Another TBB post featuring the most eclectic links around the web such as how tech jobs have dried up, OnlyFans economics, ice hotels, guide to ETFs, what the Fed rate cut means, more scams and Elon Musk shenanigans, offbeat Arctic research, wildlife photographer of the year entries, magical tree house hotels, amazing religious wonders, new Southwest & Hilton Offers and much more and of course always all of the most important developments in the crazy world of miles and points. See you next next week, enjoy the weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

You like my blog? Send a link to someone please!

No clickbait. No sponsored posts. Also, no AI!

Follow me on Instagram and Subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This is a one man labor of love operation, enjoy it while it lasts.

BLOG HOUSEKEEPING

There was no post on Tuesday so today’s post is very long. The reason is I traveled to the Los Angeles area for a wealth management conference and just did not have any time. Sticking with the Friday posts for a little while until we travel to Thailand in November. We see what happens around here but changes are coming most likely as I am thinking to take the blog back to its roots, pure travel and my hobby addiction of miles and points. And separate everything else out, maybe start a Substack newsletter with it. Because my two personas mixed together sure is not helping my brand and my blog stats. Not that I cared for blog metrics that much but still, it is an ego thing primarily at this point in my life. Anyway, I do march differently and I have been thinking to do this for years and here I am once again so…it goes.

Thank you for coming along this ride with me. Here is my new look and I am starting to like it:

PERSONAL FINANCE

So much hype about all things Fed lately. Please ignore the noise and focus on what you can control. Anyway: What the Fed Rate Cut Will Mean for Five Areas of Your Financial Life. Here’s what the half-point interest rate cut will mean for your car loans, credit cards, mortgages, savings and student loans. If you do things right, the only area you need to care about is Savings.

Lots of useful data in this: Guide to ETFs by J.P. Morgan Asset Management.

My son reads my blog. And some of his friends who work in tech. So, this Wall Street Journal article is for them: Tech Jobs Have Dried Up—and Aren’t Coming Back Soon. Things have changed so much in this area from late 2019.

Once heavily wooed and fought over by companies, tech talent is now wrestling for scarcer positions. The stark reversal of fortunes for a group long in the driver’s seat signals more than temporary discomfort. It’s a reset in an industry that is fundamentally readjusting its labor needs and pushing some workers out. Postings for software development jobs are down more than 30% since February 2020, according to Indeed.com. Industry layoffs have continued this year with tech companies shedding around 137,000 jobs since January, according to Layoffs.fyi.

Wages have increased by an average of just 0.95% compared with last year. Equity grants for entry-level roles with midcap software as a service companies have declined by 55% on average since 2019.

SCAMS/CRYPTO/AI/TECH

These stories are getting numerous lately. And increasingly sad. Lured by a Promising Job, He Was Forced to Scam People. A Ugandan man named Jalil Muyeke traveled to Thailand for a promising job opportunity. He ended up being trafficked into a cybercrime operation. From the New York Times.

I loved Twitter, it was a special place online. It had a great impact in my career in the wealth management industry. And then Elon Musk bought the company and it has been downhill ever since. This article is an excerpt from a book about the transfer of the company to him as it happened and it was a painful read: “Are You Saying No to Elon Musk?”: Scenes from the Slash-and-Burn Buyout of Twitter”. In an excerpt from their new book, Character Limit, Kate Conger and Ryan Mac detail how Musk’s “goons” instilled fear and uncertainty among the rank and file, while his inner circle employed hardball tactics in a touch-and-go transaction.

This blog is not going to blog itself. I rely on my readers helping it grow as I don’t have time to do any promotion/marketing. Which leaves the content clean of intrusive sponsoring posts and stupid ads and stuff like that.

You like my blog? Send a link to someone please!

ODDZ & ENDZ

Many bloggers have moved to YouTube. But after reading this article, maybe Only Fans is the way lol: Breaking Down OnlyFans’ Stunning Economics. These numbers will blow you away (pun intended).

In 2024, OnlyFans generated $6.3 billion in gross revenues, up from $300 million five years earlier.

OnlyFans revenues are now believed to be twice that of pornography giant Aylo (formerly known as MindGeek), which owns PornHub, Brazzers, RedTube, YouPorn, and XTube, and the platform counts over 300MM registered users (not all of whom pay or are active, but no such disclosures have been made). Two thirds of revenues are from users in the United States and, while the UK plus Europe is another 16%, with the remaining 17% “Rest of World.”

