Another TBB post featuring the most eclectic links around the web such as how the regional bank crisis continues, Kremlin explosions, world changing ideas, how to fly Qatar QSuites free, we elaborate on banks in the US, the lack of retirement savings, amazing account of a shipwreck in the Pacific, Uber’s lost and found index, biking in Australia, most beautiful hikes, lots of soccer stuff and a lot more…

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS or Buy Me a Coffee or visit our LINKS

I use and recommend Proton VPN <—– REFERRAL LINK

You like my blog? Send a link to someone please!

No ads, no clickbait. No sponsored posts.

This blog publishes every Friday and Tuesday…for now.

Trying to make my posts shorter.

This blog plays around with the SECTIONS always…

BANKING

This section is back you guys…

There are some weird things going on in our banking system lately. I thought it was going to blow over after the surgical strikes by FDIC and CEO Jamie Dimon over at JP Morgan Chase swallowing First Republic Bank in the past weekend. But it appears the regional banks continue to be under pressure. It does not make sense and here is Matt Levine of Bloomberg: Nobody Trusts The Banks Now.

At least read towards the bottom of the post where he tries to explain why this MAY be happening and it is, well, interesting: Such as the internet and how much faster information is spreading these days and, this is very important, how much faster with a few clicks of your mouse or on your phone you can take your cash out of a bank and send it almost instantly to another bank that pays you a lot more interest. Maybe it is also happening because of the end of relationships with, you know, your friendly banker? And maybe the mark to market regime has finally arrived in banking too? Of course, no doubt the ten rapid increases of interest rates by the Fed was the catalyst. Which would not have happened if the mother of all pandemics did not enter our lives…which is a theme explaining everything as it changed, well, everything.

Anyway, we knew something would break…if someone tells you they knew all along the regional banks will start falling they are almost certainly lying. At the same time, if you have less than $250,000 of cash in the bank you should not be worried. If you do have more, well, when was the last time a depositor actually lost money? Or is there some type of sustained short selling conspiracy going on? #developing

This may be already obsolete by the time you read this: Visualizing the Assets and Liabilities of U.S. Banks.

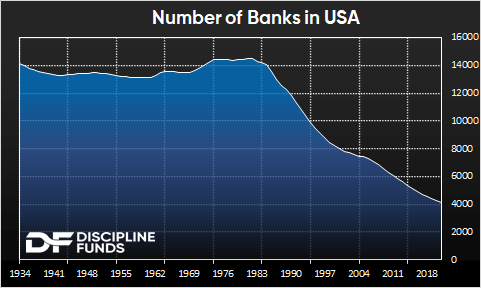

Actually, I always thought we had too many banks in the US! Chart of the Week – We’ve Got Shrinkage (In Banks).  I liked this analogy of what is going on:

I liked this analogy of what is going on:

A useful analogy in understanding the risks of all of this is the piping of your home. Banks are the plumbing in our financial system. They control and direct the flow of funds in the system. The Fed influences the pressure in the water main and when they sent rates to 5% quickly they broke the water main to many people’s homes (the small pipes couldn’t handle the pressure change). So now the regional plumbers are scrambling to seal the leaks. And some of them are realizing that the leaks are too much for them to contain. The process of fixing all these leaks causes disruptions across the flow of water in the house. This is being seen in the economy through the tightening of lending standards which is reducing credit issuance. How much does the flow of water slow here? We don’t know quite yet because it’s really only just beginning to be seen in the real economy.

Never forget, over the short term, everything is possible. Stick with your plan and stop looking at the markets and go play outside! And also:

In the long-run these problems always sort themselves out. Some banks fail, the water main gets fixed and life goes on. But in the meantime these leaks can cause big disruptions and we’re all in the process of discovering how much damage was caused to the pipes AND whether those leaks will cause damage in other parts of the house like commercial real estate, residential, consumer credit, etc. Like all of investing, it’s a temporal conundrum. If you’re patient and have a long time horizon then none of this really matters. But if you’re sensitive to volatility and need liquidity then this is consistent with the sort of environment where you need to be more cognizant of the potential short-term risks because they’re elevated.

I did intend to make my posts shorter and looking at everything above, you know, I could stop here and move on…

PERSONAL FINANCE

These are grim statistics indeed. You can see where you stand and I hope you are nowhere near some of the averages! Half of American households have no retirement savings.

And this tweet by Morgan Housel is timeless:

Reminder that no matter how the economy is performing there will always be a loud group of people saying:

– Big recession around the corner

– Hyperinflation imminent

– The dollar is doomed

– The Fed broke everything

– Stocks are overvalued

Been like that for 100+ years.

