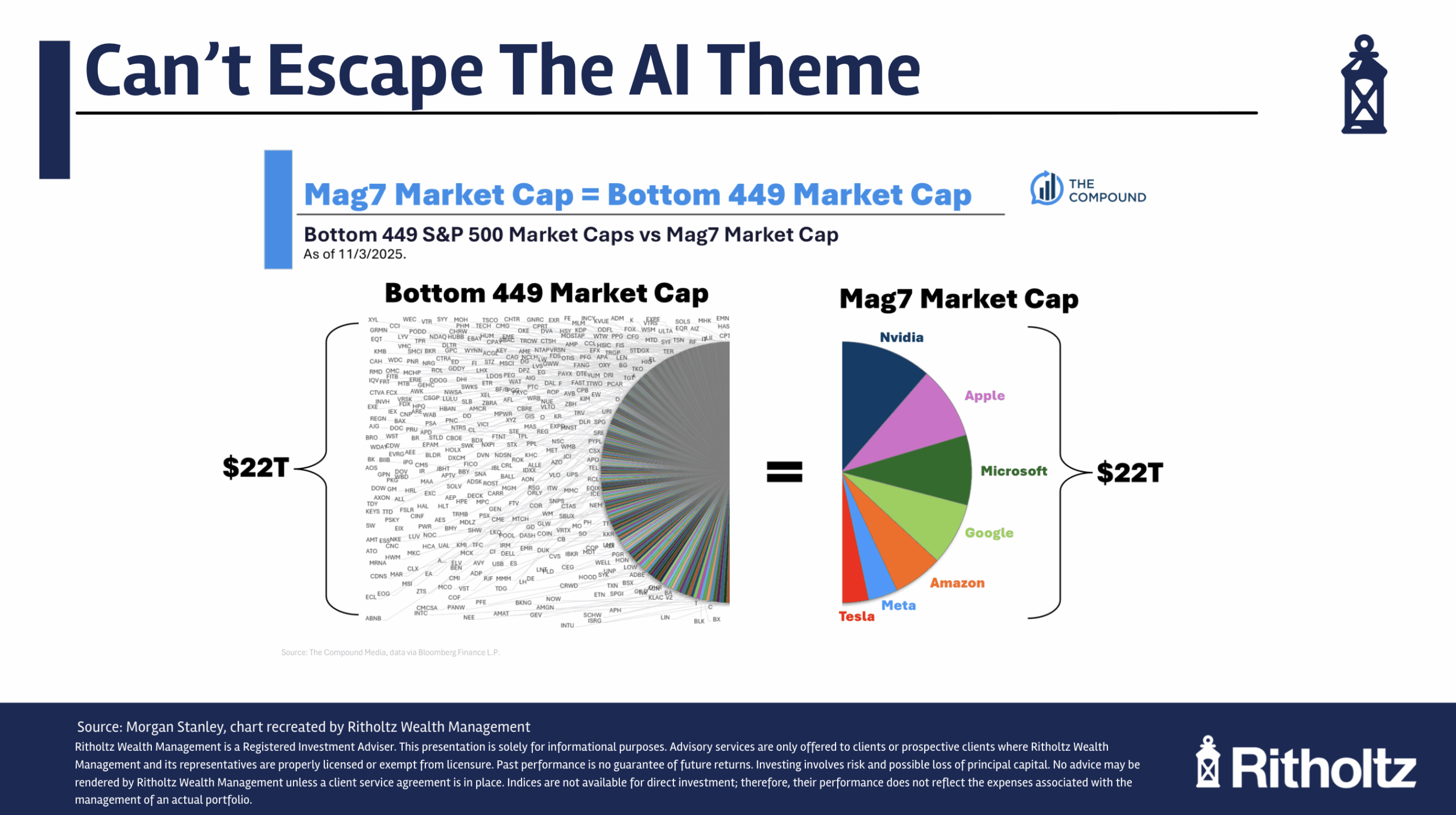

Some excellent charts in this article about AI that captures what is going on these days…

Good evening Buzz,

Just great, trials for eating through our butts coming soon.

Gold for the desert rats perhaps.

Fascinating group of qualifiers for the WC.

Thanks for the great reading and have an awesome time overseas.

Man, I am impressed that you still post such a great amount of info each week despite being way over there! Thanks! I’ll be dipping in over the weekend as per usual and much appreciate all the good stuff. Have a wonderful time there and enjoy!

Thanks for the wonderful links. Good to keep up with Krugman on crypto!

The food at the Hyatt place certainly looks better that at the Hyatt places I stay! Wow.