OnlyFans has paid its two owners $1.1 billion in dividends since 2019, with $472 million paid in 2023 alone.

I had no idea about all the research done over the years in the Arctic, wow! The Golden Age of Offbeat Arctic Research. The Cold War spawned some odd military projects that were doomed to fail, from atomic subways to a city under the ice.

The Army’s most ambitious Arctic dream actually came true. In 1959, engineers began building Camp Century, known by many as the City Under the Ice. A 138-mile ice road led to the camp that was about 100 miles inland from the edge of the ice sheet. Almost a vertical mile of ice separated the camp from the rock and soil below. Camp Century contained several dozen massive trenches, one more than a thousand feet long, all carved into the ice sheet by giant snowplows and then covered with metal arches and more snow. Inside were heated bunkrooms for several hundred men, a mess hall, and a portable nuclear power plant. The first of its kind, the reactor provided unlimited hot showers and plenty of electrical power. The camp was ephemeral. In less than a decade, flowing ice crushed Century — but not before scientists and engineers drilled the first deep ice core that eventually penetrated the full thickness of Greenland’s ice sheet. In 1966, the last season the Army occupied Camp Century, drillers recovered more than 11 feet of frozen soil from beneath the ice — another first.

Amazing photography in the 2024 Wildlife Photographer of the Year Contest.

TRAVEL

A review of all the Ice Hotels in the Nordic Countries. I understand the novelty of these places but I am not sure I would ever want to sleep inside one of them.

Some of these look amazing: 15 Magical Tree House Hotels Around the World.

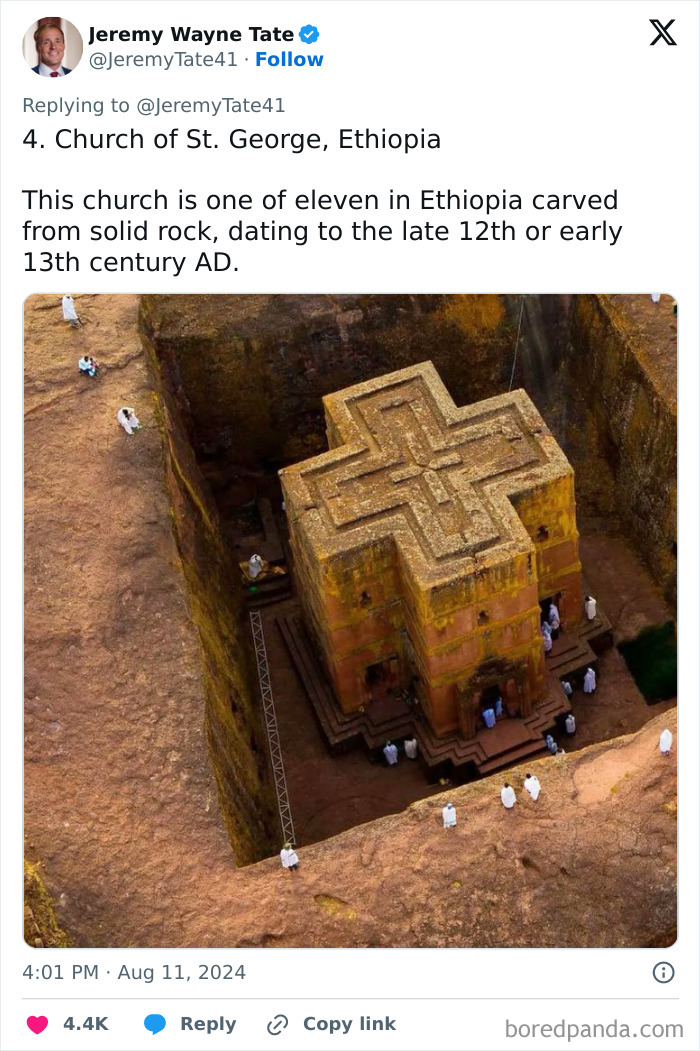

I am not religious but I have always been in awe of religious places: “You Won’t Believe They Exist”: 25 Amazing Religious Wonders.

