We bring you another edition of the TBB Best of Web links: How we all pay a steep credit card tax, a great rant on what the truth is, how not to get away with murder, how we came about the money invention, curing yourself of a mysterious disease and an awesome time-lapsed storm video!

TBB Blog Mission: To Educate. Entertain. Inspire. In That Order!

Support TBB by applying for CREDIT CARDS & clicking our REFERRAL LINKS

You like my blog? Send a link to someone please!

At every Best of Web post I pick the best reads that blew my mind in the previous week. It can be…anything! I like to be eclectic and despise salesy/clickbait/sameold content you read…everywhere else!

As always, click on the headline to be taken to the original source. Sometimes I insert my incendiary comments on article excerpts between [brackets].

Why are we all paying a tax to credit card companies?

It is amazing to me that the current system has prevailed here in the US. Fat times indeed for these companies!

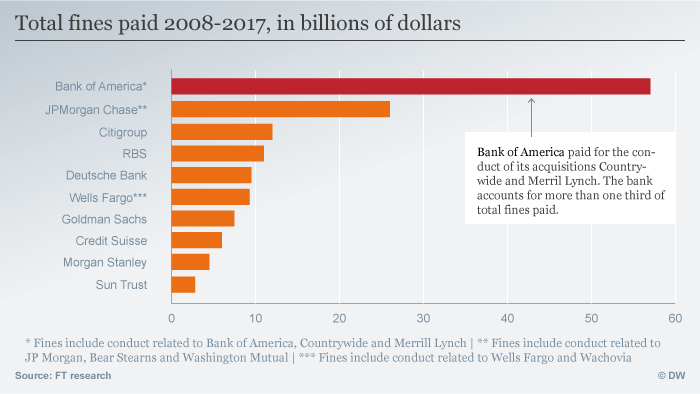

Visa made $10.3 billion in profits in 2018 on just $20.6 billion in revenue, up from $6.7 billion and $18.3 billion respectively in 2017. Profits were up again to $3.0 billion in the first quarter of 2019, a 14 percent increase from the same period in 2018. Mastercard, meanwhile, took in $5.9 billion in profits in 2018, up almost 50 percent from 2017, and saw a similar 25 percent jump in the first quarter of 2019. Beyond that, individual banks who issue such cards rake in billions more, especially with credit cards. A 2018 Federal Reserve report shows that between 2011 and 2017, large credit card banks have collected returns on assets between 3.37 percent and 5.37 percent — as compared to 1.32 percent for all commercial banks in 2017.

Think about it, in this era of great technological advances…why is it so expensive to move around money huh? The article does a GREAT job, in my humble opinion (remember, I am no thought leader on anything!), to explain the present complicated system charade…

Some selected excerpts for you follow:

The card networks are private companies — mostly Visa and Mastercard, which together account for about 72 percent of the market — that banks and merchants can join (American Express accounts for another 22 percent, but it is operated in-house, with no external bank involvement save a couple exceptions)

But the big money in credit cards today isn’t in loans and interest, it’s fees. (interchange and swipe fees)

…in 2000 there were 15.6 billion and 8.3 billion credit and non-prepaid debit card transactions respectively, while in 2017 the figures were 40.8 billion and 69.6 billion

So why aren’t debit cards as profitable? Simple: They aren’t allowed to be. As mandated by the Dodd-Frank financial reform, the Fed capped interchange fees on debit cards at 0.05 percent of the transaction, plus 22 cents (though not all types of debit cards are included). This slashed average debit interchange costs when it took effect in 2012. But credit cards were not included in this section of Dodd-Frank at all, and naturally charge much higher amounts. For consumer credit cards, interchange fees typically run between 1.55-1.95 percent (that is, 31-39 times the regulated debit percentage fee) plus 10 cents, but can get as high as 2.95 percent for certain corporate cards

Merchants paid $64 billion in interchange fees just to Visa and Mastercard in 2018, an increase of 17 percent from the previous year and 77 percent from 2012.

The Truth Is…

You know I have a strong antipathy towards financial product salesmen masquerading as advisors. Oh wait, I feel the same towards self proclaimed travel blogger experts who are nothing but credit card salesmen…But you knew that already.

Author goes off here…

The truth is:

What matters most is your spending and savings rates. The rest is window dressing.

The market owes you nothing.

The bad news is a headline. Gradual improvement goes unnoticed.

Insure what you can’t afford to lose.