UKRAINE RUSSIA WAR/GEOPOLITICS

I think the most likely explanation of the exploding drones over the Kremlin is that it was a Russian false flag operation. Professor Timothy Snyder appears to agree with me 🙂 Explosion Over the Kremlin.

Did you catch Wagner’s leader bitching at Defense Minister Shoigu threatening to leave Bakhmut for lack of ammunition? And doing it walking all over corpses of his soldiers? Yikes…

ODDZ & ENDZ

These are just great: 40 Things I Wish I’d Known At 40.

And these too! 2023 World Changing Ideas Awards. Which one is your favorite? Mine is this: The transformation of the land that the old Athens airport occupied. The thing is…the airport closed for good in 2001 and this is being worked on ever since…things in Greece move very slow, maybe it will be done by 2030? Definitely by 2050 lol.

What a wonderful so well written story: The Titanic of the Pacific. A tale of disaster, survival, and ghosts. Involves a horrific shipwreck, lots of dead bodies and amazing things some survivors did to stay alive!

TRAVEL

Ever wonder what Uber passengers leave behind? The 2023 Lost & Found Index. The list with the 50 most unique items is hilarious! It includes: a bidet, pet turtles, a lightsaber, ankle monitor and a remote-controlled vibrator…woohoo.

The Ten Most Beautiful Hikes in the World. Some of these that require more than one day/night…wouldn’t it be great if there was a Hyatt to spend every night in? 🙂

Love the photos! The Sunburnt Desert: A Solo Bikepacking Journey Across Australia.

BUZZING

A section where I go on and on about some stuff that happens in my life and anything else that just does not fit in another section above.

A Greek player had an amazing buzzer beater in Turkey going up 2 to 1 in the 5 game playoff series to make it into the Final Four of the EuroLeague. And here are the announcers in many languages, it is wonderful.

Napoli won the Italian soccer championship, first time since the glorious Maradona days. And the city just exploded!

On this day back in 2007 my hometown AEL FC Larisa won the Greek Cup. I remember watching the game in Chicago in a small restaurant in Greektown surrounded by fans of the opposing team from Athens. Except of one waiter who had just arrived in the US. And he was from my neighborhood who was a friend of my dear cousin who passed away way too young. Kind of surreal how small the world is. Anyway, I play this video every once in a while which pleases me in an amazing way, full of pride, look at our fans!

Maybe I should add a SOCCER section?

Four leaders of the Proud Boys were convicted of sedition yesterday. Bet their moms are not that proud of them #LockThemUp.

I have been recovering and doing mostly walking ever since my last marathon. Getting back into running next week, can’t wait! Next goal is to crush my PR in Chicago in October. Also, my wife just signed up for her second marathon in Detroit a week after we get back from Chicago. Yeah, 26.2 miles is addictive…

Love Massive Attack and this fan video: Girl I Love You

I intend to go back to posting once a week, every Friday. Unless things change…which is most likely not going to happen. I am just not cut out for this blogging thing, commercially speaking, sad!

This blog started with a focus on miles and points and travel. It has evolved since then. Everything below deals with the hobby of collecting frequent flyer miles and points. If you are not interested, you can stop here, thank you.

MILES & POINTS NEWS/PROMOS/MY ACTION

Once a month or so I check out this website to see if any spending promotions pop up in all our Chase credit cards.

I remember travel rewards credit cards giving the signup bonus after the first purchase! You hardly see that anymore. Now the minimum spend required just keeps going higher. And this is just beyond ridiculous, seriously Capital One? Capital One Venture X Business Card Now Has $500,000 Minimum Spend Requirement.

Before AA kills this, hurry? How to find Qatar QSuites award space.

American Airlines sent me an email wanting me to pay them cold hard cash or burn a bunch of my miles to buy elite status, LOL!

I need to sit down and do some serious burning of my miles/points stash, this is ridiculous!

MILES & POINTS

HOT CREDIT CARD OFFERS: 75k CAPITAL ONE Venture X, 75k CAPITAL ONE Venture Rewards, 75k CHASE Ink Business Cash, 75k CHASE Ink Business Unlimited, 100k CHASE Ink Business Preferred, 60k CHASE Sapphire Preferred, 40k CAPITAL ONE VentureOne Rewards, 45k BARCLAY’S Wyndham Rewards Earner Plus, $1,000 Cash Back CHASE Ink Business Premier, 60k CHASE United Quest, 140K CHASE IHG Rewards Premier, 60k US BANK Business Altitude and many more, including many AmericanExpress cards such as Delta Airlines, Marriott Bonvoy and Hilton Honors cards!