The discount is now $60 if you sign up for ETF using code TBB below. You can be first!

SAVE $60 FOR 2024 THE EXTRAORDINARY TRAVEL FESTIVAL

Follow me on Instagram please. Subscribe to my YouTube channel.

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points and maximizing your travel experiences. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/CREDIT CARD CORNER/MY ACTION

I did not post on Tuesday so we have a lot to cover. Fast developments in the Alaska Airlines takeover of Hawaiian Airlines along with a bunch of new credit card offers. And much more, buckle up.

GENERAL NEWS/PROMOS/NEWBIES/ETC.

Lounge Review App: Finally, an app for checking out what lounges are in each airport, along with access rules. I like it a lot and I deleted Lounge Buddy.

Hilton just continues to plug away: Hilton Adds 102 Additional Small Luxury Hotels Of The World On Its Platform On September 17, 2024. These additions now make it 396 out of 570 SLH hotels available with Hilton points. Numbers may be a off a bit but the point remains that these really nice hotels are available with Hilton points and free night certs.

Since we are into nice hotels, this is a nice aspirational list: The Best Points-Bookable Hotels in the World (2024).

Big win for consumers, nice job by the DoT: DoT Approves Alaska-Hawaiian Merger, Miles MUST Convert 1:1. This will happen but it will take some time. Good to see the miles belonging to Hawaiian Airlines members will not be devalued as the DoT is watching the airlines closely. Which is great, finally! Alaska Airlines remains a feisty competitor in this highly competitive industry. Update: Wait, this is moving in lightning speed: Alaska Airlines Takeover Hawaiian Closes. These are all great developments, very consumer friendly; hopefully, after we have one mileage program the pace of devaluations is not too bad.

For a deeper analysis, read this from the Cranky Flier: Alaska and Hawaiian Finalize the Merger After Agreeing to Largely Hollow DOT Conditions.

Talking about feisty airlines, how about JetBlue Plans to Introduce Airport Lounges and New Premium Credit Card. Actually, just thought about it, how about the next airline consolidation is between Alaska and JetBlue? About a year after Hawaiian Airlines is tucked in. If it happens, I can point to this post in which I predicted it. If it does not happen (most likely) I will keep silent lol.

You can register for the latest IHG One Rewards promotion to earn 3,000 points every two nights through December 31, 2024 HERE.

You should not care that much about Marriott Bonvoy or Starbucks. But, you know, you can not escape them, they are everywhere. And now they have partnered together. Interesting hookup, rewards continue to expand: Limited-time offer for new members of Marriott Bonvoy® or Starbucks® Rewards: Earn 1,000 Marriott Bonvoy points when you join and link your accounts by October 18, 2024.*

CREDIT CARD CORNER

I will indicate with NEW every new section as the rest is the same from the previous blog post and will finally roll off those parts as offers expire, thank you.

NEW: Time to register: Q4 2024 5% Quarterly Categories: Activate, Offers & Suggestions (Freedom/Flex, Discover, Dividend, Cash+ & More). I keep a Discover card for my kids that I will likely keep for ever. And I always have a Chase Freedom Flex card around. And this is the first time I can remember I am going to have a much harder time to get easy 5x. Maybe it is time to stop focusing on the little fish and free up a Chase slot and move on and focus on the much bigger Signup Bonus hauls…

