Another TBB post featuring the most eclectic links around the web such as market insanity, AI meltdown, flight chaos, 90k Chase Ink cards finale, ACA health plan horrors, millionaires per capita, more Medicare and Social Security scams, Gene Hackman’s end, the nanny from hell, oldest bridges, tiny European countries, my Thailand/Malaysia trip miles/points burn summary, the best photography links and of course always all of the most important developments in the crazy world of frequent flyer miles and points at the lower half of the post. Have a great weekend!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or click on LINKS

If you like my blog please subscribe, share it, and forward it widely. It’s free and I NEVER sell or give away email addresses.

No clickbait. No ads. No algorithms. No sponsors. No AI. No Paywalls.

Follow me on Instagram and subscribe to my YouTube channel

This blog started way back in 2012 focusing on my crazy hobby addiction of traveling with frequent flyer miles, hotel and bank points. It has since evolved to curated posts featuring the best web content along with my commentary.

This blog stays in business with clicks only from readers for credit cards and coffees. You can always get to my credit card links by clicking on “CREDIT CARDS’ at the menu on the top of the homepage or the “We make finding a new credit card simple” banner on the right sidebar. Or, preferably, you can receive new offers in your email inbox by signing up to receive alerts HERE . Or just email me.

BLOG HOUSEKEEPING

This is truly a one man labor of love operation, enjoy it while it lasts.

I added a new section “Must Read Gems”. For truly one or two truly exceptional articles (always imho) that deserve to be singled out.

The post next Friday will come to you from Bangkok, Thailand. I will be posting frequent trip updates in Instagram. And YouTube when I get around to it.

QUOTE OF THE WEEK

“Wonder is the beginning of wisdom” – Socrates

MUST READ GEMS

Two articles blew my mind. I will not excerpt any parts of them because I will do a great injustice. I highly encourage you to take some time to read them.

The Joy of Giving Up on “Having Enough” by Jacob Schroeder at The Root of All

and

How to end your extremely online era by Tommy Dixon

PERSONAL FINANCE

This may change any moment. Until then we all pull our hair out cursing smh: What to Know About Signing Up for ACA Health Plans as Rates Rise. If this applies to you, please be prepared and you should sit down with no sharp objects within reach, you have been warned.

When people invest they do not like volatility. Actually, let me rephrase that. Investors love upwards volatility and despise downwards volatility. And you can’t have the one without the other. And to persevere you must be able to stay sane. Because otherwise you will go through periods that can drive you insane: How to invest without going insane. Knowing why you invest, having a process and having a crash plan for that inevitable time when everything goes to hell will really help.

Don’t be in the same position as her: Her Husband Died Unexpectedly. She Spent a Year Untangling Their Finances. When only one partner manages the investments, death can bring even greater stress. I am a huge advocate of simplifying/consolidating finances. To make it easier to the survivor, who would have lots on their plate grieving. And not partying hopefully lol.