This section is about my hobby addiction of collecting frequent flyer miles and hotel points since the early 1990’s! SKIP if you are not into it!

As of today, I have burned 501,000 miles/points year to date in 2023 and have 4,411,131 miles/points in the bank. Some do drugs, I do miles lol!

BEGINNERS

The Beginner’s Guide to Getting Started with Credit Cards, Points & Miles

BASICS: This travel hacking hobby is mostly about getting the fat Signup Bonus of travel rewards credit cards while of course NEVER EVER carrying a balance. Banks have a marketing budget and are willing to give us many THOUSANDS of miles/points to travel mostly for free hoping to hook us to charge 20%+ interest rates on our balances. The poor souls who fall for their marketing paying these ludicrous interest rates end up subsidizing us responsible consumers who enjoy taking advantage of, cough, such bank marketing budgets! Some of us have been doing this for thirty years creating amazing travel memories…Feel free to ask me questions or post them in the comments.

BASICS: Prefer credit cards from the proprietary points programs of banks, such as Chase Ultimate Rewards, American Express Membership Rewards, Citi ThankYou Network, Capital One Rewards Miles because they are a lot more flexible and are not devalued as frequently. Over pure airline and hotel travel rewards credit cards. Pure cash back credit cards may work for you best and they are getting more valuable as airline and hotel loyalty programs keep getting devalued. Sometimes, a pure no annual fee 2% cash back card works best for simplicity!

Credit Card Recommendation Flowchart: March 2023

Remember, you are NOT allowed to ever carry a credit card balance if you ever get a credit card here!

Let me leave you with this…

Some of the links are behind a paywall. You can try to read them using Archive.is.

Thank you for reading my blog. If you enjoy it please pass it on to a family member or friend. Or Buy Me a Coffee, thank you!

TBB

travelbloggerbuzz@gmail.com

You can join 556 email subscribers to receive each blog post by entering your email address below and then clicking on Subscribe:

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Good morning!

I think ‘team transitory’ has some culpability in the banking disaster now and to come. If inflation goes away no reason for interest rates to rise. With long bonds and unhedged interest risk if Milton Friedman was right — print money, prices and interest rates go up — there go the banks.

I’d never heard of that lake to ocean trail in Florida, thanks.

How long until the Fed panics and cuts rates?

Busy you guys, just out at VFTW: Man Misses Flight In Las Vegas, Calls In Bomb Threat

smh…gotta pack to Cleveland, will get back in here when I have time, thanks!

YES to the soccer section! coming from a Uruguayan soccer fan. Love the craziness of Greek football, reminds me of how football looked in the 80s before massive commercialization.

Great post again George.

Another great post! I am kinda kicking myself a little bit because I had toyed with the idea of spending my last week in Italy in Naples instead of Florence. Would have been a blast to be there for all the celebrating. Guess that is what I get for not paying much attention to Soccer!

Home next week and back to the real world. Ah, well. Then to start planning how to spend more points. I am tiring of the game though, I must admit. I am not feeling the thrill of glomming up points as much as I get older. I’ve got to admit, the traveling the way I have done it is wearying me more now. But, we shall see. Once I am home for a couple months, I start getting the itch to go again. I think that next though is a road trip!

Thanks as always for the blog points! Good luck to your wife on her 2nd Marathon and hope your training goes well when you start up again!

Carl, I am feeling the same on the points front. Whereas I used to eagerly update my points spreadsheet on a daily basis these days I have to push myself to do it more than once a month. I’ve been trying to spend my points down but feel part of getting older is I am no longer prepared to do an extra stop or find an airline I don’t enjoy just because of points. Maybe also it’s because there aren’t too many great promos these days to give a quick points boost so become blase about it all.

Yeah, the burnout is real. I am 66 and have been in Italy for the last month but as far as using points and all, it was a so-so deal. Too many places to go where nothing worked. I am not an “aspirational” travel guy either, so I am slowing down. Health has been a thing the last couple years, too.

Definitely, if it isn’t being fun, then it is time to do something else. I have a pile of points with Amex and Chase as well as odds and ends of different things but I think spending down and just using $$$ in the future is gonna be where it is at.

Thanks Buzz, great reading for the weekend. Great to see a victory for the patient folks of Napoli. Buzzer beater…great too.

Just finished the Atlantic article from your last post, love the creative spirit of Ukraine.

Good luck with the walking and have a great weekend