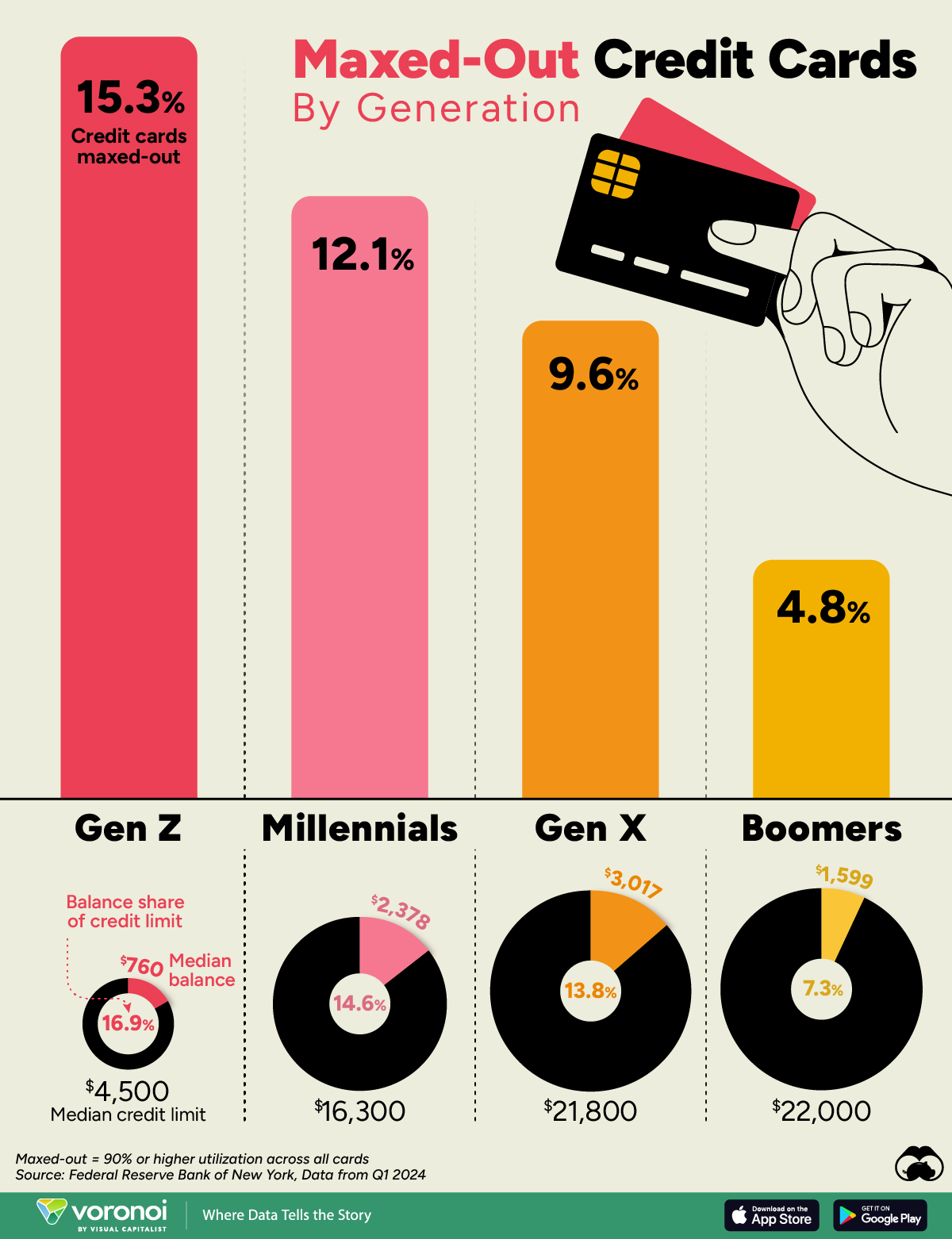

NEW: Over 95% of the miles and points bloggers and YouTubers will cease to exist the day after banks paying them to sell plastic. And you can take this to the bank (pun intended). Maybe we are responsible for the ridiculously harmful ways we inflict on consumers who are just not as responsible with their money habits as we are? Don’t contribute to this folks: Maxed-Out Credit Cards by Generation. Please, if you carry a balance you should not be reading this right now. STOP spending and come back here when you no longer carry any credit card balances.

MY ACTION

I did not post on Tuesday this week. Because I traveled to Orange County in California to attend the 2024 Future Proof Conference which is billed as a “Wealth Management Festival”. At first I thought to do a streaming blog from the conference but a quick peak on blog’s stats quickly changed my mind. I brought along my wife again at this conference which I attended for the third year in a row. I have lots of pics and videos and will be posting on YouTube and Instagram when I get around to it. For now you can check out a few posts on Instagram from the trip, more coming. Just a quick wrap of the travel involved:

We flew Southwest Airlines. Everything worked flawlessly. I paid for my own ticket, a business deduction and the miles posted right away after the completion of the return flight home. Burned about 35k Southwest miles for my wife to fly to John Wayne airport in Los Angeles round trip. How will this airline flip to a reserved seating model from its unique line up boarding process? The task seems to be too much imho, as everything about boarding is wired in this system for decades. I think the current system works. And I hope the switch to the new system goes smoothly.