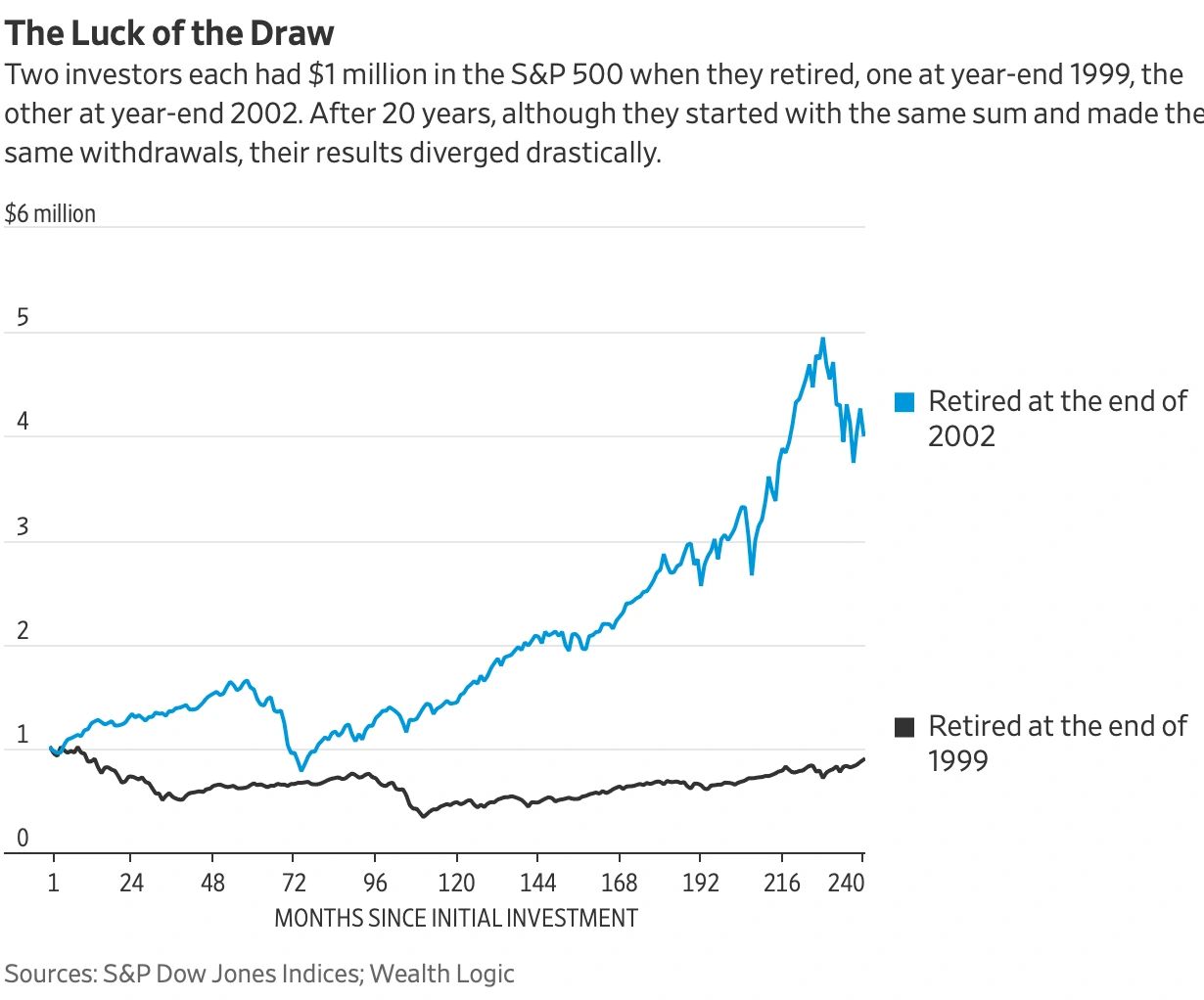

We all have a risk tolerance level. And it is different because we are all different because our life experiences are all different. Going through massively disrupting events like the dot com crash around the turn of the century and the Great Financial Crisis, well, it changes you. And of course luck plays a role, something we do not control. I like this article: how much chaos can you stand? And the way it concludes:

In investing, though, circumstances set limits that may override your natural instincts. Sometimes you have to pull back even when the market feels hot, because too much is on the line. Sometimes you have to stretch past your comfort zone rather than play it too safe. The goal is neither to be fearless nor paranoid. It’s to find the balance between boldness and caution. Too little risk and your money doesn’t grow enough; too much and you end up stoned in the front row, hoping not to get stabbed by a Hells Angel. Most of us do best somewhere in the middle, which is why professional portfolios mix steadier assets with riskier ones.