Your first investments should be in yourself, not the financial markets.

How well you control your behavior determines the size of your net worth.

If you don’t have an “edge”, buy index funds.

Managing taxes and investment costs are a risk-free method for increasing returns.

A diversified portfolio will always leave you with regret. If not, it’s not diversified.

Risk and return are conjoined twins.

The people who suffer permanent injuries on rollercoasters jump off. The same advice goes for bear markets.

Despite conventional wisdom, the best long term investment isn’t your home.

If you feel safe and comfortable with your investments, something is probably wrong.

Most financial education is marketing in disguise.

Risk never disappears. It’s just transferred someplace else.

Good investing is pretty boring.

The ultimate widow maker trades involve penny stocks and naked options.

The President can’t control the stock market.

If day trading classes were valuable, why are they advertising on mid-day sports talk radio?

The smart money isn’t always so smart.

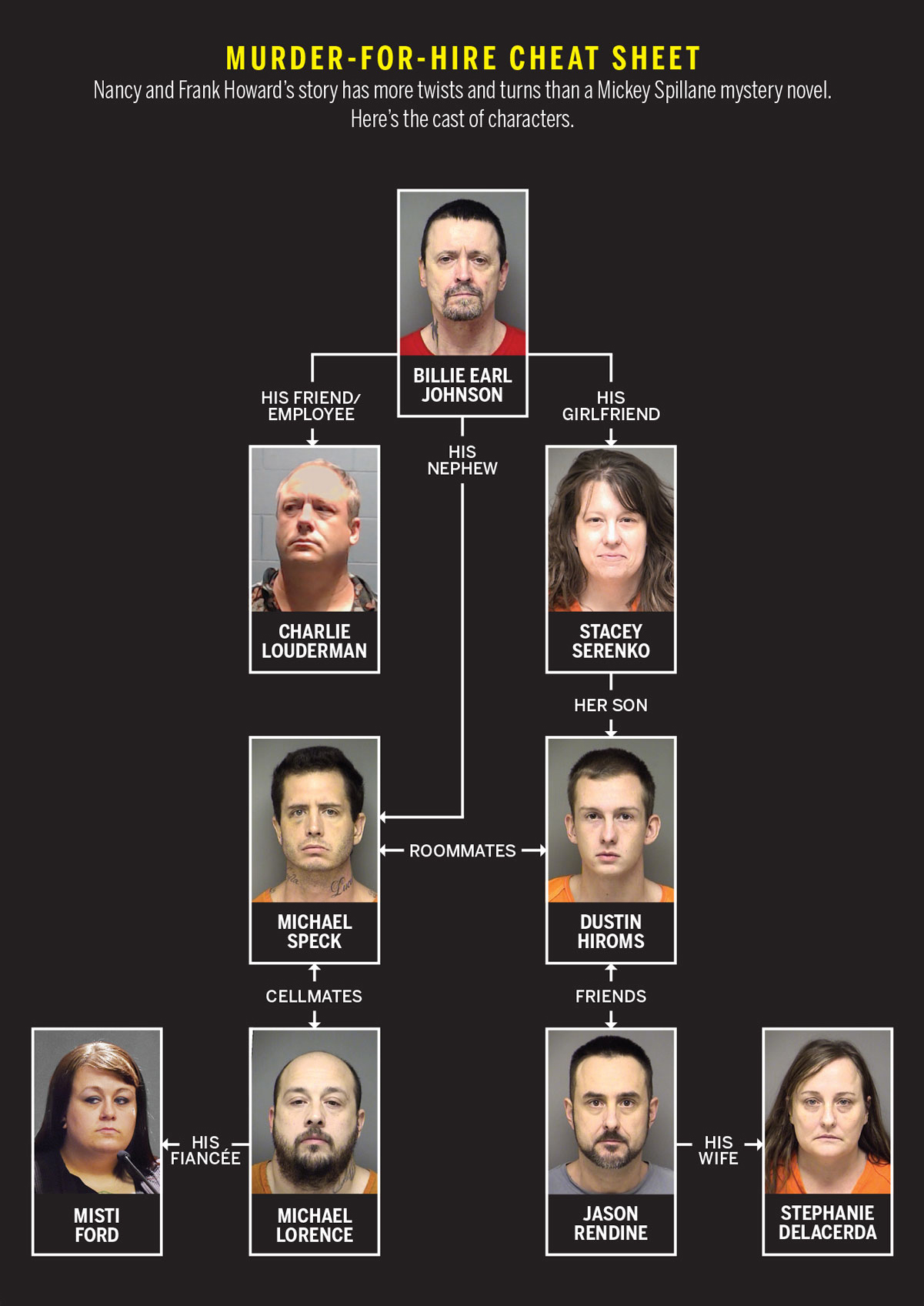

How Not to Get Away With Murder

This is one hell of a story full of characters so dumb you will scream WTF!