Both flights had a stop in Denver. And, if you know me, you know why. On the outbound, we spent time at the Amex Centurion Lounge. And, on the return, we visited the Capital One Lounge. This is the second Capital One lounge I visit, after the one in Dallas. They are nice but is it just me they feel so small? I placed us in the waiting list through the Capital One app while still on the plane right after we landed in Denver. And I got the text that we are next in line as we are walking to the lounge, pure perfection. Others in line were not happy when told they have to wait. I guess my travel skills have not diminished. Lounge looks cool but they need more tables. Love the bathrooms, very clean and very nicely designed. As is everything. I like the smaller plates and love the to-go section. Service is great. I am just not that in tune with the hype about Capital One lounges, maybe my expectations were set too high.

For the third year in a row I stayed at the great Huntington Beach Hyatt Regency Resort & Spa. Four nights for 100,000 World of Hyatt points. And with a confirmed Suite upgrade. I am shocked and so lucky to be able to stay here again at the conference hotel without any issues with my award reservation and every time no issues at all staying in a suite, very impressive. If this was not the case I may have not been attending this conference, it makes it all so sweet and super convenient. Great hotel, great suite with a great balcony and view, unbeatable location with a magnificent beach in front, really great service. Breakfast quality is great but the buffet is not daily for some reason. There is no lounge here, breakfast is at the main restaurant. Great fitness facilities, visited to take a few pics only, boo me. Great swimming pools, on the smallish side. Just your average fantastic Hyatt Regency resort with yet another awesome use of World of Hyatt points, thank you Chase Bank once again hehe. With a $25 credit to the hotel shop which of course I used, the folio ended up with $8.02 on it #winning. Also, another four nights gets me to 34 Hyatt elite night credits in the books.

I need to get back to award searching trying to get us back to Detroit from Kuala Lumpur in early December. And look for something better for daughter’s trip to Thailand over Thanksgiving as the present United award I have booked for her can sure use some improvement. Stay tuned.

3,750 United miles finally posted from a United online shopping easy promo.

ADVANCED

So, Qatar Airways announced a ridiculously high increase in Avios surcharges and (partially) took it back. Until it does it again in the near future most likely. I am so glad I did not transfer any of my Avios to Qatar.

We are perhaps starting to see moves by the airlines to soften the impact of the DoT interference with their business devaluations. As I predicted here. And let’s hope the trend continues: As The DOT Investigates Mileage Programs, United Makes Mostly Positive Award Chart Changes.

I need to reevaluate my life choices with my blog. As it is evident I will never be discovered. Ok, I am joking. Kind of. When I see companies like this get millions of dollars in funding to come up with what is the slowest of these software tools and here I am blogging about all these developments for a few dollars a day I get a bit distraught: Point.me secures $15 Million to Expand Travel Rewards Search Platform. When you start seeing glowing reviews of this product around the blogs you now know why.

MILES & POINTS

HOT CREDIT CARD OFFERS:90k CHASE Ink Business Unlimited, 75k CHASE Ink Business Cash, 75k CAPITAL ONE Venture X, 75k CHASE United Business, 150k AMEX Business Platinum, 200k CAPITAL ONE Spark Cash Plus, 150k CAPITAL ONE Venture X Business, $1,000 Cash Back CHASE Ink Business Premier, Three 85k CHASE Southwest cards, 5 FREE Nights with AMEX Marriott Bonvoy Business, 15k AMEX Blue Business Plus and many more!

As of today, I have burned 1,556,957 miles/points year to date (1,148,286 in 2023) and have 4,495,077 miles/points in the bank. Some do drugs, I do miles lol!

BONUS OFFERS NOTIFICATIONS

Would you like to be automatically notified every time a card comes out with (or is about to remove) an elevated welcome offer? If yes, I highly encourage you to sign up if you haven’t yet. And when you apply for a credit card from a link in these emails you help support the blog.

Elevated Card Offer Notifications

All you have to do to receive these free notifications is:

1. Click on the link above

2. Create an account

3. Subscribe

Remember, you are NOT allowed to ever carry a credit card balance!

Let me leave you with this:

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please forward it to a family member or friend. Or Buy Me a Coffee, thank you!