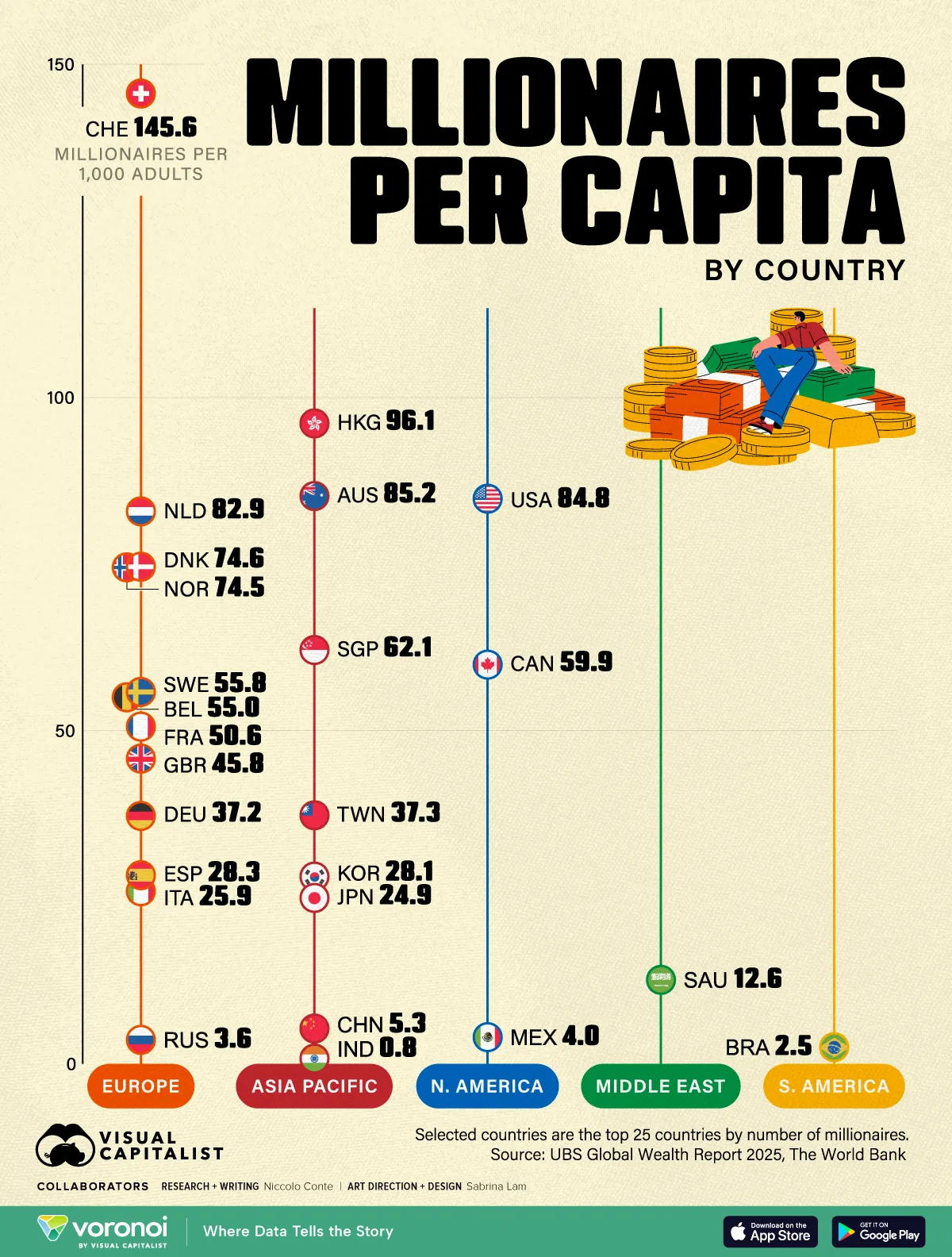

Always interesting visuals from The Visual Capitalist:

SCAMS/CRYPTO/AI/TECH

Very interesting read: Here’s How the AI Crash Happens The U.S. is becoming an Nvidia-state.

For now, many of these tech companies have cash to burn from their other ventures: Alphabet and Microsoft both made more than $100 billion in profit over the previous fiscal year, while Meta and Amazon both made more than $50 billion. But at some point in the near future, data-center spending will likely outpace even these enormous cash flows, reducing Big Tech’s liquidity and worrying investors. And so, as the AI arms race continues to escalate, the companies are beginning to raise outside money—in other words, take on debt. [Oh yeah, debt…]

The biggest lesson of the past two decades of Silicon Valley is that Meta, Amazon, and Google—and even the newer AI labs such as OpenAI—have remade our world and have become unfathomably rich for it, all while being mostly oblivious or uninterested in the fallout. They have chased growth and scale at all costs, and largely, they’ve won. The data-center build-out is the ultimate culmination of that chase: the pursuit of scale for scale itself. In all scenarios, the outcome seems only to be real, painful disruption for the rest of us.

Be careful out there: How to spot Medicare, Social Security scams as crooks target seniors.

Scams are so prevalent and growing that we now have victims getting into the business of protecting others from scams: He lost nearly $100k to a con artist. He turned it into a business. How can scammers do this destroying others slowly and deliberately I never understood. There must be a gene for this. Or something, yikes.

Can you guess which country is #2 in electric vehicle sales? Of course we probably all heard or read somewhere that Norway is #1. Anyway, I was shocked to find out the #2 country and I guarantee you will be too. If not, you will be issued a refund immediately. Oh wait…

Don’t mind me asking, but what am I missing with the United Gateway card spend bonuses? Do you have to call to ask? I can only spend so much at Zales 🙂 !

They keep coming to me via email. Already knocked one out for some spend by 12/31. Also waiting on another one for 3x on gas/groceries/dining to post. I am sure more are coming based on past experience.

Thanks for the terrific links! The credit card checking procedure is so clever! And

the story about the Hackmans’ deaths so sad.

And thank you for the kind words and always commenting. And for the coffees too!

Bon Voyage to Thailand! Hope all goes well with the trip and all flights are on time! Much to read here and thank you! The wind has stopped and the sun has come out here finally. Much to do over the next day or two but I’ll slip in some reading on what looks like a bunch of good stuff that you have included. Thanks, George!

Yeah, hope my flight goes out as scheduled. On Lufthansa. Out of Detroit, one of the 40 airpors scheduled to be impacted. Are we at 40 yet? As in govt shutdown?