How can people think like that? How can people be so gullible? How can some stick with the main character after he was found guilty? You will read this and if you don’t scream WTF…you probably don’t belong here. Maybe you need to get a family member a sweet ChaseSapphirePreferred card with my links then 🙂

Just look at them smh…

The Invention of Money

A wonderful article about the history of money…

In three centuries, the heresies of two bankers became the basis of our modern economy.

I could be finding ways to sneakily insert my direct affiliate links all over my blog posts…which I don’t.

So enjoy this piece, it is incredibly educational!

This college dropout was bedridden for 11 years. Then he invented a surgery and cured himself

Incredible story about a normal guy who then fell ill by a mysterious illness suddenly. Doctors were baffled and he was bedridden for 11 years. But he never gave up and researched non stop to find and cure his disease. It is a remarkably inspiring story, good one to leave you with today.

Never give up!

And pay it forward okay!

And an extra link for you today: Take a Wild Ride Through Two Seasons of Supercell Storms With Mike Olbinski’s Time-Lapsed Film.

Vorticity 2 (4K) from Mike Olbinski on Vimeo.

And I leave you with this…

TBB

TBB

travelbloggerbuzz@gmail.com

Follow TBB on Twitter @FlyerTalkerinA2.

You can subscribe to TBB below, winners only!

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Remarkable collection today!

Thank you.

Silver! For the Pacific Northwest!

Hey, the thing about interchange fees, swipe fees, etc, is that (and I have to say Mr. G. Leff was saying similar to this before I stopped reading his stuff) is that technology will eventually drive them down. *That* is what is gonna really hurt the points and miles game. It will take time, but the move by the Fed to start progress towards instant funds movement for people, is gonna be a step in that direction, mark my words.

What I don’t get is why WalMart, now paying 0.3% interchange in the UK by law, is not up in arms about paying 1.5% in the US. This literally costs them hundreds of millions of pure extra profit per year.

I agree, technology will eventually have an impact. Already other payment modes are becoming more popular, especially for the younger generations. It will be interesting what happens with rewards – as the airlines and hotels make a crap ton of money selling their miles/points to the banks.

I don’t quite get the author’s moral outrage, though. No it doesn’t cost that much to move the money. But lots of things that for which we pay money are not priced on a cost-plus basis. It’s whatever price (or price range) will the market bear.

– Does it really cost an airline $250 to change your ticket? $100 to redeposit your miles? Of course not.

– An an airline ticket for AAA-BBB may be more than a ticket AAA-BBB-CCC. Yet it doesn’t cost the airline less to fly the 2nd route. Does that make their ticket obscene or outrageous? Maybe, maybe not. But if people are buying at that price…

– A good friend recently retired as a manager from the Toyota plant in Kentucky. The actual total cost to Toyota, to produce a 4-cylinder Camry is a bit over $1,000 (material, labor, etc). A V6 adds about $200. There are some corporate indirect costs beyond the plant level not allocated to that figure, but he estimated it’s not a lot, maybe another $1K or so. Yet you’ll pay >$20K for a new Camry.

To me the way to frame the question isn’t whether their fees are tied to costs, or their profits are “obscene”, but whether there is collusion. I think there is. The same is true with the airlines (which also shouldn’t have been allowed to merge as extensively as they have). But the government – in the form of both Democrat and Republican Administrations – has been rubber-stamping such for decades. So I don’t see anything changing by government action.

So we get back to the market forces which will eventually bring about change.

Your car manufacturing costs are way off. COGs are about 50%.

I will likely get to the comments tomorrow.

Another 6 miles in the morning. Focus, focus, focus.

https://travelbloggerbuzz.com/airplane-landings-bunker-business-ayn-rand-fans-fighter-jets/#comment-415246

Oh, Ingy is back and having such a tough narcissistic time and not admitting he sold after just 17 months when since then there have been MILLIONS of cc conversions (which continue) and he lost out on all of them when he could have just phoned in crappy content and could have kept converting some newbies….But noooooooooo. Sold early, spent the money and now having to get back in at Pointchaser pushing bumped.com and frugal.me referral links.