Feel free to contact me anytime at travelbloggerbuzz@gmail.com, all feedback is very appreciated.

George

You can receive each blog post by entering your email address below and then clicking on SUBSCRIBE below, no spam ever!:

This site may receive compensation for sending traffic to partner sites. Travel Blogger Buzz and Your Best Credit Cards may receive a commission from card issuers. This compensation may impact how and where links appear on this site. This site does not necessarily include all financial companies or all available financial offers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

Thank you to Paul and Christian for the four coffees. $17.81 blog revenues since September 4. This blog post is for you guys, thank you.

Blog traffic, comments, email list, Instagram and YouTube subscribers down or flat. The present format is just not working and I feel horrible for having so much credit card content really hoping one will click on a cc link. While so many get buried in debt because, you know, life can get in the way sometimes.

I think my blog content quality has stayed at high levels. If not, improved. And yet, the above facts are just too painful for my psyche and people change when they surpass their threshold of pain. And I am there pretty much.

Keeping it real. Enjoy the weekend. Don’t start a blog lol.

I’m not a military engineer but building stuff beneath glaciers doesn’t seem like a great idea.

Good morning Buzz,

Great to hear your enthusiasm regarding the Hyatt in Huntington Beach as we’ll be staying there over the weekend.

We spent a few nights at the Alila Marea a couple weeks ago, great location and great bar for sunsets, but severely understaffed at times.

Have a great weekend and thanks again for another great post.

Far too much to absorb now! Well, there is the weekend.

Thanks for the tip about the lounge locator!

@ Nick: Yeah, amazing.

@ David: If into Italian food, Nardo within walking distance was great, ymmv.

@ DML: Thanks for always commenting, helps a lot to know a few of you guys are reading.

Going to the gym, been a while, time to work off the free food I had in this trip #storyofmylife

Downloaded Lounge Review. Still gotta put in my details but need to be at my desk for that. (I am at my kitchen table now). Thanks for the tip on that! Looking forward to seeing how it all looks on the new iPhone 16 Max Pro which ought to be here in a day or two! Whee!

So was I dumb to apply for the Hawaiian Credit Card Wednesday? Did I wait too long? I didn’t really think the merger would get approved so had held off. Will I even get the card? (It went pending.) I’m starting to get a bit overwhelmed by some of this stuff since my internal bleed-out a couple months ago. I think too many shorted-out brain cells are on permanent strike.

Was starting to plan a near future trip domestically, but Pneumonia and next week a drainage of fluid around the lungs has again put me on the sidelines. Too many health troubles this year.

I LIKE today’s long posting though and there is a bunch of stuff to read so this will fill some time off and on all weekend. I know it is disheartening not to accumulate more readers and have few commenters. I have been told by a friend who does a Patreon that 90% of the comments are from the same very small percentage of members. I guess most folks just don’t comment for some reason. Don’t be dismayed, if they are still subscribed then they are likely reading.

Thanks for the hard work for this, it’s really a gift to us all. Used to read a lot of travel bogs but you are one of the only two I read now and the other I just read some stuff from.

The beard looks sharp, too! Time for a new portrait picture!

I was thinking of applying for the Hawaiian card as well. I don’t see why it wouldn’t be a good idea if you want Alaska miles, which I do.

In other news, I don’t like this development: https://www.cnbc.com/2024/09/20/american-airlines-credit-card-talks-to-pick-citigroup-over-barclays.html

@ Carl: I did not bother opening an account with Lounge Review to enter my info. Maybe I do it one day. I just like to see the lounges in each airport. And if you click in on Access Rules it really explains it well if you can access them.

Take care of your health, eating healthy is paramount. And movement. And muscle strength. That’s it. And keep it up of course. When I stay at Hyatts I am so in tune to maximize my experience I eat way too much. Every freaking time. I need to fix this. But with Globalist requalification plan under way, it may not be until 2026 lol.