I’ve only been to four of those bridges. Thanks for giving me more reasons to travel! I’ve been thinking about a long-overdue trip to the seven-mile bridge in the Florida Keys next year, we’ll see…

That bridge is long 🙂 And worth it.

When my P2 graduated from University of Michigan for Med School, we flew DTW-FRA-BKK R/T for like 110,000 UA Miles. It was my first redemption with miles from a Fidelity offer. It is cool to see that routing still working.

I have a screenshot somewhere from the check-out page with the ‘are you sure you want to use miles you could pay for it’. It was something like $13,000 for Econonmy for 2; 12cpp.

Great school 😉

I am probably going to fly the same exact planes as you, they are old lol

We lucked out and DTW-FRA-BKK-FRA were all undersold, so I had an entire middle row and P2 had a side row for all of those flights. A340-300 (I think) over the Atlantic and the A380 to and from BKK. There was a tiny economy section at the back of the upper deck, so that was awesome, my first time flying upstairs!

Enjoy Bangkok, I’ve put in some “back up” reservations for Bangkok and Chiang Mai in January. Usually fly to Tokyo on New Years Eve, spend a week, and then fly south for the warmth!

Solid links this week. I’m impacted by the ACA change, I think my premium goes from free to $50 a month if sticking to a silver plan with a max out of pocket of $3.5k or just switching to a free bronze plan but the out of pocket max is something like 10-13k. I’ve yet to ever use American healthcare since getting on Obamacare, more just have it in the backpocket for a serious injury I’d rather have treated back home vs. abroad. But still on the fence with what I’ll pick for this year.

The 7 teeny countries list seems like they just populated the actually population sizes as their list. Andorra actually has became a haven for professional cyclist as it has their right characteristics for altitude training.

Liechtenstein is interesting as a soccer fan, FC Vaduz, the only pro soccer team in Liechtenstein, plays in the Swiss League. But as a guest club, they cannot represent Switzerland in UEFA competitions. This means they are ineligible to earn a Champions League or Europa League spot based on their final position in the Swiss Super League or by winning the Swiss Cup.

So they’re only way to ever play in the Champions League would mean winning the Liechtenstein Cup and entry into the UEFA Europa Conference League qualifying rounds and winning the competition. That gets them an entry the next season into the Europa League, they’d have to win the Europa League to win a Champions League entry.

A loss anywhere starts them all the back at the beginning.

Thanks for the travel updates, nice.

When the govt shutdown ends there should be changes to make ACA more affordable. Then again, who knows with the circus governing.

Very interesting info on FC Vaduz. In the meantime my soccer team in Greece lost again and it is in a major crisis. Everyone understands now that everything went wrong since the day after winning the Second Division undefeated last year. And the product on the field in the First Division is totally inadequate to escape relegation. More developments are coming soon, never seen the team play so weak ever before and it is totally depressing us fans and the whole city. I will probably miss watching the games while in Thailand. Then again, watching such tragic performance is not good for my health, sad lol.

You should check to see if Thai Port FC is playing while you are in Bangkok, they’re the ‘expat’ team of choice and have the closest stadium to town. And having another good season sitting 4th on the table right now. You can get a walk-up ticket for like $3-4. You can get there an hour early and there will be all kinds of vendors set up with food and drinks and it’s a cool atmosphere.

It is on my list but not sure I will get to it. Thanks a lot.

Going to just zone out the rest of the day…Today got the news many of us in the financial advisor world dread…learning of a client’s death. It is incredibly sad. RIP Denise, you will be so missed. And I am devastated I can’t be in the funeral as I am departing to Thailand in a few days.

In today’s WTF crypto scammer news… https://nypost.com/2025/11/11/world-news/russian-crypto-scammer-and-wife-dismembered-after-fleeing-investors/

That list of Hyatt exclusions….maybe they should make a shorter list of hotels that allow suite upgrades

Award seats next summer from Africa in business are, well, non existent.

Hi from Bangkok…I need to make sure the Friday post will get published. See Instagram for trip updates.

https://onemileatatime.com/insights/awkward-conversation-blog-monetization/

Read this while fighting jetlag in my Hyatt Place deluxe room and…maybe it is time to move on after 13 years of blogging (as of yesterday). If he has a hard time making enough online when his weekly revenue probably beats my annual revenue…and he is thinking memberships and targeted ads…come on!

Finding I am spending way too much time and may not even get to post tomorrow (and 90% of the post was done back in the US)…and how am I going to make another new post. And miss doing what I came here for.

Anyway, Bangkok is great, had the most amazing foot massage yesterday and today my feet are so sore lol. And now fasting 12 hours before my all day checkup at Bumrungrad Hospital next door.

Oh, Capital ONe Venture X cards are back at 100k and 200k signup bonuses.