Aging gracefully….NOT!

See what I mean? Your leader, the Chief Angry will say anything without substantiation just to try and prove he is right.

See if you can understand this: I’m writing because I want to, not because I need to. I still have the sale proceeds and they are still growing nicely.

Are you really that unprofessional to say things without substantiation to your clients as well. Says a lot about you Mr travel begging blog.

Ingy’s right. Trump says all kinds of things with no basis in reality.

I’m glad Rick has finally begun to see the light.

Buzz-You should hold out an olive branch and offer Ingy a few free English lessons. No hablo pig Latin, and all that stuff.

I think George should get an intern and go back and collect the 10 “BEST” Ingy comments and post them all in its own blog post…

Now THAT will be entertaining as hell!

Ingy, the Chosen One!

Good idea!

First, thanks to the reader who bought the ipads with my Amazon link. Please don’t return them lol.

Quick comment today to review Ingy’s latest post at Pointchaser about what he reads every day:

He does not mention TBB…which he reads and trolls every day!

I left a comment informing readers about that, lets see how fast Ariana is on censoring it 🙂

Language like this rivals Trump’s lol:

>>>>>>>>>>Remember, in this hobby, every one of us has a different goal and things that are important to them.

Of course he does not read Frugal Travel Guy every day, I mean, does anyone? He reads Holly???? Lol.

He makes a mistake in the Frequent Miler and Miles to Memories links. Sloppy as always. Phoning it in again?

It would not be a Rick post if there was no $$$$ to be earned of course. Pumping the Be Frugal referral link again. Oh how the mighty have fallen!

Links to Ariana’s FB posts where there even less comments than an FTG post woohoo.

Tells readers to network. Wow.

First commenter says to add ThePointsGuy…This is the type of reader who falls for Be Frugal and bumped referral links #clueless

In other words, another lazy post targeting newbies who are prime targets for pumping (hey, why is it taking so long to get credit card links back, come on, you know that is where the dinero is at!)….something that could have been done for YEARS and enjoying A LOT MORE conversions but…sold too early, SAD!

Friday post coming tomorrow….going to be a good one.

Hopefully the guy who applied for a Capital One Venture Rewards card in my site yesterday gets approved for another conversion…which is equivalent to over 250 Be Frugal referral link clicks… #winning

George, you promised us huge BoardingArea-related news a few days. What’s the scoop?

Ingy begs Randy to let him join BA because the conversions at Pointchaser are worth shit? And, you know, he just wants to blog only

I’m going to take a wild guess here.

Ingy comes back with his own blog on Boarding Area. Names it “Frugal Travel Geezer”, so he still use his “FTG” golf shirts.

“Cause he’s frugal.

Lol

Another audit from the state regulators making sure everything is all right. And of course it is.

As a former auditor…I realize the pain involved but it is necessary to catch the scammers in my industry.

And now I need to focus on putting together the blog post for tomorrow!

Where is Ramsey?

We all know that Ingy will post again here defending himself…trying to come up with excuses for selling so early giving up so many CONVEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEERSIONS

THANKS to the reader who got the Capital One Venture Rewards card with my link!

Second one this month. One more and Andy gets paid, thanks guys. Wait, Andy will get paid irrespective of that of course lol.

Blog post tomorrow is shaping up to be great! Some amazing photos I have discovered included. You will love it. Except Ingy 🙂

Geo,

Look man, you need to hire Ingy to increase your conversions… merging is the only way forward. Get Ingy in here to write up a couple of somewhat travel related articles, drop in 15 or 20 links for the Chase Sapphire Reserve, Discover Gold, and the Amex Purple Unicorn cards… you sell out to TPG and it’s freaking Winner Winner Chicken dinner.

Or you slave away over a hot keyboard for the reset of your life making minimal bank with amazon links, only to have them yanked back by greedy chumps who shouldn’t be buying $750 ice cream makers from Amazon in the first place.

C’mon man – Capitalism! Sleepy Joe just ain’t gonna win!

Lol, thank you!

Looks like Ingy is refraining from posting here since they called him out at PC and now realizes it will hurt his crappy conversion links. You see, before he was retired…and did not give a shit. Now, it’s $$$ and with him, it is all about that!

I am worried about Sleepy Joe…I like Mayor Pete!