@ Carl and @ Nick: Yeah, should be plenty of time to apply for the Hawaiian credit card with the plan to move the miles to Alaska. I must admit I am shocked the path opened so fast. Of course, shit can happen to disrupt this but I don’t think so. I bet Barclay staff is backed up with apps. I should go for it it but that bank is so weird. I recently closed AA cards with them for me and my wife so I am not that hopeful. And I need to slow down here. Or just go for another Chase Ink Unlimited for 90k, admittedly no path to Alaska miles that way but still, I think I should be ok 🙂

You know when I see the credit card section my eyes glaze over and I appreciate that my days of applying for cards for the high of getting points is over. I realise how fortunate that I am in a place of not really caring about my points stash and I will break out my credit card to buy the exact flight I want. Not saying I don’t use points when I can – tonight I managed to redeem 15k Avios for a biz flight from Germany to UK that was going to cost 435 – so got a high from that. I am wondering whether my feelings are related to a lack of spectacular redemptions this year. Much to ponder.

Personally I am looking forward to the merge of Alaska/HA points as that will be useful to get from Oz to Hawaii.

Thank you for taking the time to comment Vicky.

Sadly, the cc section is where this blog derives well over 95% of its revenue. And not a single soul has clicked on it since September 4th, the last day of the 120k Chase Ink Business Preferred offer. I know where you are coming from and I am trying to kick this habit but it is so hard quitting earning miles so easy like this. And now I am getting paid for getting credit cards from my own site, which makes it even better. But I am opened up way too much, this blog takes hours to produce. And it is getting way too painful. Prison laborers make more, it is so unfair. Ok, life is unfair but after 12+ years I am reaching my limit. Wednesday I was hanging out at the pool at the Huntington Beach and felt at peace not thinking about the blog. And then I spent all my time at the Capital One Lounge working on it. For a few comments (which I always appreciate). Anyway, told son to come read that WSJ article and not quit anytime soon lol.

Getting caught from my trip and started posting pics on Instagram, fist batch from the Future Proof conference. Posts from the Hyatt Regency Huntington Beach will follow.

https://www.instagram.com/p/DAN4uk6pPia/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA==

Hi George,

A couple of things:

I have two Cap One business cards but no personal ones. Any idea if I use your link to apply if I can merge the points? Keeping track of them separately is a pain. I can kill off one of my business cards if need be but I’m keeping the Venture X biz.

I just checked and there’s some Singapore business class award space on 06 December KUL-SIN-FRA-JFK for 111,500 SQ miles. The Frankfurt connection is about 15 hours but there’s no shortage of airport hotels, including the Sheraton where I stayed on a 35K free night certificate last week. Nice German restaurant there too. Just a FYI.

Capital One bank is really weird. No reconsiderations, I mean, you can try recon but likely not going to make a difference. So, if it was me, I would probably kill the non Venture X biz card before applying for a personal CO card. And I don’t know if that would be enough because there is a “rule” out there that says you can not have more than 2 CO cards. But it appears, like with so much with this bank, it is ymmv. So, going for a third card will likely not work. But then again, it is CO and nobody knows! I mean, this is the bank that would not approve the Frequent Miler for any card for years straight.

I thought you can send points from one card to another easily, nothing to do with using my link. You can send the points from another person’s card to you too, like P2 or P3 or Pinfinite 🙂

Thanks for the coffee and the SQ award find. Going to hold off for now, hoping to find that ideal award redemption. No time to panic yet…

And thanks for the coffee, appreciated it. Trying to keep this blog going…

There will be a shorter Tuesday post tomorrow.

Going out with a bang I guess. Blog revenue is just 4 coffees since September 4. Weekly blog stats at least showed a tiny improvement. And there was a gain of 1 email list subscriber for the week. So I need to keep up the “momentum” smh.

Hit the longest dry patch of no credit card clicks, wow. #depressing

Enjoy the two posts this week, Tuesday and Friday.

Nov 12 this blog completes 12 years of existence. It is the day I depart to Thailand. Looks like the perfect day to wrap a bow and move on.

I know this is post is a couple weeks old, but I’m just getting caught up on TBB posts. I have been to Lalibela, so at least one of your readers has. It was really fantastic to see the churches there and it is/was a very special place to visit. Very worth the side trip. (I was coming back from an Africa trip, and gave myself a 2 day layover in Ethiopia, just enough time to get up to Lalibela.)

I also liked your credit card debt graphic. Not so much for how many people are maxed out, but to see how far off the median I am for credit card limit. (I don’t know exactly, but I’m pretty far out there, like many of your readers, probably.)